The real estate market in 2023 faced numerous challenges, with declining asset valuations and a decrease in transaction volume. As we enter 2024, investors are hopeful for a better year and a return to normal levels of activity. However, it is important to understand the trends and navigate the changing landscape to make informed investment decisions.

Distress Starts to Bite as Loans Mature

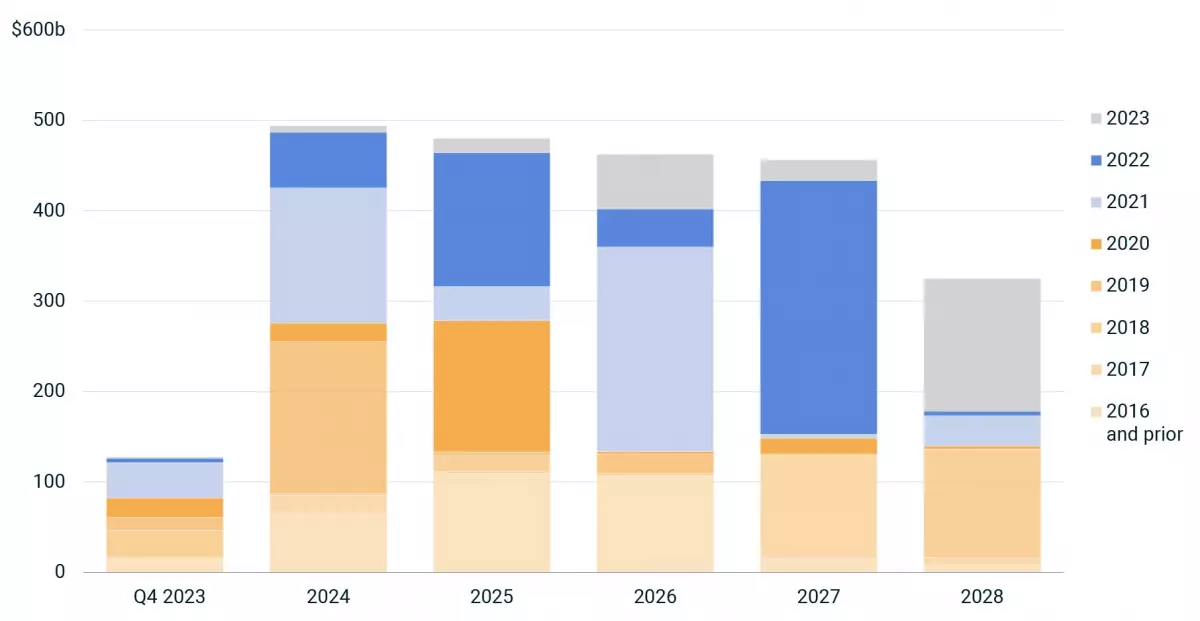

One key trend to watch out for is the maturing loans facing the real estate market. Many loans originated at record-high property prices and low mortgage rates, and as these loans mature, some investors may struggle to rebalance their capital structures. This could lead to forced selling and present opportunities for investors looking to acquire assets at discounted prices.

Loan maturities by origination vintage. Loans outstanding at Q4 2023. Data as of Dec. 5, 2023. Source: MSCI Mortgage Debt Intelligence

Loan maturities by origination vintage. Loans outstanding at Q4 2023. Data as of Dec. 5, 2023. Source: MSCI Mortgage Debt Intelligence

