The UK residential property market witnessed a rollercoaster ride in 2021, marked by the impact of the pandemic, the introduction of the stamp duty holiday, and the rise of hybrid working. As we delve into the numbers that defined the year, it becomes evident that the landscape of the property market has undergone significant shifts.

Rising Market Valuations: A Promising Start to the Year

Market valuation appraisals, a leading indicator of supply, reached their highest level in ten years in November. The data from Knight Frank showed a 6% increase compared to the previous year and an astounding 20% surge compared to November 2019. This suggests that sellers are positioning themselves early for the upcoming year[^1^].

The Stamp Duty Holiday Effect: A Temporary Distortion

The first extension of the stamp duty holiday to June had a profound impact on the residential property market. HMRC data revealed a staggering 62% drop in sales in July compared to June, the month when the maximum saving of £15,000 ended. Despite this dip, the number of transactions in June was the highest ever recorded in a single month since 2005. As we enter 2022, the market is still in the process of re-balancing supply and demand[^2^].

Gravity-Defying Price Growth: A Result of Competitive Mortgage Rates

Annual house price growth in the UK soared to 10% in November, according to Nationwide and Halifax data. This growth rate was further fueled by competitive mortgage rates and a tight supply of properties. However, experts predict a reversal in the trend as mortgage rates increase and supply gradually improves. The Omicron variant's impact on the market remains uncertain but could potentially hinder supply and trigger a slowdown in price growth[^3^].

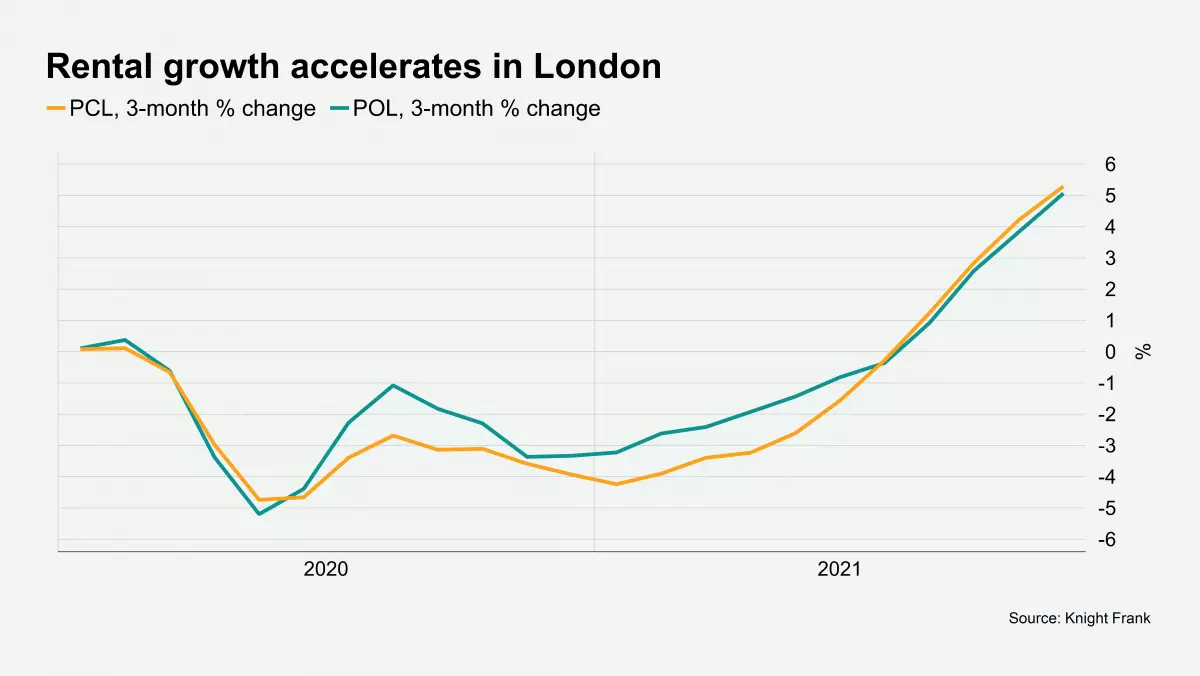

Rental Market Rebound: Steady Rise in Rents

Rental values in prime central and outer London experienced a remarkable upswing in the three months leading up to November. The rental growth rates reached 5.3% and 5.1% respectively, reaching their highest levels since 2010 and 2004. The persisting upward trajectory of rents indicates that any setbacks caused by the Omicron variant are unlikely to reverse this trend[^4^].

