If you're looking to make smart real estate investments, it's crucial to be able to evaluate deals effectively. Whether you're deciding whether to move forward with a deal or analyzing an existing property, performing a thorough rental property analysis is key. Fortunately, with the right rental property calculator, making these choices becomes much easier. By using the following calculations to analyze your next deal, you might be surprised by what they can help you predict.

Earning Income From Rental Properties

Rental properties have long been considered one of the best ways to build wealth. The wealth generated from rental properties can be passed down through generations. As long as a rental property is being used, it can generate cash flow. Landlords can use this cash flow to pay off monthly mortgage operations and even make a profit. Additionally, each mortgage payment made increases the owner's equity in the property.

It's important to note that income isn't limited to cash flow and equity. Rental properties can also be used as a tax shelter, thanks to the tax benefits awarded to rental property owners. By taking advantage of these benefits, investors can lower their taxable income each year. This can result in significant savings over the life of a property.

Investment Property Analysis: 8 Factors To Consider

A thorough rental property analysis involves considering several crucial factors that can affect the profitability of a deal. Here are eight key factors to consider in your next rental property cash flow analysis:

- Location: The location of a rental property greatly impacts its desirability and vacancy rates.

- Income And Cash Flow: Analyze the rental income generated and the net cash flow to determine profitability.

- Property Type: Consider the type of property you're looking at, such as single-family homes, multi-family homes, or apartments.

- Ideal Tenants: The right tenants are crucial for income generation. Tailor your marketing techniques and rental applications to attract reliable tenants.

- Vacancy Rates: Calculate the portion of the year the property may be vacant to estimate possible rental expenses.

- Rental Strategy: Decide whether you're focusing on short-term or long-term rentals to determine the types of properties to invest in.

- Operating Expenditures: Consider ongoing costs, including maintenance, property management fees, and utilities.

- Capital Expenditures: Take into account periodic expenses, such as property maintenance and improvements.

How To Use A Rental Property Calculator

A rental property calculator relies on variables to determine the potential performance of an investment property. Gather information about the property, such as purchase price and value. Estimate other numbers, such as vacancy rate and rental price, based on your research. By inputting these variables into a rental property calculator, you can estimate the property's potential profitability.

When To Use A Rental Property Calculator

A rental property calculator can be used to analyze potential deals or evaluate existing rental properties. While it's not required to make investment decisions, it provides insights into the potential or current profits of a property. Using a rental property calculator when deciding whether to invest in a property can help you avoid costly mistakes. It can also help determine if it's time to sell or reorganize existing properties.

Investment property calculators can evaluate various property types, from single-unit homes to multi-unit apartment buildings. Whether you're a first-time investor or have experience, these calculations can help you predict rental yield and make informed decisions. Additionally, rental property calculations can be shared with potential buyers to improve the selling process.

What Is A Good ROI For A Rental Property?

ROI stands for "return on investment" in real estate. While a good ROI varies from investor to investor, some ranges can serve as general guidelines. An ROI between five and ten percent is considered solid for most rental properties. An ROI of over ten percent usually indicates a great investment opportunity. However, an ROI below five percent is typically not considered a worthy investment.

When considering the ROI of a rental property, pay attention to variables such as vacancy rates and repair costs. Err on the side of caution when estimating potential ROI to avoid overestimating profits. Accurate numbers and realistic estimates will ensure your calculations align with reality.

What Is The 2% Rule?

The 2% rule is used to determine whether a rental property is worth investing in. It sets a benchmark for investment potential by evaluating a property's cash flow. According to this rule, the property should generate at least 2.0% of its purchase price each month in cash flow.

