In a surprising turn of events, financial markets have dramatically adjusted their expectations for UK interest rates by the end of 2024. What was once a projected single rate cut of 0.25% has now transformed into an anticipation of five such cuts. This shift in outlook can be attributed to the faster-than-expected decline in inflation, prompting mortgage lenders to significantly reduce their rates in recent weeks. This strategic move aims to attract customers in a low-volume market.

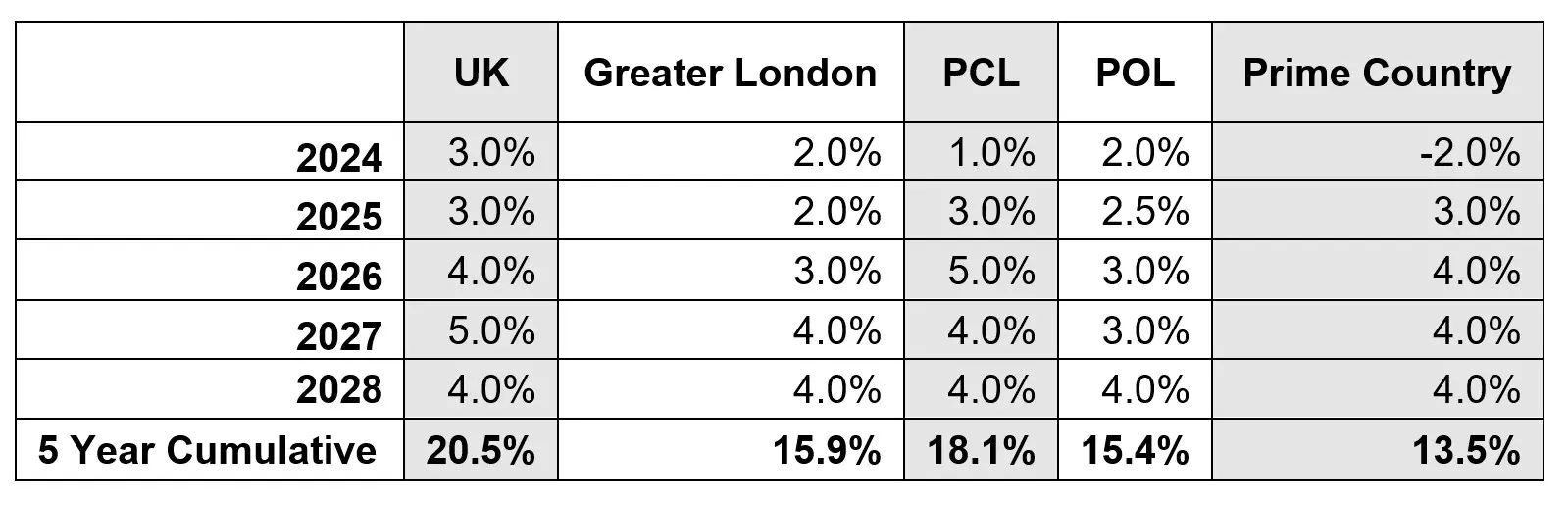

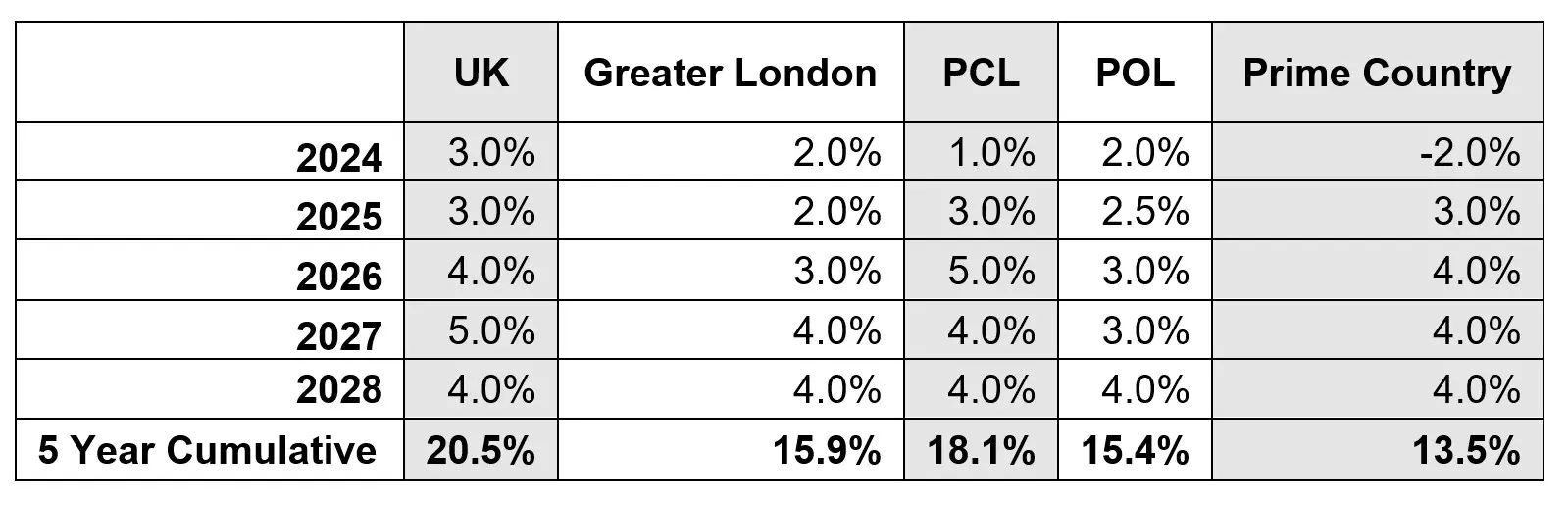

With a more positive landscape unfolding, it is only appropriate that we revise our UK house price forecasts from three months ago. The latest projection suggests that UK mainstream prices will increase by 3% in 2024, contrary to the 4% decline predicted in October. Following this trajectory, we anticipate cumulative growth of 20.5% in the five years leading up to 2028, accompanied by low-level single-digit growth in the subsequent years.

Data from Halifax and Nationwide corroborate this positive shift. While Halifax reported a 1.7% increase in prices in 2023 and Nationwide observed a decline of 1.8%, these figures pale in comparison to the 5% drop both institutions identified in August. Additionally, charting the course of UK housing transactions reveals that the market has finally reached its nadir, as prices are seemingly beginning to stabilize.

The surge in demand is further evidenced by a 10% increase in mortgage approvals in November compared to the previous year. This substantial uptick signals a double-digit percentage growth in sales volumes this year, outperforming the figures recorded in 2023.

Image: UK House Price Forecasts: January 2024

Image: UK House Price Forecasts: January 2024

That said, we project slightly lower growth for the mainstream London market (+2%) this year due to ongoing affordability constraints in the capital. Conversely, areas outside of London, which offer more affordable housing options, are likely to experience stronger growth.

