The Portland housing market in December showcased a mix of positive and challenging trends. The median and average sales prices experienced notable increases, indicating a seller-friendly environment. However, the slight decrease in closed sales and the rise in months of inventory suggest a market where buyers may find more options and potentially negotiate favorable terms.

How is the Portland Housing Market Doing Currently?

Portland, known for its stunning landscapes, vibrant culture, and booming real estate market, is closely watched by both homebuyers and real estate professionals. The Portland Metropolitan Association of Realtors® (PMAR) recently unveiled its comprehensive report on the state of the Portland housing market in December 2023.

- The median sales price was $525,000, an increase from the previous year ($507,500).

- The average sales price was $586,800, an increase from the previous year ($566,700).

- Number of closed sales was 1330, a decrease from the previous year (1464).

- Number of pending sales was 1309, an increase from the previous year (1206).

- New listings were 1026, a decrease from the previous year (1073).

- Months of inventory equaled 2.7, an increase from the previous year (2.3).

- The average number of days on the market was 60, an increase from the previous year (55).

Median and Average Sales Prices

The median sales price in December 2023 witnessed a substantial increase, reaching $525,000, up from the previous year's figure of $507,500. Similarly, the average sales price also experienced an upward trajectory, reaching $586,800, compared to the prior year's average of $566,700. These figures indicate a positive trend in property values, reflecting a robust and competitive real estate market.

Transaction Activity

Despite the overall growth in property values, the number of closed sales saw a slight decrease, totaling 1330, down from the previous year's figure of 1464. In contrast, pending sales demonstrated an increase, reaching 1309, compared to the previous year's count of 1206. This suggests a market characterized by active buyer interest and a potential backlog of transactions yet to be finalized.

New Listings

While the Portland housing market experienced a decline in new listings, with 1026 reported in December 2023, compared to 1073 in the previous year, the decrease is indicative of a possible inventory challenge. A limited number of new listings may contribute to increased competition among buyers for available properties.

Inventory and Market Dynamics

The months of inventory, a crucial indicator of market supply and demand, rose to 2.7 from the previous year's 2.3. This increase suggests a slightly more balanced market, providing buyers with a bit more options compared to the previous year. However, it also implies a potential challenge for sellers as they navigate a market with increased inventory.

Days on the Market

The average number of days a property spent on the market increased to 60, up from 55 in the previous year. This extension in the time it takes for properties to sell may be attributed to various factors, including market conditions, pricing strategies, and buyer behavior. Sellers and real estate professionals should closely monitor this metric for insights into the pace of transactions.

