The Miami housing market has established itself as a thriving real estate haven. With its beautiful beaches, delightful weather, mouthwatering cuisine, and vibrant culture, Miami offers a unique lifestyle that attracts both residents and investors. However, the local real estate sector has gained significant attention due to the lasting effects of the pandemic and the Federal Reserve's efforts to combat inflation. As a result, the Miami housing market has become a coveted commodity for buyers, sellers, and investors alike.

Miami Real Estate Market Overview 2022

Before diving into the reasons why investing in Miami real estate is advantageous, let's take a look at the current market conditions:

- Median Home Value: $556,582

- Median List Price: $549,667 (a 24.9% increase year over year)

- 1-Year Appreciation Rate: 27.4%

- Median Home Value (1-Year Forecast): 2.0%

- Weeks Of Supply: 25.2 (up 8.1% year over year)

- New Listings: 779 (a 15.9% decrease year over year)

- Active Listings: 11,901 (a 9.6% decrease year over year)

- Homes Sold: 566.8 (a 26.6% decrease year over year)

- Median Days On Market: 54 (a 0.9% increase year over year)

- Median Rent (1 & 2 Bedroom Units): $2,050 (a 6.3% increase year over year)

- Price-To-Rent Ratio: 22.62

- Unemployment Rate: 2.3%

- Miami-Dade County Population: 2,662,777

- Miami-Dade County Median Household Income: $53,975

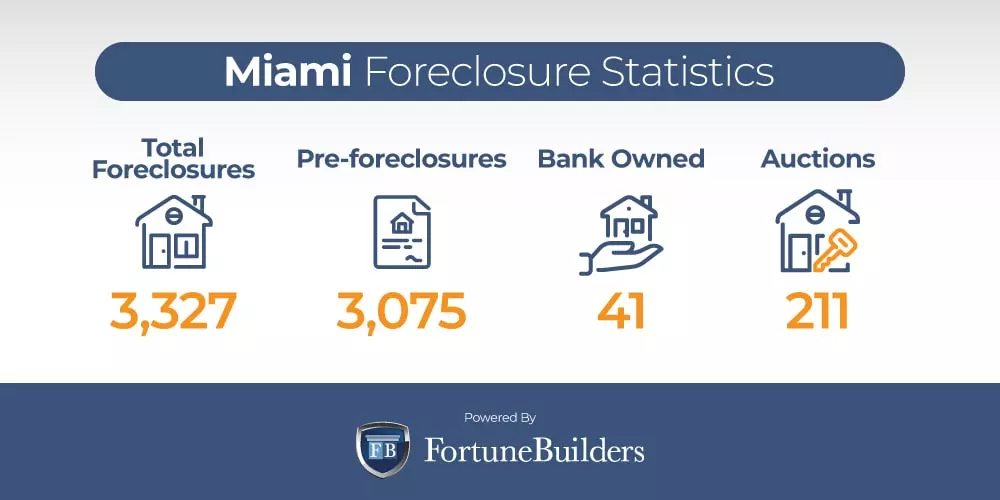

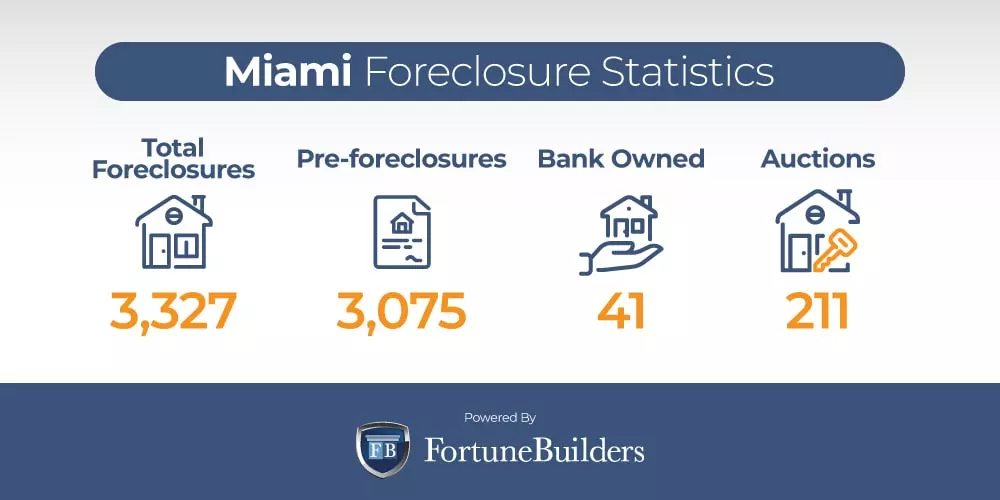

- Total Foreclosures: 3,327

As seen from the data, the Miami housing market has experienced impressive growth in property values. With supply unable to meet the high demand, home prices are projected to rise by an additional 2.0% over the next year.

Caption: Miami housing market trends

Caption: Miami housing market trends

Miami Real Estate Market Predictions 2023

Looking ahead to 2023, the Miami real estate market is expected to face new challenges as the Federal Reserve tightens its grip on the housing sector. Higher interest rates and reduced activity will shape the market's trajectory. While it's too early to predict the exact future of Miami real estate, we can identify the key trends likely to persist beyond 2022:

Buying a House in Miami Will Become More Expensive

The median house price in Miami has already increased by 27.4% over the past year. This surge is primarily due to supply and demand constraints resulting from the pandemic. With demand decreasing due to higher mortgage rates and the looming recession, Miami's current 25.2 weeks of supply cannot keep up. The shortage of housing is projected to contribute to a further 2.0% increase in home prices by the end of 2023.

Miami Foreclosures on the Rise

