Real estate has long been regarded as one of the best asset classes for building long-term wealth. Unlike stocks, real estate doesn't simply disappear in a sudden market downturn. In today's digital age, finding great real estate syndication deals has become much easier, thanks to the emergence of online real estate crowdfunding platforms.

Real estate is a physical asset that generates cash flow through rental income. During economic downturns, rental incomes tend to remain stable, as tenants are often locked into year-long leases and are reluctant to renegotiate downward. Moreover, with interest rates at record lows due to the pandemic, the value of cash flow from rents has significantly increased. In other words, it now takes much more capital to generate the same amount of risk-adjusted income.

While owning physical properties can be a hassle to manage, sophisticated investors are increasingly turning to real estate syndication deals for more passive returns. After selling my San Francisco rental home in 2017 and reinvesting a portion of the proceeds in real estate syndication deals, I realized the benefits of this investment strategy. As a new father with limited time, I needed an investment that didn't require hands-on tenant management. Additionally, the soaring real estate prices in San Francisco compelled me to seek opportunities in areas with lower valuations and higher rental yields, such as Austin, Texas, and Charleston, South Carolina.

What Is A Real Estate Syndication Deal?

A real estate syndication deal involves a group of investors, called limited partners, pooling their money to invest in a real estate transaction organized by a sponsor. To participate in a real estate syndication, certain criteria must be met:

- Accredited Investor: You need to earn more than $250,000 as an individual or $300,000 as a married couple, or have at least $1 million in assets outside your primary residence.

- Connections: To invest in a syndication, you either need to know the sponsor personally or receive an invitation from a limited partner.

- Fundamental Understanding: Never invest in something you don't understand. It is crucial to grasp the type of real estate investments being made, the timeline, and the return objectives.

In a real estate syndication, investors contribute capital, while the sponsor provides their expertise, know-how, and often their own money to demonstrate commitment to the deal. It is essential to ensure that the sponsor has a personal investment in the syndication as it aligns their interests with the investors'.

Real Estate Syndication Structures

Real estate syndication deals are typically structured as Limited Liability Companies (LLCs) or Limited Partnerships (LPs). In an LP, the sponsor assumes the role of general partner/manager, while the investors are limited partners or passive members.

Carefully reading the operating agreements (LLC) or partnership agreements (LP) is crucial, as these documents outline how distributions are paid, establish voting rights, and specify any fees the sponsor receives before distributions. All important terms and conditions are included in one of these documents.

Some syndication deals have a "waterfall structure," where certain limited partners receive preferred payouts before others. For example:

- First, Class A investors receive an 8% preferred return on their contributions.

- Then, Class A investors are distributed 70% of the remaining cash.

- Finally, Class B members (sponsors) receive 30% of the distributable cash.

Understanding the structure of how distributions are made based on performance is vital for investors. It is worth noting that LLCs are primarily designed to protect the sponsor, not the investor, in the event of a deal going south.

Real Estate Investment Return Metrics

To evaluate real estate syndication deals, it is important to consider various investment return metrics:

- Return of Investor's Capital: How and when will your initial investment be paid back? Often, investors are paid back before the sponsors.

- Preferred Return: The preferred return is the amount paid to investors first on distributions. In the example above, the preferred return is 8%.

- Catch-Up Clause: If present, the sponsor receives 100% of distributions up to a certain point before the carried interest. Not all deals have a catch-up clause.

- Carried Interest: After all is said and done, the profit is split between investors and sponsors. In the example above, the split is 70/30.

- Internal Rate Of Return (IRR): This metric helps investors estimate their potential return over the life of the project. It is essential to be cautious with overly optimistic IRR assumptions and cut them in half to stay conservative.

Real Estate Syndication Fees

Investors also need to be aware of fees that can impact their investment returns. It is crucial to understand all the fees charged by the sponsor and inquire about the expected net IRR after fees. Here are some common fees:

- Acquisition Fee: This fee covers the costs associated with closing the fundraising, finding the deal, organizing the transaction, and purchasing the property.

- Financing Fee: If financing is involved, this fee covers the procurement of the acquisition loan.

- Management Fee: This is the fee paid to the sponsor for managing the assets of the company.

- Property Management Fee: This fee covers the cost of managing the property.

- Disposition Fee: This fee is paid to the sponsor when the property is sold.

The goal is to minimize fees and maximize returns on your investment.