7 Cash Flow Equations For The Passive Income Investor

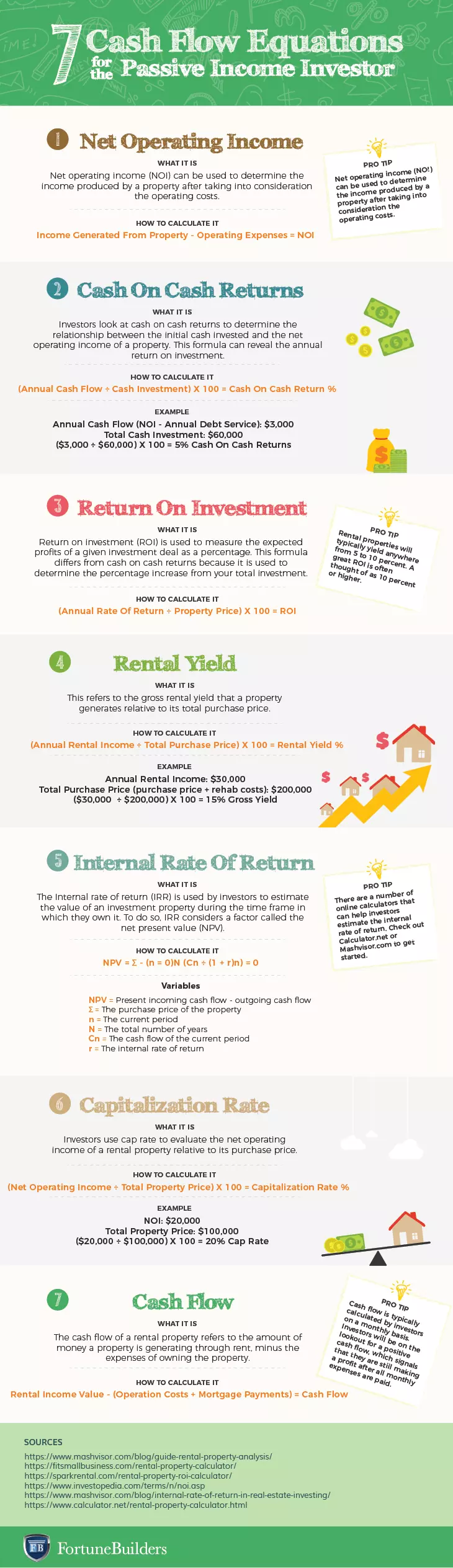

To calculate cash flow for a property, there are several formulas investors should be familiar with. Understanding these calculations is crucial for deal analysis. Here are seven cash flow equations to help you evaluate a property:

- Net Operating Income: The income generated after deducting operating costs.

- Cash On Cash Returns: Annual cash flow divided by the total cash investment.

- Return On Investment: Expected profits as a percentage of the property price.

- Rental Yield: Gross rental income as a percentage of the total purchase price.

- Internal Rate Of Return: Evaluation of investment value during ownership.

- Capitalization Rate: Expected returns of an investment, expressed as a percentage.

- Cash Flow: Monthly income from rent after subtracting expenses.

These equations provide valuable insights into a property's potential profitability.

Responsibilities Of A Rental Property Owner

Owning a rental property comes with several responsibilities. Some universal responsibilities include property maintenance, finding tenants, and handling paperwork. Property owners are responsible for keeping their properties in good condition and ensuring regular maintenance, repairs, and renovations are carried out. Finding and screening tenants, as well as managing bills and paperwork, are also important tasks.

However, property owners can choose to enlist the services of property managers to handle these responsibilities. Property managers can handle everything from finding tenants to maintenance requests and rent collection. This allows investors to collect passive income and expand their portfolio without adding additional work to their schedule.

A Landlord's Responsibilities

If you choose to manage your rental property yourself, you'll take on additional responsibilities as a landlord. This includes property maintenance, repairs, advertising listings, tenant screening, and administrative tasks such as collecting rent and filing paperwork. Alternatively, you can utilize property management software or work with a property management company to simplify these tasks.

Summary

A reliable rental property calculator can guide your investment decisions, whether you're a beginner or experienced real estate investor. By performing accurate calculations and analyzing properties effectively, you'll be able to choose profitable real estate deals and enhance your portfolio. Remember to use a rental property calculator when evaluating potential deals or analyzing existing properties to make informed investment decisions.

Ready to take advantage of the current opportunities in the real estate market? Register for a FREE online real estate class and learn how to get started investing today!

The information presented is for educational purposes only and should not be considered financial, tax, legal, or accounting advice.