Real estate investors know that valuing rental properties requires a different approach than valuing primary residences. While homeowners focus on living comfort, investors consider potential monthly rental income and long-term property value appreciation. In this article, we'll explore five methods that real estate investors use to value rental properties, along with an innovative solution for automatically receiving updated property values each month.

5 Unique Ways to Value a Rental Property

Determining the value of a rental property is not a one-size-fits-all process. Investors often employ multiple methods to generate a range of potential values. Let's delve into the five most common approaches.

1. Sales Comparison

Appraisers and real estate agents utilize the sales comparison approach to determine a property's value. This method involves analyzing recent comparable sales to establish the market worth. Known by terms like "SCA," "comps," or the "price-per-square foot approach," this method compares similar properties sold within the last 30 days. The best comparisons are homes with similar characteristics, such as square footage, age, number of bedrooms and bathrooms, and lot size. By comparing these properties, investors can estimate the value of their rental property.

2. Income Approach

The income approach considers the net operating income (NOI) the rental property generates in relation to its value. Unlike the sales comparison approach, the income approach focuses on the property's potential cash flow. Operating expenses are deducted from the rental income, such as property operating costs, but not mortgage payments or depreciation expenses. To determine the value, investors calculate the capitalization rate (cap rate) by dividing the NOI by the property price. A higher cap rate indicates a potentially better investment, but it's essential to consider operating expenses and potential repairs.

3. Cost Approach

The cost approach is useful when recent sales data is scarce or when the property is not generating income. It operates on the principle that investors should not pay more for a resale property than it would cost to construct the same property from scratch. The value is calculated using the formula: Value of Property = Cost - Depreciation + Land Value. Reproduction and replacement are two commonly used methods within the cost approach. Reproduction determines value based on identical materials, fixtures, and floor plans, while replacement considers new materials and updated floor plans.

4. Gross Rent Multiplier

The gross rent multiplier (GRM) offers a straightforward way to estimate the fair market value of a rental property. By dividing the property's market value by the gross annual rental income, investors can calculate the GRM. However, it's essential to remember that the GRM does not account for operating expenses like property management, repairs, taxes, insurance, or vacancy rates. A property with a lower GRM might appear more valuable, but it could come with additional maintenance or significant repair costs.

5. Capital Asset Pricing Model

The capital asset pricing model (CAPM) is a complex method that values rental properties based on income. It incorporates various factors such as property age, condition, location, neighborhood rating, and operating expenses. CAPM suggests that investors can earn higher returns by accepting higher levels of risk. Nevertheless, some argue that it's possible to find rental properties offering a balanced mix of risk and reward in the real world.

How Rental Property Valuation Changes Over Time

Valuation methods provide specific property values at a particular moment, based on certain assumptions. However, rental property values can fluctuate from year to year. Factors such as market conditions, property improvements, and changes in the area can affect the property's worth. It's crucial for investors to monitor and update property valuations regularly to accurately assess their investments.

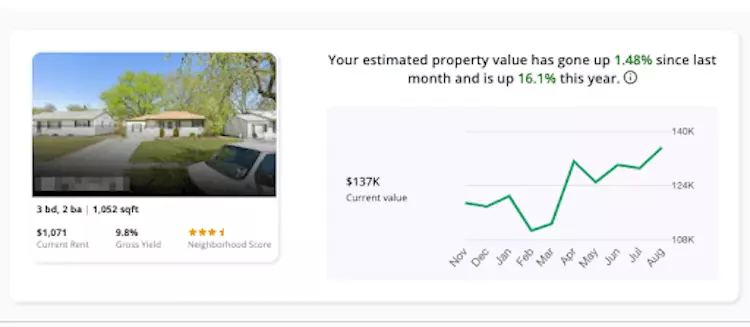

Why Investors Automatically Update Property Value

Traditional rental property financial software often fails to provide accurate valuation metrics over time. Stessa, a leading platform for rental property owners, has introduced a new valuation feature that automatically updates estimated property values each month. By utilizing data-based valuation tools, Stessa empowers investors with more accurate measures of potential financial performance and owner's equity. While actual sale prices may vary due to market conditions, this feature enables investors to make informed decisions about financing and expanding their rental property portfolios.

With Stessa's estimated valuations feature, investors gain valuable insights into their property's net profit potential, making it easier to decide on refinancing or funding down payments for additional rental properties.

Remember, valuing rental properties is not a one-size-fits-all process. It's crucial to consider multiple methods and keep your property valuations up-to-date to make informed investment decisions.