Note: This article was written by Shujie Wu, a Ph.D. student in Agricultural and Consumer Economics at the University of Illinois, and edited by Joe Janzen. It is one of the exceptional articles produced by graduate students in Prof. Janzen's ACE 527 class on advanced agricultural price analysis this semester.

Introduction:

Investing in farmland real estate investment trusts (REITs) has gained popularity over the past decade. These REITs acquire and manage farmland portfolios, generating revenue from rental income, farmland operation, and land value appreciation. Investors in farmland REITs benefit from dividends and share price increases. In this article, we delve into the factors that impact farmland REIT share prices, building on the previous analysis by Peterson and Kuethe.

Where Do REITs Own Land?

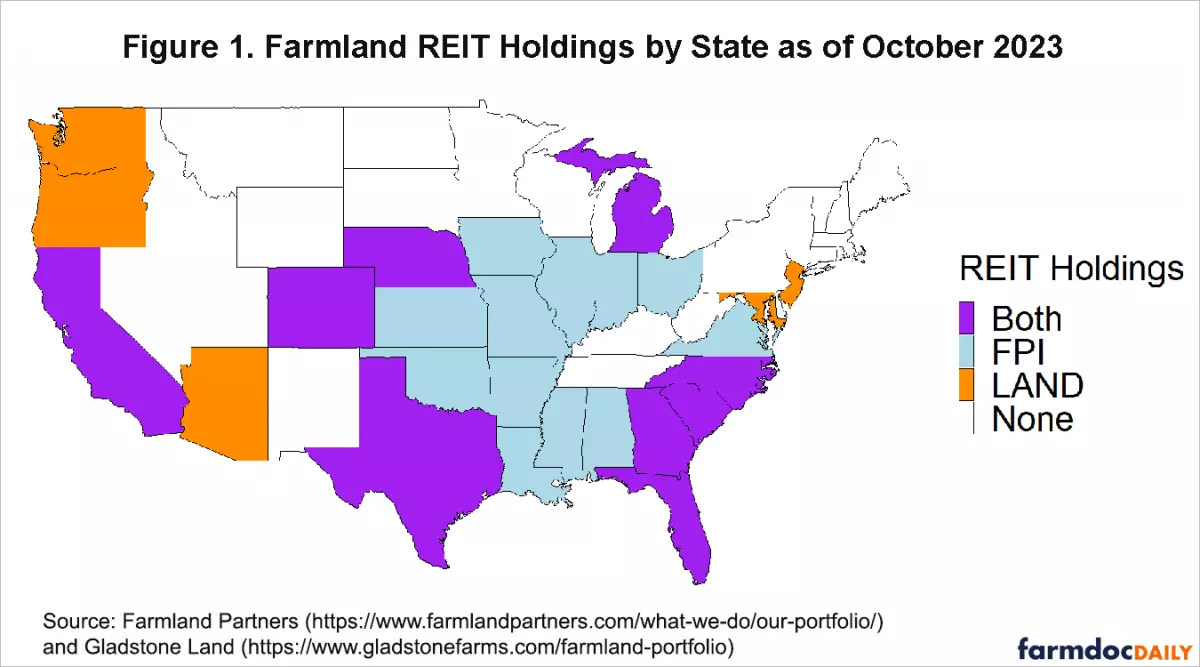

Currently, two farmland REITs are actively traded on US exchanges: Farmland Partners (NYSE ticker: FPI) and Gladstone Land (NASDAQ ticker: LAND). While both REITs own land in multiple states, their geographical concentration differs. FPI's holdings are primarily in the Midwest US, with corn, soybeans, and wheat being the main crops. It also has land in California and the southeast US. On the other hand, Gladstone has a stronger presence in California and other coastal states, with a greater focus on tree nuts, winegrapes, and other fruits and vegetables. This diversity in geographic concentration and crop variety within the portfolios offers resilience against production risks.

