If you're interested in the biggest U.S. real estate property portals and want to know the key facts, revenue figures, and recent controversies, you've come to the right place. Online Marketplaces regularly reports on and analyzes real estate portals in the United States, and in this guide, we'll compare and contrast the three biggest players: Zillow, Realtor.com, and Homes.com.

Zillow: The Powerhouse of Real Estate Portals

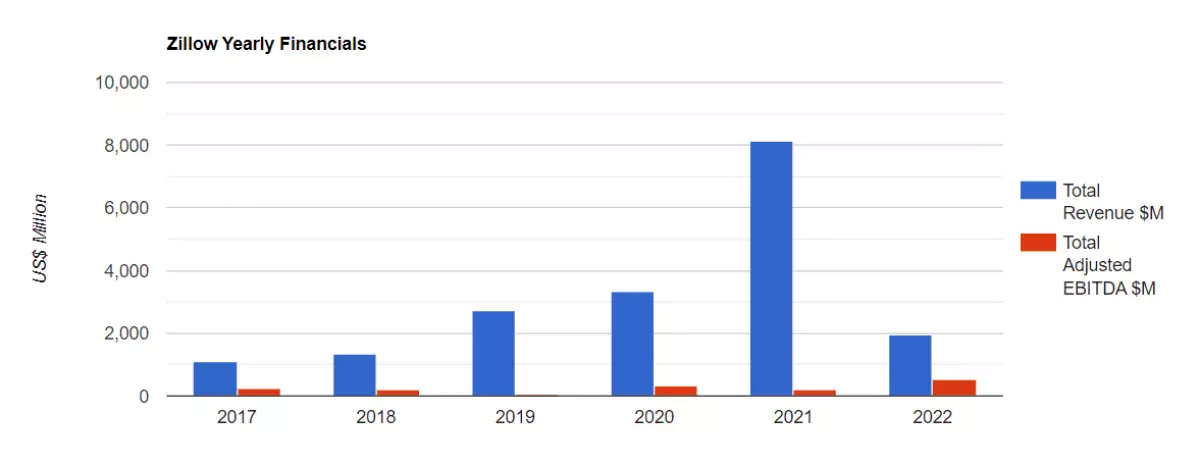

Zillow is not just one of the most powerful real estate portals in North America but in the entire world. Established in 2006, Zillow continues to thrive, making billions of dollars each year, even after the collapse of its iBuying home renovations business in November 2021.

Zillow Financial

Zillow Financial

Realtor.com: The Runner-Up

Realtor.com has historically played second fiddle to Zillow. Founded in 1995 and initially backed by the National Association of Realtors, Realtor.com has seen some changes in its relationship with the industry association. Nevertheless, it remains a prominent player in the real estate portal market.