In the prime country house market, we anticipate a narrower decline of 2% this year, as it gradually moves away from the highs of the pandemic years. Given the changing dynamics, realistic asking prices will remain crucial, as the once-prominent demand for larger living spaces subsides.

While prime London markets are also expected to see somewhat positive growth, their prospects are accompanied by heightened risks resulting from the upcoming general election. Specifically, we foresee underperformance in prime central London (PCL) and prime outer London (POL) compared to the broader UK market. However, it is worth noting that growth in PCL is projected to fully materialize from next year onwards, as prices there are still 17% lower than their previous peak in mid-2015.

Image: UK House Price Forecasts: January 2024

Image: UK House Price Forecasts: January 2024

It is important to emphasize that these forecasts pertain to average prices in the existing homes market. New build prices may not experience the same rate of movement.

The General Election

The future trajectory of the housing market to a certain extent hinges on the timing of the general election. Uncertainty arises from the potential widening ideological divides within Rishi Sunak's party, particularly concerning immigration. Speculation surrounding the stability of the government tends to negatively impact sentiment in the housing market, as demonstrated in 2019 under former Prime Minister Theresa May.

Another potential risk looms on the horizon due to the ongoing conflict in the Red Sea, which could impact UK inflation. On the positive side, pre-election giveaways in the March Budget could boost market activity further. Speculations range from tax cuts to measures aimed at assisting first-time buyers, such as longer fixed-term mortgages, reduced deposit requirements, and a revived "help-to-buy" scheme.

