When it comes to real estate market analysis, there is a wide range of interpretations and definitions. But if we focus specifically on commercial real estate and financial modeling, the purpose becomes clearer.

The Purpose(s) of Commercial Real Estate Market Analysis

Commercial real estate market analysis serves the purpose of generating reasonable assumptions for financial models and ensuring that the qualitative aspects of the market and property meet your requirements.

For instance, if you are creating a real estate pro-forma for a multifamily property acquisition, you'll need to make assumptions for various factors such as average rents, annual growth in rents, occupancy rate, expenses, net operating income margins, required capital expenditures, and cap rates.

Market analysis helps you determine these numbers or evaluate the reasonableness of someone else's assumptions. It allows you to compare rents for similar properties in the same area and make informed decisions based on market trends.

How to Conduct Real Estate Market Analysis

To conduct real estate market analysis, a combination of online research and offline work is essential. Some key components of this analysis include:

- Comparable Property Sales: Investigate the sale prices of similar properties in the area to determine market value.

- Comparable Properties: Analyze average rents, occupancy rates, and tenant concessions at similar nearby properties.

- Historical Rent, Expense, and Other Trends: Examine how rents, expenses, and cap rates have changed over the past few years.

- Lease Terms and Renewal Probabilities: Understand average lease terms, rent-free periods, and the percentage of tenants that renew their leases.

- Absorption Data: Determine the amount of space that becomes occupied or vacant in a given period.

- Demographic Trends: Research population growth, income levels, and the unemployment rate in the area.

- In-Person Assessment of Property and Neighborhood: Visit the property to gather information that cannot be found online.

Online sources like Zillow can be useful for single-family homes, but for commercial real estate, paid databases such as Real Capital Analytics, CoStar, or LoopNet, as well as market reports from brokerage firms like JLL and CBRE, provide more comprehensive information.

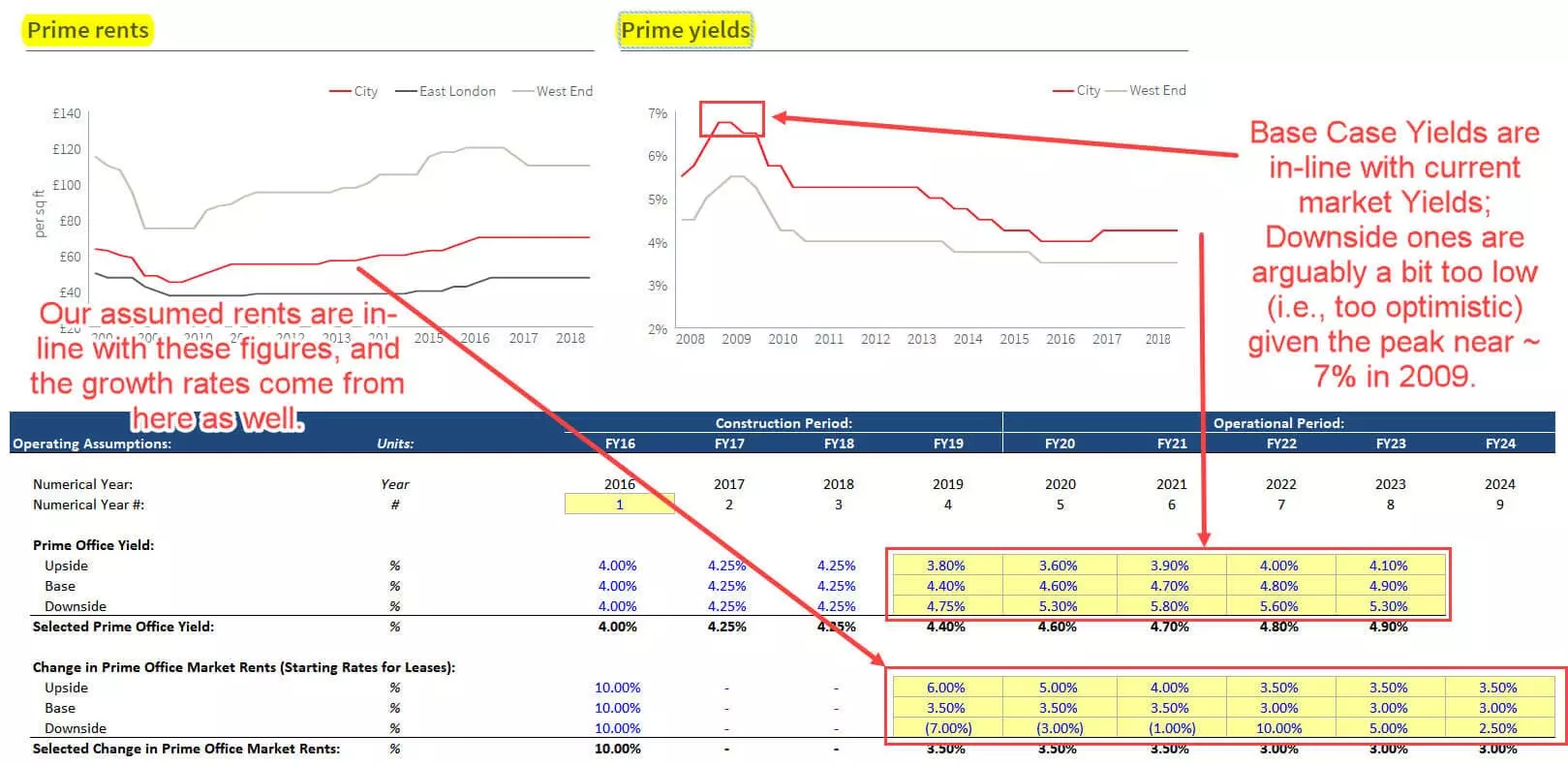

Caption: Rents and Prime Yields

Caption: Rents and Prime Yields

In-person visits play a crucial role in real estate market analysis. They provide insight into the neighborhood's condition, demographics, and the property itself. Through on-site observation, you can assess the viability of assumptions made based on online research.

