Are you considering selling your investment property but unsure about the right time to do it? You're not alone. As an experienced investor with multiple properties, I've faced the same dilemma. In this article, I'll guide you through the indicators to consider when deciding to sell your investment property.

Riding the Wave of Inflation

The current real estate market is experiencing an inflation wave. By holding onto your property, you can benefit from the increasing property prices and rising rents. Inflation has been running at around 3.3%, boosting the value of real estate since the pandemic. This upward trend in property prices and rents makes holding onto your investment property an attractive option.

Changing Perspectives on Property Ownership

As we grow older, our priorities and mindset change. What once seemed like a smart investment strategy might no longer align with our current circumstances. Parenthood, career changes, and personal preferences can influence our willingness to deal with tenants and property maintenance. We need to consider if the joy of owning the property outweighs the stress and complications it brings into our lives.

Major Life Events and Changing Income Sources

Significant life events like becoming a parent, the loss of a loved one, a job change, or a relocation often require us to reassess our investment properties. These events may demand more of our time, money, or attention, making it challenging to manage rental properties effectively. In such cases, selling your investment property might give you the financial flexibility and peace of mind you need.

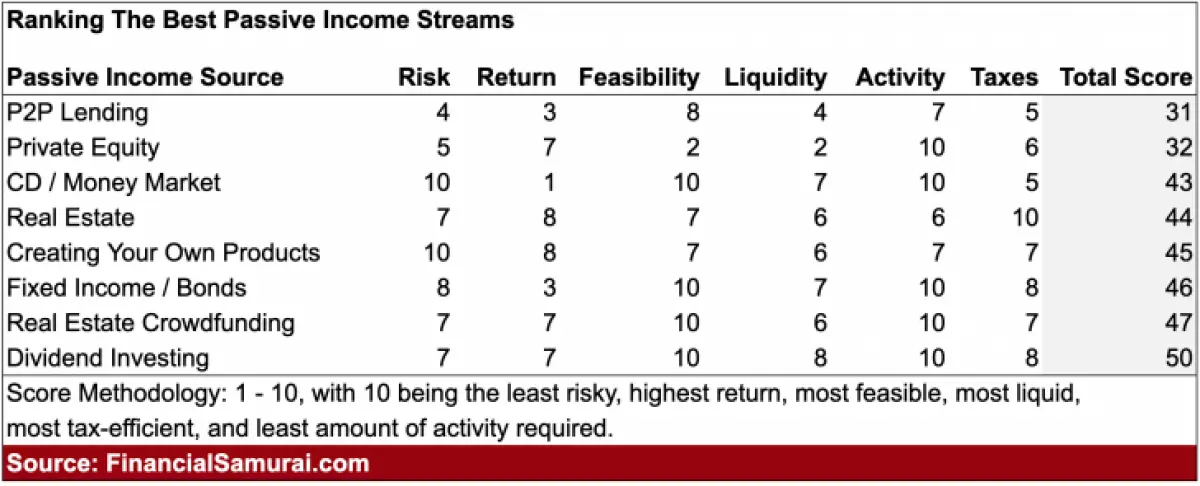

Additionally, it's important to diversify your passive income sources. While rental income provides stability, exploring other options like dividend income, bond income, real estate crowdfunding, or royalty income can supplement or even replace the need for rental income. Understanding the potential returns and level of involvement required in each passive income stream will help you make an informed decision.

Calculating Cap Rates and Evaluating Risk

Cap rates, which determine the net rental yield, are an important factor to consider when deciding to sell your investment property. If the cap rate is lower than what you can earn from a risk-free investment like a 10-year Treasury bond, it might be a sign that you're not getting sufficient returns for the risk you're taking. Calculating your cap rate based on your property's net operating income and market value can help you make an informed decision.

The Impact of Commercial Real Estate Trends

Commercial real estate trends can often indicate potential changes in the residential housing market. Understanding the growth in jobs, income, and supply in your area can help you anticipate future pricing pressures. If there's a large pipeline of condos or new homes in your market, there's a higher chance of downside pricing pressure. Selling your property before the market gets flooded can be a wise move.

