Image caption: The cyclical nature of property markets - Buy to let

Image caption: The cyclical nature of property markets - Buy to let

If you've ever considered becoming a landlord and investing in buy-to-let properties, then you're in the right place. This comprehensive guide will provide you with all the essential information you need to know before taking the plunge. From understanding the risks and costs involved to evaluating your potential returns, we'll cover it all.

Is Buy-to-Let Worth It?

Once a highly popular investment strategy, buy-to-let has faced numerous changes over the years. The government's introduction of new tax regulations in 2014 significantly impacted the sector. However, despite these changes, buy-to-let properties can still offer attractive investment opportunities if approached strategically.

Instability

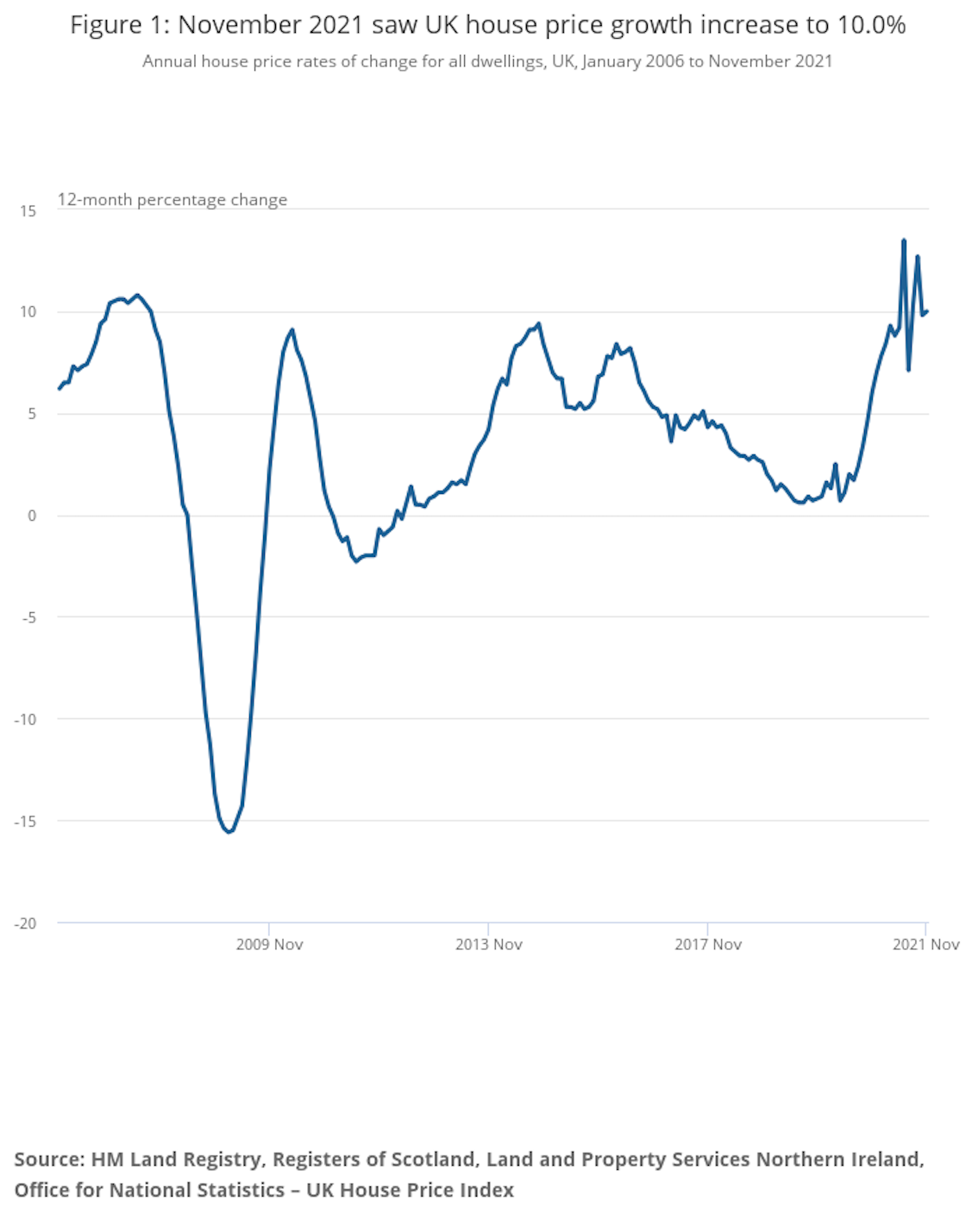

It's important to remember that property prices are not always on an upward trajectory. The market can experience fluctuations, and it's crucial to view buy-to-let investments as long-term endeavors. While rental yields may be high at present, influenced by limited availability for first-time buyers, this situation won't last forever. Future periods of low demand could lead to falling rents.

Cyclical Nature of Markets

Both property prices and buy-to-let rental yields follow cyclical patterns. Jumping in and out of investments for short-term gains isn't suitable for this type of venture. Unlike liquid assets, property sales can take months to complete. Therefore, buy-to-let is best suited for individuals looking for long-term income and growth.

Image caption: Graph displaying house price percentage inflation

Image caption: Graph displaying house price percentage inflation

Void Periods

As a landlord, it's unrealistic to expect that your property will be occupied at all times. The rental market is dynamic, with tenants frequently changing properties due to various reasons. It's essential to plan for these periods and be prepared to cover the costs of maintaining your property during vacancies. Rent guarantee insurance is one option to consider.

What Returns Can You Expect?