Foreclosures in Miami are on the rise as government aid and moratoriums come to an end. The expiration of assistance programs will require delinquent homeowners to catch up on missed payments, leading to an increase in foreclosures. This trend is expected to persist as the looming recession adds to the number of financially distressed property owners in the area.

Rental Properties as a Promising Investment Strategy

While house price appreciation has reduced profit margins for house-flipping investors, rental properties have emerged as a more viable investment strategy. Rental rates have recently outpaced home values in Miami, making rental properties more attractive. With the growing number of people entering the rental market and the limited supply of homes, landlords stand to benefit from increasing rental rates and reduced vacancy risks.

Miami Housing Market Trends 2022

The Miami housing market closely follows national trends shaped by the Federal Reserve's tightening policies. However, several key trends specific to Miami have emerged in recent years:

Supply Trends

Currently, the Miami housing market has around 11,901 active listings, resulting in approximately 25.2 weeks of available inventory. Although Miami has more inventory compared to other markets, it is still insufficient to meet the high demand. Despite a slowdown in mortgage applications due to higher interest rates, demand continues to surpass supply. While inventory will increase in the future, it won't be enough to balance the market, requiring more time for equilibrium.

Home Price Trends

Similar to other major metropolitan areas, Miami has witnessed significant price increases in the past decade, with the highest appreciation occurring in the last three years, influenced by the pandemic. However, the pace of price appreciation is expected to slow down due to recent Federal Reserve decisions, reducing the power of sellers in the market.

Interest Rate Trends

The Federal Reserve's efforts to fight inflation have led to increased interest rates on 30-year fixed-rate loans. With rates currently at 7.08%, mortgage rates have more than doubled year-to-date. As a result, the cost of buying a home has risen significantly. Macroeconomic indicators suggest that rates will continue to rise in order to curb inflation, further increasing the cost of acquiring a home in the Miami housing market.

Investor Trends

The Miami real estate market was previously dominated by house-flipping investors. However, the surge in home prices has diminished the profit margins of such ventures. Consequently, long-term strategies like rental properties have become more attractive due to their higher profitability. While house flipping remains a viable exit strategy, economic indicators favor rental properties as a lucrative investment option.

