Are you looking for investment opportunities in the real estate market? Interested in exploring international markets with potential for high returns? In this article, we'll dive into the world of ultra-cheap real estate markets, uncovering hidden gems and debunking common misconceptions. Join us on this journey as we explore the factors that contribute to a market's ultra-cheap status and how you can identify investment-worthy opportunities.

Understanding Ultra-Cheap Real Estate Markets

First, let's define what we mean by an ultra-cheap real estate market. According to Andrew Henderson, an expert in international real estate, an ultra-cheap market is one where the price per square meter falls below $1,000 and is located near the city center. These markets offer investors the potential to capitalize on deeply discounted prices.

However, not all ultra-cheap markets are created equal. Some may have poor fundamentals and remain cheap indefinitely, while others have the potential for growth and attractive returns. The goal of this article is to help you identify the markets that are destined to be winners.

Comparing Prices Across Cities

To get a sense of the price discrepancies between cities, let's take a look at some examples. According to data from Numbeo as of December 2021, the price per square meter in various cities around the world varies significantly. For instance:

- Hong Kong: $33,596

- New York: $15,576

- San Diego: $8,754

- Montreal: $5,693

- Kansas City: $2,819

- Detroit: $1,320

- Medellin: $974

- Caracas: $946

As you can see, the difference in prices is staggering. With the same amount of money, you could buy one apartment in Hong Kong or 35 apartments in Medellin. These variations highlight the potential for significant savings in ultra-cheap markets.

Image Source: sanaulac.vn

Image Source: sanaulac.vn

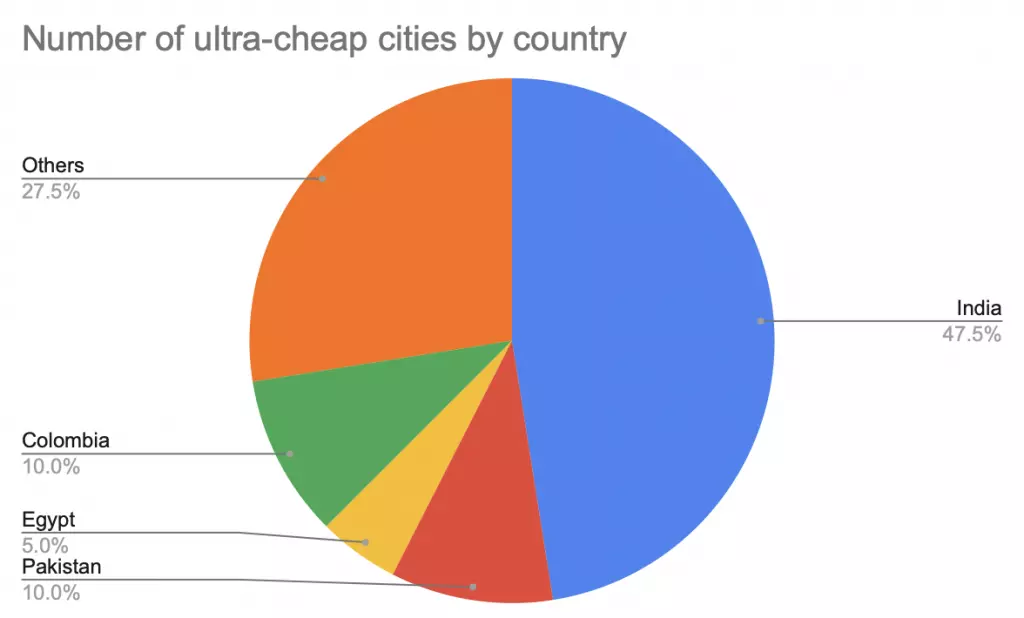

However, keep in mind that only 8% of cities on the list have prices below $1,000 per square meter. The majority of cities fall within the $1,000 to $5,000 per square meter range. These figures emphasize the potential for finding real estate bargains in ultra-cheap markets.

Unveiling Potential Winners

To further validate the accuracy of price estimates, let's examine some actual listings in different markets.

