Investing in the stock market is a common strategy for growing wealth. But have you considered adding real estate hedge funds to your investment portfolio? These funds offer a unique opportunity to diversify and balance your investments while potentially earning substantial capital gains.

What are Real Estate Hedge Funds?

A real estate hedge fund is a type of investment that pools capital from multiple investors to make a single investment in real estate. Unlike mutual funds, hedge funds generally take on more risk. Managed by professional firms, these funds aim to hedge against the inherent risks of investing while seeking significant returns.

Picture: Money Coins

Picture: Money Coins

Real estate hedge funds have gained popularity in recent years, with nearly 40% of hedge funds heavily investing in real estate. If you're looking to diversify your investment portfolio or balance low-risk investments, real estate hedge funds can be an excellent opportunity.

How Do Real Estate Hedge Funds Work?

There are various ways a real estate hedge fund can make investments, depending on their specific strategy. The most common method is investing through Real Estate Investment Trusts (REITs). A REIT owns and operates income-generating real estate, which can be traded on major exchanges. Investing in a REIT through a hedge fund offers long-term returns, dividend yields, and portfolio diversification.

Picture: House Property Investing

Picture: House Property Investing

Another method is acquiring under-performing properties at below-market rates. Hedge funds purchase these properties, which can be centralized or located worldwide. Unlike investing in REITs, a pure real estate hedge fund directly owns the properties, allowing for different investment strategies such as property development or debt security investments.

Hedge Funds vs. Mutual Funds

While hedge funds and mutual funds share similarities, there are crucial differences to consider. Mutual funds are regulated by the SEC and have limitations on leverage, making them less risky. They are available for daily trading and can be purchased by the public. In contrast, real estate hedge funds are private investments limited to accredited investors. However, hedge funds offer the potential for higher returns if you're willing to take on more risk.

Picture: Money Wallet

Picture: Money Wallet

How to Invest in a Hedge Fund

Before investing in a hedge fund, it's important to understand the restrictions and guidelines involved. Investors must have the ability to make high-risk investments and meet the minimum investment requirements set by fund managers. The minimum investment can range from $100,000 to $1 million. Most real estate hedge funds require accredited investors due to less direct regulation by the SEC. Some hedge funds are listed on exchanges, allowing individual or broker-assisted purchases.

Picture: Paperwork Rules Guidelines

Picture: Paperwork Rules Guidelines

Profits and Risks in Real Estate Hedge Funds

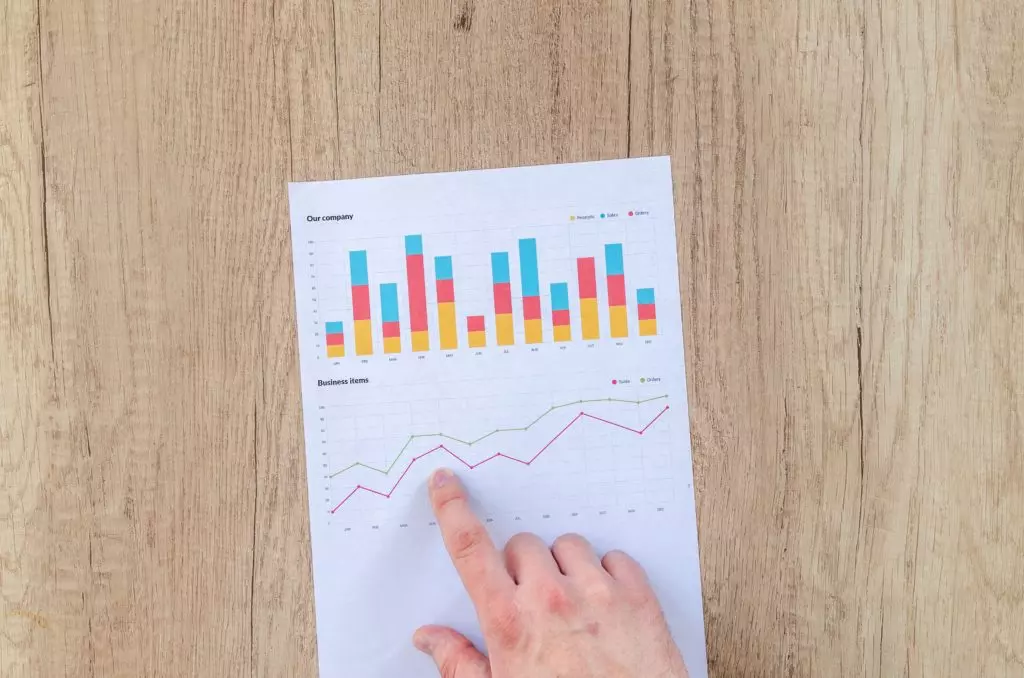

Real estate hedge funds offer advantages and disadvantages worth considering. These funds provide the opportunity for high returns and profits, even in falling markets. You can customize your investment strategy and benefit from top-notch investment managers, reducing some risks associated with these investments.

Picture: Graph Charts

Picture: Graph Charts

However, hedge funds carry risks as well. Significant losses can occur if the fund fails or investments don't perform as expected. Hedge funds also involve higher leverage than liquid assets, leading to increased risk. Additionally, funds may have lock-up periods, restricting access to your money for extended periods.

Investing in Real Estate Hedge Funds

Real estate hedge funds offer a variety of ways to invest and can be highly beneficial for portfolio diversification and potentially higher returns. By balancing your portfolio with hedge funds, you can reduce risk while increasing overall returns. Whether you choose to invest in properties or REITs, finding a reputable hedge fund management company is key to success.

Picture: Checklist Yes No Investment Option

Picture: Checklist Yes No Investment Option

Consider adding real estate hedge funds to your investment strategy and explore the potential they offer for substantial gains. With the right knowledge and guidance, these funds can be a valuable addition to your investment portfolio.