Image: Structure of National Association of Real Estate Investment Trusts (NAREIT)

Image: Structure of National Association of Real Estate Investment Trusts (NAREIT)

When it comes to the world of Real Estate Investment Trusts (REITs), one organization stands out as a true advocate for the industry – The National Association of Real Estate Investment Trusts (NAREIT). Established in 1960, shortly after the creation of the REIT structure by the United States Congress, NAREIT has played a vital role in shaping the industry, advocating for legislative and regulatory changes, and providing valuable information and resources to its members.

What Is the National Association of Real Estate Investment Trusts (NAREIT)?

The National Association of Real Estate Investment Trusts is a trade association that represents the interests of REITs and publicly-traded real estate companies. Its primary purpose is to advocate for policies that benefit the REIT industry, promote best practices, and provide educational resources for investors and industry professionals.

NAREIT's mission is to advance the interests of REITs and real estate companies by fostering a business and regulatory environment that promotes responsible investment and growth. Its objectives include promoting the benefits of REITs, providing a platform for industry networking, and offering education and research resources to investors and professionals.

Structure of NAREIT

Organizational Structure

NAREIT's organizational structure ensures effective governance and decision-making processes. The Board of Directors, composed of senior executives from member companies, provides strategic direction and oversees the organization's activities. The Executive Committee, a subset of the Board of Directors, manages NAREIT's day-to-day operations, ensuring the organization remains focused on its mission and objectives. Additionally, NAREIT's advisory committees, composed of member company representatives, provide guidance on various aspects of the organization's activities, shaping policies, educational programs, research initiatives, and advocacy efforts.

Membership

NAREIT offers different types of memberships, including corporate, individual, and associate memberships. Corporate members are REITs and other real estate companies, while individual members are professionals in the industry. Associate members include service providers, such as law firms, accounting firms, and financial institutions. To become a NAREIT member, companies and individuals must meet specific eligibility criteria. Membership provides access to valuable resources, networking opportunities, and industry insights, including exclusive events, research publications, educational programs, and the opportunity to influence industry policies and regulations.

Staff and Management

NAREIT's staff and management team, comprised of professionals with expertise in various areas, including advocacy, research, education, and communications, are responsible for executing the organization's mission and objectives.

Real Estate Investment Trusts (REITs)

A REIT is a company that owns, operates, or finances income-producing real estate. REITs provide individual investors with access to large-scale, professionally-managed real estate portfolios, offering diversified assets and regular income streams.

There are different types of REITs:

Image: Types of Real Estate Investment Trusts (REITs)

Image: Types of Real Estate Investment Trusts (REITs)

- Equity REITs primarily invest in and own income-producing real estate properties, such as office buildings, shopping centers, and apartment complexes. They generate income from rent collected from tenants and their value is driven by property appreciation and rental income growth.

- Mortgage REITs invest in and own property mortgages, including mortgage-backed securities and mortgage loans. These REITs earn income from the interest on the mortgages they hold. Mortgage REITs can be more sensitive to changes in interest rates and have different risk-return profiles compared to equity REITs.

- Hybrid REITs combine the investment strategies of both equity and mortgage REITs, owning both income-producing properties and mortgage assets. This diversified approach provides a balance between the income generated from property rents and interest on mortgage investments.

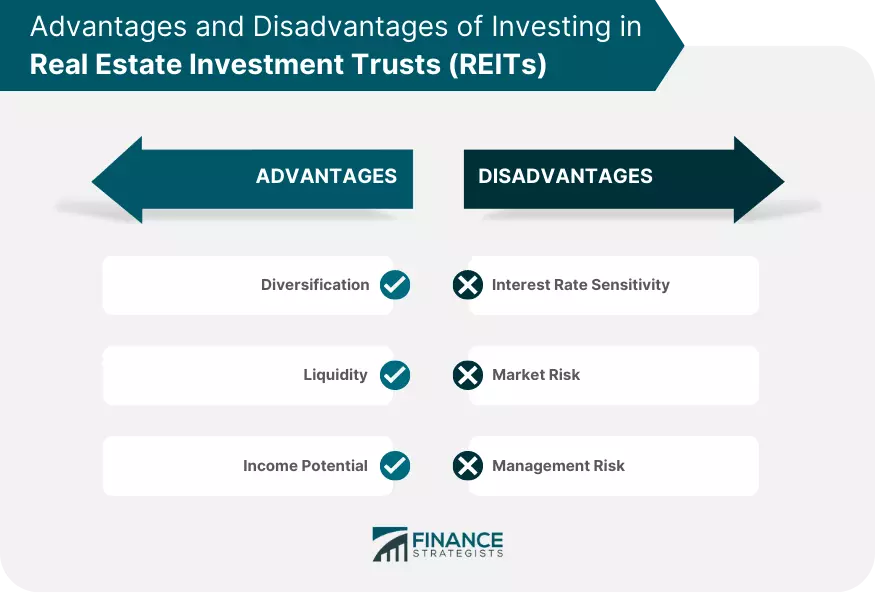

Investing in REITs offers several advantages, including diversification, liquidity, and income potential. REITs provide exposure to various types of real estate assets, reducing the risk associated with investing in a single property. Additionally, REIT shares are publicly traded, offering investors liquidity not typically found in direct real estate investments. Finally, REITs are required to distribute at least 90% of their taxable income to shareholders, providing a steady stream of income.

