jimfeng/E+ via Getty Images

jimfeng/E+ via Getty Images

After weathering the storm of the housing bubble, the real estate market is showing signs of cooling off due to high mortgage rates. However, amidst the challenging conditions, Compass (NYSE:COMP), the leading U.S. broker, stands tall as an opportunity for investors. With a year-to-date increase of around 50%, Compass proves its resilience and potential for growth.

Adapting to Market Conditions

While the current housing market may be frigid, it's important to take a long-term perspective. Which brokerages are well-positioned to lead the rebound and capitalize on the downturn to become more scalable and profitable businesses? Compass is one such brokerage that has reacted swiftly to the housing downturn. Through three rounds of layoffs, the company aimed to eliminate $500 million in annual operating expenses. By the end of this year, Compass expects to achieve a target annual operating expense, excluding commissions, of $900 million. Despite the contraction in housing transactions, Compass has outperformed its peers and gained market share.

Data by YCharts

Data by YCharts

The Bull Case for Compass

There are several reasons to be bullish on Compass as a long-term investment. Firstly, Compass has rapidly become a dominant brokerage, with a growing market share of U.S. real estate transactions reaching approximately 5%. While already deeply embedded in major coastal markets, Compass is also expanding into new office opportunities in the Midwest, leaving plenty of room for further expansion.

Secondly, Compass has been exploring tertiary revenue opportunities by venturing into new monetization avenues, such as launching its own title company. This allows Compass to derive more wallet share from real estate transactions as a whole. With its strong branding as a full-service, high-quality real estate brokerage, Compass stands out from tech-first rivals like Redfin.

Furthermore, Compass boasts a scalable platform, with primary costs focused on research and development for its technology platform and sales and marketing efforts. As Compass continues to grow its scale and agent productivity, we can expect improvements in profitability margins, as demonstrated in the company's latest results.

All things considered, Compass presents a promising investment opportunity. Although the stock has experienced volatility in recent quarters, it remains a good candidate for short-term trades. As a long-term hold, the company stands out with its relatively low market cap of around $1.5 billion, equivalent to just a quarter's worth of revenue during the downturn. So, stay invested and seize the opportunity.

