Are you interested in diversifying your investment portfolio with real estate but want to explore all your options? Fundrise is a popular choice, but there are numerous alternatives that offer different investment strategies and opportunities. In this article, we will introduce you to 10 unique alternatives to Fundrise that cater to both accredited and non-accredited investors.

Yieldstreet: Best for Alternative Investing

Minimum Investment: $2,500

Fees: 1% - 2.5% in management fees

Fund: Access to real estate, commercial, marine, legal, and art investments.

Minimum Investment: $2,500

Fees: 1% - 2.5% in management fees

Fund: Access to real estate, commercial, marine, legal, and art investments.

Yieldstreet is an alternative investment marketplace that brings private investment opportunities to retail investors. While most transactions are restricted to accredited investors, Yieldstreet launched the Prism Fund in 2020, which is accessible to non-accredited investors with a minimum investment of $2,500. With Yieldstreet, you can invest in a range of assets, including real estate, art, legal finance, and more.

RealtyMogul: Best for REITs and 1031 Exchange

Minimum Investment: $5,000 Fees: 1% Fund: MogulREIT I and MogulREIT II

RealtyMogul allows both accredited and non-accredited investors to invest in real estate. Non-accredited investors can choose from two different real estate investment trusts (REITs) that provide a diversified portfolio of properties. Accredited investors have the option to acquire individual properties or participate in a 1031 Exchange, which offers tax advantages when selling and reinvesting in similar properties. RealtyMogul has attracted over 128,000 investors and facilitated over $650 million in investments.

