An Offering Memorandum, also known as a Private Placement Memorandum (PPM), serves as a crucial communication tool between sellers and potential buyers in the real estate industry. It provides essential information about an investment opportunity to encourage potential investors to purchase a property.

The Purpose of a Real Estate Offering Memorandum

The main goal of a Real Estate Offering Memorandum is to aid potential investors in making informed decisions by highlighting investment objectives, risks, financial statements, and business operations. It is crafted to strike a balance between clear and concise information, thorough financial analysis, and adherence to securities laws and regulations set by bodies like the Securities and Exchange Commission (SEC). The ultimate aim is to foster transparency and trust between sellers and potential buyers.

Example of an Offering Memorandum in Real Estate

To illustrate the concept, let's take a look at an example of a real estate offering memorandum. Suppose a real estate firm plans to construct a commercial office space in a growing business district. They create an Offering Memorandum that outlines the project specifics, such as location and expected profits. This document analyzes factors such as the objective of capitalizing on the demand for modern office spaces, possible risks like construction delays or economic downturns, financial projections estimating rental income, and the experienced team with a successful track record in similar projects.

Investors review this Offering Memorandum, assess risks and rewards, and decide whether to invest in the project.

The Importance of an Offering Memorandum in Real Estate

An Offering Memorandum plays a vital role in the real estate industry by building trust between potential investors and business owners. It allows investors to evaluate the credentials of the management team and understand the business's operations, fostering confidence in the investment. Clear explanations of potential challenges and risks demonstrate the company's commitment to full disclosure, reassuring investors that they are entering the investment with full knowledge. This level of transparency not only improves trust but also establishes a strong foundation for a successful and mutually beneficial real estate transaction.

Consequences of Breaking a Memorandum of Agreement

A breach of the Memorandum of Agreement significantly damages the relationship between potential investors and business owners. Investors may feel deceived or misled if the actual conditions differ from what was initially presented. This breach of trust can lead to frustration, disappointment, and a tarnished perception of an owner's credibility. In such cases, investors may choose to pursue legal action against the owner, resulting in financial penalties and the obligation to compensate investors for their losses. Moreover, these legal actions can tarnish the business owners' reputation, making it challenging to attract future investors and partners.

How to Create an Effective Real Estate Offering Memorandum

To create a compelling Real Estate Offering Memorandum, follow these steps:

1. The Cover Page

Begin with a professional cover page that includes the property's name, an engaging image, and the company's logo. This sets the tone for what investors can expect to find in the Offering Memorandum.

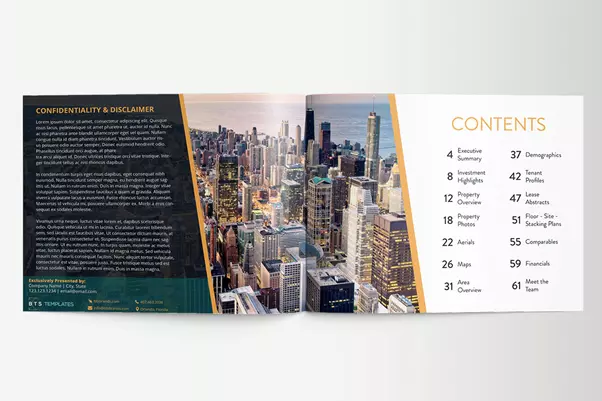

2. Content Overview

In the "Content Overview" section, outline the investment's objectives, risks, terms, and more.

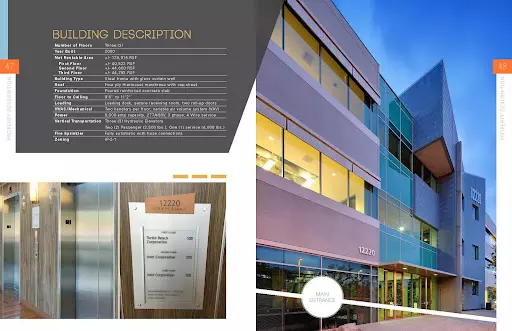

3. High-Quality Images

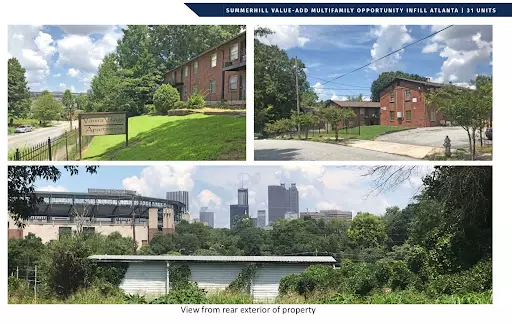

Include high-quality images that showcase the property's exterior and interior.

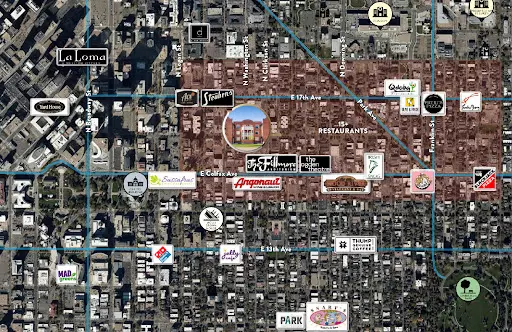

4. An Aerial View

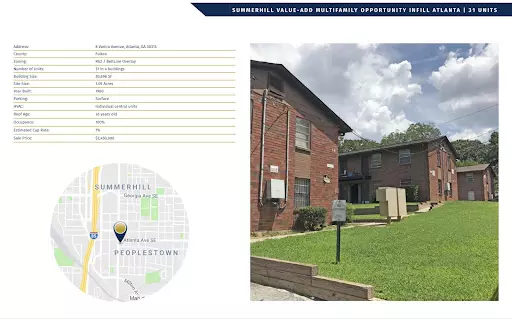

Highlight the property's location with an aerial view using a map or diagram.