Image: UK residential property market: 2021 in numbers

Image: UK residential property market: 2021 in numbers

Corporate Demand on the Rise: A Boost for Rental Properties

With the reopening of the economy, demand for rental properties has surged, particularly driven by corporate entities. This increase in demand was evident when Shell announced its move of the global headquarters to London, which is expected to drive tenant demand in the capital and Home Counties. Furthermore, the number of new prospective tenants across all sources saw a significant 44% increase in November compared to the same month in 2019. Barring any major setbacks, the demand for rental properties is anticipated to remain strong in the coming year[^5^].

Decline in Lettings Supply: A Consequence of Short-Let Properties

The supply of rental properties drastically declined throughout the year as short-let properties flooded the market due to relaxed staycation rules. Additionally, many potential landlords sold their properties to take advantage of the stamp duty holiday. The peak month for market valuation appraisals, an indicator of supply, was February, while November witnessed a 46% decrease compared to then. Consequently, the reduced supply in the face of surging demand continues to exert upward pressure on rents in the market[^6^].

London's Rejuvenation: A Surge in Buyer Interest

The number of accepted offers in November reached a ten-year high, signaling a resurgence in buyer interest, particularly in London. Prime central London witnessed a remarkable 116% increase in accepted offers compared to the same month in the previous year. Similarly, prime outer London experienced a 25% increase in accepted offers. These figures indicate a shift in demand back towards London as the pandemic has progressed. As new demand continues to rise faster in London than in other parts of the UK, it is evident that the city's allure remains strong[^7^].

Growing Disparities in Sale Prices: Intensified Competition

The difference in sale prices for apartments in prime central London has steadily widened over the past few months. This can be attributed to increased competition for highly sought-after properties with desirable attributes such as outdoor space, amenities, and good condition. The difference between the lower quartile and upper quartile prices exceeded £1,000 per square foot in July and has continued to maintain this disparity. This trend is likely to persist as uncertainties surrounding the pandemic linger[^8^].

Image: UK residential property market: 2021 in numbers

Image: UK residential property market: 2021 in numbers

The Return of 'Boomerang Buyers': London's Enduring Appeal

Contrary to predictions of a decline in cities due to the pandemic, the number of offers for properties in London from buyers outside the capital reached its highest level since January 2019. However, most buyers are seeking a bolthole in the city rather than relocating from other parts of the country. These so-called 'boomerang buyers' are expected to keep London apartments in demand for buyers and tenants in 2022, reinforcing the city's resilience[^9^].