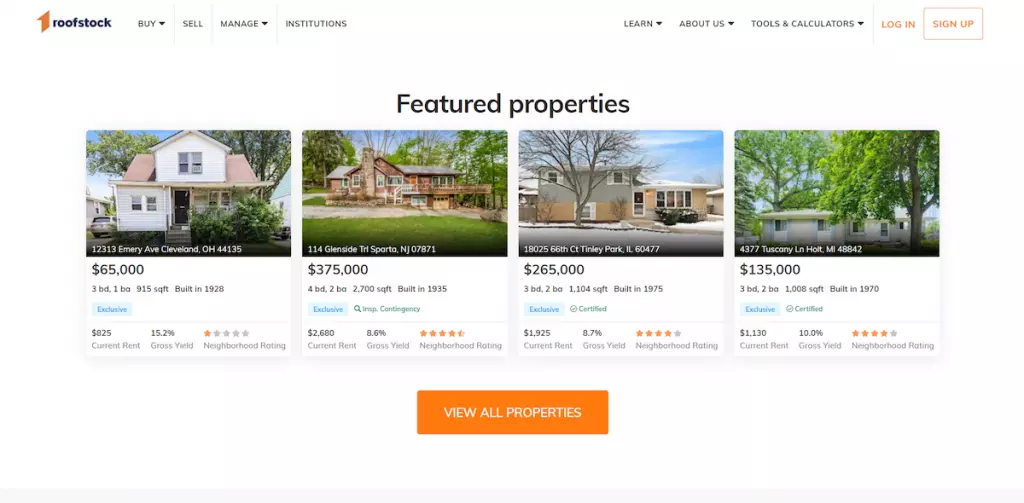

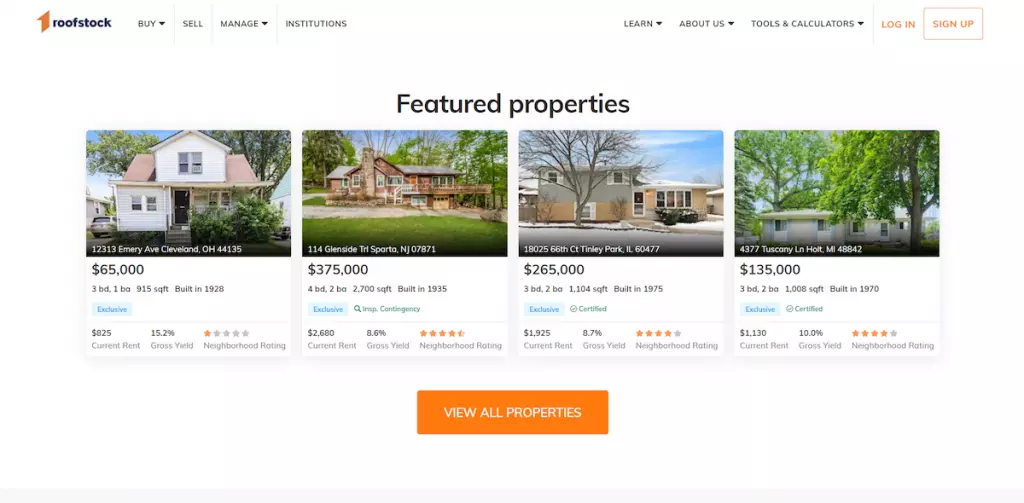

Roofstock: Best for Passive Rental Income

Minimum Investment: You make offers on rental units

Fees: 0.50% or $500 of contract price

Fund: Rental properties

Minimum Investment: You make offers on rental units

Fees: 0.50% or $500 of contract price

Fund: Rental properties

If you're looking to earn passive income from rental properties without dealing with the hassle of tenants, Roofstock is the perfect platform for you. With Roofstock, you can purchase rental properties across the United States. The listings provide detailed information on expected returns, cash flow, property taxes, occupancy status, and more. Roofstock can also connect you with local property managers to handle maintenance and tenant management.

Groundfloor: Best for Short-Term Debt Investments

Minimum Investment: $10

Fees: Investors don’t pay fees

Fund: Short-term real estate loans

Minimum Investment: $10

Fees: Investors don’t pay fees

Fund: Short-term real estate loans

Groundfloor offers a unique approach to real estate investing by focusing on short-term, high-yield real estate debt investments. With a minimum investment of only $10, Groundfloor provides an accessible option for beginners. You can build your debt-based portfolio by browsing through various real estate projects with different terms, interest rates, and risk levels. Groundfloor investors typically receive payments within six to nine months.

Streitwise: Best for Real Estate Dividend Income

Minimum Investment: $5,000

Fees: 3% upfront and 2% annually

Fund: Commercial real estate REIT

Minimum Investment: $5,000

Fees: 3% upfront and 2% annually

Fund: Commercial real estate REIT

Streitwise offers investors the opportunity to earn dividend income through their commercial real estate investment trust (REIT). With a historical dividend payment of 8% or higher since 2017, Streitwise provides a reliable source of passive income. The minimum investment is $5,000, and investors have the option to reinvest dividends. Streitwise focuses on acquiring commercial properties, which are perceived to have lower tenant risk.

DiversyFund: Best for Long-Term Investors

Minimum Investment: $500 Fees: No management fees Fund: Growth REIT

DiversyFund simplifies real estate investing by allowing investors to buy shares in a portfolio of fully vetted multifamily real estate. With a minimum investment of $500, DiversyFund offers an affordable entry point for investors. The Growth REIT focuses on residential apartment buildings, providing investors with income and the potential for long-term capital appreciation. DiversyFund owns and manages the properties, eliminating the need for investors to worry about property management.

CrowdStreet: Best for Commercial Real Estate Investing

Minimum Investment: $25,000 for most marketplace listings

Fees: 0.50% to 2.5% for most investments

Fund: Offers single properties or two types of funds

Minimum Investment: $25,000 for most marketplace listings

Fees: 0.50% to 2.5% for most investments

Fund: Offers single properties or two types of funds

CrowdStreet is one of the largest commercial real estate investing platforms for accredited investors. With CrowdStreet, you can invest in individual commercial real estate properties or choose from two funds: a single-sponsor fund or a diversified fund. The platform provides a wide variety of investment options, and fees vary depending on the projects. CrowdStreet also offers a Private Managed Account service for a more personalized investment approach.