Portland Housing Market Forecast 2024

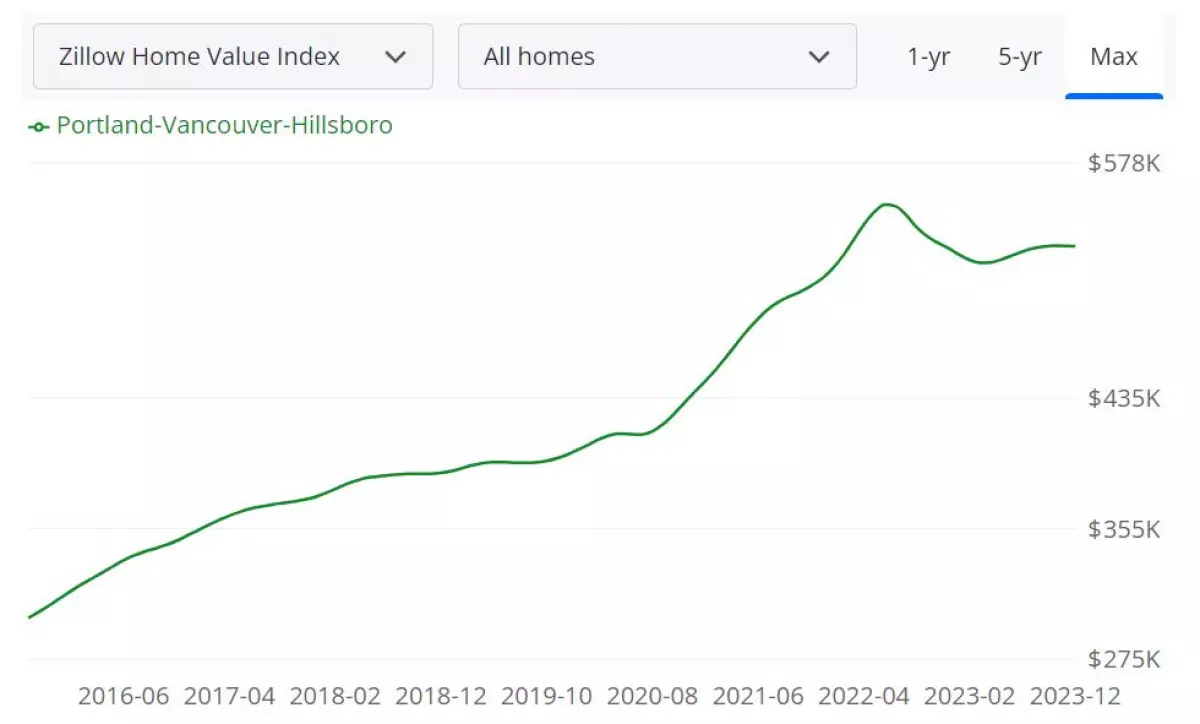

What are the Portland real estate market predictions? As the largest city in Oregon and a vibrant real estate hub, Portland's housing market has been closely monitored by both buyers and sellers. To gain insights into the current state and potential future of the market, we turn to the latest data provided by Zillow.

According to Zillow, the average home value in the Portland-Vancouver-Hillsboro housing market currently stands at $528,063, reflecting a modest increase of 0.2% over the past year. Homes typically go pending within an average of 28 days.

Crucial Housing Metrics Explained

-

1-year Market Forecast (December 31, 2023): +1.3%

- The market forecast for the next year indicates a positive trajectory with an estimated increase of 1.3%. This suggests a potential uptick in property values, making it an encouraging sign for both buyers and sellers.

-

For Sale Inventory (December 31, 2023): 6,352

- The available inventory plays a pivotal role in determining market dynamics. As of December 31, 2023, there are 6,352 homes for sale, offering a range of options for prospective buyers.

-

New Listings (December 31, 2023): 1,463

- The number of new listings is a key indicator of market activity. With 1,463 new listings, there is a continuous influx of properties, providing buyers with fresh opportunities.

-

Median Sale to List Ratio (November 30, 2023): 0.999

- The median sale to list ratio, standing at 0.999, indicates a balanced market where homes are generally selling close to their list prices. This equilibrium benefits both buyers and sellers.

-

Median Sale Price (November 30, 2023): $527,000

- The median sale price is a crucial factor for both buyers and sellers to gauge affordability. Currently, the median sale price is $527,000, providing a benchmark for property values in the region.

-

Median List Price (December 31, 2023): $553,300

- The median list price, at $553,300, represents the average asking price for homes in the market. Sellers can use this figure to set competitive prices, while buyers can assess their budget accordingly.

-

Percent of Sales Over List Price (November 30, 2023): 31.9%

- A significant 31.9% of sales occurring over the list price indicates a competitive market where buyers may need to make compelling offers to secure their desired homes.

-

Percent of Sales Under List Price (November 30, 2023): 47.3%

- With 47.3% of sales happening under the list price, there are opportunities for buyers to find deals below the initial asking prices, providing flexibility in negotiations.

Is Portland a Buyer's or Seller's Housing Market?

The balanced median sale to list ratio of 0.999 suggests that the Portland-Vancouver-Hillsboro housing market currently favors neither buyers nor sellers exclusively. It leans towards a balanced market where both parties can engage in transactions with reasonable expectations.

Are Home Prices Dropping?

As of now, there is no indication of a decline in home prices. The modest increase of 0.2% in the average home value over the past year suggests a relatively stable market with consistent property values. The +1.3% 1-year market forecast for December 31, 2023, indicates a positive outlook, making the likelihood of a housing market crash less probable in the near future.

Is Now a Good Time to Buy a House?

Considering the balanced market conditions, a reasonable median sale price of $527,000, and the forecasted positive trend, the current scenario suggests that it could be a favorable time for prospective buyers to enter the Portland-Vancouver-Hillsboro housing market.