Bridging the Gap Between Buyers and Sellers

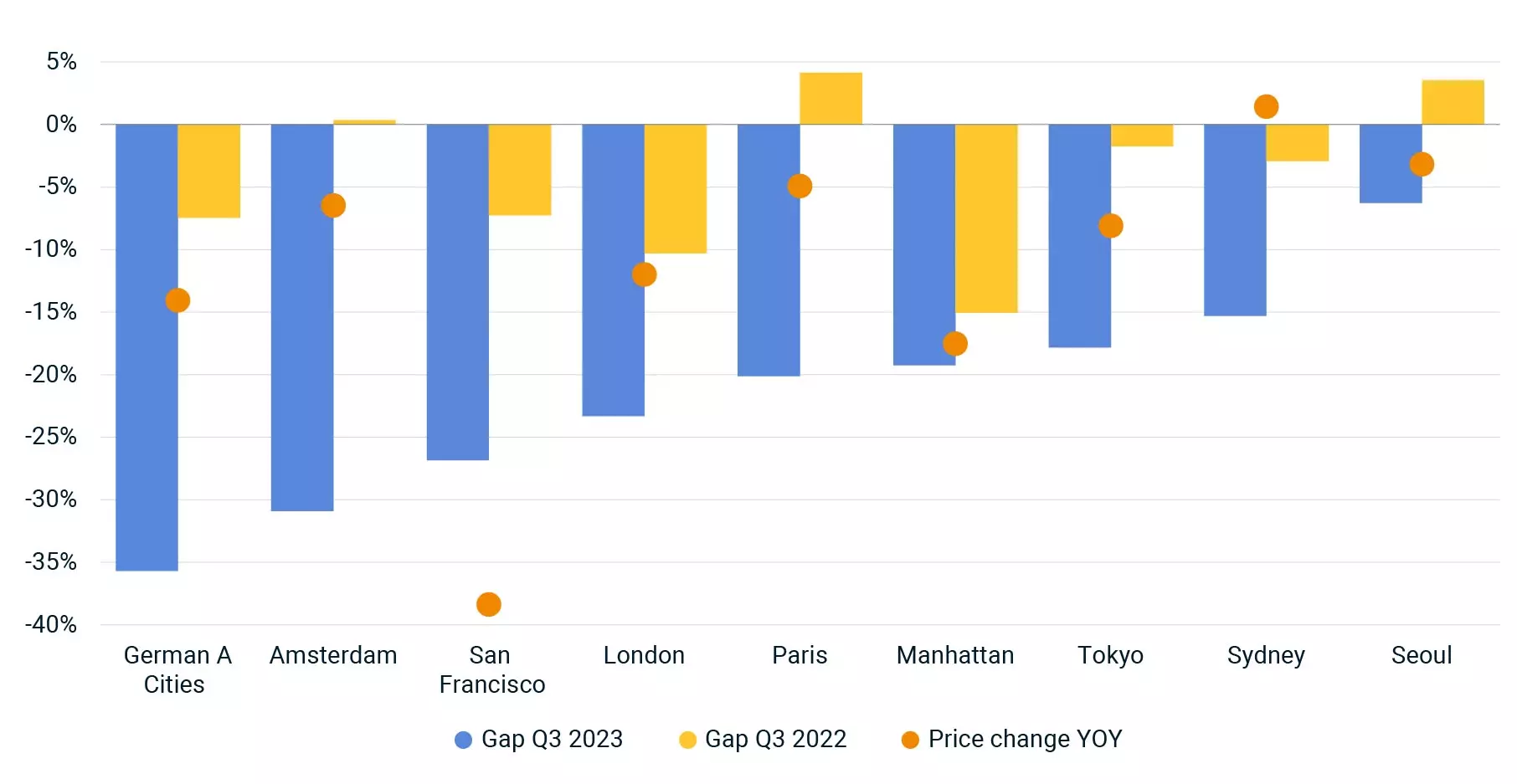

The current illiquidity in global transaction markets is largely due to the pricing uncertainty caused by rising interest rates. Buyers and sellers have different views on property prices, resulting in fewer completed deals. To restore market liquidity, there needs to be a greater agreement on pricing, which requires clarity on the trajectory of interest rates. In the meantime, investors should be mindful of the price gap and stay informed.

