Image source: MaslovMax/iStock via Getty Images

Image source: MaslovMax/iStock via Getty Images

The Vanguard Real Estate ETF (VNQ) has established itself as the premier choice for investors seeking diversified exposure to United States REITs. With the real estate market offering various investment options, VNQ stands out for three key reasons. In this article, we will explore why VNQ is the undisputed king of REIT ETFs.

Reason #1: Liquidity

As the largest REIT ETF by assets, VNQ leads the pack, outpacing competitors like Schwab and BlackRock. The fund's impressive trading volumes provide investors with the necessary support for large trades, ensuring ease and efficiency. Additionally, VNQ's market cap weighted index ensures that liquidity remains robust, even as the fund grows. This focus on larger REITs, such as Prologis, Equinix, and Simon Property Group, further reinforces VNQ's stability and appeal.

Reason #2: Options

VNQ's long-standing success and popularity have resulted in an expansive options chain for shareholders. While derivatives are typically reserved for sophisticated investors, VNQ offers a deep and diverse options chain, making it the go-to choice for those inclined to take risks. With options available in next-month and quarterly expirations, VNQ provides ample opportunities for traders looking to speculate.

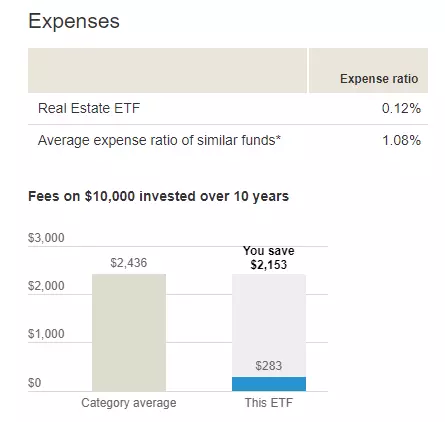

Reason #3: Expense Ratio

Managed by Vanguard, one of the world's largest fund managers, VNQ offers a highly competitive management fee of only 0.12%. This fee is significantly lower than many other large REIT ETFs, cementing VNQ's position as an attractive investment opportunity. Investors can confidently allocate their capital to VNQ, knowing that their management fees will remain minimal over time.

Conclusion:

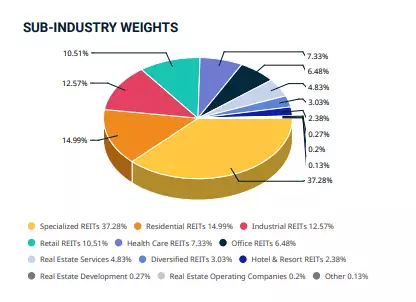

VNQ presents investors with an excellent opportunity to access the broad real estate market. With a well-diversified portfolio comprising over a hundred holdings, VNQ offers stability and growth potential. Additionally, VNQ's impressive yield of 2.91% outperforms the broader equity market, making it an appealing choice for income investors. When considering the scalability, liquidity, and competitive expense ratio, VNQ emerges as the unrivaled king of REIT ETFs.

Data by YCharts

Data by YCharts