By James Sprow, February 15, 2022

Starwood Real Estate Income Trust, Inc. has recently made an exciting announcement. The company has filed a preliminary prospectus on February 8, 2021, revealing its plan to offer up to $18 billion in shares of common stock. This follow-on offering consists of up to $16 billion in shares in its primary offering and up to $2 billion in shares through its distribution reinvestment program.

Starwood Real Estate Income Trust, Inc. primarily focuses on investing in stabilized, income-oriented commercial real estate. As a nontraded REIT, it aims to bring Starwood Capital's institutional-quality real estate investment platform to income-focused investors. The REIT is externally managed by Starwood REIT Advisors, L.L.C., an affiliate of Starwood Capital Group Holdings, L.P., a renowned global investment manager.

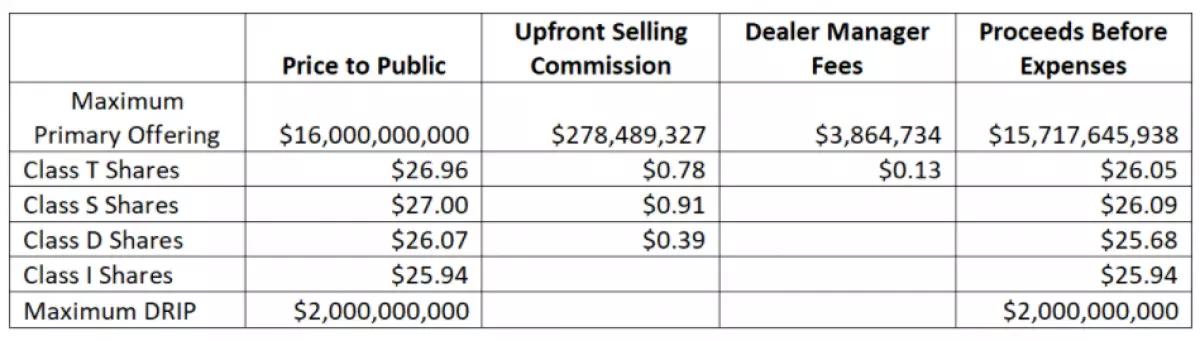

To cater to a broad range of investors, the REIT is offering four classes of common stock: Class T, Class S, Class D, and Class I. Each class has different upfront selling commissions, dealer manager fees, and ongoing stockholder servicing fees. The purchase price per share for each class will vary, generally equaling the prior month's net asset value (NAV) per share, plus applicable fees.

This follow-on offering comes after the success of Starwood REIT's initial $5 billion offering, which raised approximately $3.9 billion from investors before closing in June 2021. The subsequent $10 billion follow-on offering, launched immediately afterward, has already raised about $5.8 billion as of December 31, 2021.

The REIT's investment strategy remains focused on stabilized, income-oriented commercial real estate properties primarily in the United States, with some exposure to Europe. Additionally, the REIT may consider real estate debt as part of its investment portfolio. Starwood Capital LLC will continue to act as the dealer manager for the offering, ensuring reliable and professional management.

Investors have reason to be excited about Starwood REIT's performance. The Class I shares, for example, have seen a significant increase in NAV per share, from $21.66 as of December 31, 2020, to $25.94 as of December 31, 2021, reflecting a year-over-year increase of 19.76%. Furthermore, these shares have delivered a total return of 26.33% for the year, the highest among the 11 continuously tracked REITs by Blue Vault in 2021.

It's important to note that due to the lack of a public trading market for the REIT's common stock, the repurchase of shares by the REIT will likely be the only means of disposing of shares. The REIT's share repurchase plan allows stockholders to request the repurchase of their shares on a monthly basis. However, the REIT is not obligated to repurchase any shares and may choose to repurchase only a portion or none of the requested shares, depending on available liquidity and other significant restrictions. Therefore, the shares should be considered to have limited liquidity, and at times, they may be illiquid.

The pricing of the REIT's common shares is detailed in the Prospectus, with the price per share for each class determined as of February 1, 2022. This transaction price corresponds to the class's NAV per share as of December 31, 2021, plus applicable selling commissions and dealer manager fees.

Image Source: SEC Form S-11 filed 2-8-22

Image Source: SEC Form S-11 filed 2-8-22

Investors seeking opportunities in the real estate market will find Starwood Real Estate Income Trust's follow-on offering to be a promising venture. With its solid track record and focus on income-oriented properties, this offering presents a chance to participate in Starwood Capital's renowned institutional-quality real estate investment platform. Stay informed about this exciting opportunity and seize the chance to realize your investment goals.

Note: The original article does not indicate the number of words required for image captions. Please adjust the image captions if a specific word count is needed.