Real estate has always been an attractive asset class for investors. It offers diversification, monthly income, and protection against inflation. However, the soaring property prices have made it difficult for many to enter the market. Thankfully, there is an alternative way to gain exposure to real estate: investing in Real Estate Investment Trusts (REITs).

What is a REIT?

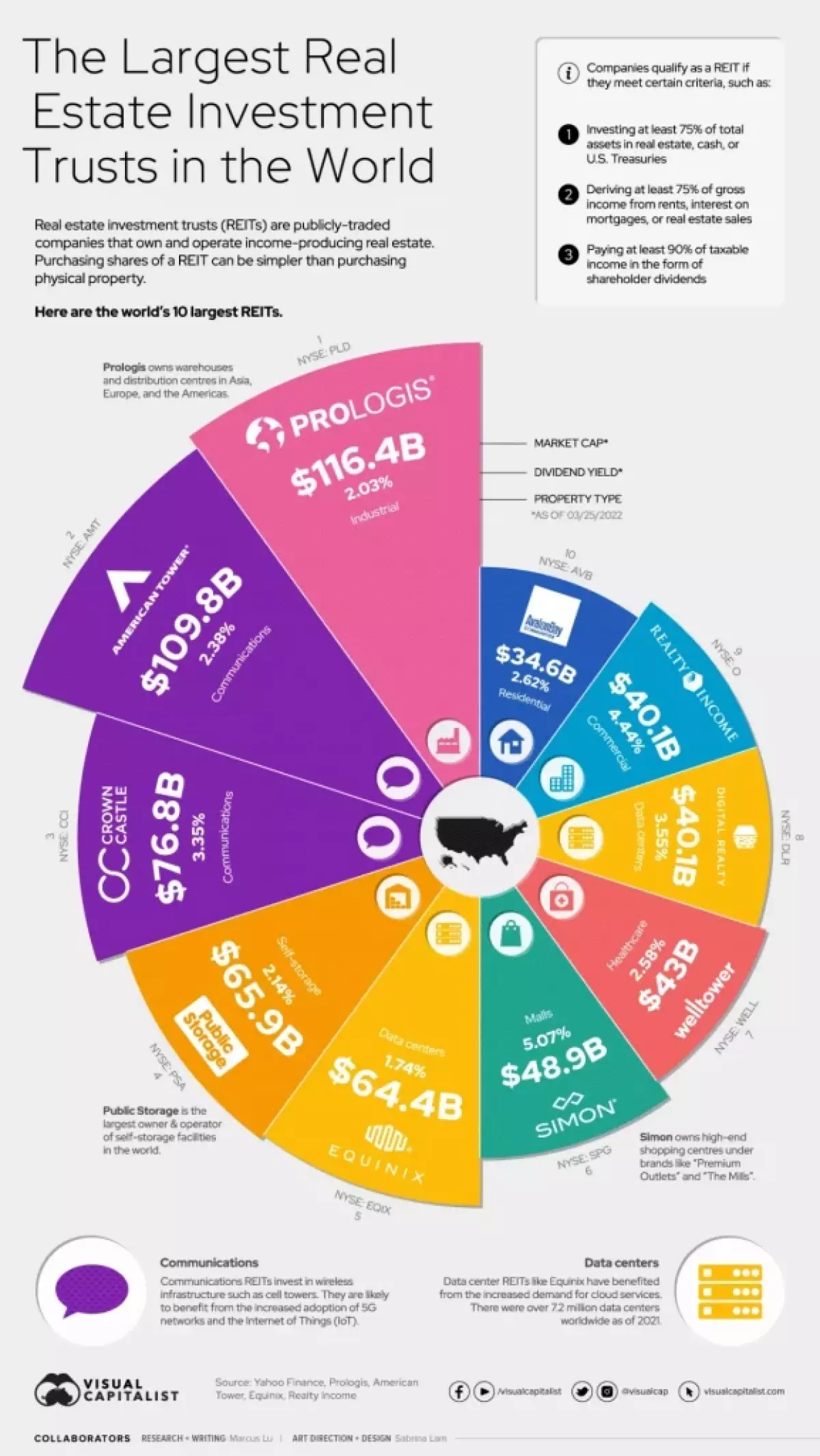

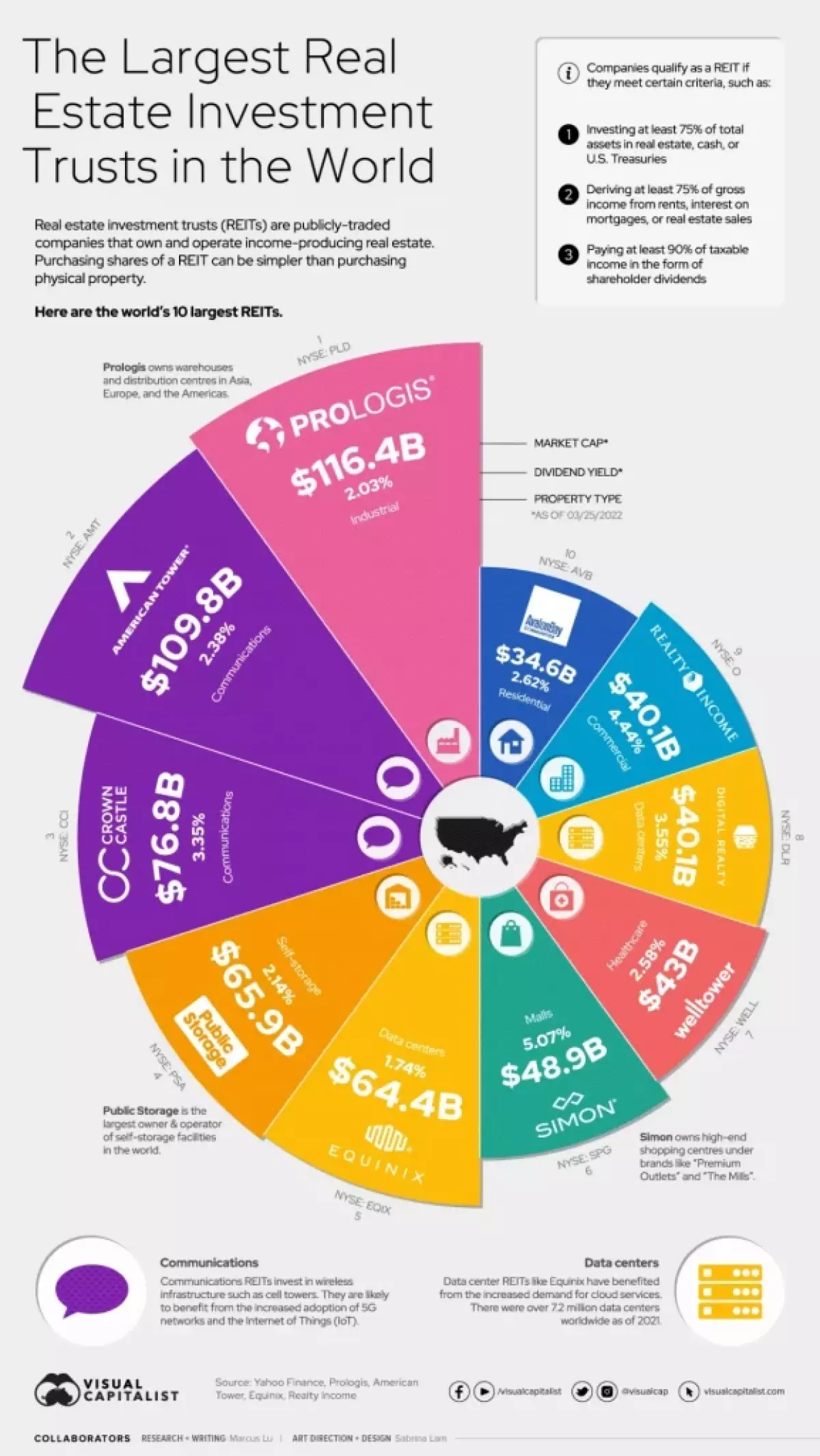

A REIT is a company that owns and operates income-producing real estate. It is typically publicly traded and offers investors the opportunity to invest in real estate without the hassle of buying and managing physical properties. To qualify as a REIT in the U.S., a company must meet several criteria, including investing at least 75% of assets in real estate, deriving at least 75% of gross income from real estate-related sources, and paying at least 90% of taxable income as dividends to shareholders.

Investing in a REIT is similar to buying shares of any other publicly traded company. There are also REIT-focused exchange-traded funds (ETFs) and mutual funds available for investors. However, it's important to note that some REITs are private and not traded on stock exchanges.

Caption: The world's largest publicly-traded REITs by market cap.

Caption: The world's largest publicly-traded REITs by market cap.

Exploring the Top 10 REITs

Let's take a closer look at the world's top 10 publicly-traded REITs as of March 25, 2022. These REITs operate in different sectors of the market, and understanding their differences is crucial before making any investment decisions.

- Prologis: Manages the world's largest portfolio of logistics real estate, including warehouses and distribution centers.

- American Tower: Owns wireless communications assets, such as cell towers, both in the U.S. and abroad.

- Crown Castle: Focuses on wireless communications infrastructure assets.

