So, you've made some profits from your investments? Well, it's time to face the music and report your transactions to the Internal Revenue Service (IRS) on Schedule D. This form not only helps you calculate how much tax you owe but also allows you to offset any gains or a portion of your ordinary income with losses, potentially reducing the taxes you owe. Reporting your capital gains and losses correctly is crucial, and Schedule D is here to help.

What is a Schedule D?

Schedule D is an IRS tax form that you need to fill out to report your realized gains and losses from capital assets, such as investments and other business interests. This form includes essential information like the total purchase price of assets, the total price those assets were sold for, and whether you held those assets for the long term (more than a year) or the short term (less than a year).

Who has to file a Schedule D?

If you realized any capital gains or losses from your investments in taxable accounts, you will need to file a Schedule D form. This includes selling assets in taxable accounts like stocks, ETFs, mutual funds, bonds, options, real estate, futures, cryptocurrency, and more. Filing Schedule D is also necessary if you have capital losses from previous tax years that you want to carry over for tax benefits.

Other individuals who need to file Schedule D include those who had capital gains or losses from partnerships, estates, trusts, or S corporations. If you have gains or losses not reported on another form, nonbusiness bad debts, like-kind exchanges, or installment sales, you may also need to report them on Schedule D.

How to Report a Gain or Loss and How You're Taxed

Now, let's dive into how you report your gains or losses and how you'll be taxed. The two-page Schedule D may seem daunting at first, with its sections, columns, and special computations, but we'll break it down for you.

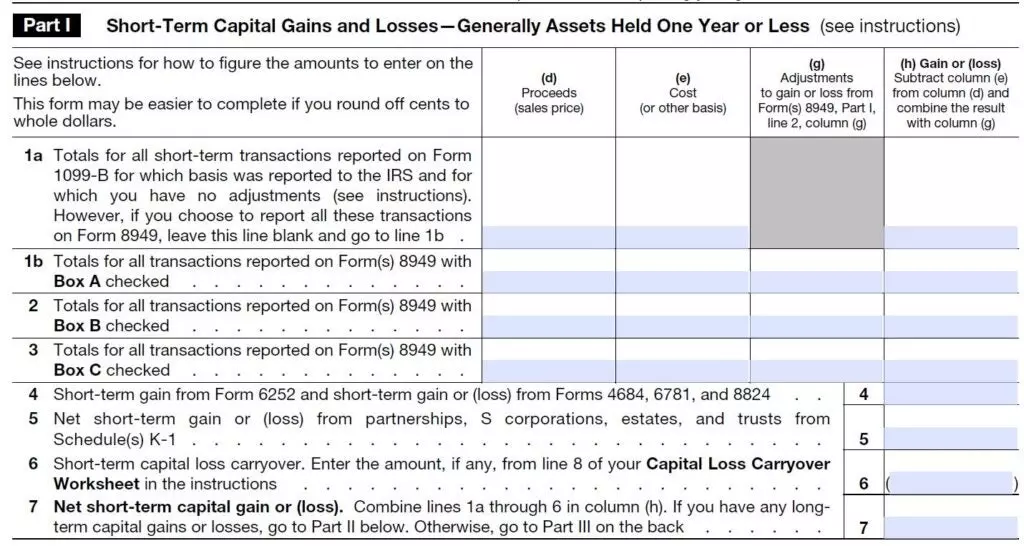

To begin, you need to report your transactions on Form 8949 and then transfer the information to Schedule D. On Form 8949, you'll note the acquisition and sale dates of the assets, as well as their cost and selling price. The length of time you hold the property determines its tax rate.

If you owned the asset for a year or less, any gain will typically result in higher taxes. These short-term sales are taxed at the same rate as your regular income, which can be as high as 37 percent on your 2023 tax return. You'll report short-term sales in Part 1 of the form.

An excerpt from Form 8949

An excerpt from Form 8949

However, if you held the property for more than a year, it's considered a long-term asset and qualifies for a lower capital gains tax rate of 0 percent, 15 percent, or 20 percent, depending on your income level. Sales of long-term assets are reported in Part 2 of the form, which looks nearly identical to Part 1.

Detail Your Transactions

Once you determine whether your gain or loss is short-term or long-term, it's time to enter the transaction specifics in the appropriate section of Form 8949. For each transaction, you'll need to provide the name or description of the asset, the acquisition and sale dates, the selling price, the asset's cost or other basis, and the resulting gain or loss.