The returns on your buy-to-let investment are measured by its rental yield. Several factors affect the rental yield, including the property type, location, market conditions, and property condition.

Gross Yield

The gross yield represents the annual rent divided by the purchase price, expressed as a percentage. The UK's average rental yields for 2021, categorized by region, are as follows:

- London: 2.83%

- South East: 3.27%

- South West: 3.70%

- West Midlands: 3.85%

- East Midlands: 3.80%

- East: 3.41%

- North East: 3.46%

- North West: 4.69%

- Yorkshire and the Humber: 4.56%

- Wales: 4.31%

- Scotland: 4.54%

Net Yield

The net yield represents the annual rental income minus costs such as mortgage payments, repair costs, fees, and void periods. It is also expressed as a percentage. While gross rental yields in the UK typically hover around 3.5%, net yields can vary significantly based on costs and rental income. Cheaper buy-to-let properties generally offer better annual yields.

Financing Your Buy-to-Let Property

Unless you can afford to purchase a buy-to-let property outright, you will likely require a buy-to-let mortgage. Lenders typically require a minimum deposit of 25% of the purchase price. The higher the deposit you can put down, the better buy-to-let mortgage deal you can secure.

Consider a free buy-to-let mortgage consultation to fully understand your lending options and secure the best deal.

Understanding the Costs Involved

Investing in a buy-to-let property involves various costs that need careful consideration.

Initial Costs

- Deposit: Lenders typically require a minimum deposit of 25% or more.

- Survey Fee: The cost of having the property professionally surveyed.

- Stamp Duty: Tax levied on property purchases.

- Legal Costs: Fees associated with conveyancing and legal processes.

- Mortgage Admin Fee: The fee charged by the mortgage provider for administering the mortgage.

- Insurance: Building insurance to protect your investment.

Letting Costs

- Property preparation: Cleaning, repairs, furniture, and appliances.

- Gas and Safety Report: Ensuring compliance with safety regulations.

- Advertising: Necessary if you choose to let the property privately.

- Letting Agent Fees: If you opt to use a letting agent's services.

- Inventory Costs: Creating inventories and obtaining references.

Running Costs

- Mortgage Payments: The most significant ongoing cost for most landlords.

- Maintenance Costs: Expenses related to property upkeep.

- Insurance: Covering property, contents, and public liability.

- Ground Rent and Service Charge: Applicable for leasehold properties.

The Responsibilities of a Landlord

Entering the buy-to-let market requires an understanding of your legal responsibilities as a landlord. Compliance is crucial to avoid penalties and potential legal issues. Here are the main categories of responsibility:

Electricity - Electrical Equipment (Safety) Regulations 1994

- Ensuring electrical supply and appliances are safe.

- Regular checks for defects and maintenance by a qualified engineer.

- Installing and maintaining smoke alarms.

Gas - Gas Safety (Installation and Use) Regulations 1998

- Regular maintenance and inspections of gas appliances and pipework.

- Providing a Gas Safety Record (GSR) to tenants.

- Providing instructions on how to operate gas appliances.

- Ensuring proper ventilation and safety measures.

Furnishing - Furniture and Furnishings (Fire and Safety) Regulations 1993

- Ensuring compliance with fire safety regulations for furniture and furnishings.

Tenants' Deposit

- Depositing tenants' deposits within a government-approved scheme.

- Failure to comply can result in financial penalties.

Penalties

Non-compliance with regulations can lead to fines, imprisonment, civil damages claims, invalid insurance, criminal records, and even potential manslaughter charges.

Exploring Different Strategies for Success

To maximize your chances of success as a buy-to-let landlord, it's essential to consider several key areas.

Decide Your Strategy

- Determine your investment goals and the purpose of your buy-to-let investment.

- Consider the type of properties you want in your portfolio.

- Define your exit strategy for when you decide to move on.

Conduct Thorough Research

- Understand the properties and locations that yield the best results.

- Learn about potential pitfalls and timeframes for realizing your investment.

- Seek advice from experienced buy-to-let investors.

Choose the Right Property

- Identify areas with promising rental yields.

- Decide whether you want a ready-to-let property or are willing to invest in renovations.

- Consider proximity to your home versus potential yield.

Determine Tenant Criteria

- Establish criteria for tenants (e.g., families, pet owners, smokers).

- Decide whether to rent to students or those on benefits.

- Consider vetting tenants yourself or using a letting agent.

Management Options

- Decide whether to manage the property yourself or hire a letting agent.

- Understand the full scope and costs of the services provided.

Financial Planning

- Consider all costs involved in buy-to-let investment, including stamp duty, mortgage fees, insurance, and ongoing expenses.

- Understand your tax obligations and seek professional advice if necessary.

Finding the Right Mortgage

- Shop around for the best buy-to-let mortgage deal.

- Consider consulting a mortgage adviser to ensure you secure the most favorable terms.

Additional Resources

For further guidance on becoming a successful buy-to-let landlord, consider exploring the following resources:

- The 27-point checklist of a successful buy-to-let landlord

- Buy-to-let tips: The 8 things that can kill your buy-to-let investment

Remember, investing in buy-to-let properties requires careful planning and consideration. Use the information provided in this guide as a starting point and conduct thorough research before making any commitments. Happy investing!

Disclaimer: The information provided in this article is for informational purposes only and should not be considered financial advice. Always consult with a professional advisor before making any investment decisions.

This article may contain affiliate links. If you decide to use these links, Money to the Masses may receive a small commission to help keep the platform free to use. You can also access the same information without using affiliate links through the following sources: VouchedFor, Habito.