Move Inc Financial

Move Inc Financial

Homes.com: The Rising Star

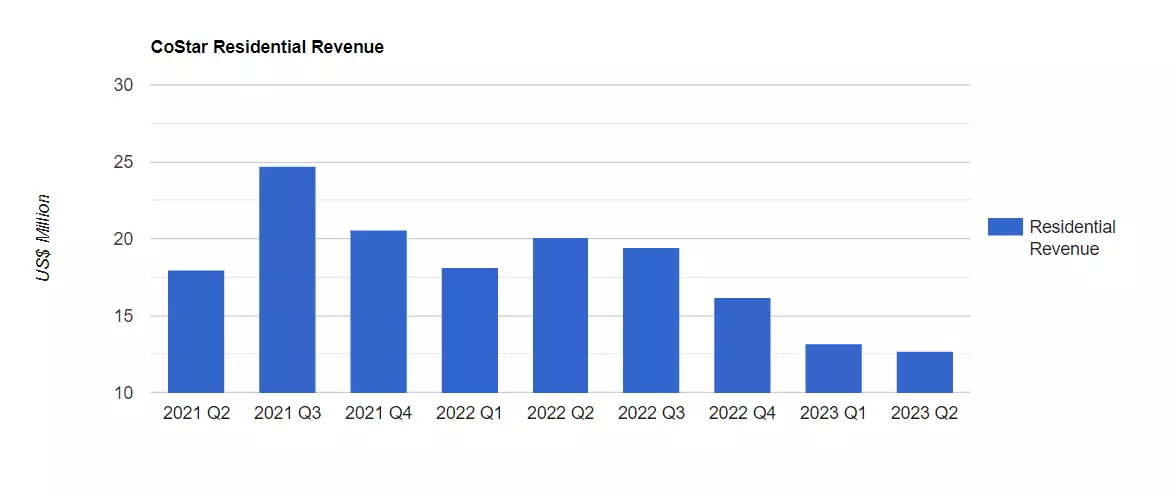

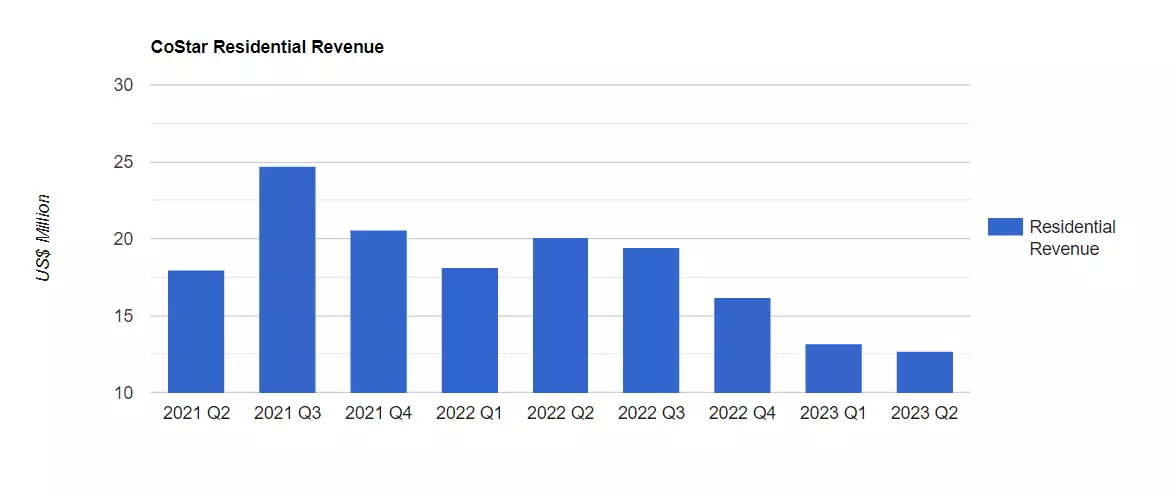

Homes.com, although still relatively new to the scene, has been on a clear upward trajectory since its acquisition by commercial real estate giant CoStar Group in 2021. While it may not yet be a direct challenger to Zillow, Homes.com, as part of CoStar's 'Residential' business segment, is generating significant revenue, ranging between $10 to $20 million per quarter.

Costar Financial

Costar Financial

Traffic Rankings: Zillow Takes the Lead

When it comes to website traffic, Zillow remains the undisputed leader among U.S. real estate portals. According to Similarweb, Zillow receives the most traffic compared to its competitors. However, Realtor.com has acknowledged a loss of 20% in traffic between March and July 2023 compared to the same period last year. Zillow's traffic also experienced an 8% decline during this period due to high mortgage rates and low inventory.

CoStar Group has been heavily focusing on boosting traffic to Homes.com. By diverting traffic from Homesnap.com, which is also owned by CoStar, they have managed to drive more visitors to Homes.com. Moreover, CoStar plans to launch a nationwide media campaign to further increase awareness and traffic to Homes.com.

US Portal Traffic

US Portal Traffic

Ownership of Zillow, Realtor.com, and Homes.com

Zillow is owned and operated by Zillow Group, a publicly traded company. Realtor.com is owned by Move, Inc., which is 80% owned by the media corporation Newscorp and 20% owned by the Australian specialist portal company REA Group. Homes.com is owned by CoStar Group, the same company that owns Apartments.com and Homesnap.com.

