The housing market in Osaka continues to sizzle, with little relief in sight for buyers hoping for a cool down in prices. In fact, the prices of newly constructed apartments in Osaka have skyrocketed in recent months, reaching new heights that have caught the attention of both investors and homebuyers.

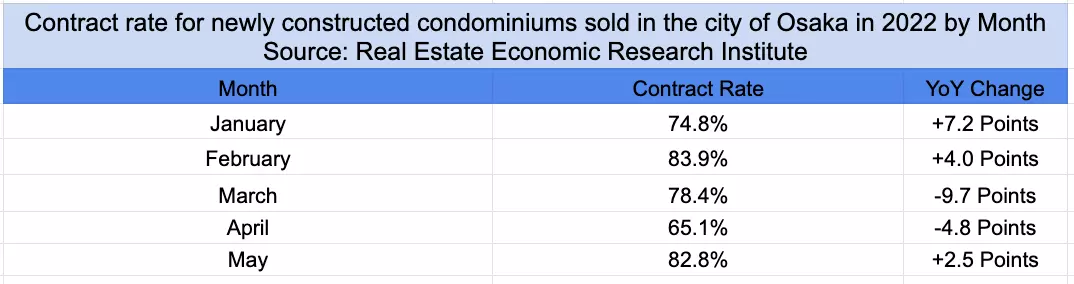

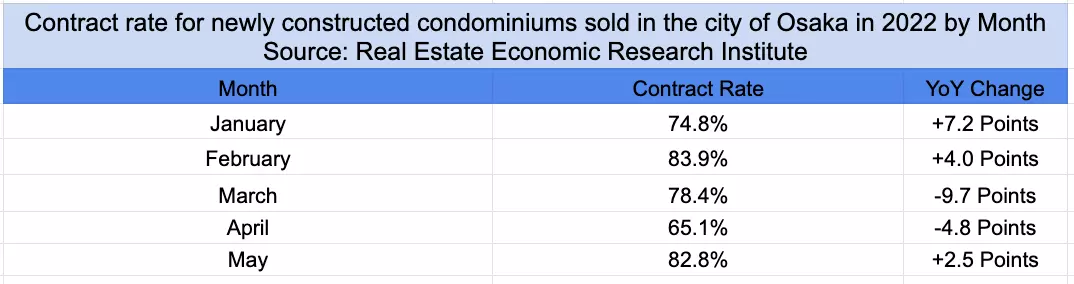

According to the latest data from the Real Estate Economic Research Institute, the average sales price of a newly constructed apartment in Osaka in May 2022 was a whopping ¥65,210,000. This represents a staggering year-on-year increase of 105.3% and a significant jump of 61.0% compared to April. The average sales price per square meter also saw a notable increase, rising by 31.0% year-on-year and 11.9% compared to the previous month.

These robust sales figures confirm the upward price trend that has been observed in the Kansai region since the beginning of the year. Despite a slight dip in April, the market has quickly rebounded, dispelling concerns that it was just a temporary setback.

What's Driving the Price Surge in Osaka?

There are several factors driving the surge in sales prices in Osaka. One key factor is the current inventory shortage of new condominiums, particularly in the city of Osaka itself. The demand for housing far exceeds the available supply, leading to fierce competition among buyers and driving prices even higher. Additionally, macroeconomic factors such as Japan's ultra-low interest rate environment and the weak yen contribute to the strong demand for real estate in the region.

The impact of the pandemic cannot be ignored either. When the economy started shutting down in March and April 2020, condominium developers across Japan significantly reduced the release of new units into the market. This created a supply shortage that persists to this day. Although supply has gradually recovered since then, it is still below the annual average level for the past decade.

On the other hand, demand remains high due to various factors. The Bank of Japan's commitment to keeping interest rates low has resulted in historically low mortgage rates, making homeownership more affordable. Furthermore, the shift towards remote work prompted by the pandemic has also influenced buyer sentiment, with more people considering buying homes that meet their changing lifestyle needs.

It's also worth noting that Osaka's popularity as a tourist destination plays a role in driving demand for real estate in the region. With the anticipation of the Osaka Expo 2025 and the gradual reopening of borders to tourists, land prices are expected to rebound, leading to further appreciation in the residential segment.

Foreign Buyers and the Weak Yen

Foreign buyers are increasingly attracted to the Japanese real estate market due to the weak yen. The Bank of Japan's monetary policy, divergent from that of other major central banks, has caused the yen to depreciate against the US dollar. This depreciation, combined with Japan's stable economy and attractive investment opportunities, makes Japanese real estate an appealing option for foreign investors.

Conclusion

The housing market in Osaka shows no signs of cooling down, with prices reaching unprecedented levels. The shortage of inventory, coupled with strong demand driven by macroeconomic factors and shifting buyer preferences, continues to drive prices higher. As the city gears up for the Osaka Expo 2025 and the gradual return of inbound tourists, the housing market is expected to remain hot in the coming months.

Sources: Real Estate Economic Research Institute