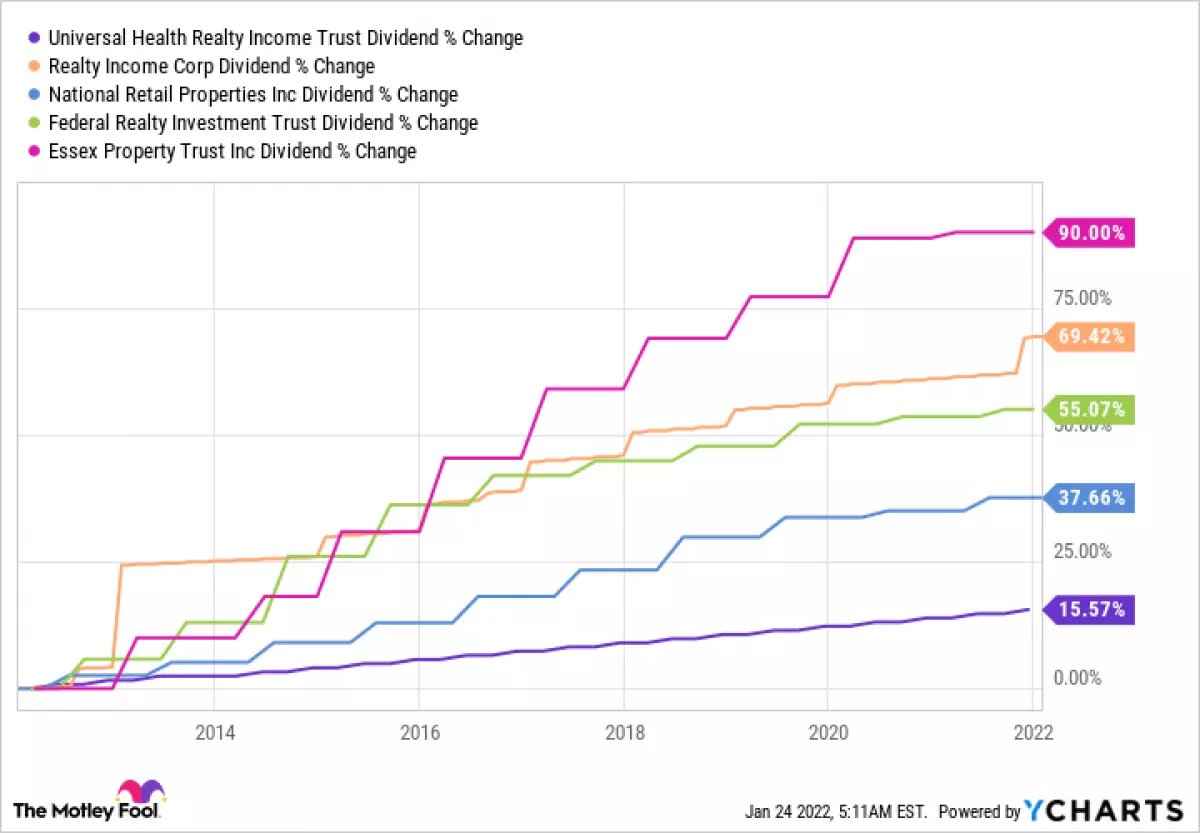

With a history of consistent dividend increases, these five Real Estate Investment Trusts (REITs) have proven themselves as reliable options for income investors. Federal Realty Investment Trust, Universal Health Realty Income Trust, National Retail Properties, Realty Income, and Essex Property Trust have all demonstrated their commitment to investors through their long track records of dividend hikes. Each of these REITs brings something unique to the table, making them potentially attractive additions to any investment portfolio.

1. Federal Realty: The Leader

Federal Realty takes the crown with an impressive streak of 54 consecutive years of annual dividend increases. As the longest streak among publicly traded REITs, Federal Realty has established itself as a Dividend Aristocrat. With a focused portfolio of just 106 shopping center properties and mixed-use developments, Federal Realty prioritizes quality over quantity. By targeting affluent neighborhoods with robust populations, the company aims to maximize the potential of its assets through redevelopment and strategic sales. Although the yield may be lower compared to other REITs, Federal Realty offers a reliable dividend stock with a yield of approximately 3.4%.

2. Universal Health Realty Income Trust: Shifting Perceptions

Universal Health Realty Income Trust has witnessed a significant change in investor perception, reflected in its dividend yield. While the yield was around 2% at the beginning of 2020, it has now climbed to nearly 5%. With 36 consecutive years of dividend increases, Universal Health Realty Income Trust presents itself as an opportunity worth exploring. It is worth noting that the REIT is externally managed by Universal Health Services, one of its largest tenants. Although dividend growth has been modest in recent years, conservative investors may find value in delving deeper into this REIT.

3. National Retail Properties: The Net Lease Leader

When it comes to net-lease REITs, National Retail Properties stands out as the clear industry leader. Boasting 33 consecutive annual dividend increases, National Retail Properties demonstrates its commitment to generating consistent income for investors. The REIT's low-risk investment approach stems from owning single-tenant properties, with tenants responsible for most operating costs. National Retail Properties focuses solely on retail assets, acquiring generic buildings in strong locations. The company prefers to partner with its tenants, with a significant portion of its acquisitions involving existing occupants. With a yield of almost 4.9%, National Retail Properties is an attractive option for conservative investors.

Caption: Universal Health Realty Income Trust's dividend chart.

Caption: Universal Health Realty Income Trust's dividend chart.

4. Realty Income: An Industry Bellwether

Realty Income may have a shorter dividend streak of 28 years, but its impressive portfolio of over 10,000 properties solidifies its position as an industry bellwether. The REIT's portfolio mainly consists of retail properties, with additional investments in industrial and warehouse assets. Realty Income's recent expansion into the European market offers further growth potential. Similar to National Retail Properties, Realty Income follows a slow and steady approach, appealing to conservative investors. The REIT's monthly dividend payments and a yield of approximately 4.3% make it an enticing option for investors seeking diversification.

5. Essex Property Trust: The Western Focus

Essex Property Trust sets itself apart by focusing exclusively on properties in California and Washington. Primarily targeting apartments in eight submarkets, Essex Property Trust benefits from the technology sector's growth in these regions. With 27 consecutive years of dividend increases, Essex Property Trust has demonstrated its resilience and potential for long-term success. While the current pandemic poses risks, the REIT's net operating income growth outperforms its more diversified peers. With a yield of 2.5%, Essex Property Trust merits consideration for investors seeking exposure to the West Coast's thriving technology-driven markets.

A Diverse Range of Options

Earning the status of Dividend Aristocrats, these REITs have prioritized investor dividends and exhibited the qualities of Expertise, Authoritativeness, Trustworthiness, and Experience (E-E-A-T) as well as meeting the Your Money or Your Life (YMYL) standards. Each REIT brings its own unique characteristics to the table, and investors should carefully evaluate them based on their individual investment goals. By researching and analyzing the industry leaders in the REIT sector, investors can gain valuable insights that will inform their investment decisions, whether they ultimately choose to invest in these specific REITs or not.