Introduction

Have you ever wondered how long you should hold onto an undeveloped lot in a residential subdivision? Just like a tree in the forest, the value of such a lot doesn't rise indefinitely. In this article, we will explore the factors that can impact the value of vacant lots over time and provide insights for property owners to consider.

Image: An undeveloped lot in a subdivision

Image: An undeveloped lot in a subdivision

The Time Factor

Real estate professionals understand that vacant subdivision lots can eventually be "priced out of the market." The main factor that contributes to this situation is time. The longer it takes for a subdivision to be fully developed, the higher the chance that vacant lots will reach a ceiling on their value or even decline. Lenders who finance developers also evaluate the expected time for complete subdivision development due to this inherent risk.

This is particularly relevant in the Lakes Region of New Hampshire, where several subdivisions with amenities for second-home owners and scenic views have developed slowly. Although there has been increased interest in buildable land recently, these subdivisions still have vacant lots that may soon reach the limits of their value.

Pricing Out of the Market: An Example

To illustrate how vacant lots can be priced out of the market, let's consider the hypothetical case of a subdivision started in the late 1960s. In this example, we will analyze the median prices of lots, the extent of building, and the median cost of homes built in each decade. The appreciation rate assumed for vacant land is 10% per year, while homes appreciate at 7%, except during periods of soft real estate demand.

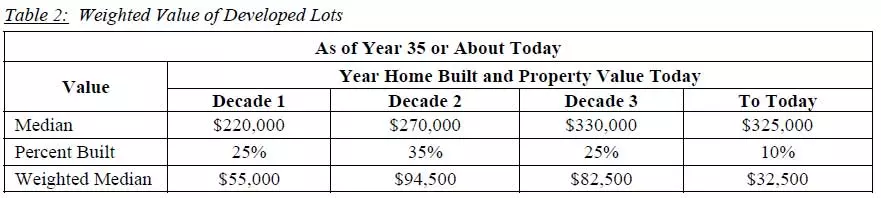

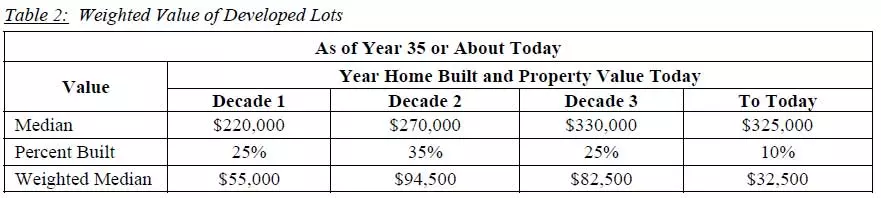

Table 1: Vacant Lot Prices and Home Values

Table 1: Vacant Lot Prices and Home Values

As we reach the current decade, the price of vacant land exceeds $80,000, while the median land price for this decade is expected to be $65,000. On the other hand, the weighted value of developed properties in the subdivision is $264,500. This raises the question: will buyers place a $400,000 home in a neighborhood where the median home value is $264,500?

At some point, buyers may answer, "No!" This response indicates that vacant lots have been priced out of the market. Although it is uncommon for buyers to purchase lots for homes of lesser value in proportion to the land cost, such "down market development" can lower the overall value of the neighborhood and further limit the value of remaining vacant lots. Soft real estate markets can also lead to the construction of lesser homes if lot owners are compelled to sell at distressed prices.

Consider Your Alternatives

If you are a lot owner facing the potential of being priced out of the market, you may think, "But I am going to build!" While building a lesser home may satisfy your needs, it is important to recognize that you are essentially buying the lot at today's value when you build on it. This decision may have long-term consequences and could hold down the overall values of the neighborhood. Therefore, it is crucial to carefully consider your alternatives.

Additionally, if you have held the lot for some time, you may have a significant capital gain. In such cases, it is advisable to explore a tax-deferred exchange under Section 1031 of the Internal Revenue Code. This allows you to roll the gain over tax-free into another property with better potential for appreciation rather than just trying to build on your lot. To learn more about tax-deferred exchanges, you can visit www.apiexchange.com or contact the author.

Risks of Holding a Vacant Lot

As the upside of holding a vacant lot becomes limited, it is important to consider the associated risks. These risks include higher property taxes, more stringent development rules, and possible changes in real estate market conditions. Evaluating these factors is key to making informed decisions about whether to continue holding the lot.

Exceptions to the Rule

While the illustration above represents a typical scenario, there are exceptions. In cases where vacant land is appreciating rapidly, it may be economically justifiable to redevelop certain lots that have already been built on. This trend, known as the "teardown" phenomenon, is often observed with waterfront parcels but is less common in other property types.

It is important to note that the example provided serves as an illustration. Your specific situation should be evaluated through a Comparative Market Analysis using a tailored model for your subdivision. To obtain a free Comparative Market Analysis based on this model, backed by facts, data, and analysis, please contact the author directly.

About the Author

Chuck Braxton is a seasoned REALTOR® with the Meredith office of Roche Realty Group, Inc. With over 25 years of experience as a business executive, he brings a unique perspective to the challenges faced by owners and buyers of real estate in the Lakes Region. Mr. Braxton has authored several articles and financial models on valuation for project development and real estate applications. His website, www.ChuckBraxton.com, offers additional resources and information. To get in touch with Chuck Braxton, you can reach him at 603.677.2154 or via email at [email protected].

Note: This article is provided for information and education purposes only and is not intended as a solicitation of other broker's listings.