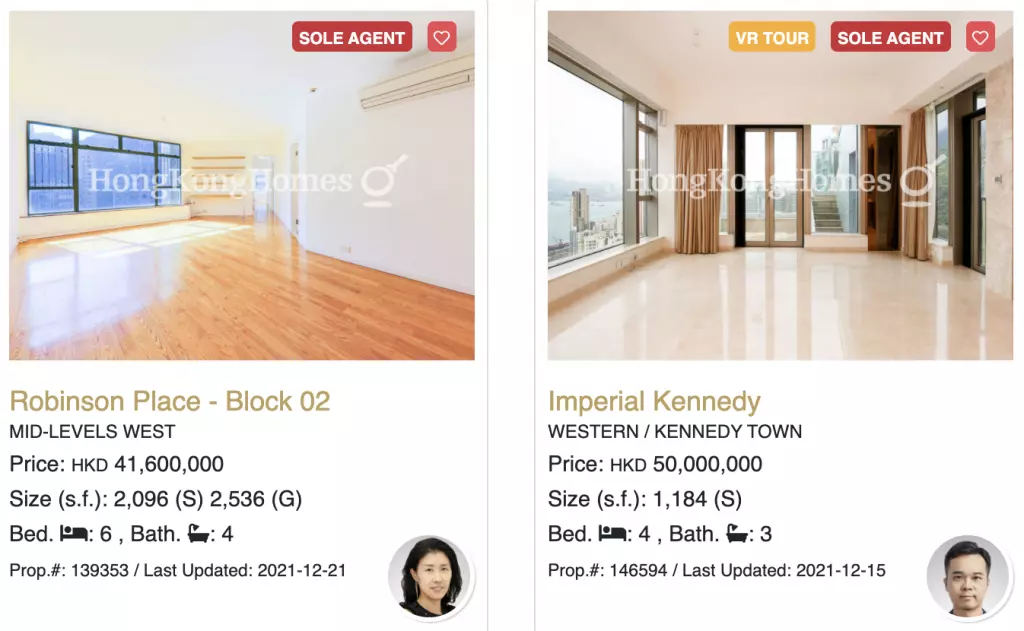

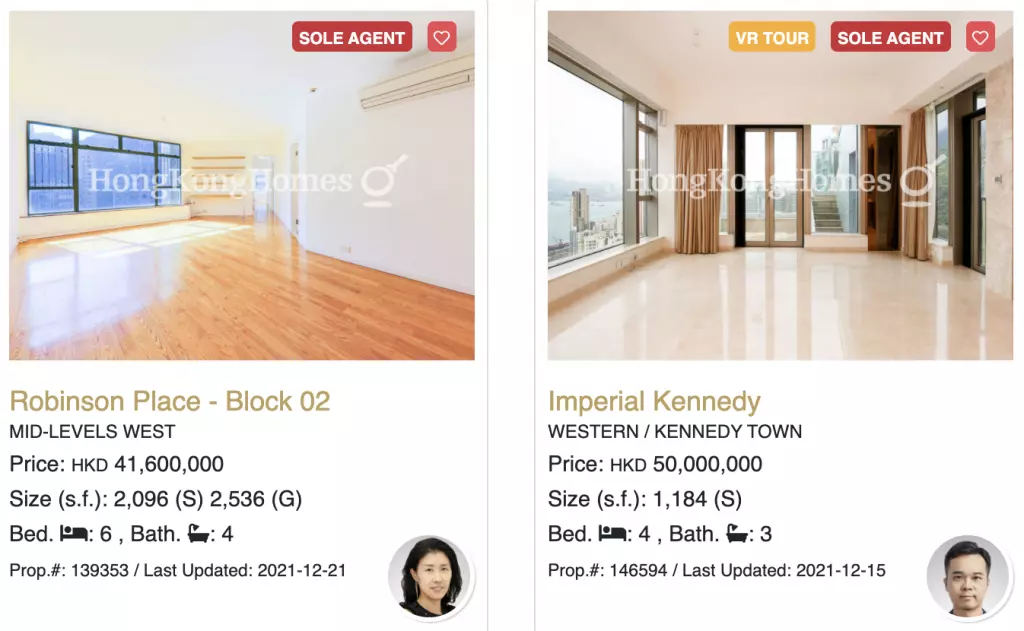

Hong Kong

Robinson Place - Block 2

Robinson Place - Block 2

In Hong Kong, for example, the Robinson Place - Block 2 apartment costs $5,335,000 for 195 square meters, resulting in a price per square meter of $27,000. This aligns with the Numbeo estimate of $33,596 per square meter.

New York City

1601 3rd Ave

1601 3rd Ave

In New York City, the 1601 3rd Ave apartment covers 73 square meters and is priced at $885,000, translating to a price per square meter of $12,000. This closely aligns with the Numbeo estimate of $15,576 per square meter.

