Image Source: airdone

Image Source: airdone

Are you looking for a strong growth real estate investment trust (REIT) that offers a solid yield? Look no further than VICI Properties Inc. (NYSE:VICI). With a concentrated portfolio of entertainment properties, VICI Properties is one of the best passive income streams available to investors.

Despite the cyclical nature of its earnings, VICI Properties' dividend is well-protected and likely to continue growing even in an economic downturn. The low pay-out ratio, comparable to Realty Income Corp. (O), and the inclusion of trophy assets provide strong justifications for investing in VICI Properties in 2024.

My Rating History

Almost a year ago, I published an article about VICI Properties titled "VICI Properties: Don't Miss This 4.5% Dividend Yield." It highlighted the trust's rent escalators in lease contracts, which act as an inflation hedge. The trust's FFO has been growing organically, and I believe the presence of rent escalators makes VICI Properties a compelling investment even in a low-rate, low-inflation environment. In fact, the trust raised its dividend by an impressive 6% in the previous quarter.

VICI Properties' Real Estate Concentration: Opportunities And Risks

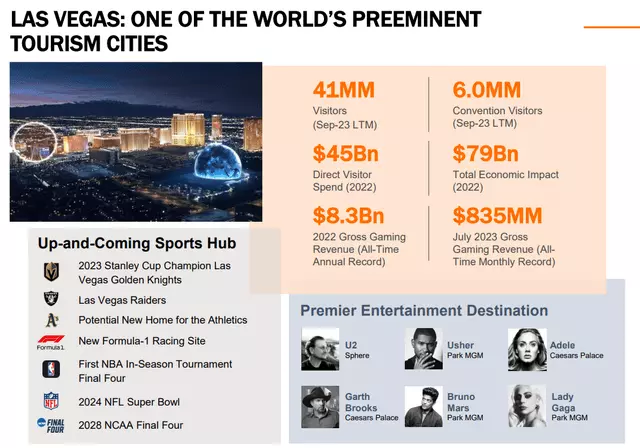

VICI Properties is a net lease REIT focused on the entertainment industry. Its portfolio includes a significant number of casino properties, particularly in Las Vegas. In addition to casinos, the trust owns convention spaces, a considerable number of hotel rooms, and even golf courses.

The trust's core Las Vegas trophy assets, such as the Mirage, Caesars Palace, Park MGM, and The Venetian Resort, enjoy universal name recognition and are synonymous with the city itself. With 41 million visitors in the last twelve months, Las Vegas is a major tourist attraction. This makes it an essential revenue source for VICI Properties' casino properties. However, the trust's Las Vegas-focused portfolio is vulnerable to a decline in tourist traffic during economic recessions.

Fortunately, VICI Properties benefits from a relatively high barrier to entry due to the expensive and capital-intensive nature of building new casinos in Las Vegas. The trust also boasts an exceptionally long weighted-average lease term of 42 years, providing stability and security.

Growth In Adjusted Funds From Operations

VICI Properties has been experiencing robust growth in its underlying cash flow. Its adjusted cumulative FFO since January has risen 34% YoY to $1.62 billion, while adjusted EBITDA has soared 38% to $2.16 billion. With a 100% occupancy rate in the third quarter, the trust's portfolio remains attractive and primed for further growth. VICI Properties is well-positioned to capitalize on future acquisitions, especially during economic recessions when real estate prices become more favorable.

How Safe Is VICI Properties' Dividend?

VICI Properties' dividend is reasonably safe, and the combination of a growing dividend and moderate pay-out ratio makes it an enticing passive income investment. In the last quarter, the trust raised its dividend pay-out by 6.4%. The pay-out ratio in 3Q-23 was 72%, based on adjusted funds from operations. Additionally, VICI Properties pays out only 75% of its AFFO in the last twelve months. Compared to Realty Income Corp. (O), which is often considered one of the safest blue-chip REITs, VICI Properties offers top-of-the-class dividend safety.

What Is VICI Properties' AFFO Multiple?

Considering a stock price of $31.88, VICI Properties' AFFO multiple stands at 14.9x. Its 2023 guidance projects adjusted funds from operations at $2.14-2.15 per share. If the U.S. economy avoids a recession, the trust could potentially achieve 4-5% AFFO growth in 2024. Based on these factors, an AFFO multiple of 17x may be appropriate, implying a target value of $36.

Comparatively, EPR Properties Inc. (EPR), another experiential REIT, sells at an AFFO multiple of 9.4x, but it faces challenges with its large exposure to struggling movie theaters. Realty Income Corp. (O), a retail-oriented REIT, has an AFFO multiple of 14.4x and serves as a reference point for the dividend pay-out ratio.

What Headwinds Must Passive Income Investors Be Prepared To Deal With?

It's essential to note that VICI Properties is a more cyclical REIT compared to those focused on core residential strategies. As Las Vegas heavily depends on tourism and a strong economy, the trust's profits may fluctuate more during economic downturns. However, VICI Properties also has the potential to generate stronger profit and dividend growth during periods of economic prosperity.

Conclusion

In conclusion, VICI Properties is a solid choice for passive income investors in 2024, irrespective of an inflationary backdrop. The trust's moderate pay-out ratio, 6% dividend hike, and focus on long-term lease contracts make it an appealing investment. Even in a low-rate environment, VICI Properties stands out as a compelling choice, with potential dividend growth ahead. So why wait? Consider VICI Properties for your passive income portfolio today!

Image Source: VICI Properties

Image Source: VICI Properties