However, there are potential disadvantages to investing in REITs, such as interest rate sensitivity, market risk, and management risk. REITs, particularly mortgage REITs, can be sensitive to changes in interest rates, impacting their performance. Market risk refers to potential losses due to fluctuations in real estate markets, while management risk arises from suboptimal investment or operational decisions negatively impacting performance.

NAREIT's Role in Advocacy and Policy

NAREIT's advocacy efforts encompass legislative, regulatory, and judicial arenas, ensuring that the interests of REITs are represented and protected.

Legislative Advocacy

NAREIT plays a crucial role in representing the interests of REITs and real estate companies in Congress. By advocating for favorable legislation and policies, NAREIT helps ensure that the REIT industry can thrive and contribute to economic growth. The organization addresses key policy issues, such as taxation, financial regulations, and housing policies, taking informed positions to shape policy debates and influence decision-making in ways that benefit its members and the broader real estate sector.

Regulatory Advocacy

NAREIT works closely with regulatory agencies, such as the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA), to promote regulations supporting the growth and stability of the REIT industry while protecting investors. The organization also helps its members stay compliant with industry standards and regulations by providing guidance, resources, and best practices to maintain high levels of transparency, governance, and operational efficiency.

Judicial Advocacy

NAREIT provides legal representation and support for its members when necessary, protecting their interests in the courts. It defends against potential lawsuits, navigates complex legal issues, and advocates for the rights of REITs. NAREIT's judicial advocacy efforts focus on protecting the interests of REITs in legal disputes and regulatory challenges, influencing court decisions that may have significant implications for the industry.

NAREIT's Educational and Research Initiatives

NAREIT offers a range of educational and research initiatives aimed at providing valuable resources and insights to its members.

Conferences and Events

NAREIT's flagship event, the annual REITWeek conference, brings together REIT executives, investors, and industry professionals. This event offers valuable learning opportunities, facilitates networking, and serves as a platform to discuss industry trends. In addition to the REITWeek conference, NAREIT participates in and sponsors other industry events throughout the year, such as regional conferences, workshops, and seminars, providing additional opportunities for members to connect, learn, and exchange ideas.

Research Publications and Resources

NAREIT regularly publishes performance reports that provide insights into the REIT industry's performance, trends, and outlook. These reports offer valuable information for investors, analysts, and industry professionals to make informed decisions and evaluate market conditions. The organization also produces whitepapers and policy briefs, addressing key regulatory and legislative issues affecting the REIT industry. These publications help inform policymakers, regulators, and industry stakeholders about the implications of various policy proposals and potential regulatory changes.

Educational Programs and Webinars

NAREIT offers educational programs and resources designed to help investors and industry professionals better understand the REIT industry, investment strategies, and risk management. These programs include online courses, workshops, and training sessions. The organization also hosts webinars featuring industry experts who discuss current trends, challenges, and opportunities in the REIT industry. These webinars provide valuable insights and analysis, helping members stay informed and make strategic decisions.

NAREIT's Impact on the Real Estate Industry

NAREIT's contributions to the real estate industry extend beyond advocacy, education, and research initiatives.

Promoting Transparency and Best Practices

NAREIT plays a significant role in promoting transparency and best practices in the REIT industry. By providing guidance and resources on governance, financial reporting, and risk management, NAREIT helps its members maintain high standards of corporate responsibility and investor confidence.

Contributions to Economic Growth and Development

The REIT industry, represented by NAREIT, contributes to economic growth and development by facilitating investment in real estate assets. This investment helps drive job creation, supports local communities, and fuels economic expansion across various sectors.

Influence on the Real Estate Investment Landscape

NAREIT's comprehensive efforts in advocacy, education, and research have a profound influence on the real estate investment landscape. Through its initiatives, NAREIT has helped shape policies and regulations that encourage investment in REITs, foster industry growth, and provide individual investors with access to diversified real estate portfolios.

Final Thoughts

The National Association of Real Estate Investment Trusts (NAREIT) serves as a leading advocate for the REIT industry, promoting its growth, advocating for favorable legislation and policies, and providing valuable resources for investors and professionals. NAREIT's educational initiatives, such as conferences, research publications, and educational programs, offer members opportunities to learn, network, and stay informed about industry trends. The association's advocacy efforts encompass legislative, regulatory, and judicial arenas, ensuring that the interests of REITs are represented and protected. NAREIT's impact on the real estate industry extends to promoting transparency and best practices, contributing to economic growth and development, and influencing the real estate investment landscape. Through its comprehensive approach, NAREIT continues to shape the future of the REIT industry and support its members in achieving their goals.