I've written about fortress REITs before. They're an immensely important part of my portfolio. And, in my well-backed opinion, they should be at least an important part of most others' too.

That's why I'm going to go about explaining precisely what they are today. Because I'm not really sure when the last time I did that was.

I can say all I want that fortress REITs are a great investment idea. I can point out individual examples of what they are every time I do.

But you know what they say: "Give a man a fish, and he'll eat for a day. Teach a man to fish, and he'll eat for a lifetime."

Now, naturally, there are investments outside of REITs that can be considered "fortress" companies. I'm not trying to imply otherwise (we have plenty of them on Dividend Kings).

Any of my followers know I'm all about holding a balanced portfolio with many baskets. That way, I don't just have one nest egg I'm banking everything on.

There's no single golden goose to be accidentally cooked. Or stolen. Or risk falling ill.

Instead, there's an entire farm's worth, all working for my benefit. And when that entire farm has numerous "fortress" aspects to it, all the better.

That's why I can have the same investment mantra as billionaire JPMorgan Chase (JPM) CEO Jamie Dimon, regardless of whether he invests in REITs or not.

The Jamie Dimon Approach

In putting this article together, I came across a solid writeup about Jamie Dimon from Alliance Wealth Advisors. Here's a portion of it:

"Jamie Dimon… often credits the success of the company through good markets and bad to always maintaining a 'fortress balance sheet.' Going back well before the global financial crisis of 2007-2008, Dimon was relentlessly focused on having the firm's balance sheet prepared to withstand all stages of the business cycle despite receiving criticism by some for being too conservative or risk averse.

"In hindsight, it left the firm in a stronger position than many of the banks who needed bailouts or became insolvent when the crisis did strike. Trying to understand the financial statements of a big Wall Street bank is no simple task. But the concepts involved in Dimon's fortress balance sheet approach are pretty straightforward…

"The main components are as follows: ensuring you have sufficient liquidity at all times (cash on hand), you are not over-levered (don't have too much debt), and you are well-prepared to withstand unexpected shocks while maintaining flexibility should opportunities arise (i.e., loss of a job or income…)"

I'd say that's a pretty solid summary of a healthy financial situation. In short, a company should:

- Have enough cash on the side for good times and bad

- Make more than it spends

- Have a game plan and the proper personnel - not just the money - to handle life's hard knocks

Though I would add in one aspect that may or may not be implied by the first three points:

- Have growing income and profits.

In REITs' case, it can be little by little. I'm usually fine with that. But publicly-traded companies should always work at staying relevant regardless.

And that's through some sort of growth.

Assets, Liabilities, and Equity

Again, in the case of REITs, we're talking about dividend-paying stocks. In which case, they should always work at keeping a "progressing" payout system.

Not a "progressive" one, as in anything that's radical or overly aggressive. But one that progresses nonetheless.

In short, REITs should be bringing enough in on top of what they already have. That way, they can warrant dividend hikes.

One of the best ways to see if that's been happening and can continue to happen is to know how to dissect a balance sheet, which addresses three elements:

- Assets - pieces of property, cash and cash equivalents, inventory, investments, etc.

- Liabilities - salaries and other employee obligations, short-term debt, dividends payable, bonds sold, etc.

- Equity - retained earnings and shareholder stakes.

Now, as a company's assets grow, its liabilities and equity tend to as well. But you want to make sure they're proportional. And if the percentage decreases quarter to quarter or year to year, that's often even better.

(I say often because there is a certain point where it would get counterproductive.)

"So what does a strong REIT balance sheet look like?" That's something I ask in The Intelligent REIT Investor Guide, due out in just a few months now.

"To answer this," I continue:

"… investors should first look at two important ratios. For one, there should only be a modest amount of debt relative to its total market cap, the total market value of its assets, or its earnings before EBITDA. For another, there should be strong coverage of the interest payments on that debt and other fixed charges from operating cash flows."

So let's look at three REITs that do exactly that.