Office properties only. Source: MSCI Price Expectations Gap, RCA Hedonic Series

Office properties only. Source: MSCI Price Expectations Gap, RCA Hedonic Series

Office Performance and the Double Dip

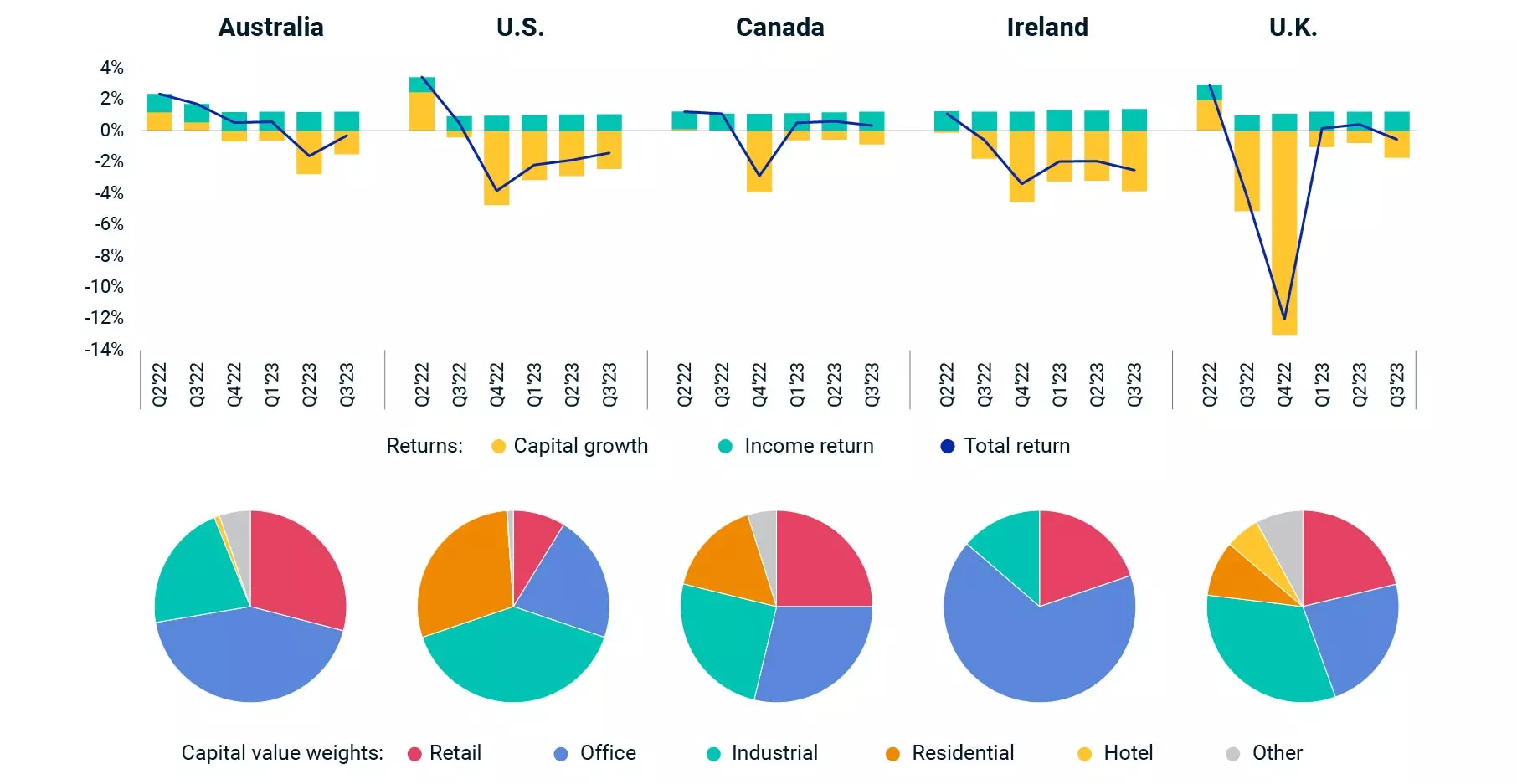

Weakening tenant demand in the office sector and factors like higher interest rates and weakening economic growth could potentially trigger a double dip in property performance. Pricing plays a crucial role in determining capital growth, and many market segments may require further price reductions to restore liquidity. Investors should pay attention to capital value weights and monitor the performance of office properties, especially in markets heavily weighted toward this sector.

Capital value weights as of Q3 2023. Source: MSCI UK Quarterly Property Index, MSCI/SCSI Ireland Quarterly Property Index, MSCI/REALPAC Canada Annual Property Index (Unfrozen) Published Quarterly, MSCI U.S. Quarterly Property Index (Unfrozen), The Property Council of Australia/MSCI Australia Annual Property Index (Unfrozen) Published Quarterly

Capital value weights as of Q3 2023. Source: MSCI UK Quarterly Property Index, MSCI/SCSI Ireland Quarterly Property Index, MSCI/REALPAC Canada Annual Property Index (Unfrozen) Published Quarterly, MSCI U.S. Quarterly Property Index (Unfrozen), The Property Council of Australia/MSCI Australia Annual Property Index (Unfrozen) Published Quarterly

