Real estate investment trusts (REITs) have long been a popular choice for investors seeking tax advantages and simplified reporting obligations. However, with the recent passing of the Tax Cuts and Jobs Act (TCJA), REITs have become an even more attractive investment option. The TCJA allows for ordinary REIT dividends to qualify for the new 20 percent pass-through deduction, making it a valuable tool for reducing the tax burden on real estate holdings.

In this article, we will explore two ownership tests that pose challenges for investors considering a REIT for their real estate investments - the 100 Shareholder Test and the closely held prohibition test. Understanding these tests is crucial for anyone interested in incorporating as a REIT.

The 100 Shareholder Test

To qualify as a REIT, the organization must have 100 or more shareholders for at least 335 days in a 12-month taxable year. The number of shareholders is determined based on the actual holders of REIT shares, without considering any attribution. This test includes all classes of stock.

While public REITs rarely face issues meeting this requirement, it can be more challenging for private sector REITs to secure the necessary number of investors. Many private REIT sponsors enlist the help of shareholder accommodation firms to meet this requirement.

The Closely Held Prohibition Test

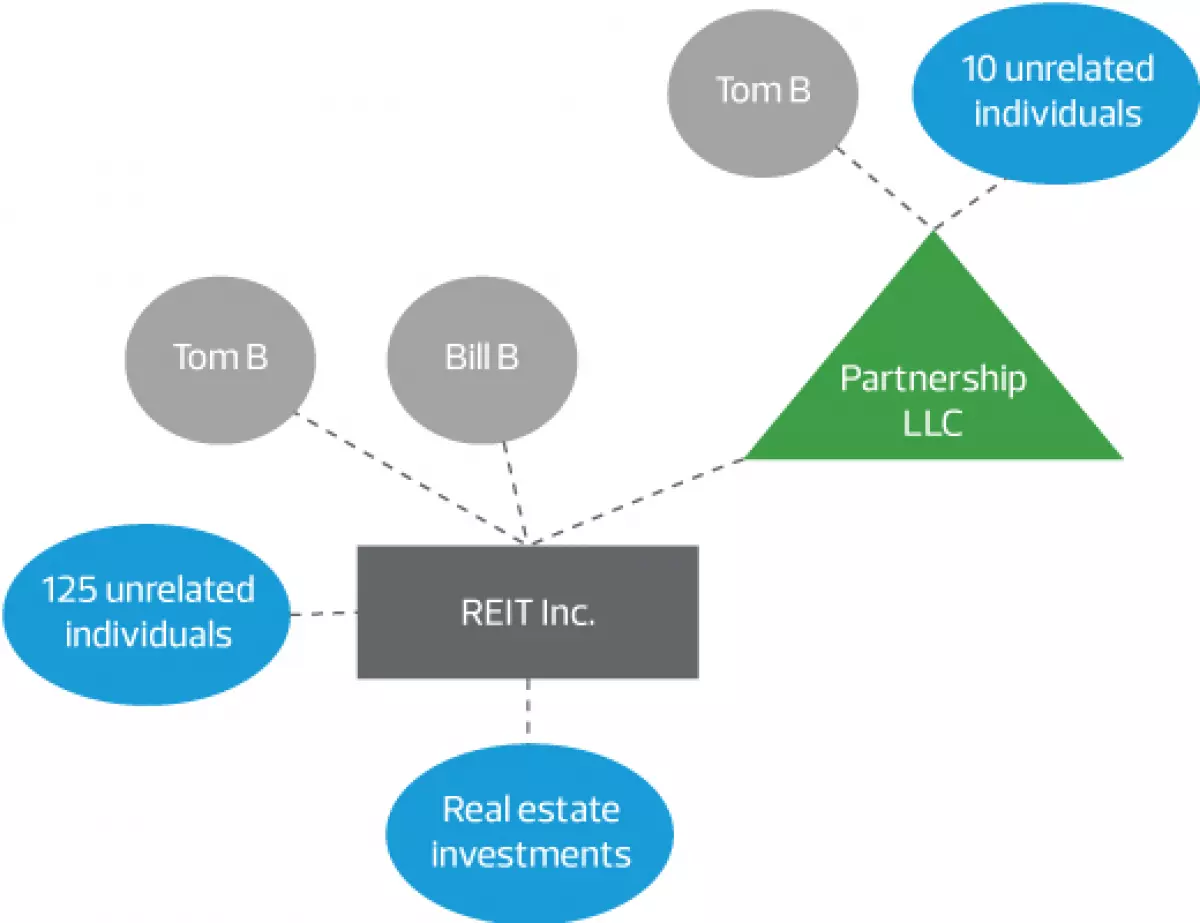

REITs cannot be closely held, meaning that more than 50 percent of the value of the outstanding stock must not be owned by five or fewer individuals. This test, also known as the 5/50 Test, takes into account attribution rules under section 544 (with exceptions for partner attribution).

The attribution rules require the REIT to look through corporations, partnerships, trusts, or estates to the ultimate owners, shareholders, partners, or beneficiaries. Each individual is assumed to own all shares owned by their immediate family members. It's essential to consider the treatment of shares owned by certain trusts, tax-exempt entities, and foreign entities, as it may vary based on specific circumstances.

Maintaining Compliance

It is crucial for REITs to implement strategies and mechanisms to monitor ownership and ensure compliance with these tests. Share ownership and transfer restrictions are often included in REITs' governing documents to preserve their status. In particular, an excess share provision can limit the increase in stock ownership by any shareholder, thereby preventing inadvertent violations of the closely held prohibition test.

Additionally, REITs are required to issue annual shareholder demand letters to confirm the actual owners and number of shares owned. These letters help ensure accurate and up-to-date shareholder information.

Violating these ownership rules can lead to severe penalties and the disqualification of REIT status. Therefore, it is vital for REITs to work closely with experienced advisors who can assist with navigating these complex issues.

Image: Example of 5/50 Test

Image: Example of 5/50 Test

By understanding and proactively addressing the ownership requirements of REITs, real estate investors can take advantage of the benefits offered by this investment vehicle. The 100 Shareholder Test and the closely held prohibition test may present challenges, but with proper guidance, compliance can be maintained. As always, seeking advice from knowledgeable professionals is vital to ensure the successful incorporation and operation of a REIT.