Introduction

Are you torn between pursuing a career in real estate or insurance? Both industries offer unique advantages, and it's important to consider your personal preferences and long-term financial goals. In this captivating article, we will delve into the intricacies of real estate and insurance, comparing their key differences and shedding light on the path that suits you best.

Real Estate vs Insurance: A Profitability Analysis

While being a successful realtor can earn you substantial commissions from million-dollar property sales, it's important to assess the long-term profitability. Imagine selling $100,000 worth of real estate each year at a 6 percent commission. In this scenario, you would earn $6,000 in both year one and year two. On the other hand, selling a $100,000 insurance policy, which typically carries an 8-10 percent commission, would generate $6,000 in year one and an additional renewal commission in year two. From a financial standpoint, insurance agents have the potential to earn more income for fewer work hours than realtors.

Lifestyle Considerations: Onsite vs Remote

Real estate is a dynamic field that requires constant on-site presence, perfect for those who enjoy being out and about. As a realtor, you'll find yourself immersed in property visits, showcasing homes to potential buyers, and exploring new neighborhoods. On the other hand, insurance sales predominantly take place over the phone, especially when dealing with personal care and home product policies. This remote aspect of insurance sales enables agents to work from the comfort of their own homes, making it a convenient option for those seeking a flexible lifestyle.

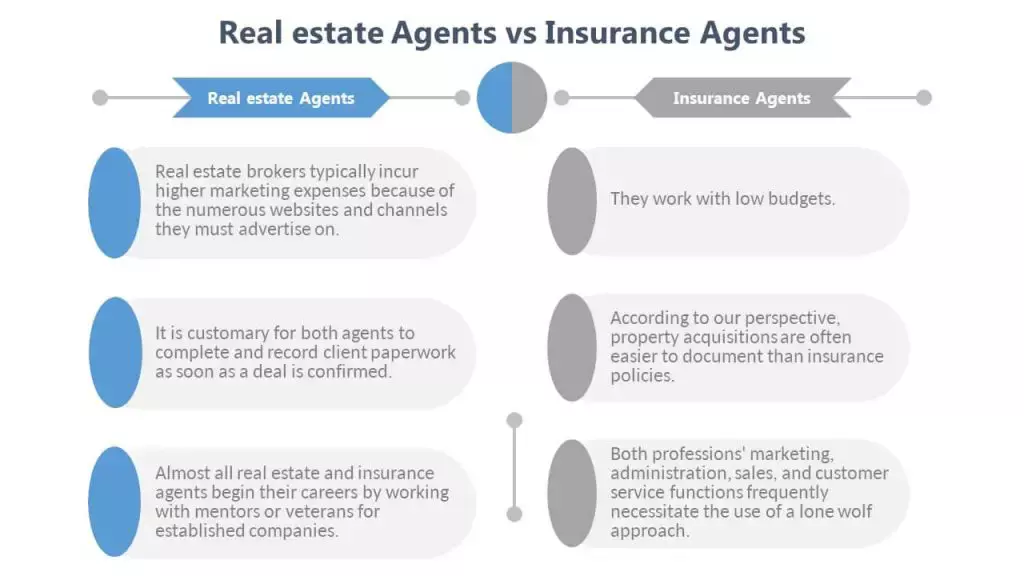

What are the main similarities between Real Estate Agents vs. Insurance Agents?

Communication, Grooming, and After-Sales Service

Both real estate agents and insurance agents rely heavily on effective communication to establish trust and build lasting relationships with their clients. Dressing professionally and maintaining a polished appearance is equally important in both industries. Clients want to work with individuals who exude trustworthiness and expertise, and personal grooming plays a significant role in making a positive impression.

Real estate agents maintain regular communication with their clients, even after a sale. With the potential to retarget prospects who didn't make a purchase, exceptional realtors nurture relationships and create long-term opportunities. In contrast, insurance agents prioritize after-sales service, reviewing and updating insurance plans annually as clients' needs evolve. Additionally, insurance agents provide crucial assistance during insurance claims, ensuring their clients are well-supported during challenging times.

Travel Opportunities: Expanding Horizons

Real estate agents often have the exciting opportunity to market newly launched properties in different countries. This offers a chance to travel, explore new markets, and expand clientele internationally. However, insurance agents rarely have such global prospects, with their work primarily focused on local markets.

Closing Deals: Negotiation and Interpersonal Skills

Real estate agents frequently negotiate sale terms and prices, requiring strong interpersonal skills and the ability to assess a potential buyer's needs. Their role involves securing the best possible outcome for their clients. On the other hand, insurance agents have less involvement in haggling since insurance agencies typically set policy costs and terms.

Responsibilities: Marketing and Client Interaction

Both insurance and real estate professionals need to market their services to attract new clients. Real estate agents also handle the sale or rental of properties, while insurance agents focus on evaluating clients' insurance needs and updating policies accordingly. Gathering data from clients, maintaining records, and preparing paperwork are essential tasks for professionals in both fields.

Insurance Agents

Insurance agents, commonly employed by insurance companies, are responsible for selling various insurance policies. Effective communication is critical in this role, as clear and concise explanations help clients make informed decisions. While many insurance agents sell a wide range of policies, some choose to specialize in specific areas such as life or health insurance.

Key Job Responsibilities of Insurance Agents:

- Promoting services to clients

- Evaluating clients' insurance needs

- Updating client policies

- Storing documents

- Answering client questions

Real Estate Agents

Real estate agents assist clients in buying, selling, or renting properties. Strong negotiation skills, financial acumen, and contract management are essential for success in this role. Whether working in an office or remotely, real estate agents often put in extra hours to meet client demands and manage their finances effectively.

Key Job Responsibilities of Real Estate Agents:

- Promoting properties for sale or rent

- Answering client inquiries

- Finalizing sales and rental contracts

Income Analysis: Insurance Broker vs Real Estate Agent

According to Zip Recruiter, insurance brokers can expect to earn an average annual salary of $84,989, ranging from $23,500 to $177,500. However, salaries vary based on factors such as employer and location. Among the highest-paying locations are Washington, D.C., with an average salary of $94,614. When assessing salary comparisons, consider the cost of living in each location to determine your actual earning potential.

Zip Recruiter reports that real estate brokers earn an average yearly salary of $51,254, ranging from $17,500 to $100,000. Certain cities, such as Sunnyvale ($64,761) and Vacaville ($59,536), offer higher-than-average salaries due to local market conditions. Remember to consider the rising cost of living in these areas when evaluating potential incomes.

Bottom Line: The Importance of Real Estate and Insurance Agents

In today's complex society, real estate and insurance agents play crucial roles in helping individuals navigate the intricacies of their respective markets. Whether you choose to pursue a career in real estate or insurance, you'll find ample opportunities for personal growth and development. Both professions offer unique advantages and the potential for financial success. So, make an informed decision and embark on a rewarding journey that aligns with your interests and goals.

Note: The images used in this article belong to the original article and have been placed fittingly for visual appeal.