Shifting Risk/Return Landscape

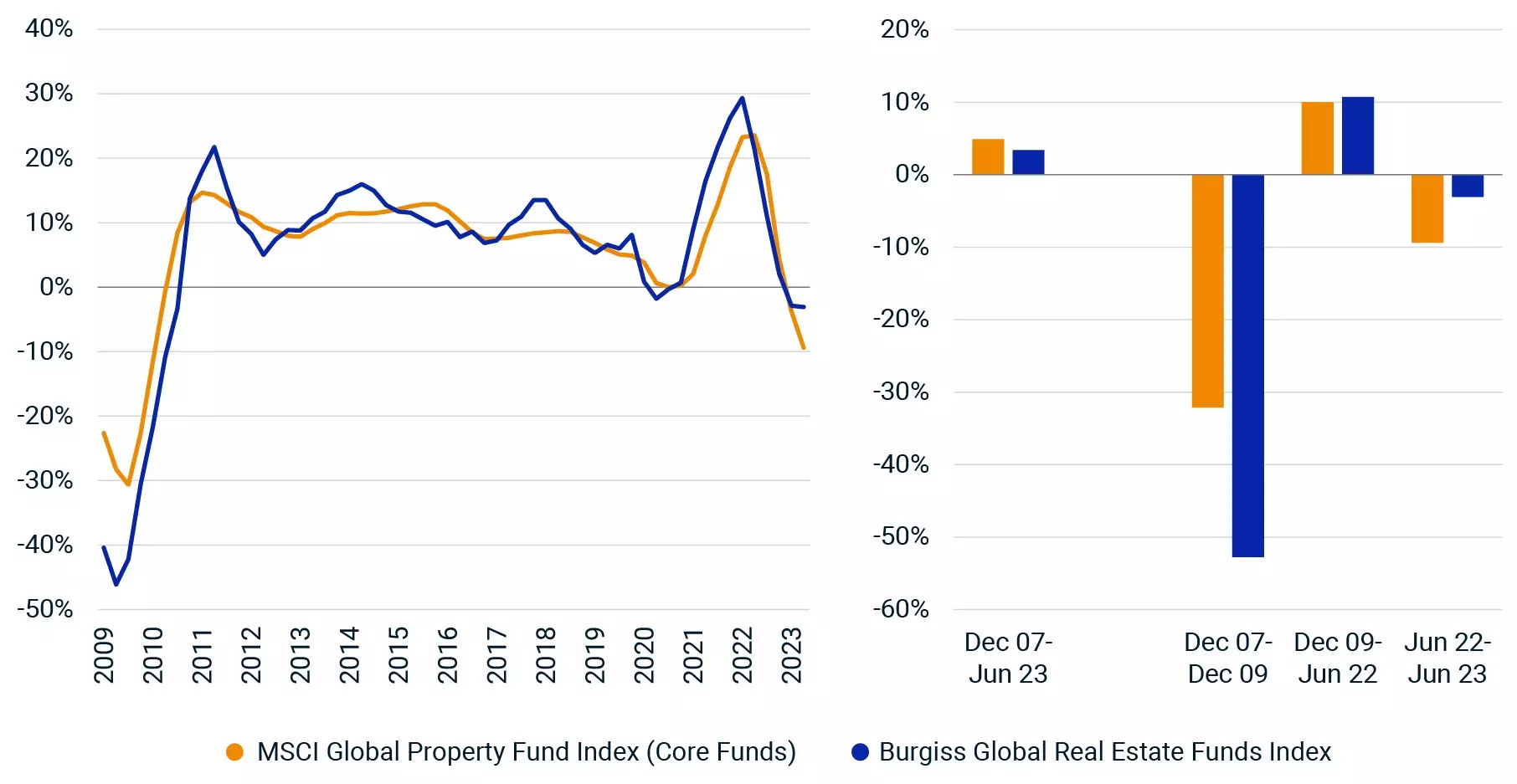

Global real estate investing has undergone significant changes, driven by economic and financing shifts. Investors are reassessing their perception of value and capital allocations within the real estate market. Risk, ranging from core to opportunistic strategies, is a crucial factor to consider. Analyzing the return characteristics of different investment funds can provide valuable insights into market performance.