EquityMultiple: Best for Investment Variety

Minimum Investment: $5,000 for short-term loans and $10,000 or more for equity-based investments

Fees: Typically 0.50% to 1.5%

Fund: Variety of investment options, including debt, preferred equity, and opportunity funds

Minimum Investment: $5,000 for short-term loans and $10,000 or more for equity-based investments

Fees: Typically 0.50% to 1.5%

Fund: Variety of investment options, including debt, preferred equity, and opportunity funds

EquityMultiple offers a range of real estate investment options for accredited investors. You can choose to invest directly in single properties or opt for fund investing, which provides a diversified portfolio of assets. EquityMultiple offers low fees and a variety of investment properties, including townhouses and commercial office spaces. The platform also supports 1031 Exchanges for tax-efficient investing.

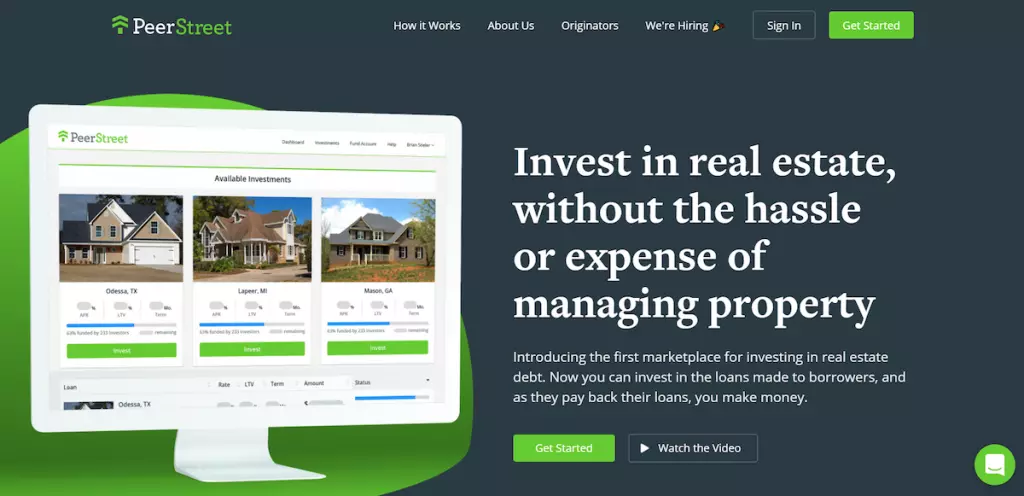

PeerStreet: Best for Real Estate Debt Investing for Accredited Investors

Minimum Investment: $1,000

Fees: 0.25% to 1.00%

Fund: Real estate debt investments and a Credit Opportunity Fund

Minimum Investment: $1,000

Fees: 0.25% to 1.00%

Fund: Real estate debt investments and a Credit Opportunity Fund

PeerStreet allows accredited investors to invest in short-term real estate debt investments. The platform provides detailed information about each loan, including yield, loan-to-value ratio, term, and borrower credit score. With a minimum investment of $1,000, investors can earn monthly interest payments from the loans. PeerStreet also offers an Automated Investing feature and charges a servicing fee on loans.

AcreTrader: Diversifying Your Portfolio With Farmland

Minimum Investment: $10,000

Fees: 0.75%

Fund: Invest in U.S. farmland

Minimum Investment: $10,000

Fees: 0.75%

Fund: Invest in U.S. farmland

AcreTrader offers accredited investors the opportunity to diversify their portfolios with income-generating farmland. Farmland investments provide both land appreciation and rental payments from farmers. While AcreTrader has a thorough vetting process, listings are not always available. The minimum investment ranges from $10,000 to $40,000, and returns typically range from 3% to 5%. However, farmland investments tend to be less liquid compared to traditional real estate.

In summary, if you're considering real estate investing, there are numerous alternatives to Fundrise that cater to different investment strategies and investor profiles. Whether you're looking for passive rental income, dividend income, or short-term debt investments, these platforms offer a range of opportunities to diversify your portfolio. Remember to assess your investing goals, timeframe, and capital before picking the right Fundrise alternative for you.