The Easiest Way To Invest In A Real Estate Syndication

Even if you meet the criteria to be an accredited investor, you may not have the necessary connections to access real estate syndication deals. This is where real estate crowdfunding comes in.

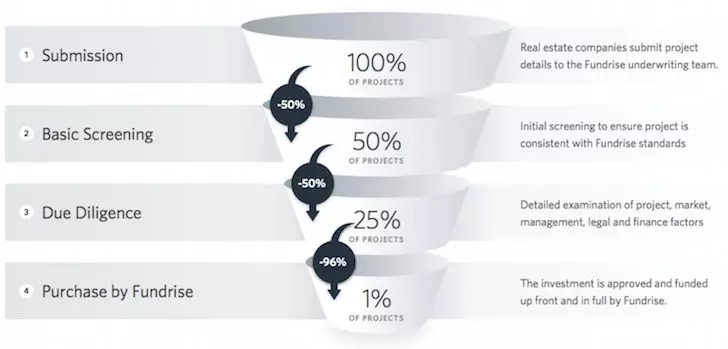

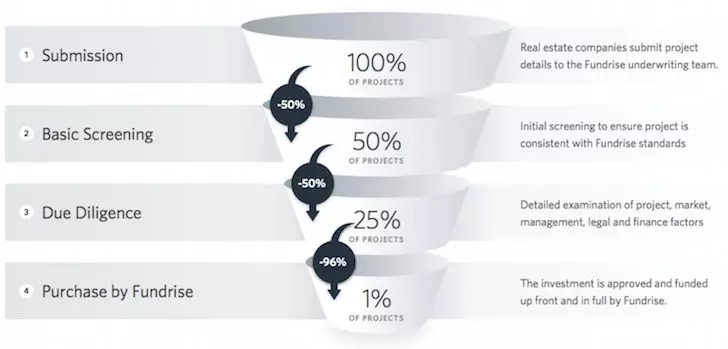

Since the passage of the 2012 JOBS Act, real estate crowdfunding platforms have emerged, allowing both accredited and non-accredited investors to participate in real estate syndications. These platforms thoroughly analyze all the deals before making them available to investors. By focusing on the most promising projects, they provide valuable guidance to investors who are unsure where to start.

With real estate crowdfunding, you have the advantage of investing in commercial real estate without the need for a substantial initial capital investment. Traditional real estate purchases can be highly concentrated bets, whereas with real estate crowdfunding, you can start with as little as $1,000 and achieve better diversification.

Currently, the two most respected real estate crowdfunding platforms are:

- CrowdStreet: Based in Austin, CrowdStreet connects accredited investors with a wide range of debt and equity commercial real estate investments. Their focus on "18-hour cities" (secondary cities) with lower valuations, higher net rental yields, and potential growth makes them an attractive option. They also occasionally offer funds.

- Fundrise: Founded in 2012, Fundrise is available to both accredited and non-accredited investors. Fundrise is best known for creating private eREITs (private real estate funds). Their track record of innovation and strong marketplace distinguishes them in the industry.

Both of these platforms have established themselves as leaders in the real estate syndication market, offering robust marketplaces and stringent underwriting processes. Sign up and explore the available opportunities on these platforms, as it is free to do so.

As always, conducting your own due diligence before investing is imperative. Personally, I have invested $810,000 in 18 different commercial real estate projects across the country. Since the end of 2016, my current internal rate of return stands at approximately 12%. Diversifying my real estate holdings and earning passive income has been a valuable asset in my busy life as a full-time father.

About the Author

Sam started Financial Samurai in 2009 as a way to make sense of the financial crisis. With over 13 years of experience working at major financial institutions like Goldman Sachs and Credit Suisse, Sam has gained valuable insights into the world of finance. He currently owns properties in San Francisco, Lake Tahoe, and Honolulu, with a total investment of $810,000 in real estate crowdfunding.

At the age of 34, Sam was able to retire thanks to his investments, which now generate approximately $220,000 a year in passive income. When he's not playing tennis or spending time with his family, Sam consults for leading fintech companies and shares his knowledge online to help others achieve financial freedom.

Join over 100,000 others and sign up for the free Financial Samurai newsletter to receive more nuanced personal finance content. Financial Samurai, one of the largest independently-owned personal finance sites since 2009, provides valuable insights based on firsthand experience.