Everyone loves a good deal, especially when it comes to investing. However, being cheap doesn't always mean you're getting good value. The key is to find high-quality businesses that are undervalued and have the potential for growth. In this article, we will look at three stocks that fit this criteria and have promising long-term futures.

Unleash the software robots

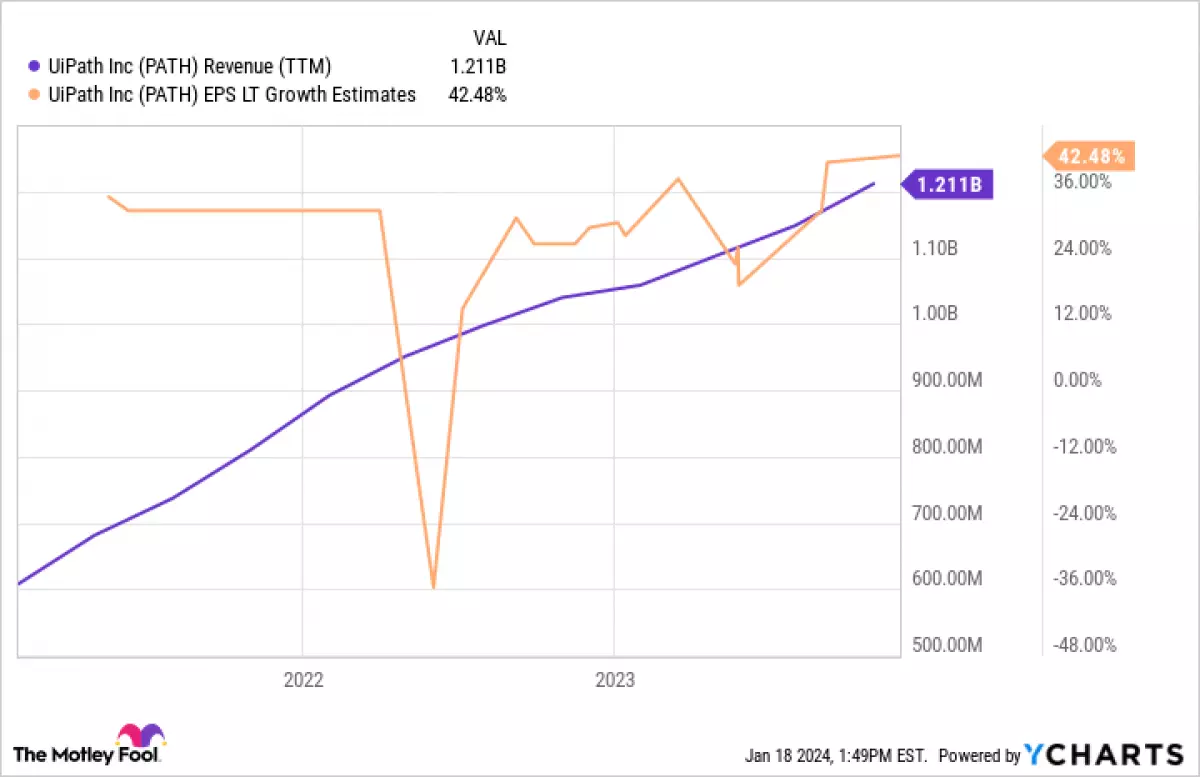

One such stock is UiPath (PATH 0.88%), a company that specializes in robotic process automation (RPA). RPA is software that can perform repetitive computer tasks in place of humans. UiPath is a leader in this field, and its strong net revenue retention rate reflects its ability to retain and expand its customer base. The company has gained traction in industries like healthcare, banking, manufacturing, and the public sector, and its revenue has doubled over the past few years. With a forward P/E of 45, UiPath's stock could be a great investment if it meets analysts' growth estimates.

PATH Revenue (TTM) data by YCharts

PATH Revenue (TTM) data by YCharts

Next-generation cybersecurity with stellar growth

SentinelOne (S -0.39%) is a next-generation cybersecurity company that uses artificial intelligence and machine learning to analyze computer files and detect potential threats in real time. Its technology has been recognized by cybersecurity evaluations and has helped the company achieve impressive revenue growth. While SentinelOne is currently not profitable, it has a substantial cash hoard and analysts believe it could become profitable next fiscal year. With a price-to-sales ratio of 11, SentinelOne's stock is trading at a discount compared to its rival CrowdStrike.

S Revenue (TTM) data by YCharts

S Revenue (TTM) data by YCharts

Don't overlook the gig economy

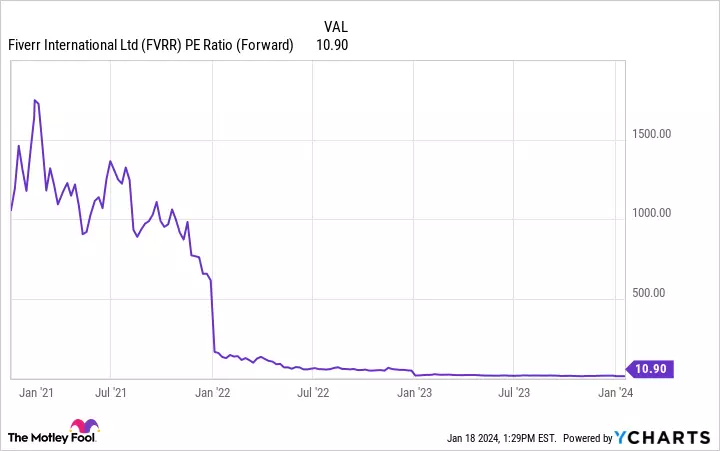

Fiverr International (FVRR -1.79%) operates a marketplace where people and companies can buy and sell freelance services. The company experienced significant growth during the COVID-19 pandemic as remote work became more popular. While growth has slowed since then, Fiverr has been making progress in attracting higher-paying enterprise customers. The company is profitable and has a price-to-earnings ratio of just under 11. With a massive addressable market and solid business execution, Fiverr's earnings have the potential to outgrow its current stock price over time.

FVRR PE Ratio (Forward) data by YCharts

FVRR PE Ratio (Forward) data by YCharts

In conclusion, finding the best stocks to invest in requires a careful evaluation of each company's potential for growth and its current valuation. UiPath, SentinelOne, and Fiverr International are three stocks that possess these qualities and could be excellent investment opportunities. Remember to conduct further research and consult with a financial advisor before making any investment decisions.