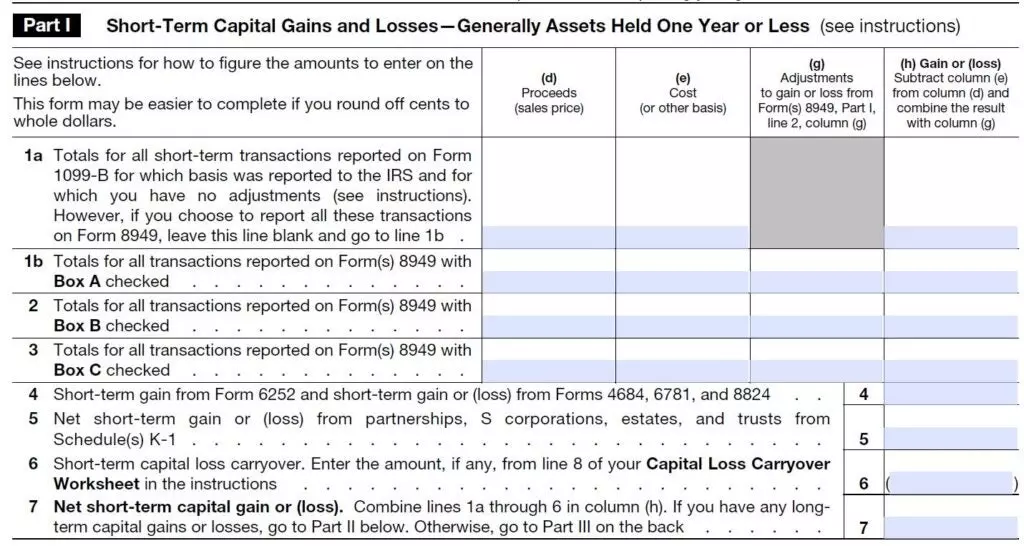

After completing Form 8949, you'll transfer the information to the appropriate short-term or long-term sections of Schedule D. On Schedule D, you'll subtract your basis from the sales price to arrive at your total capital gain or loss.

An excerpt from Schedule D

An excerpt from Schedule D

Schedule D also covers specific transactions, such as installment sales, like-kind exchanges, commodity straddles, sales of business property, and gains or losses reported to you on Schedule K-1. If any of these apply to your tax situation, it might be wise to consult a professional tax advisor to ensure accuracy.

Additionally, Schedule D asks for information on capital loss carry-overs from previous tax years on line 14, as well as the amount of capital gains distributions you earned from your investments.

It's worth noting that you may be able to avoid filing Schedule D if your return falls under either of the following situations:

- If distributions are your only investment items to report, you don't have to fill out Schedule D. Instead, these distributions go directly on your 1040 or 1040A return.

- You can also bypass Schedule D if your only capital gain comes from selling your residence. As long as you meet certain residency requirements and your home-sale profit is $250,000 or less ($500,000 for married-filing-jointly home sellers), it's not taxable, and you don't have to report it to the IRS.

Total Your Transactions

Once you've filled in the short-term and long-term transaction information in Parts 1 and 2, it's time to turn to Part 3 of Schedule D. This section consolidates your asset-sale details, but it requires a bit more than simply transferring numbers from the front of the form to the back.

Lines 16 through 22 of Part 3 direct you to other lines and forms based on whether you've calculated an overall gain or loss. Additionally, a few lines deal with special rates for collectibles and depreciated real estate. In these situations, seeking expert tax advice is highly recommended.

Schedule D helps you total up your gains and losses. If you end up with a net capital loss, it's not great news for your investments, but it's excellent news for your taxes. Your loss can offset your regular income, reducing the amount you owe - up to a net $3,000 loss limit.

If your reported net loss exceeds the annual limit, you can carry it forward to offset gains in future tax years until it's fully utilized.

As a bonus, once you have a capital loss, you're done with Schedule D. Simply transfer the loss amount to your 1040 and continue filing your tax return there.

Figure Out the Tax on Your Gains

When you have a gain, the tax paperwork doesn't end just yet. Now is when the real math begins, especially if you're doing your taxes manually.

Depending on your answers to various Schedule D questions, you'll be directed to either the Qualified Dividends and Capital Gain Tax worksheet or the Schedule D Tax worksheet. You can find these worksheets in the instructions booklet for Form 1040. These worksheets guide you through calculations of your different types of income and determine the appropriate level of taxation for each.

Before you start working on these worksheets, make sure you've completed your Form 1040 through line 11, which is your taxable income amount. This serves as the starting point for both worksheets. From there, you'll perform addition, subtraction, multiplication, and transfer numbers from various forms.

Even if you sold stocks or other assets, don't be tempted to skip Form 8949, Schedule D, the associated tax worksheets, and the additional calculations. Remember, the IRS has received copies of any tax statements your broker sent you, so they expect you to provide details about the sale and any resulting gain or loss when you file your taxes.

The Bottom Line

The extra work required to calculate your capital gains taxes is generally advantageous. Regular income tax rates can be more than twice the rate applied to long-term capital gains. So, when you're done with all the calculations, your tax bill should be lower than it would have been if you had only used the standard tax table to determine your tax liability.

Note: This article was adapted from a previous version with contributions from Kay Bell.