Image: Marcus Lindstrom/iStock via Getty Images

Image: Marcus Lindstrom/iStock via Getty Images

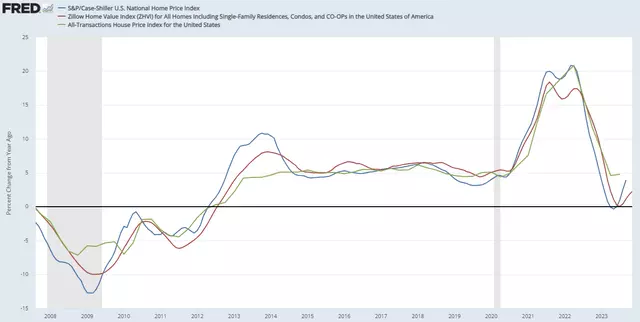

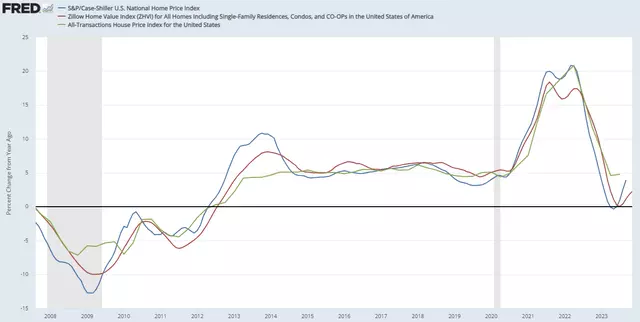

The residential real estate market in the United States has shown a mixed performance in the past couple of years. Despite concerns about the impact of aggressive monetary tightening by the Federal Reserve, home prices have remained resilient. In fact, home price indices indicate that prices have even increased by 3%-4% compared to the previous year^1^. However, residential real estate investment trusts (REITs) have experienced a significant decline in valuations, offering a potential opportunity for investors.

