Investing in a Roth IRA is a brilliant idea, especially if you already have a 401(k) or another retirement plan at work. Roth IRAs are simple and flexible, offering a range of benefits. However, understanding the nuances and deciding between a Roth IRA and a Traditional IRA can be challenging. This comprehensive guide will break down the Roth IRA and provide insights into contribution rules, when a Roth makes sense, the best and worst investments for a Roth IRA, and how to open a Roth IRA with the best online brokers.

Roth IRAs 101: Contribution Rules

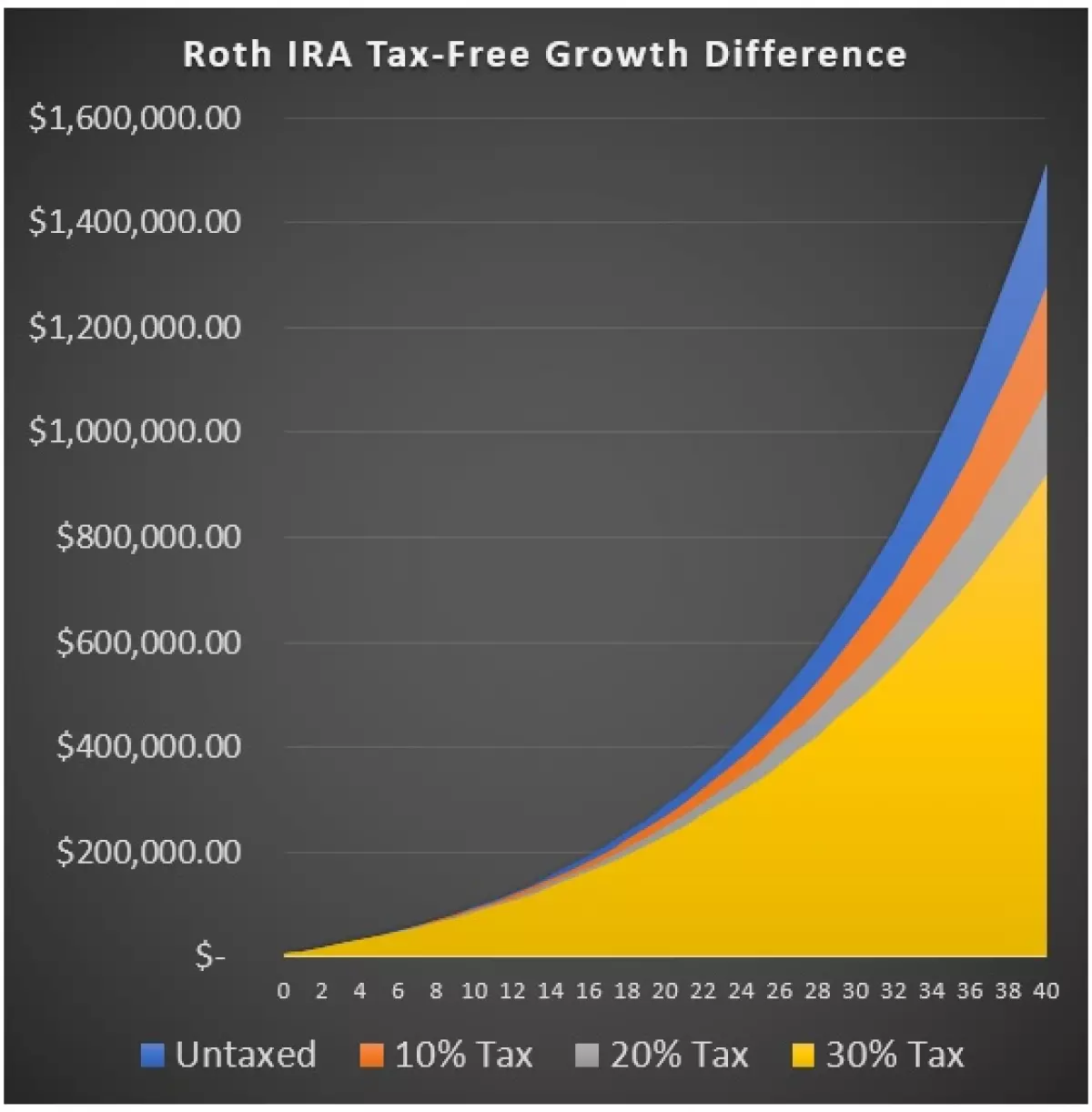

A Roth IRA, named after U.S. Senator William Roth, allows you to invest money and never pay taxes on the investment gains. Unlike traditional investments, where you pay taxes on the dividends, interest, and capital gains, a Roth IRA offers tax-free growth. The chart below illustrates the significant advantage of untaxed investments in a Roth IRA over taxed investments, assuming a 7% annual growth rate.

To qualify for a Roth IRA in 2018, you must have a modified gross adjusted income (MAGI) of less than $135,000 for single filers or $199,000 for joint filers. If you earn slightly over the income limit, you can lower your MAGI by contributing to a traditional 401(k) plan. This strategy allows you to make full contributions to your Roth IRA. Furthermore, there is no age limit on contributions or maximum age limit on withdrawals. You can contribute as long as you have earned income and leave your money in the account for as long as you wish.

