Image by BraunS

Image by BraunS

2022 was a challenging year for real estate investment trust (REIT) investors, but as we head into 2023, it's time to look forward and consider new opportunities. In this article, I will share my top REIT picks for the coming year.

Assessing REITs in 2021, 2022, and 2023

Before we dive into the picks, let's take a quick look back. In 2021, my recommendations returned an average of 40.8%, with notable winners like American Campus, Innovative Industrial, Iron Mountain, and Extra Space. However, 2022 didn't fare as well, and most of my picks ended up being losers.

Image by iREIT

Image by iREIT

While it's important to acknowledge the losses, it's also worth noting that the entire REIT sector underperformed other market categories. Despite this, I believe 2023 holds potential, even if it won't be an easy year.

Not Easy, but Still Better?

While there may not be parties of anticipation about picking up profits left and right, there is cautious optimism. The Nasdaq predicts a transition from a bear market to a potential bull in 2023. However, they also emphasize potential bumps along the way, such as concerns about inflation and recession.

Image by U.S. Sector 1 Year Performance - 14th December 2022 - Simply Wall St

Image by U.S. Sector 1 Year Performance - 14th December 2022 - Simply Wall St

Ultimately, the Nasdaq's analysis suggests a focus on consistent cash flow, dividends, and coupon generators. This shift in perspective bodes well for traditional "value" plays like REITs.

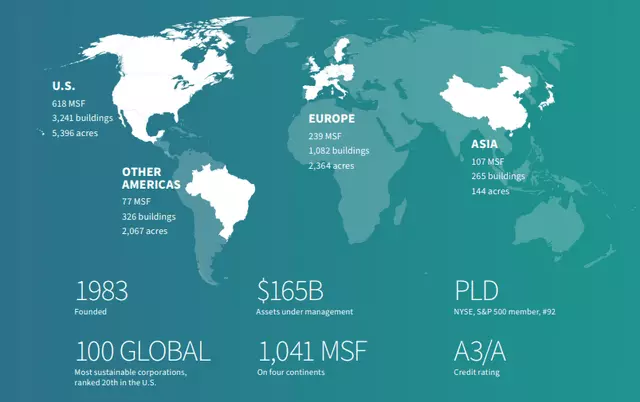

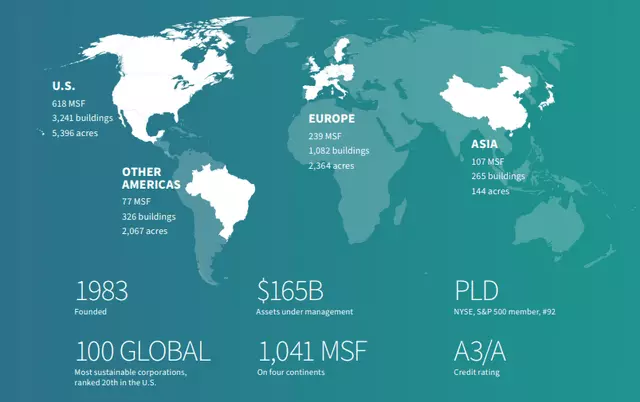

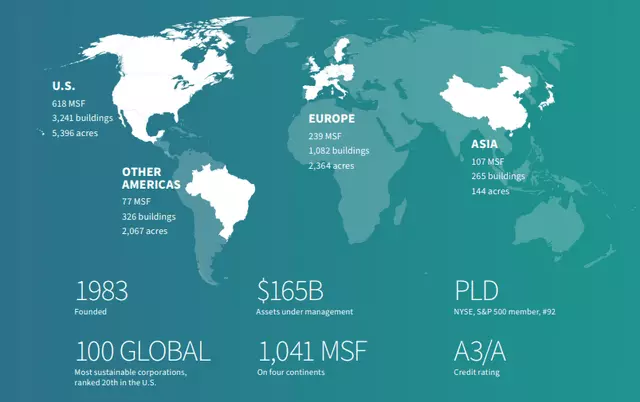

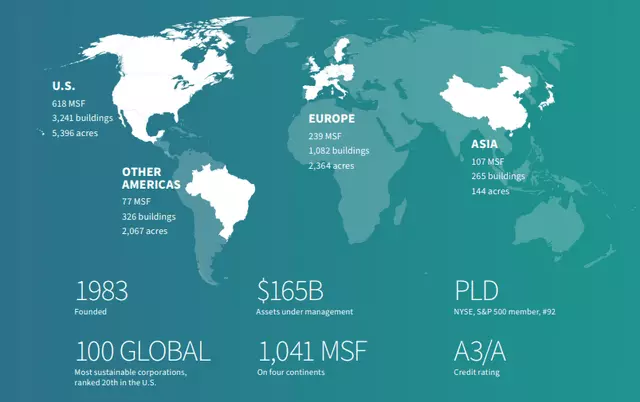

Prologis (PLD)

Image by Investor Relations

Image by Investor Relations

Prologis is a logistics real estate company with a growing portfolio, including high-profile customers like Amazon, FedEx, Home Depot, and Maersk. Their strong position in the market and the increasing demand for logistics make them an attractive long-term investment. With consistent growth in FFO and AFFO, as well as a safe dividend, Prologis is undervalued compared to its historical averages.

