In this edition of our Sector Spotlight series, we will delve into the world of Multifamily Real Estate Investment Trusts (REITs). The multifamily sector has been experiencing a steady increase in demand for many years, driven by factors such as population growth, job growth, and household formation. In this article, we will explore the key drivers of this sector and analyze the strategies employed by multifamily REITs.

The Multifamily Sector

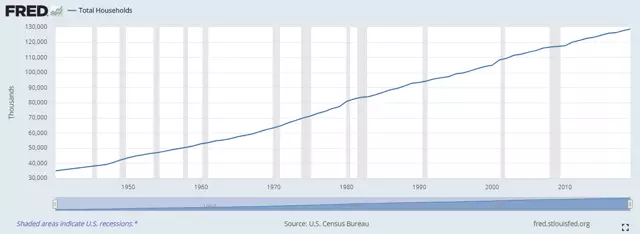

The multifamily housing market is influenced by population growth, job growth, population migration, household formation, and the homeownership rate. These metrics have all experienced positive trends, resulting in a strong and steady increase in demand for multifamily housing. Immigration plays a significant role in boosting the population and the need for housing. Job growth, especially in markets with strong employment opportunities, leads to population migration and increased demand for housing. As individuals gain employment or experience wage increases, they can afford to move out of shared-living arrangements and form new households, thus creating further demand for housing units.

The homeownership rate also impacts the demand for rental housing. When the homeownership rate is high, demand for rental housing is relatively low. Although the homeownership rate has recovered in recent years, the demand for multifamily housing remains strong.

Elevated Supply Growth

Supply growth in the multifamily sector has been robust in recent years and is expected to continue. Despite this wave of new supply entering the market, vacancy rates have continued to decline. This indicates a strong demand for multifamily housing even in the face of increased competition. While vacancy rates have fallen, they remain higher than the rates seen several decades ago.

Portfolio Strategy

Different multifamily REITs employ various strategies based on portfolio quality and geographic focus. Portfolio quality is typically categorized by class, with REITs primarily investing in Class A, Class B, and Class C properties. Class A properties are newer and have higher rents, while Class B properties are slightly older but still in good condition. Class C properties are even older and often in poorer condition. Geographic focus also differs among REITs, with some focusing on top-tier coastal markets and others concentrating on the sunbelt region. Market analysis is crucial to understand economic trends and supply/demand balances in each specific market.

Rent Collection

Multifamily REITs have maintained relatively high rent collection rates compared to other REIT sectors. Even during the COVID-19 pandemic, rent collection percentages have remained strong. As the economy recovers, rent collection figures are expected to continue rising.

Same-Store NOI Growth

Most multifamily REITs have maintained positive Same-Store Net Operating Income (NOI) growth. This growth is influenced by factors such as population migration and job growth, particularly in sunbelt regions. However, certain REITs, such as Bluerock Residential Growth REIT (BRG) and Equity Residential (EQR), have experienced slightly lower growth rates. Analyzing NOI growth can provide insights into the performance of multifamily REITs.

Debt

The multifamily sector tends to have a lower debt-to-capitalization ratio compared to other REIT property types. This is due to the stability of cash flows in the multifamily asset class, making it an attractive option for lenders. However, it is crucial to monitor the fixed charge coverage ratio to ensure the financial health of each REIT.

G&A

General and administrative (G&A) spending can significantly impact the profitability and total return of a REIT. Excessive G&A spending has been observed in some multifamily REITs, such as Independence Realty Trust (IRT). Responsible G&A spending allows for greater funds available for distribution to shareholders.

Valuation

Multifamily REITs are currently trading at a discount to Net Asset Value (NAV). The discounts likely reflect investor expectations of lower Net Operating Income (NOI) growth or higher capitalization rates in the future. It is important to closely monitor transaction cap rates in the multifamily property market to identify any shifts in investors’ expectations.

Dividends

Most multifamily REITs have maintained consistent dividend yields, with some even raising their dividends over the past year. However, certain REITs, such as Bluerock Residential Growth (BRG), have high dividend yields that may be at risk of potential cuts due to poor dividend coverage. It is crucial to analyze the dividend coverage and payout ratios of each REIT to understand the sustainability of their dividends.

Total Return

The total return of multifamily REITs over the past year varied significantly. While some REITs achieved positive total returns, others experienced double-digit declines. Factors such as portfolio quality, geographic focus, and overall market conditions can influence the total return of each REIT.

In conclusion, the multifamily REIT sector has consistently experienced strong demand due to population growth, job growth, and other key metrics. Understanding the strategies, property portfolios, and financial health of multifamily REITs is crucial for investors looking to navigate this sector successfully.

Disclaimer: The data and analysis in this article are compiled from various sources and should not be considered as financial advice. Please refer to the original sources and conduct your own research before making any investment decisions.

Source: Image by Sanaulac

Source: Image by Sanaulac