Additional contribution rules include:

- Under 50: Contribute up to $6,000 per year

- Over 50: Contribute up to $7,000 per year

- Contributions must be made from earned income (salary, wages, and tips)

- No age limit on contributions

- No maximum age limit on withdrawals

- No tax penalty for withdrawing contributions/principal at any time

- No tax penalty for withdrawing earnings once you're over 59.5 years old

- Multiple Roth IRA accounts allowed, limited to $6,000/$7,000 annual contributions for all accounts combined

- Married couples can open separate Roth IRA accounts if both have enough earned income

Roth IRAs are employer-independent, meaning you can switch jobs without affecting your Roth IRA. The contribution deadline is not December 31st; it's the tax-filing deadline for that year. For example, to make a contribution for the 2020 tax year, you must do so by April 2021. This flexibility allows you to assess your tax situation before making a contribution.

To open a Roth IRA, sign up with a brokerage that offers the types of investments that suit you best. Fidelity Investments, Charles Schwab, and Vanguard are highly recommended options.

Roth IRA vs Traditional IRA: Making the Right Choice

When deciding between a Roth IRA and a Traditional IRA, consider your current and future tax rates. With a Roth IRA, you contribute after-tax income and enjoy tax-free investment gains. In contrast, a traditional IRA offers tax deductions on contributions, tax deferral on investment gains, and taxes on withdrawals in retirement.

The key question to ask yourself is: Will your tax rate be higher now or in the future? If your taxes are lower now, it makes sense to pay them upfront with a Roth IRA. However, if you expect to have a lower tax rate in retirement, then deferring taxes with a traditional IRA might be more favorable.

There are two variables that ultimately determine which option is best: your current and future income and the potential changes in tax rates. Unfortunately, predicting these variables is impossible. If your income is expected to be higher in retirement, and tax rates are likely to increase, a Roth IRA is a wise choice.

However, if you're uncertain, you can split the difference. Contribute to a traditional 401(k) plan at work to defer taxes while also contributing to a Roth IRA outside of work to address tax obligations upfront.

The Best Investments for Your Roth IRA

When it comes to investing in a Roth IRA, diversification is key. While index funds are a popular choice for their simplicity, it's essential to consider your entire portfolio. If you have a 401(k), a Roth IRA, and a taxable brokerage account, prioritize the least tax-efficient investments for your tax-free Roth IRA.

Here is a list of investments that are suitable for a Roth IRA:

Real Estate Investment Trusts (REITs)

REITs offer tax advantages as they do not pay corporate-level taxes. However, their dividends are typically taxed at ordinary income tax rates. By holding REITs in your Roth IRA, you can benefit from tax-free growth and avoid taxation on dividends.

Options Investments

Options can provide flexibility and income for hands-on investors. While options can be complex, they can also help reduce risk and generate more investment income. However, options are not tax-efficient. To avoid tax inefficiencies, it is recommended to hold options investments in your Roth IRA.

Corporate Bonds

Interest received from corporate bonds is typically taxed at ordinary income tax rates, which is higher than the long-term capital gains and qualified dividends tax rate. Thus, allocating corporate bonds to your Roth IRA is a tax-efficient strategy.

Peer-to-Peer Lending

Similar to corporate bonds, interest income generated from peer-to-peer lending platforms, such as Lending Club, is taxed at ordinary income tax rates. Some platforms allow you to open a Roth IRA and invest in peer-to-peer lending tax-free.

Real Estate Crowdsourcing

Investing in real estate crowdsourcing platforms, like Fundrise, often results in high ordinary income tax rates on distributions. However, certain platforms offer the option to open a Roth IRA for tax-free real estate investments.

While these investments are suitable for a Roth IRA, it's crucial to evaluate your overall investment strategy and diversification needs.

Investments to Avoid in Your Roth IRA

Certain investments are inherently tax-efficient or tax-free, making it more advantageous to hold them in taxable accounts rather than a Roth IRA. Here are some investments to avoid in your Roth IRA:

Master Limited Partnerships (MLPs)

MLPs are pass-through entities that often offer tax-advantaged income. Additionally, the tax on MLPs is deferred until you sell your investment, allowing for years of compounding growth. However, MLPs may generate unrelated business taxable income (UBTI) and become a tax burden in a Roth IRA. Therefore, it's generally best to avoid MLPs in a Roth IRA unless you have specific reasons.

Municipal Bonds

Municipal bonds are tax-free investments. By placing them in a Roth IRA, you do not receive any additional tax benefits and prevent the opportunity to include less tax-efficient investments in your Roth IRA.

Foreign Dividend Stocks

Foreign dividend stocks often have tax withholding rates imposed by the country of origin. Holding these stocks in a Roth IRA means paying foreign dividend taxes, defeating the purpose of a tax-free account. However, Canadian stocks or stocks from countries without dividend withholding taxes are suitable for a Roth IRA.

It's important to note that while certain investments may not be optimal for a Roth IRA, they can still be held in the account without significant consequences.

Open a Roth IRA with the Best Online Brokers

If you prefer index funds, Vanguard, Betterment, and M1 Finance are excellent options. These platforms offer a range of ETFs and provide a seamless investment experience. On the other hand, if you want to invest in stocks and options, Robinhood, Charles Schwab, and Fidelity offer comprehensive platforms with competitive fees.

Among these options, M1 Finance is highly recommended for most investors. It is a completely free platform that allows for investing in ETFs and individual stocks. Additionally, it offers automatic portfolio rebalancing, making it a user-friendly choice.

In Conclusion

Opening a Roth IRA is a fantastic strategy, particularly if you have a retirement plan like a Traditional 401(k) at work and your MAGI is below the income limit. The simplicity and flexibility of a Roth IRA, coupled with its tax-free nature, make it an excellent way to grow your investments. By contributing consistently and making smart investment choices, you can build substantial wealth over time.

Disclaimer: The information provided in this article is for informational purposes only and should not be construed as financial or investment advice. Always consult with a qualified financial advisor before making any financial decisions.