Real estate investment groups, also known as real estate investment clubs or REIGs, are organizations formed by real estate investors to pool their resources and invest in properties together. These groups provide an opportunity for individual investors to leverage the expertise and resources of a larger group to achieve shared investment goals.

Types of Real Estate Investment Groups

Real Estate Investment Clubs

Local Clubs

Local real estate investment clubs are typically organized by geographical location and meet regularly in person to discuss investment opportunities, strategies, and market trends. These clubs often host guest speakers, workshops, and networking events.

Online Clubs

Online real estate investment clubs offer a virtual platform for investors to connect, share information, and collaborate on investment opportunities. These clubs may host webinars, online forums, and provide resources for members to access remotely.

Real Estate Investment Trusts (REITs)

Equity REITs

Equity REITs primarily invest in income-producing properties and generate returns for investors through rental income and property appreciation.

Mortgage REITs

Mortgage REITs invest in mortgage-backed securities and generate returns for investors through interest income.

Hybrid REITs

Hybrid REITs combine elements of both equity and mortgage REITs, investing in both properties and mortgage-backed securities to generate returns for investors.

Real Estate Crowdfunding Platforms

Real estate crowdfunding platforms allow investors to pool their resources online and collectively invest in a variety of property types, such as residential, commercial, or industrial properties.

Real Estate Limited Partnerships (RELPs)

RELPs are a form of investment structure where a general partner manages the investment properties and limited partners provide capital. This arrangement allows for passive investment and potential tax benefits for limited partners.

Real Estate Syndications

Real estate syndications involve a group of investors pooling their resources to acquire, manage, and profit from a specific real estate project. Syndications typically have a lead investor or sponsor who manages the investment on behalf of the group.

How to Join a Real Estate Investment Group

Joining a real estate investment group can be a game-changer for your real estate investment journey. Here's how you can get started:

Research and Identify Suitable Groups

Start by researching and identifying real estate investment groups that align with your investment objectives, strategies, and geographical focus.

Attend Meetings and Events

By attending meetings and events, you can get a sense of the group's dynamics, objectives, and member composition. This can help determine whether the group is a good fit for your investment goals.

Evaluate the Group's Objectives and Strategies

Before joining a real estate investment group, assess the group's investment objectives, strategies, and track record. This evaluation can help ensure that the group aligns with your personal investment goals and risk tolerance.

Assess the Group's Leadership and Members

Consider the experience, expertise, and reputation of the group's leadership and members. Strong leadership and knowledgeable members can significantly contribute to the group's success and provide valuable insights.

Consider Financial Requirements and Obligations

Joining a real estate investment group may involve membership fees, investment minimums, or other financial obligations. Carefully review these requirements to ensure you're comfortable with the commitment.

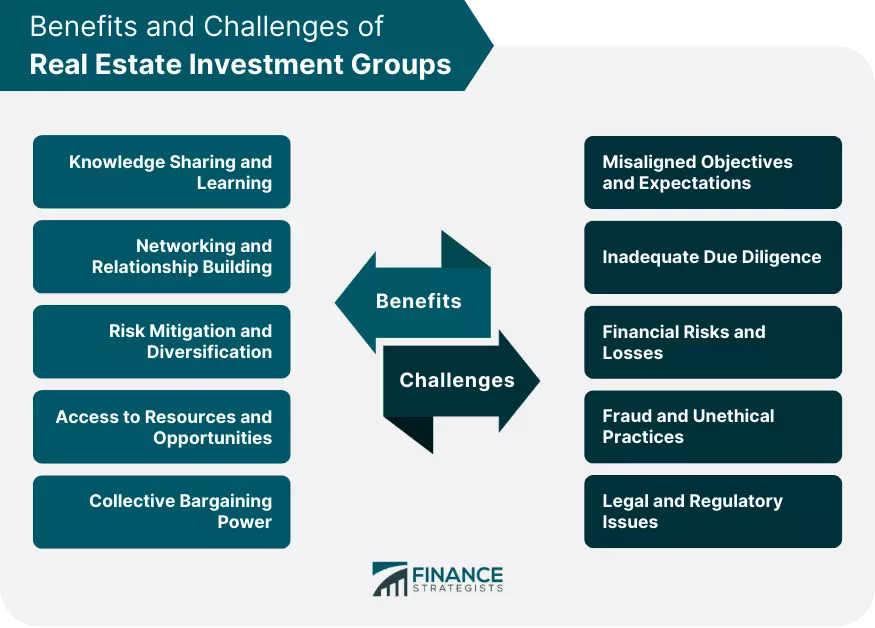

Benefits of Joining a Real Estate Investment Group

Real estate investment groups offer numerous benefits to individuals interested in investing in real estate. Here are some of the advantages:

Knowledge Sharing and Learning

Real estate investment groups provide a forum for individuals to share their experiences, expertise, and strategies in the real estate market. Members can learn from one another, stay informed about market trends, and gain insights into various investment opportunities.

Networking and Relationship Building

By joining a real estate investment group, members can develop relationships with like-minded investors, industry professionals, and potential business partners. This can help build a strong network that may lead to future investment opportunities, referrals, and support.

Risk Mitigation and Diversification

Investing in real estate through a group allows members to pool their resources and invest in a variety of properties, reducing the risk associated with individual investments. This diversification strategy can lead to more stable returns and minimize the impact of market fluctuations.

Access to Resources and Opportunities

Real estate investment groups often have access to exclusive deals, off-market properties, and financing options. Members can leverage these resources to enhance their investment portfolios and potentially achieve better returns on investment.

Collective Bargaining Power

Pooling resources and negotiating as a group can lead to better deals on property prices, financing terms, and property management services. This can help members maximize their returns on investment and minimize costs.

Potential Challenges and Risks of Real Estate Investment Groups

While real estate investment groups offer many benefits, it's essential to be aware of the potential challenges and risks involved:

Misaligned Objectives and Expectations

Conflicting investment objectives and expectations among group members can lead to disagreements, inefficiencies, and suboptimal investment outcomes.

Inadequate Due Diligence

Insufficient due diligence on investment opportunities can result in financial losses, legal issues, and damage to the group's reputation.

Financial Risks and Losses

Real estate investments inherently carry risks, and members should be prepared for the possibility of financial losses or underperformance.

Fraud and Unethical Practices

Some real estate investment groups may engage in fraudulent or unethical practices, which can result in legal consequences and financial losses for members.

Legal and Regulatory Issues

Real estate investment groups must adhere to various laws and regulations governing real estate transactions, securities, and investment activities. Non-compliance can lead to fines, penalties, and legal liabilities for the group and its members.

Best Practices for Successful Real Estate Investment Group Participation

To ensure a successful experience with a real estate investment group, consider following these best practices:

Active Involvement and Contribution

To maximize the benefits of participating in a real estate investment group, actively engage in discussions, share your experiences and expertise, and contribute to the group's projects and initiatives.

Continuous Learning and Skill Development

Successful real estate investors continuously learn and develop their skills. Stay informed about industry trends, attend workshops and seminars, and seek mentorship to enhance your knowledge and become a more effective investor.

Collaboration and Teamwork

Working collaboratively with other group members can help you leverage the collective knowledge and resources of the group. This cooperation can lead to better decision-making, more successful investments, and stronger relationships within the group.

Due Diligence and Risk Assessment

Before investing in any real estate project or opportunity, conduct thorough due diligence and assess the associated risks. This can help minimize potential losses and ensure that investments align with your personal risk tolerance and objectives.

Long-Term Strategy and Goal-Setting

Successful real estate investments often involve long-term planning and strategic goal-setting. Develop a clear vision for your investment objectives and regularly review your progress to ensure you remain on track.

Conclusion

Real estate investment groups offer numerous benefits to individuals interested in investing in real estate. These groups provide a platform for knowledge sharing, networking, pooling resources, and mitigating investment risks. It's important to research and identify suitable groups, evaluate their objectives and strategies, and consider the financial requirements before joining. While challenges exist, adhering to best practices such as active involvement, continuous learning, collaboration, due diligence, and goal-setting can help individuals maximize benefits and minimize risks. With the right group and approach, real estate investment groups can be a powerful tool for building wealth and achieving investment success.