A Closer Look at Q2 Results

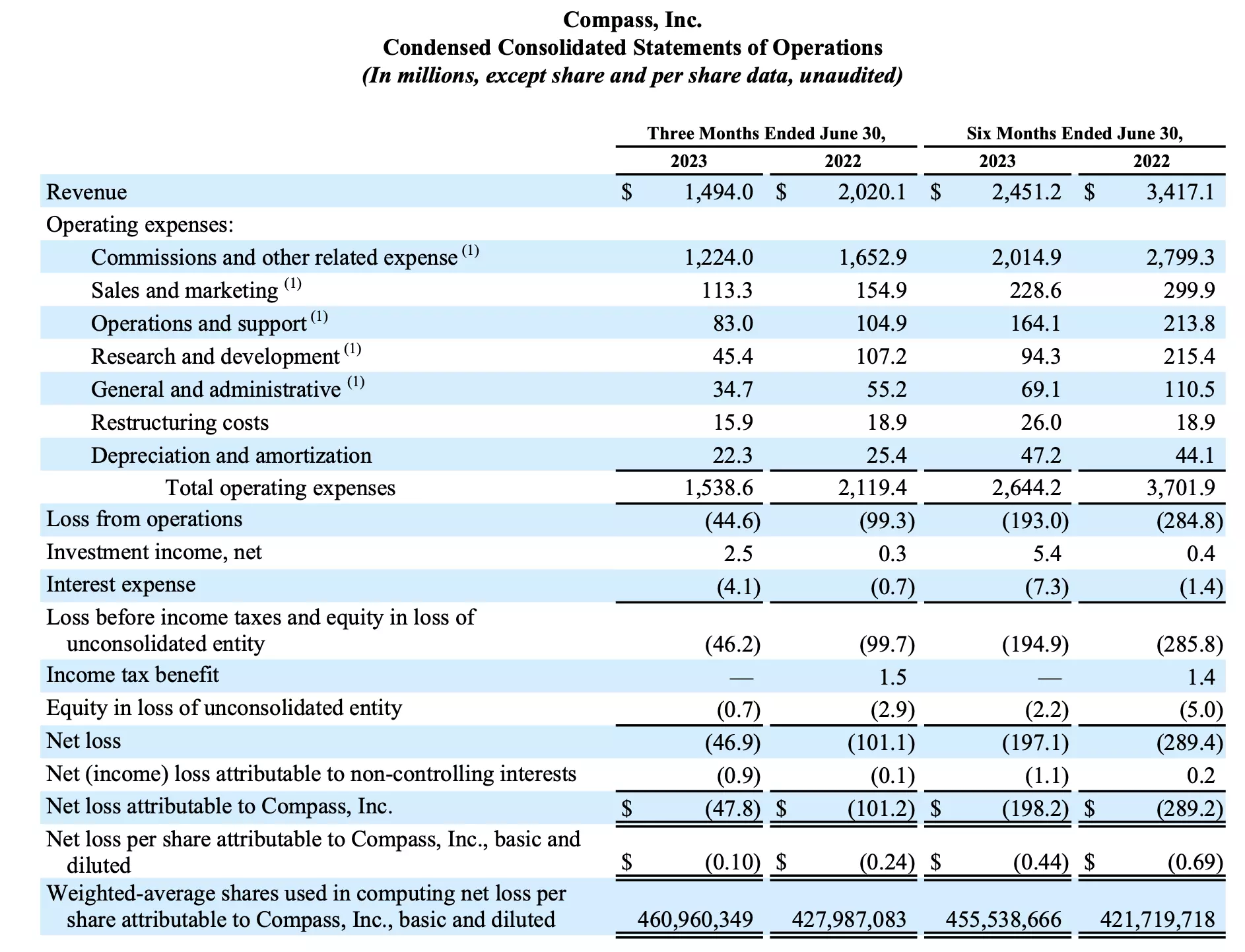

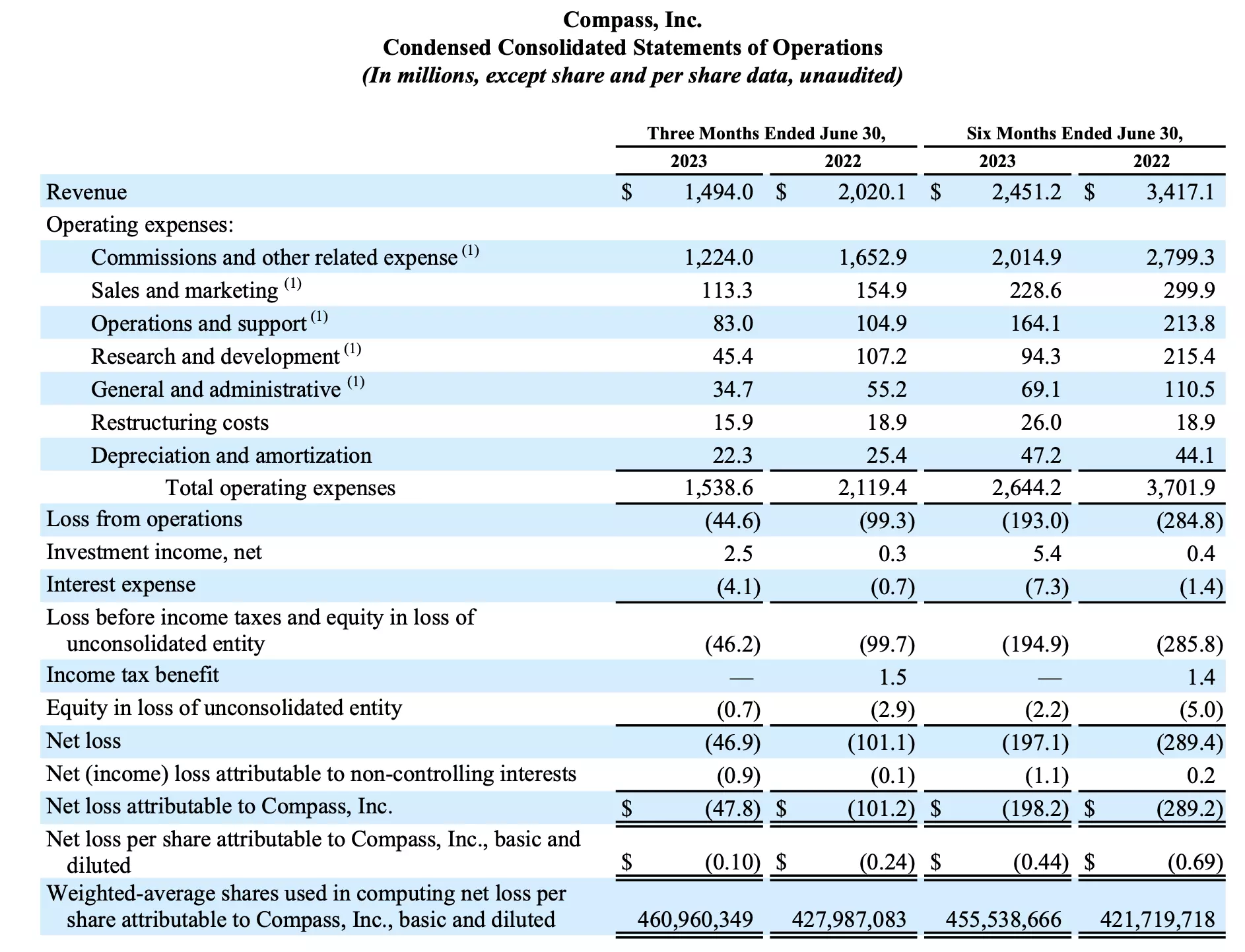

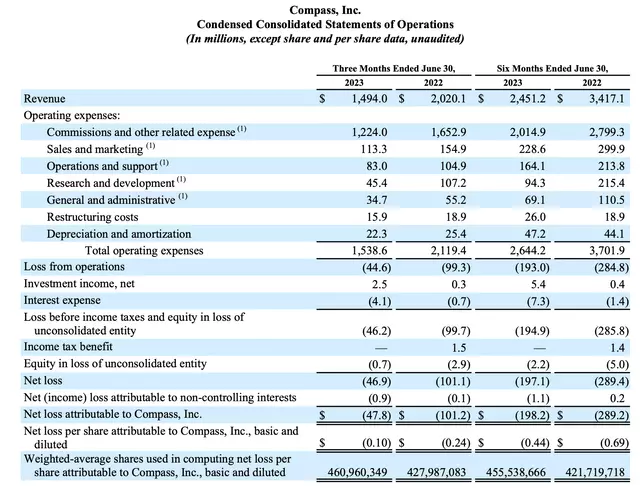

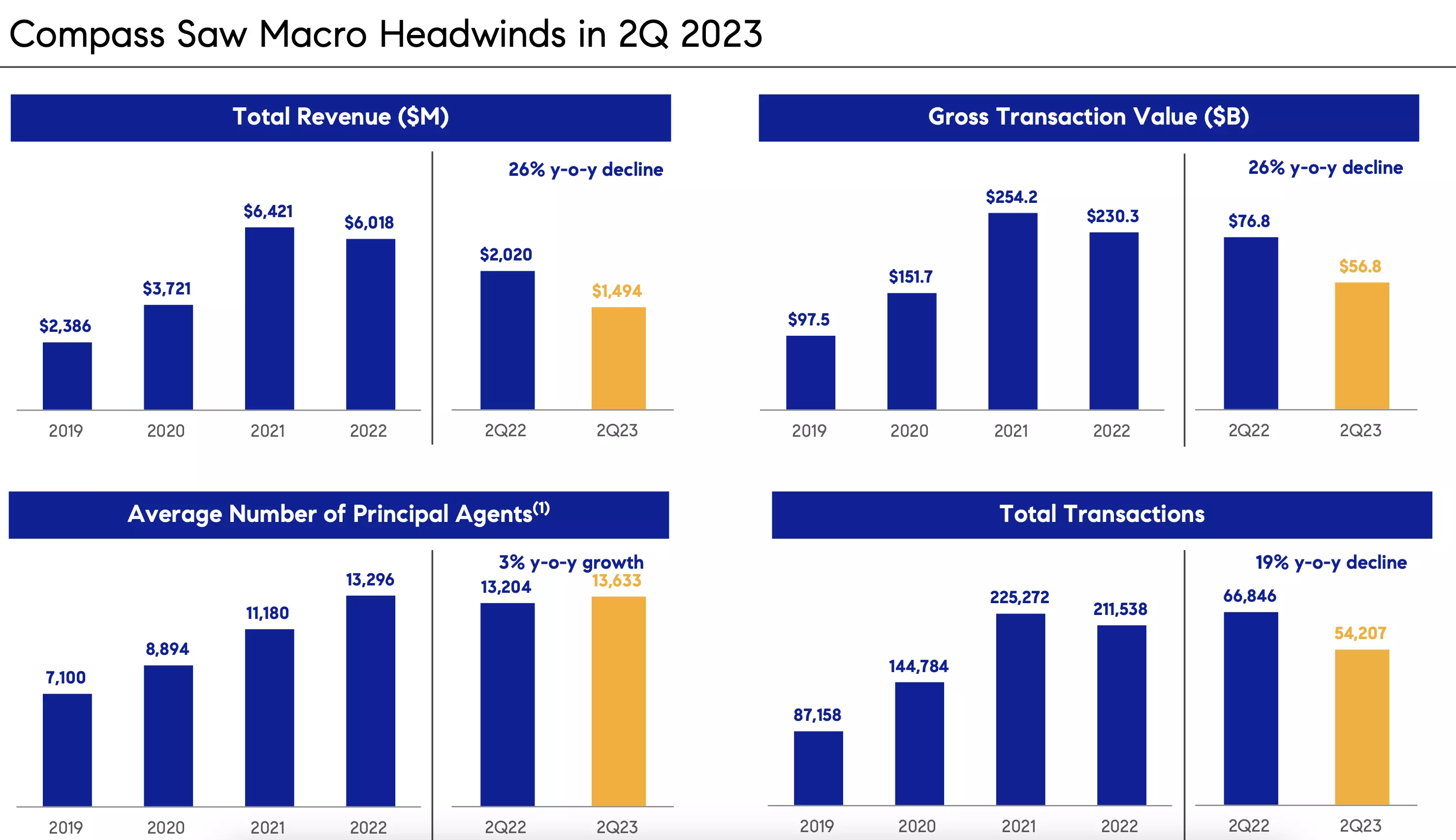

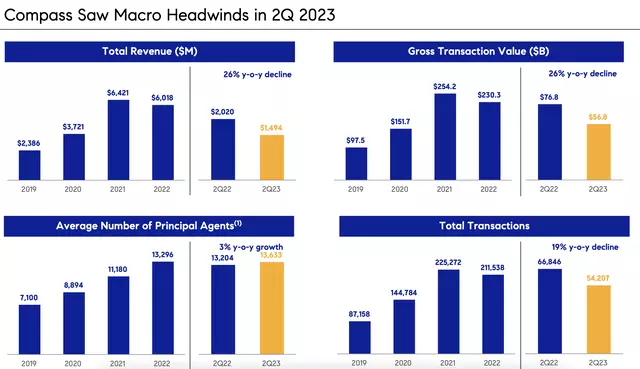

Let's delve into Compass' latest quarterly results. In Q2, the company recorded a decline in revenue of 26% year-on-year to $1.49 billion. However, this drop was less severe than the previous quarter's decline of 31%. Despite being dominant in large, expensive markets that are more susceptible to interest rate fluctuations, Compass managed to maintain its strength.

Compass Q2 results (Compass Q2 earnings release)

Compass Q2 results (Compass Q2 earnings release)

Gross transaction value in the quarter decreased by 26% year-on-year to $56.8 billion, and the number of transactions fell by 19% to 54.2k, indicating a lower average transaction value. Despite these challenges, Compass gained 13 basis points of market share in Q2, outperforming its primary rival Redfin.