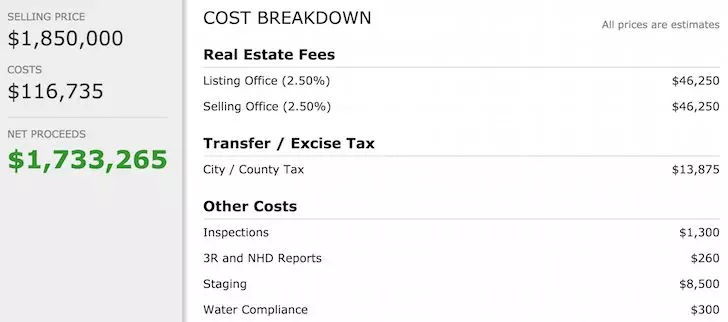

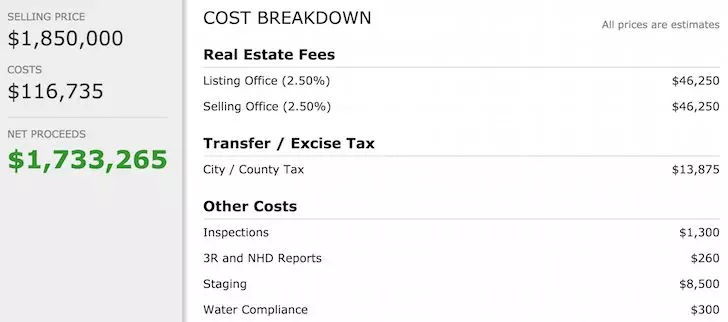

Tax Considerations and Property Expenses

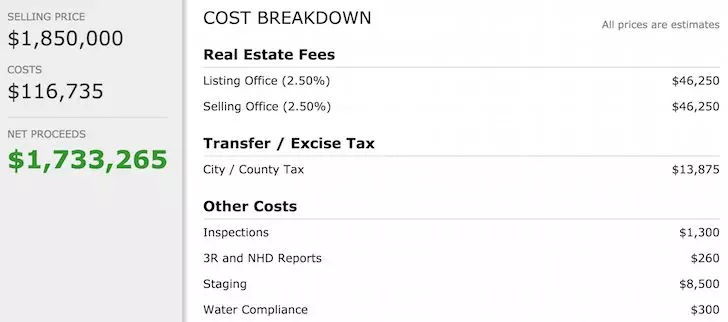

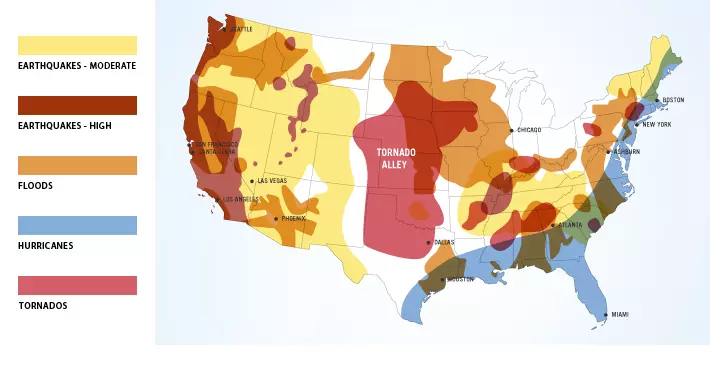

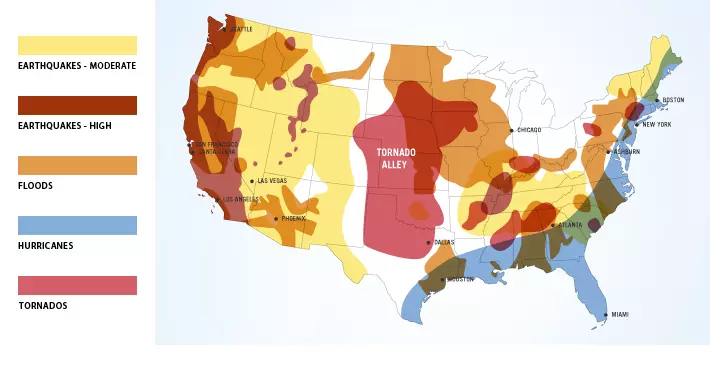

Tax laws and ongoing property expenses are important factors to consider. Take advantage of tax-free profit thresholds for primary residences. If you've reached these limits and there's potential for higher tax hikes in your area, selling your investment property might save you from excessive tax burdens. Additionally, major repairs, ongoing property taxes, and the potential for natural disasters can add significant costs and hassle to property ownership.

The Emotional Aspect of Property Ownership

Lastly, don't underestimate the emotional aspect of property ownership. The joy and pride you once felt can diminish over time. If you find that the joy of owning the property is no longer fulfilling, it might be a sign that it's time to move on. Selling your investment property can free up your time, relieve stress, and allow you to pursue other interests and investments.

Making the Right Decision

Ultimately, the decision to sell your investment property should be based on a careful evaluation of various factors such as your personal circumstances, financial goals, market trends, and tax considerations. It's essential to weigh the financial benefits and risks against the emotional toll and effort required to manage the property.

Remember, the longer you can hold onto your investment property, the greater your potential wealth accumulation. However, if you identify indicators that suggest it's time to sell, seize the opportunity to reinvest the proceeds in assets that align better with your current life goals and financial aspirations.

So, take the time to evaluate your investment property and consider these indicators. Keep in mind that selling your investment property is a personal decision that should align with your financial goals and current life circumstances. Good luck with your investment journey!