Real estate investing can often seem like a complex and overwhelming endeavor. With so many different strategies and options available, it's easy to get lost in the details. But fear not! In this article, we will break down the basics of real estate investing and provide you with the knowledge you need to get started on the path to financial success.

What Is Real Estate Investing?

Real estate investing is the process of putting your money into properties such as land, houses, warehouses, shopping centers, or apartment buildings with the expectation of generating income and/or appreciation over time. By deferring the spending of your money and placing it into real estate investments, you have the potential for your money to grow at a rate faster than inflation. Real estate investing is considered a somewhat risky venture, but it often produces high returns compared to less risky investments like savings accounts.

Why Is Real Estate Considered an Investment?

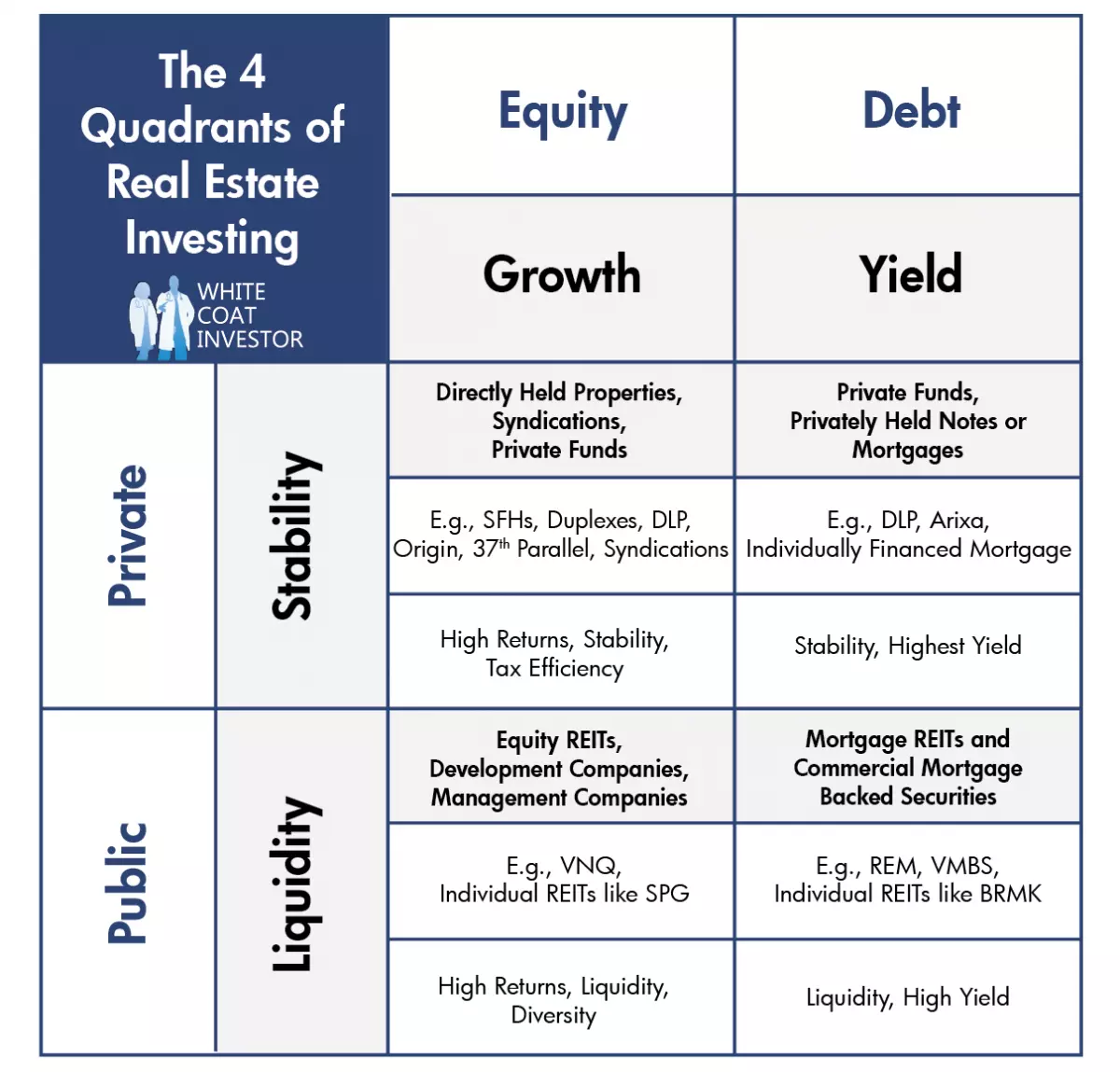

Real estate is considered an investment because it typically increases in value over time while also producing income in the form of rents. There are two main categories of real estate investments: debt and equity. Equity real estate investing means you own the property and are entitled to all profits and appreciation. Debt real estate investing involves loaning money to the property owner and earning interest as a form of return.

Real estate investing can be a lucrative way to grow your wealth.

Real estate investing can be a lucrative way to grow your wealth.

Equity Real Estate Investing

With equity real estate investing, you are the owner of the property. Any appreciation or increase in value of the property is yours, after taxes. However, this type of investment also comes with the risk of losing your entire investment, especially if you use a lot of leverage.

Debt Real Estate Investing

With debt real estate investing, you loan money to the property owner and receive interest as a return. This type of investment is less risky than equity investing since you're not responsible for the property's losses or decreased value.