Farmland REITs location distribution

Farmland REITs location distribution

What Has Happened to REIT Prices Over Time?

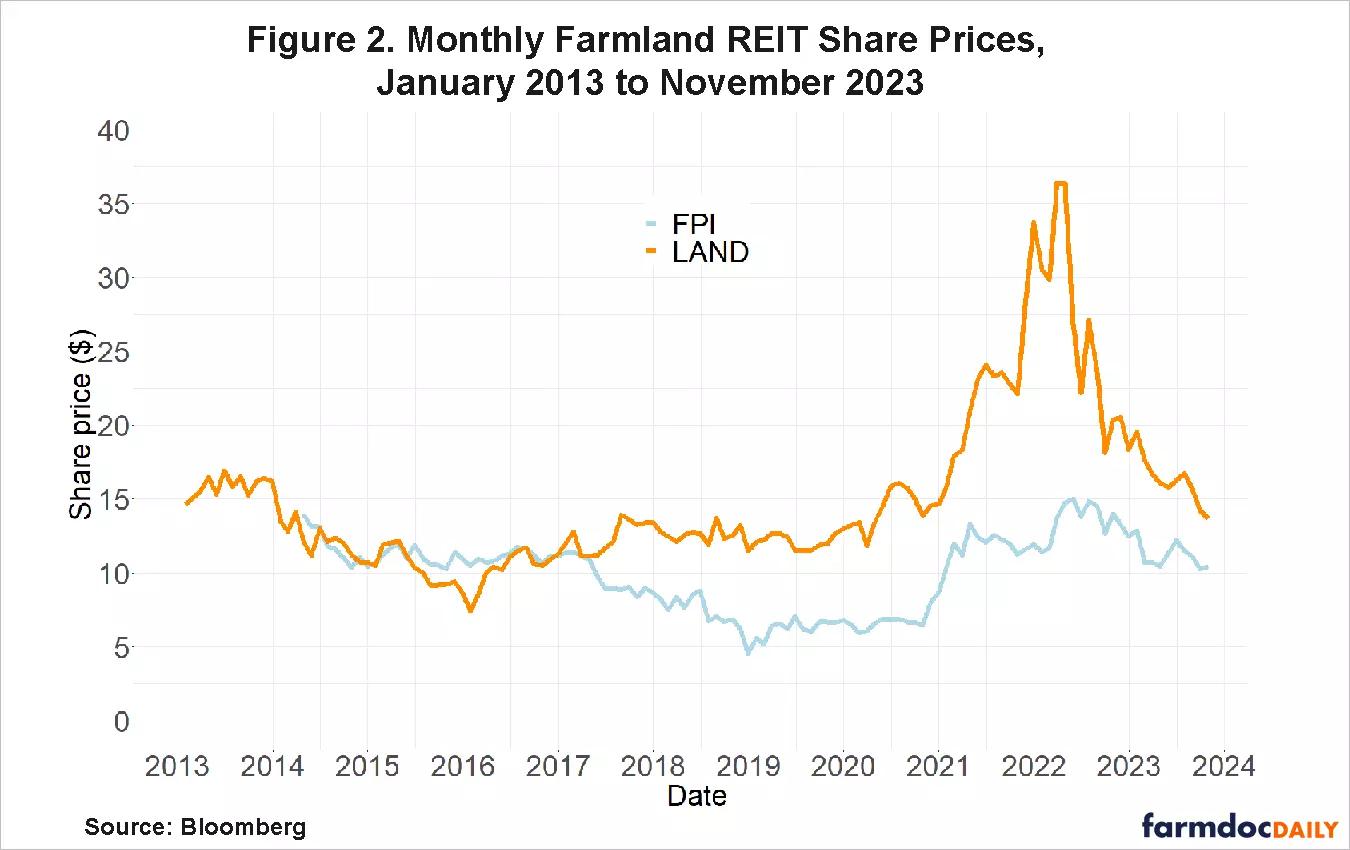

Analyzing the monthly prices of FPI and Gladstone since their inception, we observe that both REITs experienced moderate declines from 2013 to 2016. However, between 2016 and 2020, FPI's share price dropped by half, while Gladstone's remained relatively stable. The prices of both REITs surged in late 2020 and 2021. FPI's share price nearly doubled during this period and has remained at a high level. Gladstone also experienced a significant increase, but it has since returned to its previous level.