Although a Labour victory appears likely, it is important to note that while rent controls and wealth tax have been ruled out, other proposed policies could dampen demand in prime property markets. These measures include overhauling the non-dom tax regime, increasing the stamp duty surcharge for overseas buyers, adding VAT to school fees, and modifying inheritance tax rules.

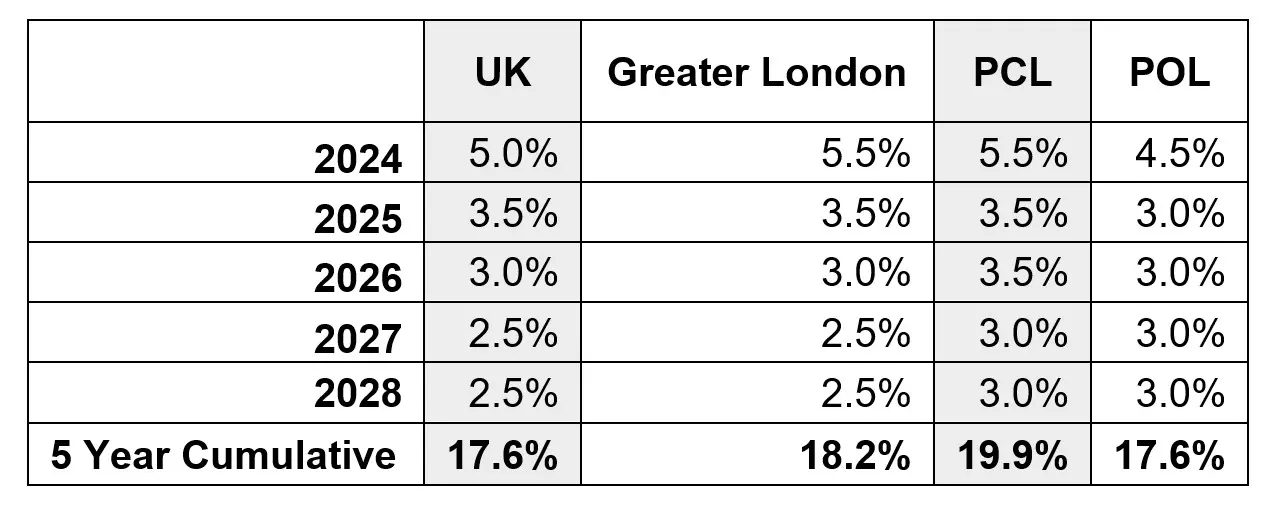

UK Rental Market Forecasts

In recent years, the rental market has experienced a decline in landlords due to increased red tape and taxes, resulting in upward pressure on rental values. However, as demand gradually stabilizes and more sellers become landlords in a sales market characterized by minimal price growth, supply is recovering.

According to Rightmove data, new listings in prime central London (PCL) and prime outer London (POL) were only 7% below the five-year average in December. Consequently, our rental forecasts remain relatively stable, with an estimated 5.5% rental value growth in PCL and 4.5% in POL for this year, compared to 8% and 6.8%, respectively, in 2023.

Image: UK House Price Forecasts: January 2024

Image: UK House Price Forecasts: January 2024

Rental value growth is anticipated to be stronger in lower-value markets due to greater supply-demand imbalances. Property owners in higher-value markets tend to exercise more discretion and have been able to rent out properties even during periods of flat price growth.

Knight Frank data reveals that during the final quarter of last year, there were 4.3 new prospective tenants for every rental listing below £1,000 per week in PCL and POL. In contrast, the figure stood at 2.7 for rentals priced above £1,000 per week. Additionally, rising mortgage costs, taxes, and red tape, including the Renters Reform Bill, are likely to exert further upward pressure on rents this year by keeping supply levels in check.

While it is essential to acknowledge that our forecast of 5.5% rental value growth in PCL this year was last surpassed in 2011 (excluding the distortive impact of the pandemic), the wider UK rental market is grappling with similar supply-demand dynamics. As these market conditions gradually ease, we anticipate a slight decline in UK rental value growth to approximately 5% this year, with a slightly higher figure of 6% in London, where demand remains strongest.