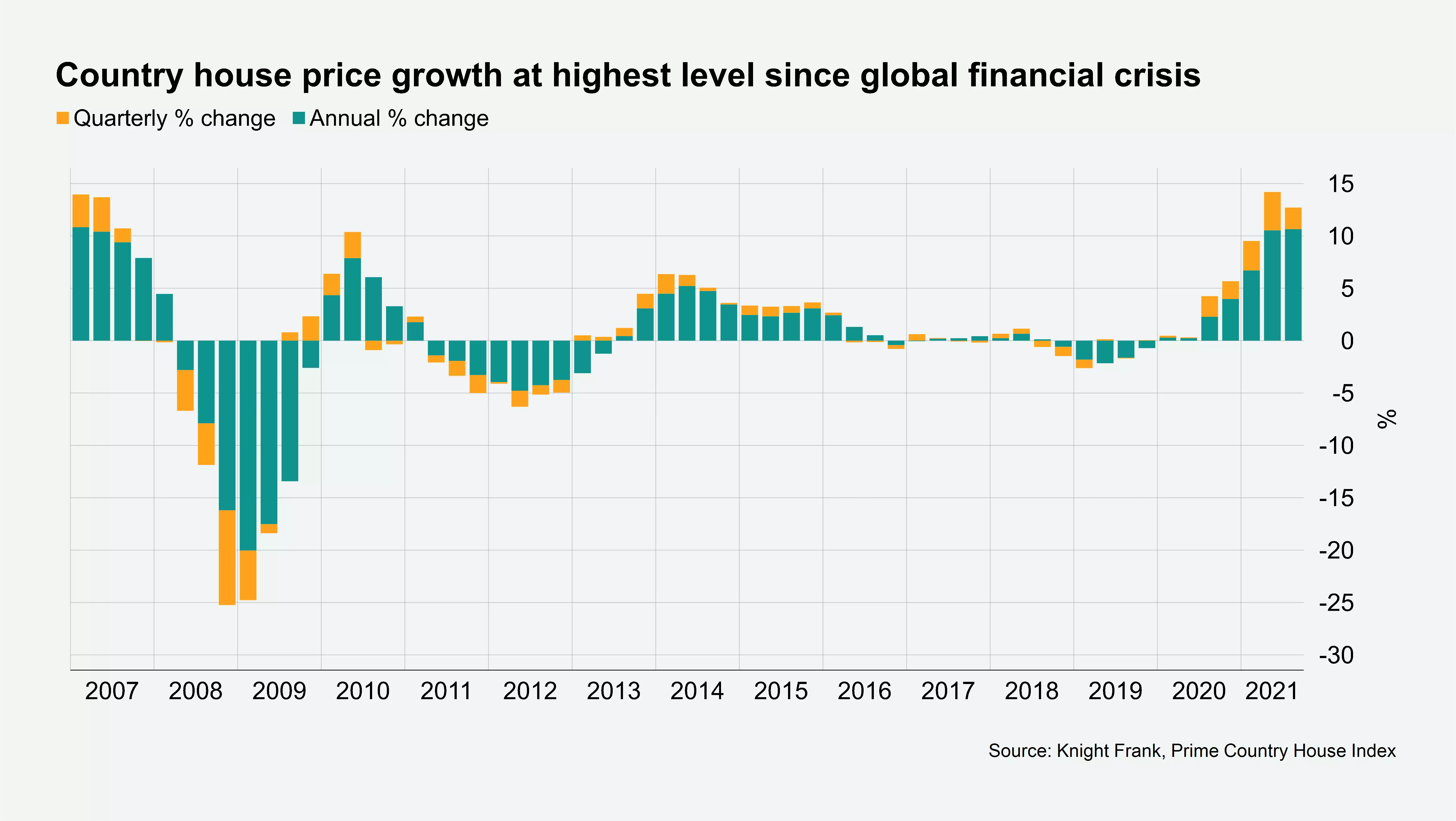

Strong Rural Demand: Price Growth in Prime Country Houses

The Prime Country House Index recorded a remarkable 10.6% annual growth rate in September, driven by the high demand for rural living and the associated supply challenges that characterized 2021. This performance was the best since before the global financial crisis, although the index remains 4% below its peak in Q3 2007. In Scotland's rural market, price growth reached 5.9% in the 12 months leading up to September, the strongest performance since 2008. Given the steady demand and limited shift in fundamentals, strong price growth is expected to continue into next year[^10^].

Supply and Demand Imbalance: The Struggle Continues

The ratio of new prospective buyers to sales instructions reached its highest level in over eight years in November, standing at 12.8. This highlights the enduring trend of people seeking refuge in the countryside, fueled by the pandemic. However, supply has failed to keep up with demand, resulting in empty shelves and frustrated buyers. The stamp duty frenzy of the summer further exacerbated the situation, with some sellers holding off on listing their properties due to a lack of available homes to purchase. As we enter 2022, experts anticipate a potential increase in supply, making January an ideal time for action[^11^].

The Acceleration of Rural Market Activity: Swift Sales and Viewings

The traditionally slower-paced rural property market witnessed a significant acceleration in activity. In November, the time between an offer being accepted and a sale being instructed decreased by 16.4% compared to the same month in 2019. The number of viewings required before an offer was accepted reached its lowest level since December 2020, with an average of 13 viewings. Buyers continue to act decisively to secure properties in a fiercely competitive market. An increase in supply, contingent on the variant news, is expected to help re-balance supply and demand in 2022[^12^].

Photo by engin akyurt on Unsplash