CoStar's Interest in Realtor.com and Homes.com

CoStar Group's interest in Realtor.com was rumored in 2022, but they eventually withdrew from the potential $3 billion deal. Instead, CoStar decided to focus on improving Homes.com using its cash reserves. CoStar's recent financial results proudly announced that they have overtaken Redfin and Realtor.com, becoming the operator of the U.S.'s number two portal network in terms of traffic.

While Move, Inc. is going through a management change with the appointment of Damian Eales as CEO, their goal remains to reclaim the top spot from Zillow while also warding off CoStar's advancements.

Revenue Streams of Zillow, Realtor.com, and Homes.com

Zillow primarily generates its revenue from its Premier Agent product, which involves selling buyer leads to agents. Agents receive leads generated by users who fill in contact forms on the Zillow website or app. This model has sparked some controversy as the agent receiving the lead may not be the agent listing the property.

Unlike most real estate portals worldwide, Zillow and other U.S. portals do not charge agents to list on their platforms. This is thanks to the MLS (Multiple Listing Service) system. Zillow, as a member of the National Association of Realtors, has access to an IDX feed that includes listings from MLSs across the country.

Apart from Premier Agent, Zillow has expanded its revenue streams in recent years. These include commission sharing with agents, paid enhanced listings, mortgage services, title and escrow services, and agent software solutions.

Zillow Vs Realtor.com Next Gen Lead Gen Revenue

Zillow Vs Realtor.com Next Gen Lead Gen Revenue

Homes.com takes a different approach when it comes to monetization. They promise not to sell leads to agents. Instead, CoStar charges agents for extra visibility packages. Agents receive leads from their listings for free, but those who want to increase their lead volume can pay Homes.com to feature their listings at the top of search results pages. This business model is common for portals outside of the U.S. and has been successful for CoStar in commercial and rental real estate.

All Home Listings on Zillow?

It's a complicated and controversial issue. While Zillow and other U.S. real estate portals have access to all home listings on the MLS, not all home listings are on the MLS. According to the National Association of Realtors' Clear Cooperation Policy, agent members should upload all home listings to the MLS within one business day of marketing them. However, big national brokerages like Compass can market listings internally to other Compass agents, creating what's known as pocket listings. These pocket listings do not appear on Zillow and other third-party real estate websites. Pocket listings have sparked debates about fair housing, as some see them as a disadvantage while others consider them a competitive advantage.

User-Friendly Features

We regularly review and compare real estate portals from around the world to identify industry-standard features and emerging trends. In our most recent analysis of major U.S. real estate portals, we discovered the common features they offer and any unique offerings.

Share Prices of Zillow and CoStar

Zillow's share prices took a hit when it shut down its iBuying business. Although they have since recovered slightly, they are still far from reaching the heights of $161 per share seen in 2021.

CoStar's share prices have experienced gradual growth over the past three years. However, they have yet to reach the record $94 per share achieved in August 2020, despite impressive revenue growth and inclusion in the prestigious S&P 500 index for 49 consecutive quarters.

Zillow Vs Costar Share Price

Zillow Vs Costar Share Price

News Highlights in 2023

Zillow remains a regular feature in the news with various lawsuits and ongoing innovations, including advancements in artificial intelligence. The portal's Q2 FY23 results boasted revenues exceeding half a billion dollars.

Realtor.com has faced challenges this year, with a significant drop in traffic and revenue. The company underwent a leadership transition, welcoming Damian Eales as the new CEO. Eales has expressed his determination to reclaim the top spot and revitalize Realtor.com.

Homes.com received a boost when CoStar withdrew from the Realtor.com deal, indicating future investments in the portal. Additionally, CoStar decided to sunset Homesnap and focus on Homes.com. CoStar celebrated its position as the U.S.'s number two portal operator in terms of traffic, surpassing Redfin and Realtor.com.

Discover more about the world of property portals, free of charge, on Online Marketplaces!