Source: Zillow

Source: Zillow

Portland Real Estate Investment: Should You Invest in Portland?

Should you consider Portland real estate investment? Many real estate investors have asked themselves if buying a property in Portland is a good investment. Portland offers a promising real estate investment landscape. Its strong economy, population growth, and rental market make it an attractive option for investors looking for potential long-term appreciation and cash flow. By carefully evaluating market conditions and working with professionals, investors can position themselves for success in the Portland real estate market.

Portland is a very ethnically diverse large city and home to around 600,000 people. However, the Portland housing market, in reality, includes more than two million people who live in the Portland Metropolitan Area or Greater Portland—comprising Clackamas, Columbia, Multnomah, Washington, and Yamhill Counties in Oregon, and Clark and Skamania Counties in Washington.

Investing in Portland real estate can be a lucrative opportunity for those seeking to grow their wealth and portfolio. With its strong economy, diverse job market, and desirable quality of life, Portland has become an attractive destination for real estate investors.

One of the key factors that make Portland an enticing investment option is its steady population growth. The city's population has been consistently increasing, driving demand for housing and rental properties. This demand creates opportunities for investors to generate rental income and capitalize on the appreciation.

Another advantage of investing in Portland is the city's thriving job market. Portland is home to a diverse range of industries, including technology, healthcare, education, and manufacturing. The presence of major employers and a growing entrepreneurial ecosystem contribute to a stable economy, ensuring a steady stream of potential tenants and buyers for investment properties.

Additionally, Portland's strong rental market offers investors a reliable income stream. With a high percentage of renters in the city, there is a constant demand for rental properties. Rental rates have been steadily increasing, providing investors with the potential for consistent cash flow and attractive returns on their investments.

Furthermore, Portland's commitment to sustainability and green initiatives has made it a leader in eco-friendly practices. This focus on sustainability has attracted environmentally conscious tenants and buyers, enhancing the long-term value of real estate investments in the city.

However, like any investment, there are considerations and risks to keep in mind. The Portland real estate market has experienced price fluctuations and can be competitive, especially in desirable neighborhoods. Conducting thorough market research, analyzing property values, and working with experienced local professionals are essential steps to mitigate risks and make informed investment decisions.

Portland is a "Hot" Real Estate Market for Millennials

One of the major factors driving the Portland real estate market is the city's popularity among Millennials. It's not just students coming to Portland driving up prices in the housing market. Millennials are attracted to Portland's family-friendly and culturally rich environment, which is often more affordable than similar cities in California.

When a city sees people move there for work, it includes everyone from 25-year-old grads to 50-year-old mid-career professionals. Portland's real estate market is especially attractive to young adults trying to buy houses, setting the stage for strong demographic momentum as they start families and increase the local population.

Portland Lacks Room to Grow, Which Drives Home Prices Up

One of the beautiful things about Portland is its proximity to the ocean and mountains, with much of the area covered in protected forests. However, this also means that the city lacks room to grow like many inland real estate markets. Developers could tear down older buildings and build skyscrapers, but that's expensive compared to developing new suburban neighborhoods a few miles away.

Relative to strong migration and income-driven demand, the supply is lagging in the entire Portland Metropolitan Statistical Area (MSA). New housing permits in the Portland MSA have been slow to recover since the 2012 bottom. The slower rate of new construction combined with fewer homes available for sale creates a supply-demand imbalance.

The relative lack of room to grow keeps rents high in the Portland real estate market for both residents and commercial firms. While Portland residents may complain about rent, the high rents in Silicon Valley have pushed firms to relocate to the Portland area, leading to job growth and population growth in the Portland MSA.

Portland's Relatively Affordable Housing Market

Portland's relatively affordable housing market is a significant draw for residents and prospective homebuyers. Compared to other major West Coast cities like Seattle and San Francisco, Portland offers a more accessible and affordable housing market.

One of the factors contributing to Portland's affordability is its lower median home prices. While housing prices in Portland have seen an increase in recent years, they still remain relatively affordable compared to other metropolitan areas. This affordability opens up opportunities for individuals and families to become homeowners without facing exorbitant costs.

