Retirement planning can be overwhelming. The question of how much money you'll need often elicits the response, "It depends." Dave Ramsey, a renowned personal finance guru, emphasizes that retirement needs vary from person to person. Factors such as individual lifestyles and desired income levels play a significant role in determining retirement needs.

One important consideration is where you plan to live after retirement. The cost of living in your chosen location, including expenses like groceries, will have a substantial impact on your financial requirements. Additionally, personal factors like having grandchildren nearby can influence your budget, as it may reduce the need for extensive traveling expenses.

While seeing and spoiling your grandkids is undoubtedly a want rather than a need, it's critical to assess your wants alongside your needs. By carefully evaluating your retirement plans and goals, you can ensure financial security and peace of mind during your golden years.

Photo Source

Photo Source

What You Need to Know About Your Retirement

When planning for retirement, it's essential to consider factors like debt repayment. Do you anticipate having student loans or a mortgage by then? Are there credit card debts you need to consider? Estimating the duration of your retirement is also crucial, although it can be challenging to predict accurately.

A common recommendation is to have a retirement nest egg of $1 million to $1.5 million. This estimate assumes an annual expense of $50,000 for 20-30 years after retirement. However, it's worth noting that life expectancy is increasing, and you may need to account for a longer retirement period.

Social Security can supplement your retirement income, but it's important to be aware of the changing eligibility age and potential reductions in benefits. Staying informed and considering alternative investment options can help you achieve a more secure financial future.

Photo Source

Photo Source

REITs to the Rescue!

As millions of Americans seek retirement funding through savings and investments, Real Estate Investment Trusts (REITs) offer a valuable opportunity. REITs serve as an investment tool to build a retirement portfolio and generate income during retirement.

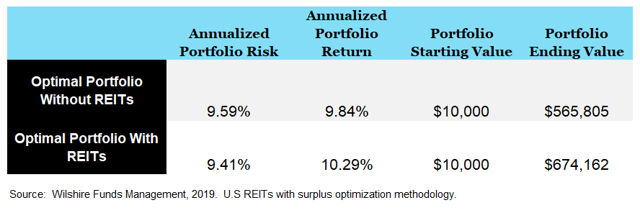

One notable advantage of REITs is their requirement to distribute at least 90% of their taxable income to shareholders. This aspect makes REITs strong income generators in various market environments. Historical data reveals that almost three-fifths of REIT total returns come from dividends. Additionally, including REITs in a diversified investment portfolio can enhance returns and reduce risk.

Photo Source

Photo Source

Steady, Stable, Dividend-Paying Opportunities

REITs are designed to offer steady and reliable dividends. While they may face downturns like any other investment, they have proven to be resilient over time. In 2019, the broader REIT index experienced a significant surge, with a collective increase of over 26%.

However, not all REITs perform equally. Careful analysis is crucial to select high-quality stocks with promising futures. The top-performing sectors have shown a 55% performance gap compared to the worst-performing sectors. By meticulously evaluating and hand-picking REITs, investors can make informed decisions and optimize portfolio performance.

Photo Source

Photo Source

Our Portfolio-Building Real Estate Blocks

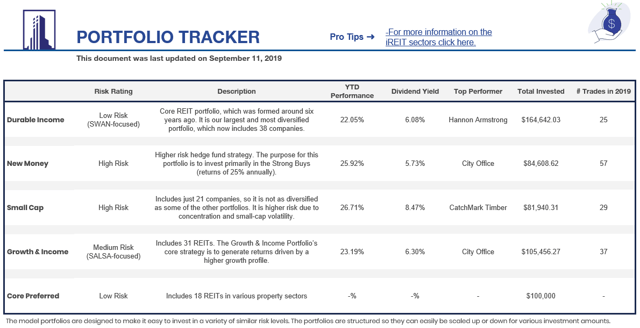

At iREIT, we provide our members with four portfolios tailored to different risk tolerance profiles. These portfolios have demonstrated impressive year-to-date returns:

- The Durable Income Portfolio, designed for low-risk income generation, returned 22.6%.

- The New Money Portfolio, a higher-risk "hedge fund-like" portfolio, returned 25.9%.

- The Small Cap REIT Portfolio returned 26.7%.

- The Growth & Income Portfolio returned 23.2%.

Photo Source

Photo Source

Sleep Well at Night with Durable Income

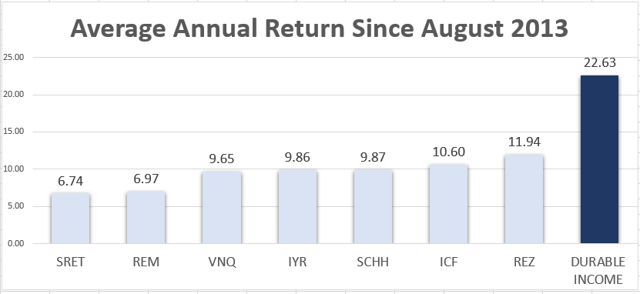

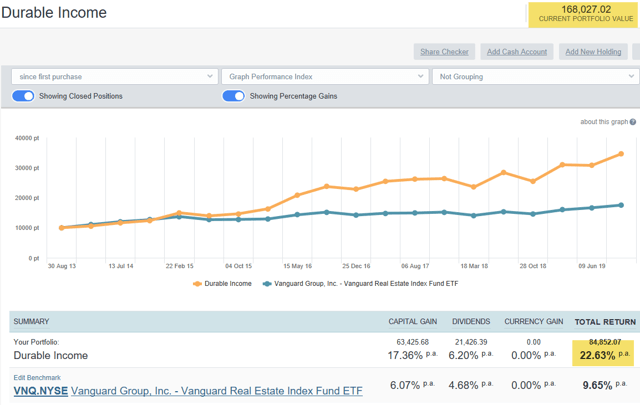

Our Durable Income Portfolio is specifically designed for retirees or pre-retirees. This portfolio aims to generate at least $30,000 per year from a $500,000 investment. With a focus on dividend safety and quality metrics, this portfolio has consistently outperformed standard REIT benchmarks.

By diversifying capital allocation and carefully selecting REITs, we aim to optimize returns and mitigate risk. Our portfolios are designed to deliver attractive returns while ensuring a good night's sleep.

Photo Source

Photo Source

The Best Way to Go

While investing in REIT ETFs is not a bad idea, it's important to recognize that it entails exposure to the entire market, including both successful and struggling REITs. Alternatively, our Durable Income Portfolio and other model portfolios offer hand-picked stocks to deliver optimized results.

Investing in high-quality REITs that align with your investment goals can yield attractive returns. Our rigorous selection process takes into account profitability, growth potential, balance sheet strength, management alignment, and innovative strategies. By intelligently diversifying your portfolio, you can effectively manage risk and achieve profitable results.

Photo Source

Photo Source

Conclusion

Retirement planning is a complex process that requires careful consideration and informed decision-making. By utilizing the potential of REITs and strategically building a diversified portfolio, you can retire rich and maintain financial security.

Remember, the key to successful retirement investing lies in assessing the profitability and long-term sustainability of your investment choices. With sound diversification and a focus on quality stocks, you can widen your margin of safety and maximize your returns.

As value investor Ben Graham wisely stated, "For most investors, diversification is the simplest and cheapest way to widen your margin of safety." By intelligently managing risk while aiming for profit, you can enhance your chances of achieving financial security during retirement.

Author's note: This article was written by Brad Thomas, a Wall Street writer. Please excuse any typographical errors, as he is focused on providing valuable insights and research rather than perfect grammar. This article is provided free of charge to assist in your research and offer a platform for deeper thinking about financial decisions.