Image: Bilanol/iStock via Getty Images

Image: Bilanol/iStock via Getty Images

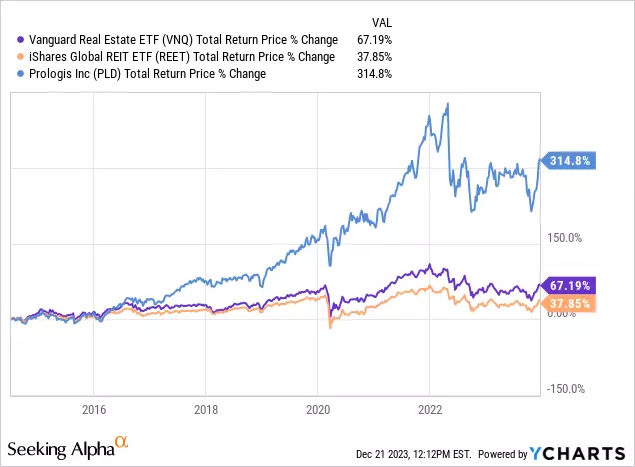

When it comes to investing in Real Estate Investment Trusts (REITs), there are several factors to consider, such as conflicts of interest and the desire to participate in value creation. Prologis (NYSE:PLD) stands out from the crowd by offering more than just a traditional REIT experience. In fact, the company has established itself as a leading energy company and much more.

Value Creation By Developing Assets

Prologis has consistently demonstrated its ability to create value by developing assets instead of simply purchasing them. Over the past 20+ years, the company has invested approximately $44 billion and generated around $13 billion in value creation, resulting in an impressive ~29% margin.

Image: Prologis Investor Presentation

Image: Prologis Investor Presentation

Continuing with this strategy, Prologis already owns land and has optioned additional land to create new assets. While logistic developments remain a key focus, the company is also investing in other opportunities such as energy generation, electric vehicle (EV) charging, and data center assets.

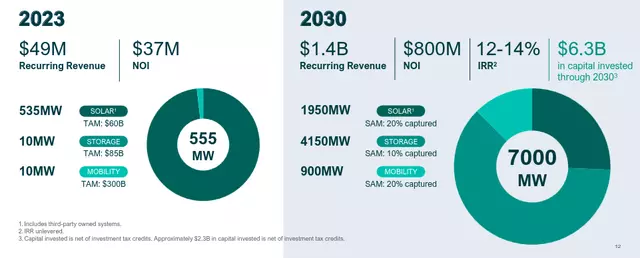

Energy Company

Prologis is not only a leading player in the real estate industry but also positions itself as a world-class energy company. Currently, the company ranks second for onsite solar generation in the US, and it has ambitious plans to further expand this business. Alongside solar energy generation and storage, Prologis is also investing in EV charging infrastructure. By scaling its solar, storage, and mobility assets to 7GW, the company aims to generate $1.4 billion in gross revenue and approximately $800 million in net operating income by 2030.

Data Centers

Another significant opportunity Prologis is actively pursuing is data centers. With around 20 potential developments identified over the next five years, the company plans to invest $7 billion to $8 billion to create 3GW of assets. The expected margins from the data center operations are almost twice those of its industrial operations. Looking ahead, Prologis has already identified more than one hundred opportunities for over 10GW of capacity.

Asset Manager

Leveraging its operational efficiency and capabilities, Prologis has built a lucrative asset management business within its real estate operations. By managing real estate assets for others and charging a fee for this service, the company estimates that it has added approximately 2% to its returns. The third-party assets under management currently stand at around $60 billion, and Prologis believes it can continue to grow this business at a healthy rate.

Integrated Solutions

In addition to leasing space, Prologis goes the extra mile to provide additional services that add value and enhance customer satisfaction. These services include property management, maintenance, energy generation and storage, and EV charging infrastructure. By offering integrated solutions, Prologis aims to not only increase revenue but also alleviate operational and maintenance burdens for its customers. The company's net promoter score (NPS) stands as a testament to its success in delivering exceptional customer experiences.

VC Investments

Venture capital investment is yet another thriving aspect of Prologis' business. While the overall investment amount is relatively small, around $250 million, the returns have been outstanding. Focusing on tech-enabled supply chain and logistics startups, Prologis has achieved returns of around 17%. This strategic approach allows Prologis to leverage its ecosystem and platform insights, giving invested companies a unique competitive advantage. Notable examples include SolarCycle, which offers an eco-friendly process for decommissioning solar panels, and Terminal Industries, which developed an AI platform to digitize yard operations.

Leading Balance Sheet

Prologis has managed to achieve remarkable growth without compromising its balance sheet strength. The company retains an excellent credit rating and demonstrates a lower weighted average interest rate compared to other large REITs. With leverage of approximately 4.3x debt to EBITDA and an 8.1x fixed charge ratio, Prologis stands as a resilient and financially sound player in the industry.

Tailwinds and Headwinds

Prologis faces a combination of short-term headwinds and long-term structural tailwinds. While global logistics rents may face pressure as assets initiated during boom times reach completion, the company benefits from the increasing market share of online retailers. The demand for logistics space by online retailers is triple that of brick-and-mortar competitors. Additionally, Prologis has the potential to negotiate higher rents with customers when existing contracts expire, given that average rents are much higher compared to in-place rents. The company estimates that adjusting rents to current market prices could add approximately $2.4 billion in net operating income.

However, concerns arise regarding the large number of logistics developments initiated during the recent surge in demand. As demand moderates, vacancy rates are likely to increase. Prologis anticipates a "mini-cycle" where vacancy rates for logistics space reach around 6% before starting to decline again. The company remains confident in its ability to continue increasing net effective rent, albeit at a slower pace compared to recent years.

Valuation

While Prologis shares may not appear particularly cheap, trading at a price to cash flow multiple above 20x, it is worth noting that similar industrial REITs also trade at high multiples. The price to funds from operations per share is also close to its ten-year average. Given the company's history of value creation, strong balance sheet, and new business development, it is reasonable to attribute Prologis with a premium multiple. The estimated net present value of its future earnings stream comes to approximately $115 per share. Thus, shares may be slightly overvalued, but they still present a potentially attractive investment opportunity for investors seeking a low return.

Risks and Conclusion

Prologis is considered a below-average risk REIT due to its strong balance sheet and above-market rates for its in-place rents. The company's track record of delivering outstanding performance and growth, coupled with its expansion into new businesses, adds further strength to its position. While the current share price may lack a margin of safety, trading at a high multiple to cash flows and with the anticipation of slightly higher vacancy rates in the near future, Prologis remains one of the highest-quality REITs available in the public markets.

Note: The above analysis is for informational purposes only and does not constitute financial advice. Investors should conduct their own research and analysis before making investment decisions.