As an investor, you're always looking for ways to maximize your returns and minimize your tax liabilities. One powerful strategy that can help you achieve both is a 1031 exchange. In part one of our investor's guide series, we discussed how a Delaware Statutory Trust (DST) can be used as a "like-kind" replacement property under Section 1031 of the Internal Revenue Code. Now, let's dive deeper into the execution of a 1031 exchange and explore some important considerations.

How to Execute a Section 1031 Exchange

Executing a Section 1031 exchange involves more than just finding the right replacement property or DST. It requires careful planning and the involvement of a Qualified Intermediary (QI). The majority of 1031 exchanges are not executed simultaneously, so having a QI is crucial to ensure compliance.

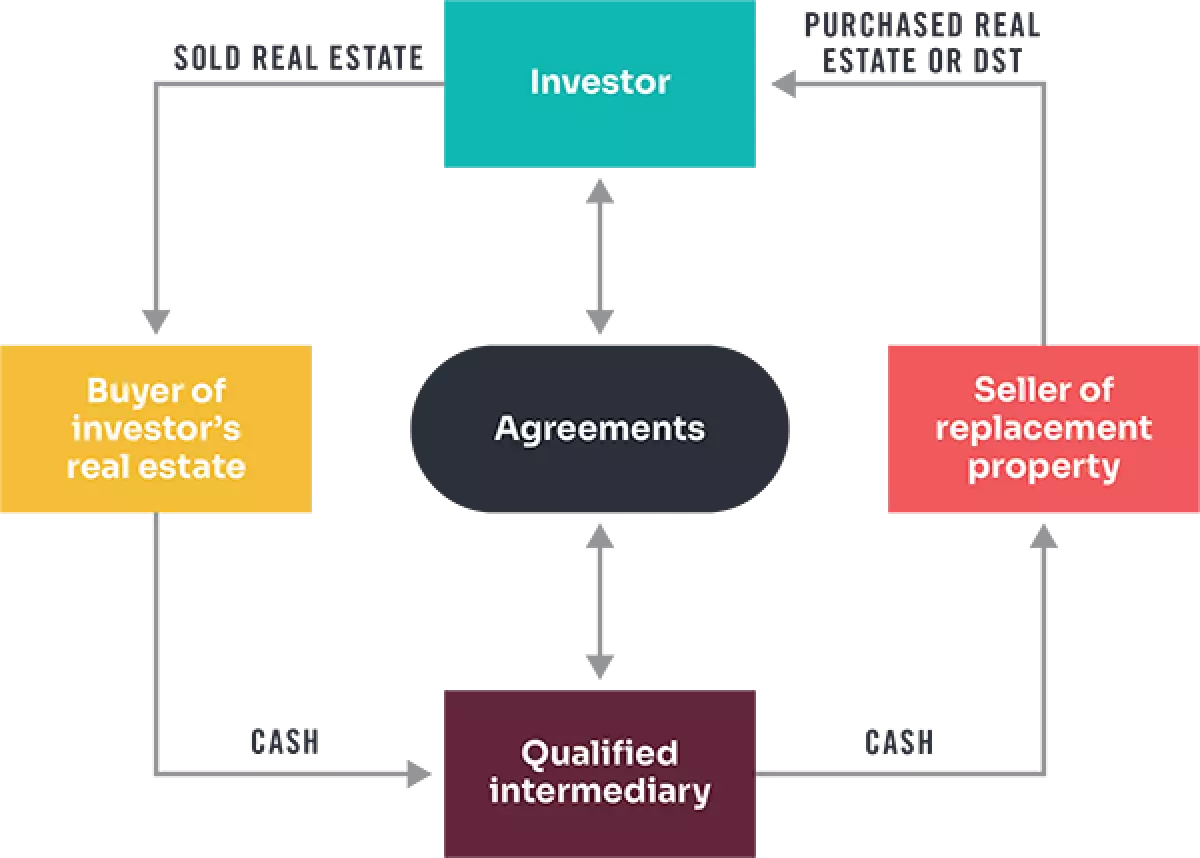

A QI's role is to defer the receipt of sale proceeds until the replacement property is ready to close. They handle the transfer of the sold property and subsequently acquire the replacement property on your behalf. This diagram illustrates the process:

Understanding Boot in a 1031 Exchange

"Boot" refers to a portion of the exchange transaction that is not "like-kind." Although boot doesn't invalidate the 1031 deferral, it is subject to taxation. Examples of boot include acquiring personal property as part of the purchase price, purchasing replacement property of lesser value and receiving cash or debt relief, and reinvesting less than the net equity from the sale of the relinquished property and receiving cash back.

To minimize taxable boot, it's important to adhere to these steps:

- Purchase "like-kind" replacement property of equal or greater value than the sold property.

- Reinvest all the net equity received from the sale of the original property.

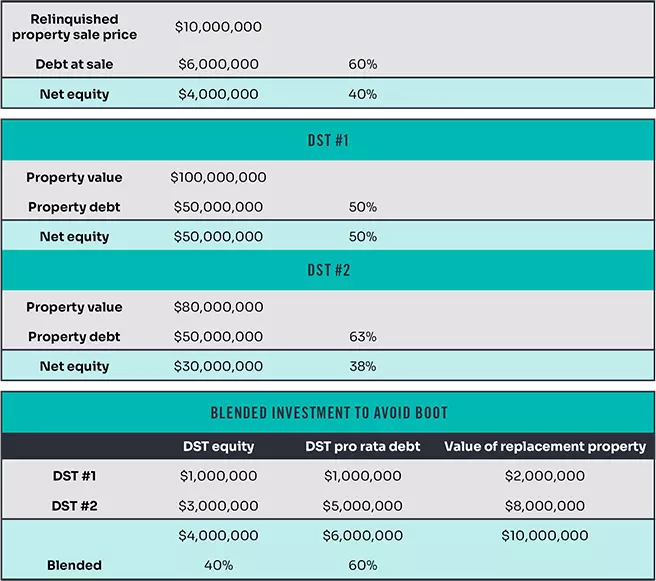

It's worth noting that when using DSTs as replacement property, the net equity must be reinvested in a property with a value equal to or greater than the value of the sold property. Additionally, the DSTs should be chosen to replicate the debt-to-equity ratio of the sold property. Take a look at this illustration:

The Flexibility of Property Identification

Now, let's discuss the rules for identifying replacement properties in a 1031 exchange. These rules provide reasonable flexibility for investors. You can either identify three properties without considering their fair market value or identify any number of properties as long as their aggregate fair market value doesn't exceed 200% of the relinquished property's value.

If you fail to meet either of these safe harbors, you can still obtain the benefits of a 1031 exchange by acquiring the replacement property before the end of the identification period or by acquiring at least 95% of the fair market value of all identified properties before the end of the exchange period.

Documenting Identified Properties

To ensure compliance with a 1031 deferred exchange, it's important to report the identified properties to your Qualified Intermediary within 45 days from the date of sale. The notice should include a specific description of the replacement property, including the legal description or street address. In the case of a DST, a distinguishable name is sufficient.

Remember, executing a successful 1031 exchange requires careful planning, expert advice from professionals like Baker Tilly, and adherence to the rules and regulations. By understanding the process and working with experienced advisors, you can reap the benefits of tax deferral and make your investment portfolio thrive.

For more information on this topic or to learn how Baker Tilly specialists can help, contact our team.

I hope you found this ultimate guide to executing a 1031 exchange via a DST informative and helpful. By following the guidelines laid out here, you can navigate the complex world of 1031 exchanges with confidence and achieve your financial goals. Remember to always consult with professionals for personalized advice tailored to your specific situation.