Lingering Pessimism Towards Real Estate: An Opportunity For Alpha

Image: fred.stlouisfed.org

Image: fred.stlouisfed.org

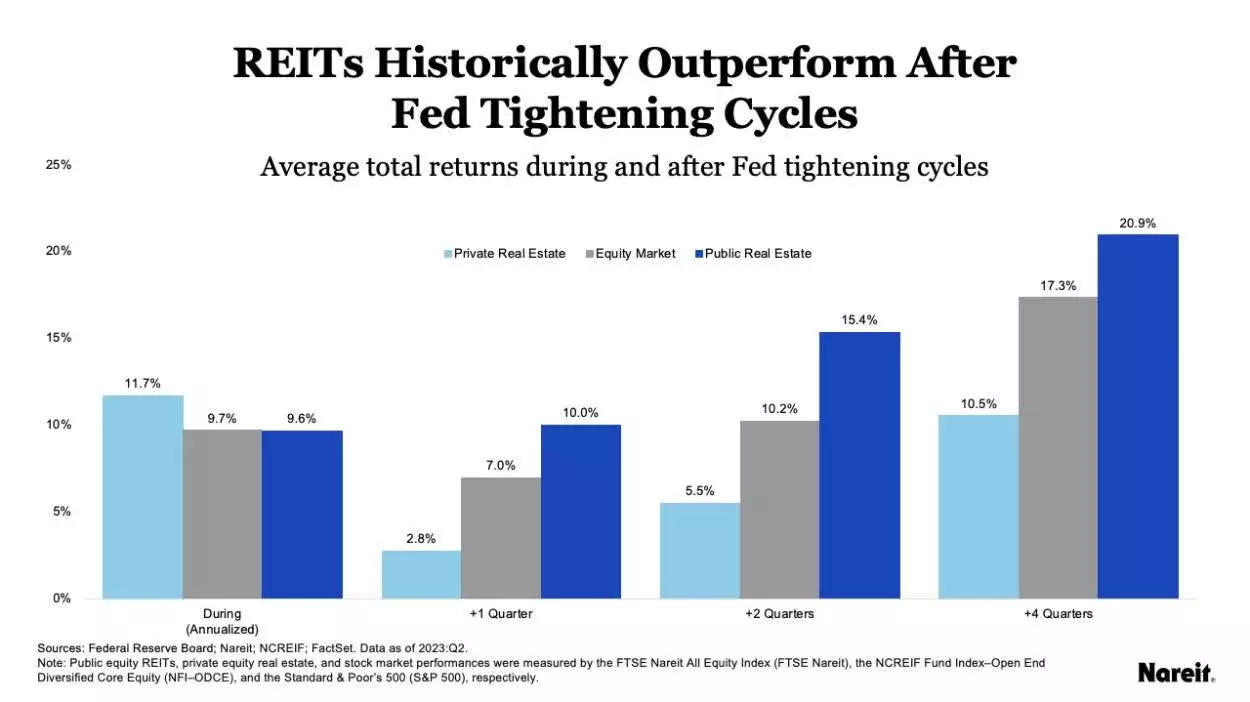

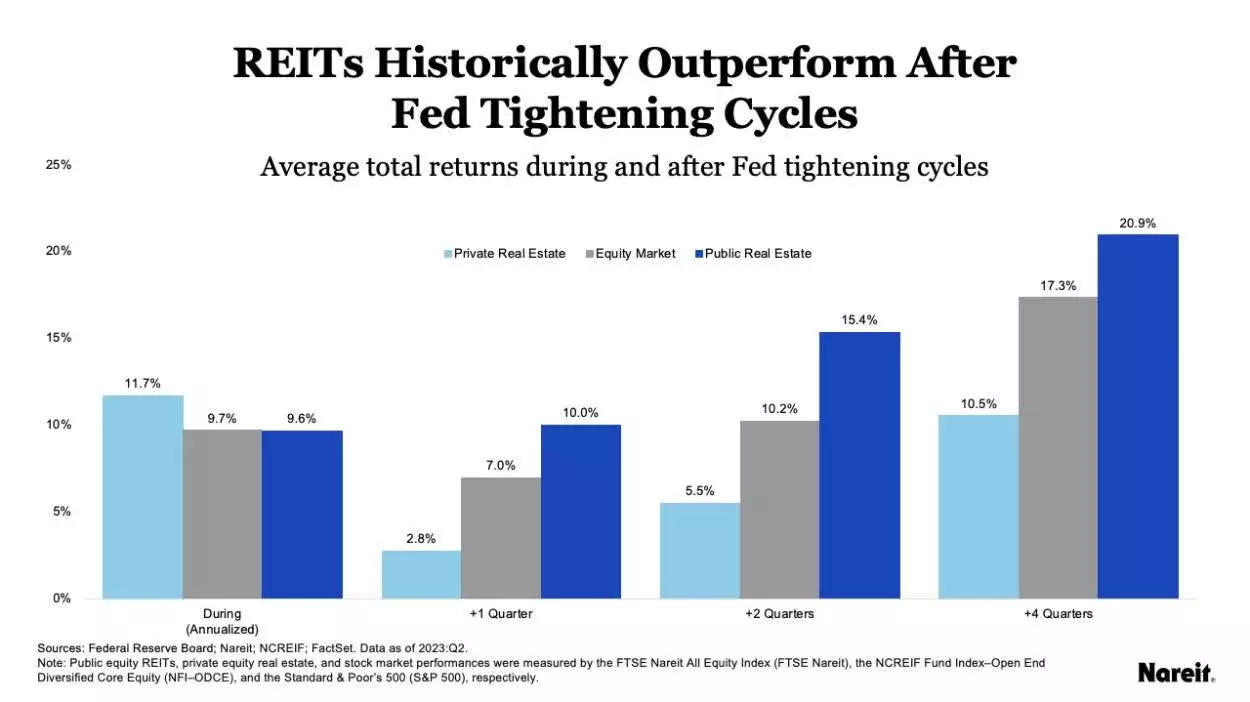

Residential REITs, which own and operate residential real estate, have seen their valuations plummet to multi-year lows. These undervalued assets provide stable and predictable cash flows, making them an attractive investment option^2^. Despite this, residential REITs have been largely ignored by the equity bull market, leaving investors puzzled. The reasons cited include concerns about potentially higher interest rates, high valuations pre-pandemic, and a lack of interest from tech investors^2^. However, a closer examination reveals that investors may be underestimating the significant potential of the asset class for the coming decade.

Healthy Demographics and Supply Shortages: Steady Rent Escalation and Higher Home Prices

Image: Nareit - 2024 REIT outlook

Image: Nareit - 2024 REIT outlook

The fundamentals supporting residential REITs have remained strong, despite pessimistic market sentiment. Healthy demographics, coupled with a shortage of housing due to years of underbuilding, continue to drive rent escalation and higher home prices^3^. Contrary to predictions, home prices have not crashed, and there is increasing confidence that they will outpace inflation in the coming years^3^. This presents a compelling opportunity for investors to capitalize on the undervalued nature of residential REITs.