Farmland REITs' monthly price movements

Farmland REITs' monthly price movements

Despite the substantial short-term returns, the long-term returns for farmland REITs have been limited. The current prices of both REITs are similar to their inception levels, even though US farmland prices have appreciated significantly since 2013.

The increase in farmland REIT share prices from 2020 to 2022 coincided with a period of relative profitability for US agriculture. This correlation between farmland REIT prices and the value of products grown on the land suggests a short-term link between the two.

Identifying REIT Price Drivers

Previous studies highlighted farmland rental rates as the main driver of REIT prices. However, we believe short-run measures such as farm product prices and equity index values also influence investor decisions. Additionally, we analyze the potential impact of climate change concerns on farmland REIT prices, as it is an important long-run factor.

Farm Product Prices:

Both FPI and Gladstone aim to generate profit from agricultural production on their farmland properties. Hence, changes in crop prices directly affect their revenue. FPI's primary focus is on row crops like corn and soybeans, while Gladstone has a broader range including fruits, vegetables, and tree nuts. We use the S&P GSCI Agriculture index as a benchmark for agricultural commodity prices and the Consumer Price Index for fresh fruits and vegetables as a proxy for general fruit and vegetable prices.

Equity Indices:

The sentiment and financial frictions in the equity markets where the REITs are traded may impact their prices. FPI is listed on the New York Stock Exchange (NYSE), while Gladstone is traded on NASDAQ. Therefore, we consider the NYSE Composite Index and the NASDAQ Composite Index as measures of the equity index factor for each REIT.

Climate Change:

In addition to the above factors, we explore the correlation between climate change concerns and farmland REIT valuation. Using the Wall Street Journal Climate Change Index (WSJCCI), which measures public sentiment on climate change, we examine the relationship between sentiment and farmland REIT prices.

Results

We conducted a Fama-French-style factor regression analysis to determine the correlation between farmland REIT prices and the identified factors. Our analysis covers the entire period of REIT trading and a shorter period, 2013-2018, where we have data on the WSJCCI.

For the complete analysis (2013-2023), we found a positive correlation between farmland REIT returns and equity index returns for both FPI and Gladstone. This indicates limited portfolio diversification benefits for investors. We also observed a significant, but smaller, correlation between FPI and the GSCI index of agricultural commodity prices. However, there was no significant relationship between Gladstone and this index. Furthermore, returns for both REITs did not show significant correlations with fruit and vegetable returns. These findings confirm the relationship between farmland REIT prices and the geographic concentration of their holdings.

In our analysis considering climate change sentiment (2013-2018), we found negative correlations between farmland REIT prices and the WSJCCI. However, this relationship was not statistically significant. Further examination is necessary to fully understand the impact of climate change sentiment on farmland REIT valuations.

Conclusion

While the short-term share price fluctuations of farmland REITs depend on factors such as commodity prices and stock market returns, the long-term returns are limited. Investors interested in farmland REITs may prioritize consistent dividend income streams over share price appreciation.

Our analysis highlights the complex dynamics that influence farmland REIT pricing. Factors such as geographic concentration, crop prices, and stock market performance play a crucial role. However, the relationship between commodity prices and farmland REIT prices is not particularly strong. Furthermore, the impact of climate change on farmland markets requires further examination.

Investors and stakeholders in farmland REITs must carefully consider multiple variables when analyzing their investment opportunities. By understanding the drivers of farmland REIT prices, investors can make informed decisions and navigate this unique sector effectively.