How to Get Into Real Estate Investing

There are numerous ways to invest in real estate, each with its own set of advantages and disadvantages. Here are a few popular methods:

Flipping

Flipping involves buying a property at a low price, making improvements, and selling it quickly for a profit. This method requires a lot of hands-on work and often serves as a side hustle rather than a long-term investment.

Rental Properties

Investing in rental properties involves purchasing a property and renting it out to tenants. This method can provide a steady stream of income, but it may also require dealing with tenant issues and property maintenance.

Real Estate Investment Funds

Real estate investment funds allow investors to pool their resources to purchase properties collectively. This method provides diversification and professional management but often requires a higher minimum investment.

No matter which method you choose, it's important to match your level of interest, control, and time commitment with the requirements of the investment.

Pros and Cons of Real Estate Investing

As with any investment, real estate investing comes with its share of pros and cons. Here are a few to consider:

The Benefits of Real Estate Investing

- Low Correlation: Real estate investments have historically had low correlations with traditional stocks and bonds, providing diversification and steadier growth.

- High Returns: Equity real estate investments offer high returns compared to many other asset classes.

- Leverage: Real estate investments can be leveraged, allowing investors to amplify their returns.

- Tax Benefits: Real estate ownership comes with various tax benefits, including depreciation and bonus depreciation.

- Inefficient Markets: The real estate market is less efficient than the stock market, creating opportunities for skilled investors to generate above-average returns.

The Downsides of Real Estate Investing

- Illiquidity: Real estate investments can be illiquid, meaning it may take time to sell or liquidate the assets.

- High Transaction Costs: Buying and selling property can be expensive due to commissions, appraisals, and other fees.

- Leverage Risk: Using leverage in real estate investments can lead to amplified losses in a downturn.

- Hard Work: Real estate investing often requires significant time and effort, especially if managing properties directly.

- Scammers: Real estate attracts both honest and dishonest individuals, so caution is necessary when entering the market.

Real Estate Investment Terms

Real estate investing has its own unique vocabulary and terms that every investor should understand. Here are a few key terms to familiarize yourself with:

- Real estate asset classes: These include single-family homes, apartments, retail properties, industrial properties, and more.

- Real estate investment strategies: These can include flipping, speculating, and various private real estate funds and syndications.

- Property classes (grades): Properties are often categorized as Class A, B, C, or D based on their quality, age, and tenant income levels.

- Fee structure and waterfalls: When investing in private real estate, there are usually fees and profit-sharing structures in place to compensate the General Partner (GP) and Limited Partners (LPs) involved in the investment.

Understanding these terms will help you navigate the world of real estate investing with confidence.

The Best Way to Invest in Real Estate

There is no one-size-fits-all answer to the best way to invest in real estate. The right approach will depend on your unique circumstances, preferences, and goals. Some options to consider include:

- Publicly traded REITs: These allow for easy diversification through low-cost index funds.

- Private real estate funds and syndications: These provide opportunities for passive investing through professional management.

- Direct ownership: Owning and managing your own properties can offer more control but requires active involvement.

Ultimately, the best way to invest in real estate is the one that aligns with your interests, resources, and risk tolerance.

Should You Invest in Real Estate?

Real estate investing can be an excellent addition to any investment portfolio. While not mandatory, many successful investors have found real estate to be a key component of their wealth-building strategy. With its potential for high returns, diversification benefits, and unique tax advantages, real estate offers opportunities to grow your wealth and generate passive income.

How Are Real Estate Investments Taxed?

The taxation of real estate investments can be complex and varies depending on the type of investment and the specific tax laws of your country. Generally, rental income is taxable, but expenses such as property taxes, insurance, maintenance, and mortgage interest can be deducted. Capital gains taxes may apply when selling a property, but there are strategies such as 1031 exchanges that can defer or eliminate these taxes.

To ensure compliance with tax laws and maximize the benefits of real estate investing, it's essential to consult with a qualified tax professional.

How to Get Started in Real Estate Investing

Getting started in real estate investing can seem daunting, but with the right knowledge, anyone can take the first steps toward success. Here are some tips to get you started:

- Educate yourself: Take advantage of resources like online courses and books to learn about real estate investing strategies, terminology, and market trends.

- Network: Connect with experienced investors, join real estate investment groups, and attend industry events to learn from others' experiences and gain valuable insights.

- Start small: Consider investing in publicly traded REITs or real estate crowdfunding platforms to dip your toes into the market without a substantial upfront investment.

- Develop a plan: Determine your investment goals, risk tolerance, and preferred investment strategy. Create a plan that aligns with your objectives and financial situation.

Remember, real estate investing is a journey, and it's essential to continuously learn and adapt as you gain experience.

Is Real Estate Investing Worth It?

Real estate investing can be a lucrative endeavor when approached with the right strategy and knowledge. While it may require more effort and involvement than other investment options, the potential returns and benefits make it worth considering. As with any investment, thorough research, due diligence, and a long-term mindset are crucial to success.

Final Thoughts

Real estate investing offers an array of opportunities to grow your wealth, generate passive income, and diversify your investment portfolio. By understanding the basics, exploring different strategies, and staying informed about market trends, you can navigate the world of real estate investing with confidence. Whether you choose to invest in residential properties, commercial real estate, or real estate investment funds, always remember to align your investments with your goals, risk tolerance, and long-term financial plans.

So what are you waiting for? Start your journey into real estate investing today and pave the way for a brighter financial future.