- Public Storage: Specializes in self-storage facilities.

- Equinix: Provides data center solutions to major tech companies.

- Simon Property Group: Operates shopping malls and premium outlets globally.

- Welltower: Focuses on healthcare infrastructure, including senior housing and medical office buildings.

- Digital Realty: Specializes in data centers and works with major tech firms.

- Realty Income: Owns a diverse portfolio of commercial real estate properties and leases them to various brands.

- AvalonBay Communities: Focuses on developing and managing multifamily properties.

Evolving Real Estate Trends

Real estate demand is influenced by global trends. One of the significant drivers is population growth and urbanization, which has led to soaring housing costs in many cities worldwide. Additionally, the rise of e-commerce has sparked a surge in demand for warehouse space. Amazon's exponential growth during the COVID-19 pandemic, which included doubling its warehouse facilities, is a testament to this trend.

Currently, e-commerce accounts for only 19.6% of total retail sales globally. If this figure continues to rise, industrial real estate prices could experience robust and long-term growth.

Caption: Real estate trends shaping the industry.

Caption: Real estate trends shaping the industry.

Investing in REITs provides individuals with an opportunity to partake in the lucrative real estate market without the high barrier to entry. Whether it's diversification, monthly income, or long-term growth prospects, REITs offer a range of benefits for investors. So, consider exploring the world of REITs and embracing the opportunities they present.

Remember, before making any investment decisions, it's always advisable to consult with a financial professional to align your goals and risk tolerance.

Note: This article is for informational purposes only and should not be considered as financial advice.