Commercial Real Estate Market Analysis In Practice

Let's explore an example of how market information can be used to validate assumptions in a financial model for a real estate deal. We'll take the case study of 100 Bishopsgate, a 36-story office development in London.

Through Google searches for terms like "London office market rent trends" and "London office prime yield," we can find reports that provide crucial information for market analysis.

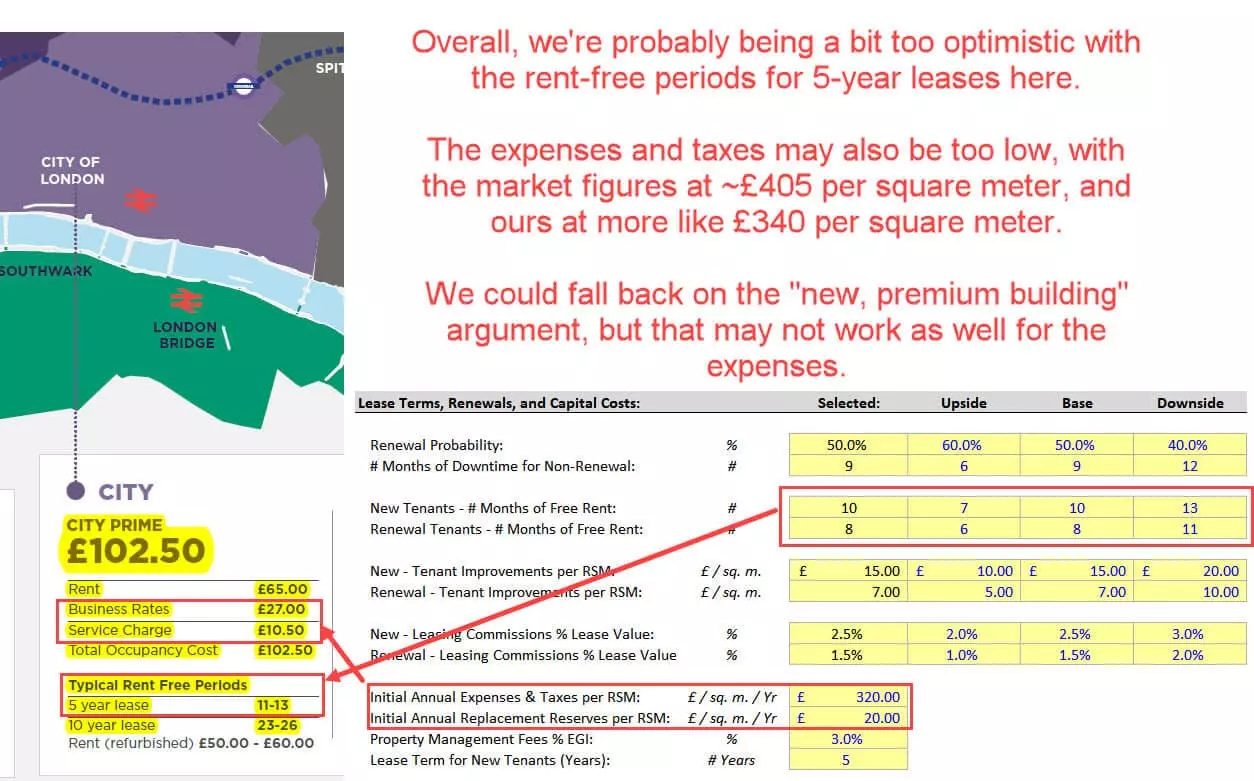

Caption: Current Rents - City of London

Caption: Current Rents - City of London

Additionally, reports from MSCI track renewal probabilities across different property types in the U.K., enabling us to assess lease expiration risks.

While online research is valuable, it has limitations. In-person visits provide unique insights that cannot be captured online. They allow you to evaluate the construction process, neighborhood dynamics, and the overall market conditions.

The Truth About Real Estate Market Analysis

It's important to acknowledge that assumptions made in real estate market analysis often lean towards optimism, especially from an equity perspective. However, lenders analyzing the same deal apply more conservative numbers and seek justifications for below-market rates.

In practice, real estate market analysis goes beyond the scope of case studies and modeling tests. It involves extensive research, interviews, and on-the-ground assessments that may vary across firms and groups.

Real estate market analysis is a complex process, and different viewpoints can lead to varying conclusions. A comprehensive understanding of market dynamics, informed by both online research and in-person assessments, is crucial for accurate analysis.

Further Reading

If you found this article helpful, you might be interested in reading "How to Get into Commercial Real Estate: Side Doors, Front Doors, Steppingstones, and Career Paths."