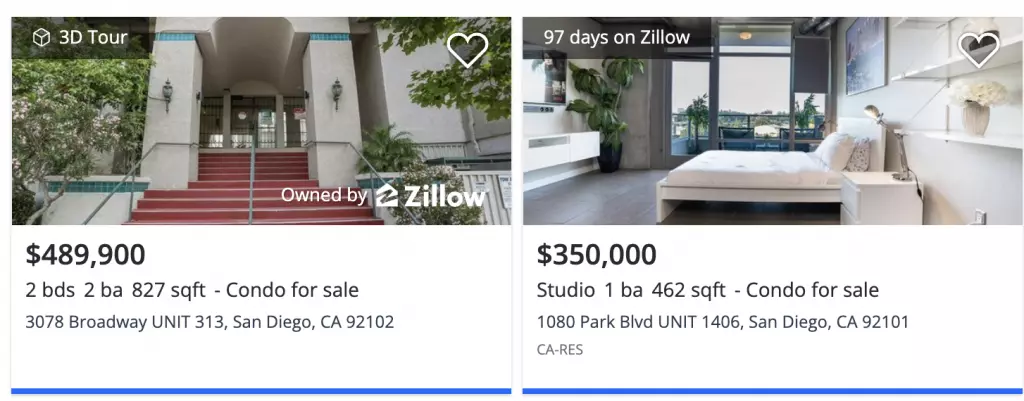

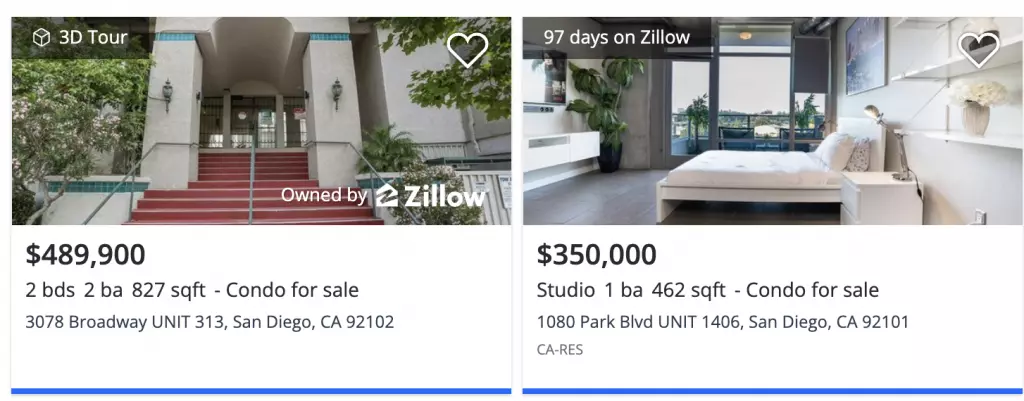

San Diego

3078 Broadway

3078 Broadway

Similarly, in San Diego, the 3078 Broadway apartment spans 77 square meters and is priced at $489,900, resulting in a price per square meter of $6,500. This is in line with the Numbeo estimate of $8,754 per square meter.

Medellin

Medellin Apartment

Medellin Apartment

Finally, in Medellin, a 300 square meter apartment priced at $295,000 yields a price per square meter of $983. This closely matches the Numbeo estimate of $974 per square meter.

These examples demonstrate the accuracy of Numbeo estimates and how they align with actual listings. It's crucial to conduct thorough research and verify data when considering investments in ultra-cheap markets.

Understanding the Factors Behind Ultra-Cheap Markets

Ultra-cheap markets aren't randomly cheap; there are underlying factors that contribute to their affordability. These factors include crime rates, economic crises, political instability, and low economic output. Let's take a closer look at some examples:

- Caracas, Cali, and Johannesburg rank among the top 50 cities with the highest murder rates and are ultra-cheap. However, Saint Louis, Baltimore, and San Juan also make the same list but are not as cheap, indicating that violence alone isn't the sole factor.

- Venezuela's economic crisis contributes to the ultra-cheap housing prices in Caracas. However, Lebanon is also experiencing an economic crisis, but its capital city of Beirut is relatively more expensive, suggesting that economic crises alone don't determine housing prices.

- Colombia presents an interesting case. Despite its growing economy, falling crime rates, and favorable demographics, it still has ultra-cheap cities. This discrepancy may be due to the false narrative surrounding Colombia as a drug capital, which keeps prices artificially low.

Discerning Potential Winners

Identifying investment-worthy opportunities in ultra-cheap markets requires a discerning eye. While not all ultra-cheap markets will experience a turnaround like Singapore, there are indicators that can help guide your decision-making:

- Favorable economic growth stories: Look for markets with strong economic growth, low debt, and positive demographics. Colombia, for example, showcases these characteristics and presents a promising investment prospect.

- Battered down by false narratives: Seek markets that are unjustifiably undervalued due to false economic narratives. By challenging these narratives, you can potentially unearth hidden investment opportunities.

- Cultivate solid local contacts: Investing in international markets necessitates having reliable local contacts who possess in-depth knowledge of the culture, language, and laws. These individuals can help you navigate the market and identify lucrative deals.

It's essential to approach international real estate investing with a global mindset, a sense of adventure, and a high risk tolerance. While not every investment will yield substantial returns, a well-researched investment in an ultra-cheap market can be a game-changer.

Conclusion

Ultra-cheap real estate markets offer enticing opportunities for investors seeking discounted prices and high returns. However, it's crucial to approach these markets with caution and conduct thorough research before making any investment decisions. By understanding the factors that contribute to a market's ultra-cheap status and keeping an eye out for indicators of growth, you can potentially uncover hidden gems and capitalize on promising investment opportunities. Remember, finding the next Singapore may require diligence, patience, and a touch of luck, but the potential rewards can be well worth the effort.