Additionally, Portland offers a range of housing options, including single-family homes, townhouses, condominiums, and apartments. This variety allows individuals to find housing that aligns with their budget and preferences.

Furthermore, Portland's affordable housing market is complemented by the city's strong job market. The region boasts a robust economy with opportunities in various industries, including technology, healthcare, education, and manufacturing. The availability of well-paying jobs enables residents to afford housing options in the city.

Additionally, the city's transportation infrastructure, including public transit systems and bike-friendly initiatives, provides residents with convenient access to different neighborhoods and reduces commuting costs. This accessibility contributes to the overall affordability of living in Portland.

Portland's Massive Student Market for Rental Property Investment

The presence of over three dozen private and public universities within 150 miles of Portland creates a massive student market for rental property investment. The University of Oregon and Oregon Institute of Technology have massive campuses in Portland. Student enrollment for STEM and IT programs is booming due to the high demand for tech talent created by Silicon Valley companies. This strong student market creates a significant demand for rental properties in the vicinity of multiple campuses.

In terms of rental statistics for apartments in Portland, the average size of an apartment is 765 square feet. Studio apartments are the smallest and most affordable, while 1-bedroom, 2-bedroom, and 3-bedroom apartments offer more generous square footage. The average rent for an apartment in Portland is $1,763, according to RENTCafé.

More than 32% of apartments can be rented for $1,500 or less, while about 40% fall in the range of $1,500 to $2,000. Rental statistics highlight that 47% of households in Portland are renter-occupied, indicating a significant population of renters. The most expensive neighborhoods to rent apartments in Portland are Arnold Creek, Old Town Portland - Chinatown, and The Pearl.

Source: RENTCafé

Portland's Better Business Climate

Oregon's lower cost of living compared to neighboring states like California makes it a favorable destination for businesses and residents. Oregon does not levy sales or use tax and has property tax rates nearly in line with national averages. The state's commitment to a lower-tax environment and business-friendly policies attracts companies looking to escape the high costs and strict regulations of other states.

Furthermore, Oregon's relatively landlord-friendly regulations, particularly for small landlords with single homes for rent, make the Portland area an attractive option for real estate investors. Unlike larger apartment buildings that face stricter regulations, these smaller landlords have more flexibility in rent rates and fewer rental assistance payment requirements when evicting tenants.

Portland Investment Properties: Where to Invest?

In any property investment, cash flow is key. The Portland real estate market has experienced double-digit annual price growth in recent years, and although home prices have slowed down, they remain strong. Finding the best investment property in Portland requires focusing on neighborhoods with high population density, employment growth, and proximity to amenities and essential services.

Bethany, Southwest Hills, Hazelwood, Multnomah Village, Raleigh Hills, St. Johns, Eastmoreland, Lake Oswego, Laurelhurst, Downtown Portland, Tigard, Alameda, Cedar Hills, Montavilla, Hillsdale, Lents, Woodstock, and Kenton are among the popular neighborhoods in Portland.

To make a successful investment in Portland, it is recommended to seek the help of local real estate agents who can provide insights into neighborhoods with affordable entry prices, high appreciation forecasts, and growing rent prices. Identifying neighborhoods popular among renters is crucial for generating positive cash flow and maximizing profits as an investor.

NeighborhoodScout.com ranks Downtown North, Downtown East, Arbor Lodge, Overlook, Overlook North, Humboldt, Concordia, Kenton East, King, and Humboldt North as the top ten neighborhoods in Portland with the highest real estate appreciation rates since 2000.

References:

- PMAR

- OregonLive

- Little Big Homes

- Realtor.com

- RentCafé

- RentJungle

- NeighborhoodScout

- RealtyTrac

- Tax-Rates.org

- SmartAsset

- Entrepreneur

- CNBC

- Portland Mercury

- Forbes

- Oregon Business

- Upwork

- University of Portland

- RENTCafé Rental Statistics

- RENTCafé

- Realtor.com Neighborhoods

- NeighborhoodScout

- RentJungle

- RENTCafé

- RealtyTrac

- Entrepreneur

- Oregon Business

- CNBC

- OregonLive

- PortlandMercury