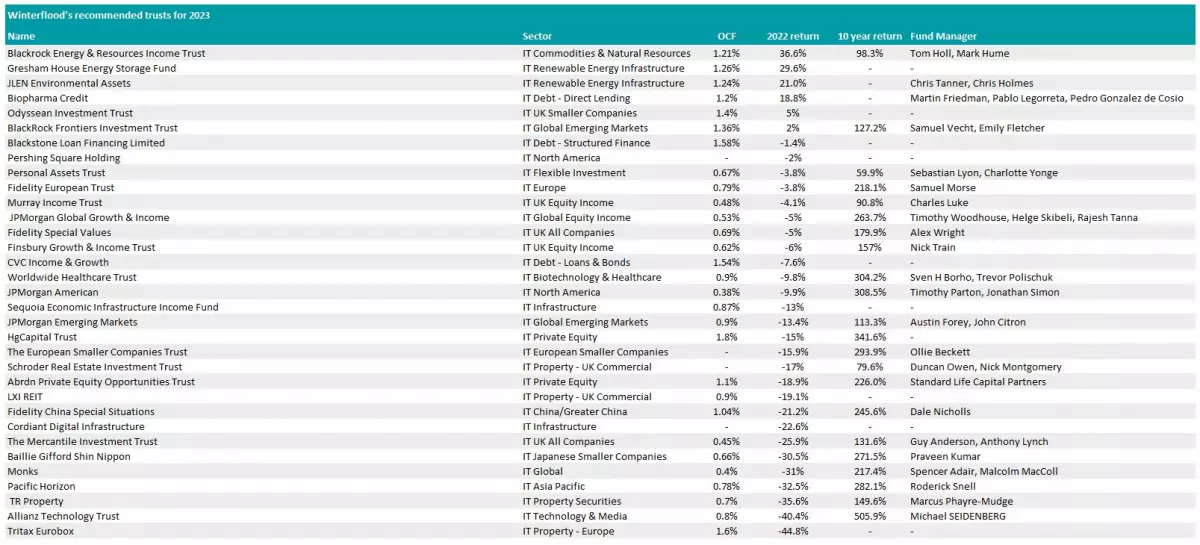

Image source: Winterflood

Image source: Winterflood

Winterflood, the renowned research firm, has just unveiled its highly anticipated list of recommended investment trusts for 2023. With 15 new names added to the list and 18 trusts removed, Winterflood's recommendations aim to guide investors towards the most promising opportunities in the coming year.

Investing in an Ever-Changing Market

Market conditions have proven to be challenging, forcing managers to reassess their strategies. Winterflood's list now consists of 33 carefully selected portfolios, with 19 focusing primarily on equities. Interestingly, the report highlights a significant increase in trust discounts, making investment company shares five times cheaper than they were a year ago. This presents a unique opportunity for astute investors to capitalize on.

UK Fund Recommendations

Winterflood analysts have introduced one new addition to their UK recommendations: the £989m Murray Income Trust. This trust boasts a long-term record of growing dividends and offers an attractive ongoing charges figure (OCF) of just 0.48%. Despite its current discount of 6.9%, larger marketing efforts and improved relative performance could potentially lead to a positive re-rating. Winterflood reduced the number of recommended UK funds from seven to five this year, retaining Fidelity Special Values, Mercantile Investment Trust, Finsbury Growth & Income, and Odyssean Investment Trust.

US Fund Recommendations

Pershing Square Holdings and JPMorgan American are the new additions to Winterflood's North American recommendation list for 2023. Pershing Square Holdings, with its impressive portfolio performance of 168.7% since its inception in 2014, invests in quality companies and private equity. Winterflood analysts anticipate a re-rating of its shares if its large-cap holdings prove resilient in 2023. The trust's fundamental analysis approach is often compared to Warren Buffett's Berkshire Hathaway.

European Fund Recommendations

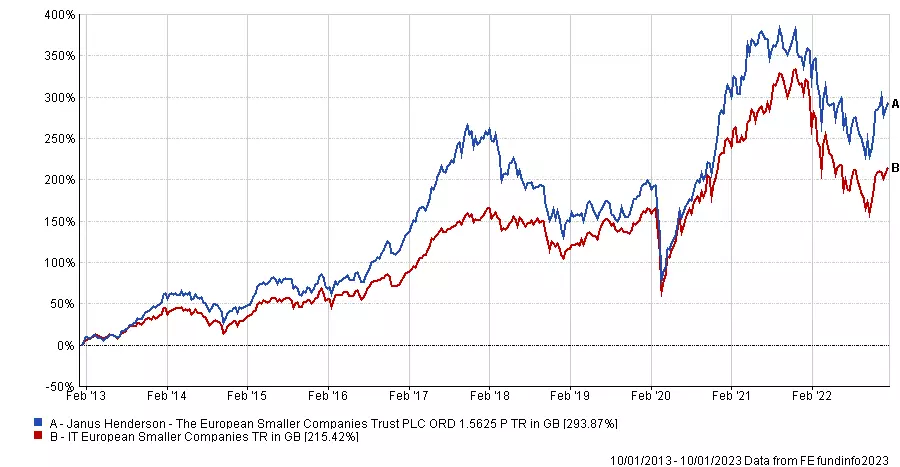

Winterflood analysts have added the European Smaller Companies Trust to their list, confident in its ability to navigate the volatile market conditions of 2023. With a highly diversified portfolio comprising 125 holdings across multiple European countries, this trust offers investors a unique opportunity with its current discount of 17%. The trust has an exceptional track record, outperforming its peers in the IT European Smaller Companies sector by 78.5% over the past decade.

Asian Fund Recommendations

Winterflood has made changes to its Asian recommendation list, adding Fidelity China Special Situations and Pacific Horizon Investment Trust. Fidelity China Special Situations stands out for its bias towards value assets and smaller companies, distinguishing it from its peers in the IT China/Greater China sector. Over the past decade, the trust has delivered exceptional returns of 245.6%. The Pacific Horizon Investment Trust offers investors a broader exposure to Asia, with analysts appreciating its contrarian stock picking approach and higher exposure to metals and mining.

Other Region Recommendations

In the emerging markets, Winterflood continues to recommend both the JPMorgan Emerging Markets Trust and BlackRock Frontiers Investment Trust. Despite a 13.4% dip in performance for the former last year, it remains a top-quartile performer with a 10-year return of 108.6%. The latter made a modest 2% gain in 2022 and boasts an even better 10-year return of 131.9%. For Japan, the analysts have selected Baillie Gifford Shin Nippon as the only option. Despite a 30.5% loss last year, this trust remains the best performer in the IT Japanese Smaller Companies sector over the past decade, with an impressive return of 285.2%.

With Winterflood's carefully curated list of investment trusts, investors can confidently navigate the ever-changing market landscape in 2023. By considering these recommendations, investors have the opportunity to make informed decisions and potentially enjoy significant returns on their investments.

Image source: FE Analytics

Image source: FE Analytics