Caption: Miami real estate market trends

Caption: Miami real estate market trends

Miami-Dade County, Broward County, and Palm-Beach County Housing Market Trends

Let's take a brief look at the housing market trends in neighboring counties to gain a comprehensive understanding of the entire region:

Miami-Dade County Housing Market Trends

- Sale Price: $475,000 (a 17.3% increase year over year)

- Sale $/Sq. Ft.: $343 (a 16.7% increase year over year)

- Total Homes Sold: 2,357 (a 30.3% decrease year over year)

- Days On Market: 51 (a 4% decrease year over year)

Broward County Housing Market Trends

- Sale Price: $394,000 (a 12.6% increase year over year)

- Sale $/Sq. Ft.: $280 (a 17.6% increase year over year)

- Total Homes Sold: 2,497 (a 26.2% decrease year over year)

- Days On Market: 46 (a 1% decrease year over year)

Palm-Beach County Housing Market Trends

- Sale Price: $432,015 (a 20.0% increase year over year)

- Sale $/Sq. Ft.: $270 (a 17.4% increase year over year)

- Total Homes Sold: 2,239 (a 26.0% decrease year over year)

- Days On Market: 50 (a 3% increase year over year)

Miami Foreclosure Statistics 2022

During the pandemic, foreclosure rates decreased due to government assistance and moratoriums. However, as the pandemic subsides, foreclosures are on the rise. According to a recent ATTOM Data Solutions U.S. Foreclosure Market Report, there has been a 3% increase in foreclosure filings compared to the previous quarter. Florida, including the Miami housing market, has experienced a significant increase in foreclosures. Miami ranked fifth in terms of foreclosure starts in the third quarter of 2022.

Caption: Miami foreclosure trends

Caption: Miami foreclosure trends

Miami Median House Prices 2022

The median home value in Miami currently stands at $556,582, a substantial increase from approximately $201,000 a decade ago. The past year alone saw a 27.4% increase in median house prices. This surge can be attributed to higher demand, limited supply, and lower interest rates. With 25.2 weeks of supply, Miami remains a seller's market, prompting homeowners to raise their prices accordingly.

Moving forward, the scarcity of available listings will continue to drive up home values, albeit at a slower pace due to higher mortgage rates.

Miami Real Estate Investing 2022

The Miami real estate market has reached a tipping point, where sky-high prices have eroded profit margins for house flippers. However, investing in rental properties has become an attractive alternative due to several factors:

- Lower borrowing costs

- Lower risk of vacancies

- Cash flow potential

- Historically high home values

The demand for rental properties in Miami is supported by a price-to-rent ratio of 22.62, indicating that renting is more affordable than owning. As home prices continue to rise, more people will opt to rent, increasing demand. Landlords stand to benefit from raising rental rates and minimizing vacancy risks.

Additionally, the current interest rates provide a favorable buying opportunity, as borrowing costs help justify the higher home values. Investors can also enhance cash flow by taking advantage of lower mortgage expenses. The convergence of these factors makes building a rental property portfolio an attractive investment option.

Summary

The Miami real estate market has been thriving for years, even amid the pandemic. While rapid price appreciation has reduced profit margins for house flippers, it has created a unique window of opportunity for passive income investors. Rental properties offer an attractive investment strategy, driven by low borrowing costs, rising demand, and limited inventory.

Investing in Miami real estate presents a lucrative opportunity in 2022-2023. Whether you're looking for a beautiful home or seeking to grow your investment portfolio, Miami's vibrant market is well worth exploring.

Banner Placeholder - Click Here to Learn More About Investing in Real Estate

*Sources: Zillow, Freddie Mac, Apartment List, RealtyHop, Redfin, RealtyTrac, Bureau of Labor Statistics, U.S. Census Bureau, ATTOM Data Solutions]