Mid-America Apartment Communities (MAA) and Camden Property Trust (CPT): Favored Picks

Image: Data by YCharts

Image: Data by YCharts

By focusing on residential REITs that are strategically positioned to benefit from inward migration trends among the Sun Belt states, investors can uncover attractive opportunities. Mid-America Apartment Communities and Camden Property Trust emerge as favored picks due to their large market capitalization, economies of scale, and strong track record of performance^4^. With attractive valuations and solid growth prospects, both companies have the potential to deliver significant gains for investors.

Unlocking the Potential: A Compelling Investment Opportunity

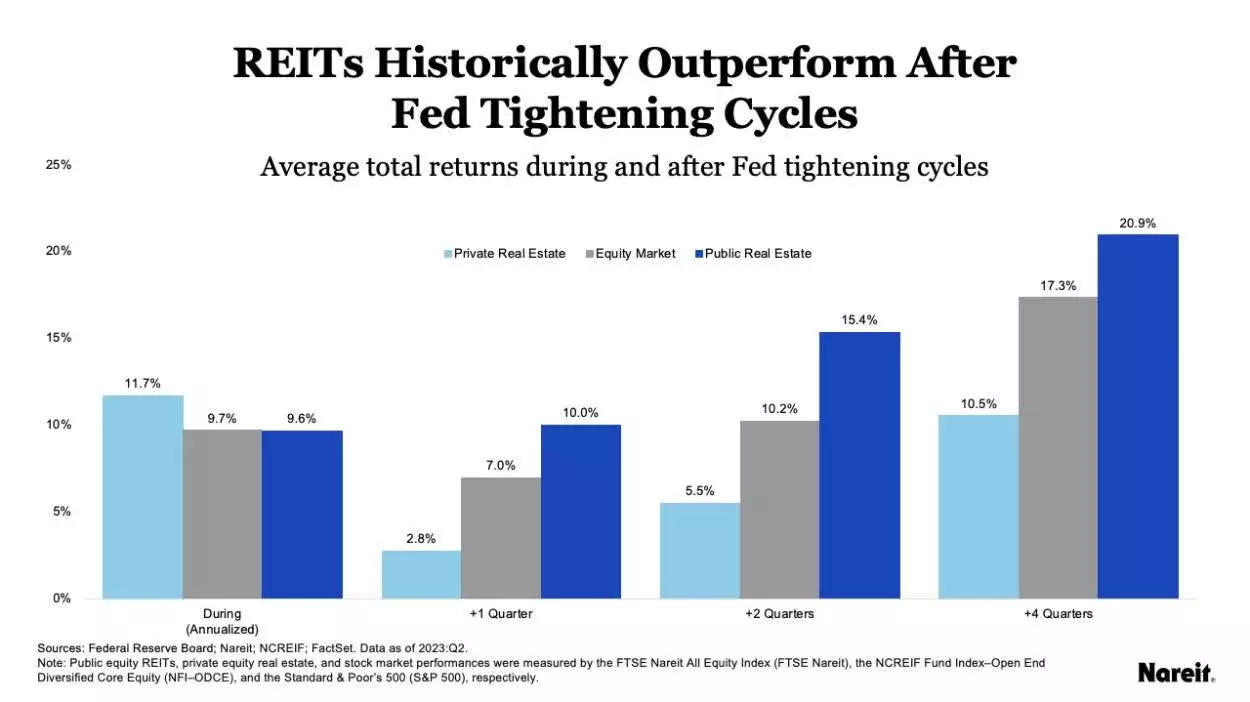

Image: Nareit

Image: Nareit

Despite the recent decline in valuations, which affected all U.S. equity REITs, residential REITs have shown resilience in terms of net operating income and occupancy rates^5^. This dislocation between fundamentals and valuations presents an opportunity for savvy investors to take advantage of the unwarranted pessimism surrounding high-quality REITs such as MAA and CPT^6^. The potential for multiple expansion further bolsters the investment case, with a projected 24% gain purely from valuation improvement^6^. With strong fundamentals and significant upside potential, MAA and CPT present a compelling investment opportunity.

Conclusion: A "Strong Buy" Rating for MAA and CPT

In conclusion, residential REITs have been overlooked by the equity market despite their stable cash flows and long-term growth potential. MAA and CPT, in particular, offer attractive valuations and strong fundamentals, making them compelling investment options^7^. With the potential for significant gains from both increasing net asset value and multiple expansion, these undervalued REITs are primed for substantial growth in 2024^7^. Based on thorough analysis, we initiate coverage of MAA and CPT with a "Strong Buy" rating, confident in their prospects for delivering impressive returns.