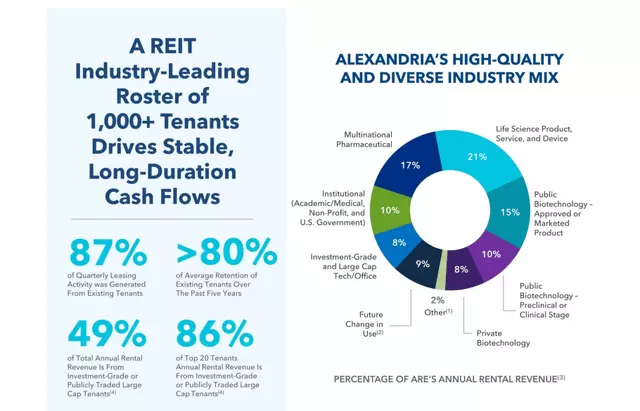

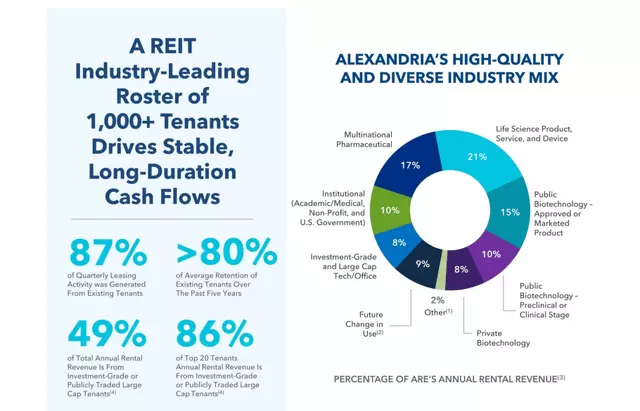

Alexandria Real Estate Equities (ARE)

Image by Investor Relations

Image by Investor Relations

Alexandria Real Estate Equities focuses on urban office real estate, specifically collaborative life sciences, technology, and AgTech campuses. These high-growth segments have contributed to substantial net operating income growth. With a strong balance sheet, solid liquidity, and a safe dividend, Alexandria is well-positioned for future growth.

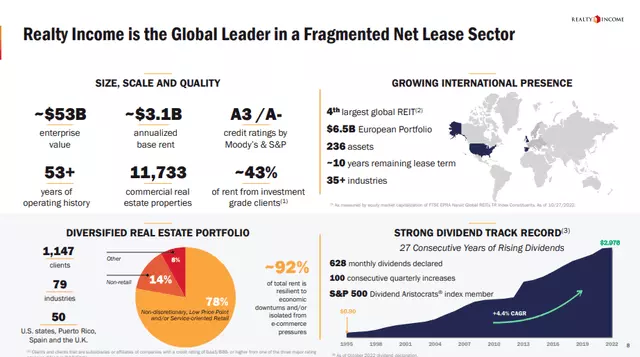

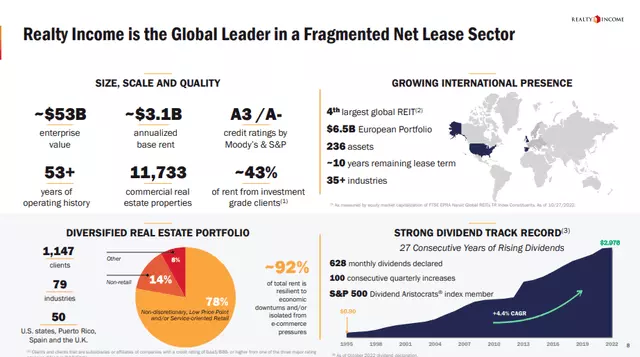

Realty Income Corporation (O)

Image by Investor Relations

Image by Investor Relations

Realty Income is a monthly dividend company with a long history of rising dividends. Their diversified portfolio of over 11,000 properties and high occupancy rates make them a reliable option for dividend-seeking investors. Trading at a discount compared to its historical averages, Realty Income provides an attractive investment opportunity.