Fund returns. Source: Burgiss Global Real Estate Funds Index, MSCI Global Property Fund Index (Core Funds)

Fund returns. Source: Burgiss Global Real Estate Funds Index, MSCI Global Property Fund Index (Core Funds)

Climate Change and its Implications

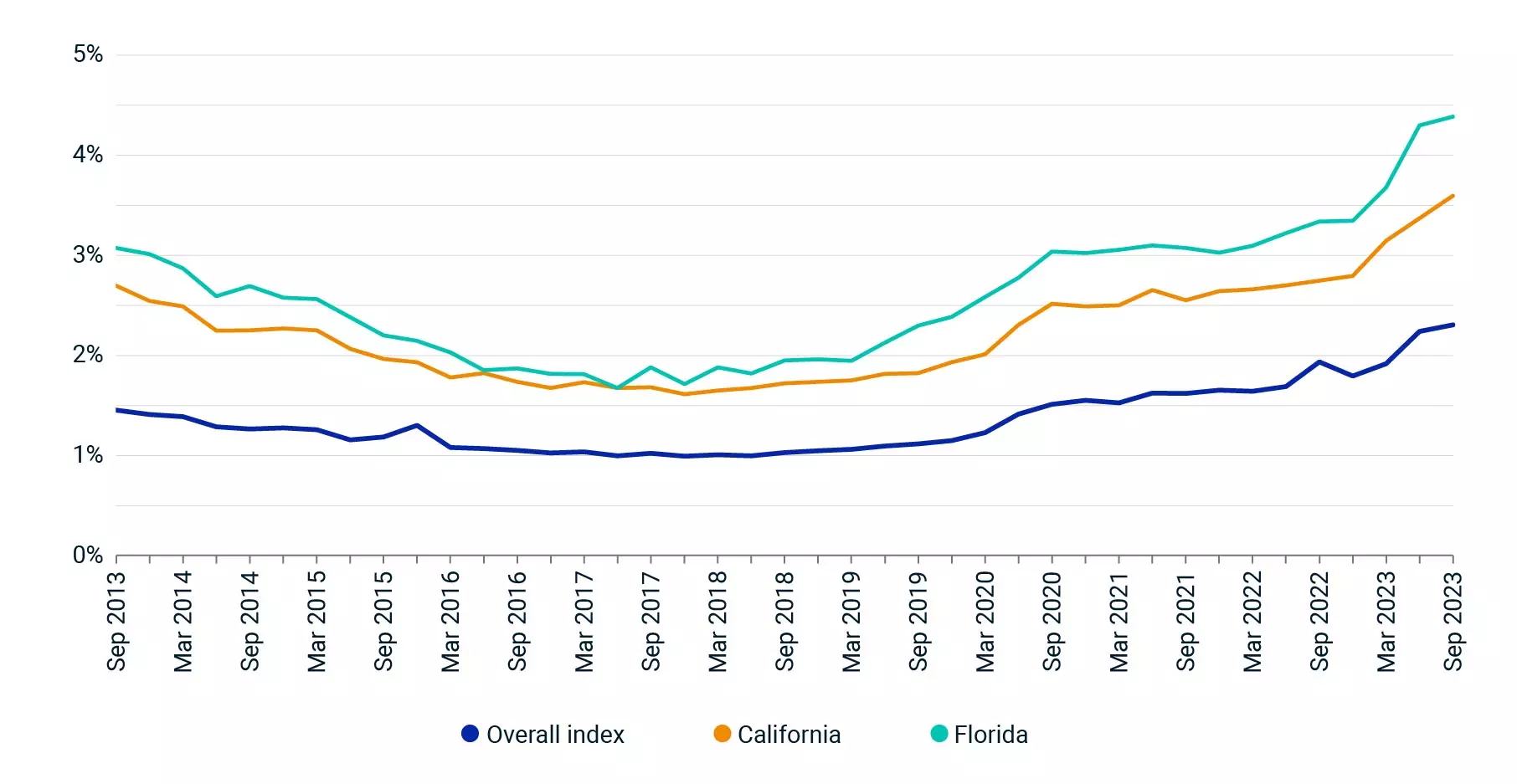

Climate change poses a significant risk for real estate investors, with changing weather patterns leading to physical damage and transition costs. The MSCI Climate Value-at-Risk Model estimates that a portion of the global annual property index could be vulnerable to both physical and transition risks. Additionally, extreme weather events have led to increased insurance costs, particularly in high-risk states like Florida and California.

Insurance costs as a share of income receivable. Source: MSCI U.S. Quarterly Property Index

Insurance costs as a share of income receivable. Source: MSCI U.S. Quarterly Property Index

As we navigate the changing real estate landscape, it is essential to stay informed about these trends and make well-informed investment decisions. By understanding the challenges and opportunities presented, investors can mitigate risks and capitalize on market dislocations.