Tax season is upon us, and if you're a homeowner in Greater Cincinnati, it's essential to know the deadlines for paying your property taxes. In this article, we'll provide you with all the information you need to ensure you meet the due dates and avoid penalties.

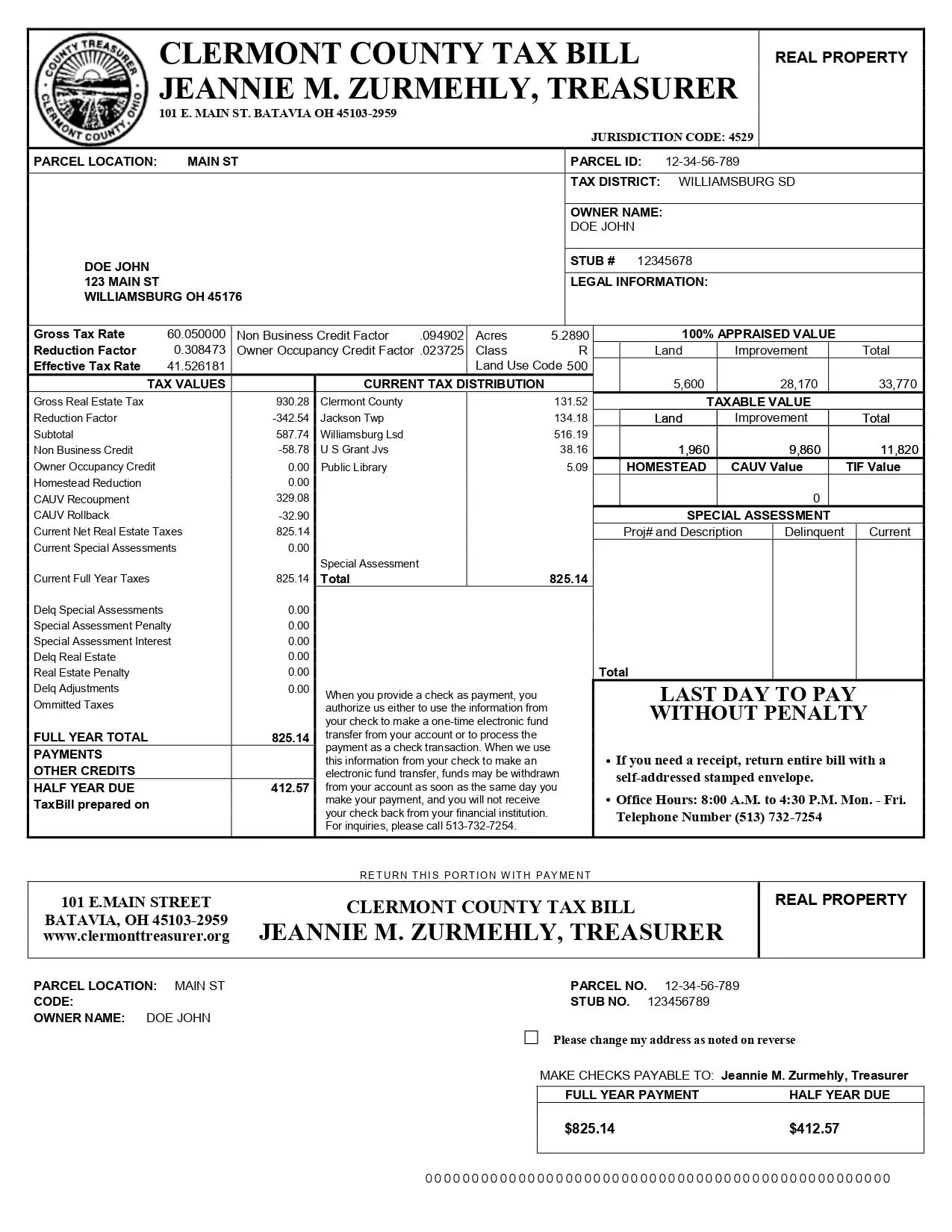

Tax season can be a stressful time for homeowners, especially if you live in Hamilton, Butler, or Clermont counties. In 2023, these counties underwent property reappraisals, leading to higher tax bills. To help you navigate this process, we've gathered all the important details.

When are the First Half of Property Taxes Due in Greater Cincinnati?

The due dates for the first half of property taxes in Greater Cincinnati are as follows:

- Butler County: February 29

- Clermont County: February 9

- Hamilton County: February 5

- Warren County: February 28

It's worth noting that unlike Ohio, Kentucky requires taxpayers to pay their property taxes in full. So if you reside in Northern Kentucky's Boone, Campbell, or Kenton counties, remember to pay your taxes in full by April 15.

How can I Check my Tax Bill?

To find your tax bill, check your mail. According to the Ohio Revised Code, county treasurers are obligated to mail tax bills out 20 days before the due date. However, some counties offer online services to view and print your tax bill.

For Butler and Clermont counties, you can conveniently access your tax bill on their treasury websites. Hamilton County provides a "Property Search" tool on the county auditor's website for taxpayers to view their property tax bill.

How do I Pay my Property Tax Bill in Hamilton County?

In Hamilton County, you have several payment options available:

- Online Payments: You can make payments using an electronic check or Visa, Mastercard, Discover, or American Express cards through Point & Pay, the online payment service provider for Hamilton County. Please note that Point & Pay charges a $1 convenience fee for electronic checks and a 2.35% fee for credit card payments.

- In-person Payments: Visit room 405 of the Todd B. Portune Center for County Government, located at 138 E. Court St., Downtown, to pay in-person.

- Mail Payments: Send checks payable to Hamilton County Treasurer to 138 E. Court St., room 402, Cincinnati, Ohio, 45202.

Butler, Clermont, and Warren counties also offer online and in-person payment options.

What Happens if I Miss the Due Date?

It's crucial to pay your property taxes on time to avoid penalties. According to the Ohio Revised Code, if you fail to pay your taxes after the due date, a penalty of 5% will be added within the first 10 days. After 10 days, the penalty increases to 10%.

However, many counties provide payment programs or monthly payment options. Some counties, like Hamilton and Butler, even offer penalty forgiveness under certain conditions, such as serious injury or county administration errors.

Can I Dispute my Property Taxes?

Unfortunately, the review process for the 2023 property values used to calculate your taxes has concluded before the tax bills were mailed out. Therefore, the final assessed values have already been determined.

If you wish to contest your final assessed value, you can file a complaint with the Board of Revision. Hamilton, Clermont, and Warren counties accept complaints until March 31, while Butler County accepts them until April 1. Remember that complaints in Hamilton County must be sent to the Board of Revision via mail and cannot be submitted via email.

Now that you're equipped with all the essential information about property tax deadlines in Greater Cincinnati, you can confidently manage your payments and ensure compliance with the law. Stay on top of your tax responsibilities to maintain a stress-free homeownership experience.