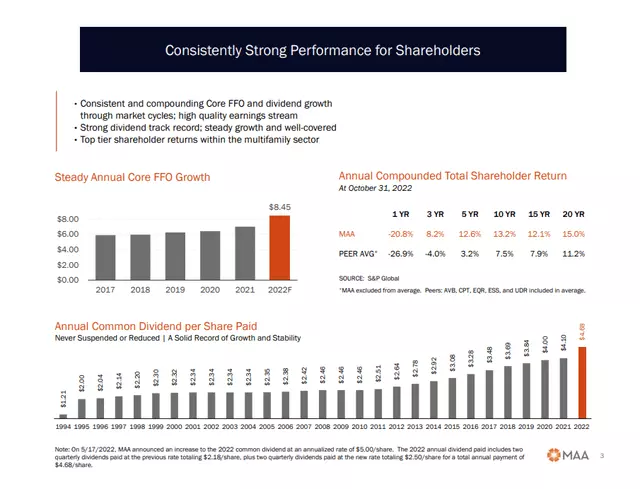

Mid-America Apartment Communities (MAA)

Image by MAA Investor Relations

Image by MAA Investor Relations

Mid-America Apartment Communities is a multifamily-focused REIT with properties in key regions of the United States. The company has demonstrated steady growth, with reliable FFO, annual total shareholder returns, and dividend increases. With a safe dividend and current valuation below its five-year average, Mid-America Apartment Communities is an appealing option.

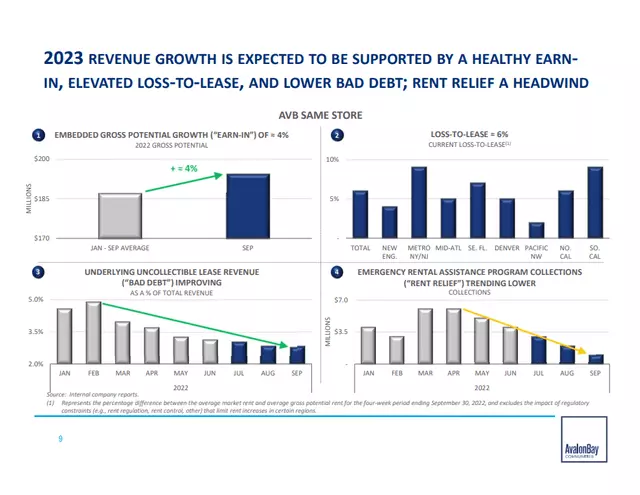

AvalonBay Communities (AVB)

Image by Investor Relations

Image by Investor Relations

AvalonBay Communities develops, owns, and operates multifamily apartment communities across various regions in the United States. Their consistent growth in FFO, strong balance sheet, and undervaluation make them an interesting investment opportunity. With a safe dividend and solid liquidity, AvalonBay is a strong choice for long-term investors.

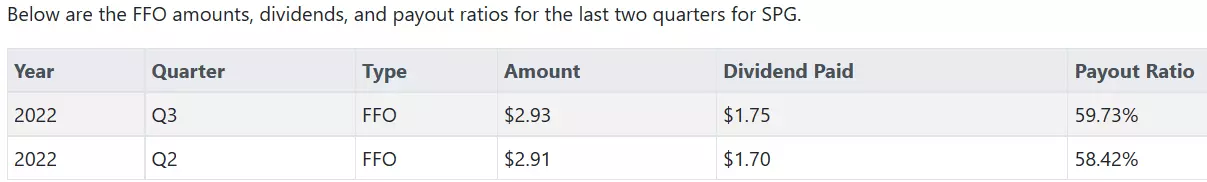

Simon Property Group (SPG)

Image by 3Q22 Supplemental Information

Image by 3Q22 Supplemental Information

Simon Property Group is a well-established REIT that owns and manages Class-A malls. Despite the challenges faced by the retail sector, Simon maintains a diverse tenant base and exhibits safety in its business operations, dividend, and current valuation. With an A- credit rating and substantial liquidity, Simon is a strong buy for investors seeking stability and potential capital gains.

Extra Space Storage (EXR)

Image by EXR Nov '22 Investor Presentation

Image by EXR Nov '22 Investor Presentation

Extra Space Storage focuses on the self-storage sector and has exhibited impressive growth in recent years. With strong earnings and dividend growth, as well as an undervalued stock, Extra Space is an attractive investment option. Their emphasis on ancillary income and ability to navigate inflationary environments adds to their appeal.

Digital Realty Trust (DLR)

Image by DLR 3Q22 Investor Presentation

Image by DLR 3Q22 Investor Presentation

Digital Realty owns a vast network of data centers, playing a crucial role in the digital infrastructure of the modern world. Despite recent challenges, the company has a history of steady growth in funds from operations and dividends. With a well-covered dividend and an FFO multiple below its long-term average, Digital Realty presents a compelling investment opportunity.

In conclusion, while past performance is not indicative of future results, these REITs offer promising opportunities for investors in 2023. By considering factors like valuation, growth potential, and dividend safety, you can navigate the ever-changing real estate market with confidence.