5. A Facilities Map

Attach a facilities map that highlights key features such as parking areas, recreational spaces, and common amenities.

6. Key Components of an Offering Memorandum

Your Real Estate Offering Memorandum should include the following key components:

1. Investment Overview

Provide a brief introduction to the investment opportunity, including the property's name, location, and purpose.

2. Investment Objectives and Strategy

Clearly define the investment objectives and explain the investment strategy to showcase how these objectives will be achieved.

3. Property Details

Include comprehensive information about the property, such as its size, type, and features.

4. Financial Projections

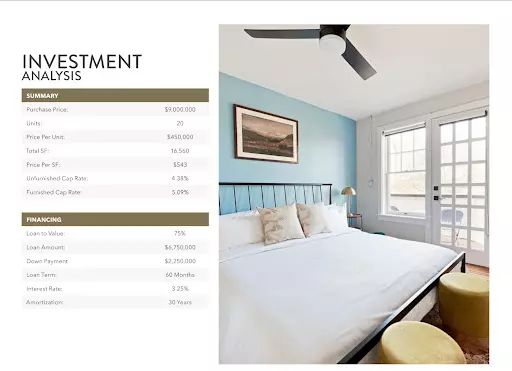

Present detailed financial projections, including income forecasts, expense estimates, and potential returns.

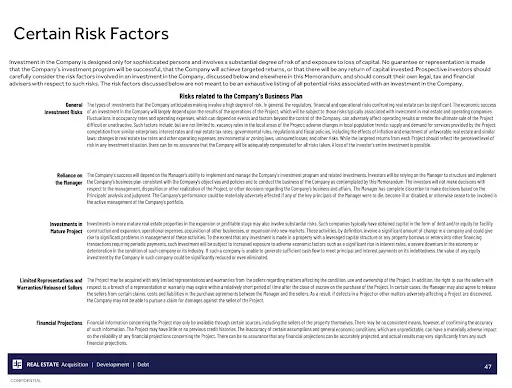

5. Risk Factors

Address potential risks associated with the investment, such as market fluctuations and regulatory changes.

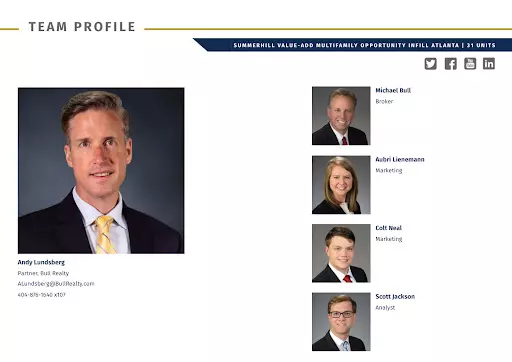

6. Management Team

Introduce the property's management team, including their biographies and relevant expertise.

7. Legal Considerations

Explain compliance with securities laws and regulations, including any necessary disclaimers.

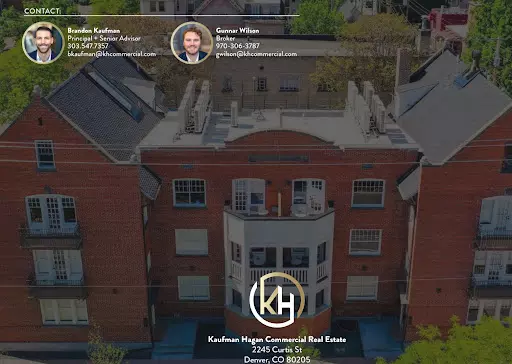

8. Call to Action

Position your contact information strategically, ensuring readers have an easy pathway to get in touch with you.

They must have an easy pathway to get in touch with you, regardless of their location.

How Offering Memorandums Help Property Managers and Brokers Grow Their Business

Offering Memorandums play a crucial role in the growth of property managers and brokers' businesses. By providing detailed information about investment opportunities, including objectives, risks, and financial projections, Offering Memorandums demonstrate a commitment to openness and honesty. Investors and clients appreciate the transparency, which in turn builds trust in your expertise and integrity. Property managers and brokers who utilize Offering Memorandums are better equipped to cultivate trust and position themselves as reliable partners in the competitive real estate market.

Conclusion

Creating a real estate Offering Memorandum can be complex, considering the multitude of elements that need to be highlighted within one document. However, with the help of automated document processing software like KlearStack, the process becomes easier. KlearStack can identify the specific details your investors are looking for and highlight them in your real estate Offering Memorandum. By streamlining the creation process, KlearStack saves you time and money, allowing you to focus on building trust with investors. Get started with its free trial version now!

FAQs on Real Estate Offering Memorandum

-

What is a real estate offering memorandum? A real estate offering memorandum is a comprehensive document outlining investment details, objectives, risks, and financial projections.

-

What is the purpose of an offering memorandum? The purpose of an offering memorandum is to inform potential investors about an investment opportunity, fostering transparency and aiding informed decisions.

-

What is required in an offering memorandum? Offering memorandums typically include property details, financial projections, risk factors, management biographies, and legal considerations.

-

Is an offering memorandum binding? An offering memorandum is not binding but offers transparency. Binding agreements follow after investor commitment through a subscription agreement.