Compass key metrics (Compass Q2 earnings release)

Compass key metrics (Compass Q2 earnings release)

Moreover, Compass has continued to prioritize its technology platform, which has helped the company retain agents and differentiate itself from discount brokerages like Redfin. The investments in technology contributed to Compass' positive adjusted EBITDA in Q2, amounting to $30.1 million or a 2% margin, compared to flat results in the year-ago quarter.

Compass adjusted EBITDA (Compass Q2 earnings release)

Compass adjusted EBITDA (Compass Q2 earnings release)

With a focus on structural improvements, Compass is set to emerge from the housing market downturn as a more profitable enterprise. The company's pro forma GAAP operating expenses in Q2 amounted to $238 million. By the end of this year, Compass aims to reach its target of $900 million in annual operating expenses, which it plans to maintain through FY24 and FY25.

Compass FCF (Compass Q2 earnings release)

Compass FCF (Compass Q2 earnings release)

Furthermore, Compass has demonstrated its confidence in generating positive cash flow by paying off its $150 million credit facility after the close of the second quarter.

Key Takeaways

Contrary to initial concerns, Compass has proven its ability to generate positive adjusted EBITDA and free cash flow in the midst of double-digit revenue declines. With its continued market share gains, investments in technology, and a focus on profitability, Compass is well-positioned to thrive in the real estate industry. Investors should consider staying invested in Compass and taking advantage of any potential downturns.

Disclaimer: The information provided here does not constitute financial advice. Please do your own research before making any investment decisions.