While most mall REITs are trying to survive during Covid-19, Simon Property Group (SPG) is actually thriving. As David Simon explained in the 2020 Annual Report:

"Not knowing how long this might last, we took immediate and decisive actions to aggressively reduce operating costs and increase our financial resources. The following are some of the significant actions we took:

- Suspended or eliminated more than $1 billion of capital for redevelopment and new development projects in the U.S. and internationally.

- Significantly reduced property operating expenses and all non-essential corporate spending.

- Made very difficult decisions affecting employees, including a reduction in force and furloughing certain field and corporate personnel due to the closure of our properties as a result of governmental stay-at-home orders.

- Increased our financial resources through an amended and extended credit facility with a $6 billion facility that included a $2 billion term loan.

- Reduced our dividend."

As one of the largest retail landlords in the world, Simon owns a portfolio that consists of 233 properties (189 million square feet) in North America, Asia, and Europe.

In addition, SPG owns a 22.4% interest in Klépierre, a leading European retail real estate company. More recently, SPG acquired an 80% interest in The Taubman Realty Group (formerly TCO). One of my favorite sayings goes as follows:

"The Golden Rule: He who has the gold makes all of the rules."

That certainly applies to SPG who acquired Taubman's 80% interest at $43.00 per share that equates to something like a sub-6% cap rate.

We viewed the deal as a win-win for SPG, despite the fact that the $2.6 billion deal was an opportune time, the mega-mall REIT was able to shave roughly $1 billion off the purchase price.

And this $1 billion of "savings" represents ~one-turn of debt/EBITDA; projected pro forma SPG debt/EBITDA of 7.8x (vs. 5.2x prior to initial deal and the pro forma ~6.1x).

Having prudent balance sheet management is a fundamental strength of SPG and is central to the ability to execute long-term strategy and deal flow effectively. The company has been very active in the debt market, raising $13 billion in 2020 and completing these deals in Q1-21:

- $1.5 billion senior note offering at 1.96%, weighted average term of 8.4 years.

- EUR 750 million note shouldn't say dollar, at 1 1/8% coupon at a term of 12 years.

- Pay off $550 million senior notes.

- Refinanced six mortgages for $1.3 billion at an average interest rate of 3.36%.

And at the end of Q1-21 SPG had $8.4 billion of liquidity, consisting of $6.9 billion available on the credit facility; $1.5 billion of cash, and $500 million of U.S. commercial paper outstanding. SPG is rated A3 by Moody's and A by S&P.

SPG has a long track record of making smart capital allocation decisions in retail, such as partnering with Authentic Brands Group to acquire Aéropostale out of bankruptcy. The success with the Aéropostale investment resulted in the creation of the SPARC platform that includes these brands:

- Aéropostale

- Nautica

- Forever 21

- Brooks Brothers

- Lucky Brands

SPG also entered a joint venture with Brookfield Asset Management (BAM) and ABG to acquire the operations, intellectual property, and certain real estate of JCPenney out of bankruptcy.

SPG also made investments in the digital world through its partnership with Rue Gilt Groupe, a premier off-price e-commerce portfolio company, consisting of three complementary brands- Gilt, Rue La La, and Shop Premium Outlets.

SPARC and its brands, RGG, and JCPenney, generate in excess of $3.5 billion annually in digital sales. This clearly demonstrates the unique value proposition for SPG and its non-real estate investments.

SPG paid a dividend of $1.30 per share on April 23, and that translates into a current dividend yield of 4.3%. Shares are now trading at $122.18 compared with our NAV of $150.00 per share. We maintain a BUY rating as we believe shares could fetch $140.00 by the end of 2021.

Our next "fortress" buy is Realty Income (O), a net lease REIT that will soon be the sixth-largest REIT in the RMZ (in the top half of the S&P 500) when it completes the merger with VEREIT (VER) in Q4-21.

Keep in mind, O did not become a "fortress" REIT overnight; it took years and years for the company to grow its business model and prove to investors and rating agencies that it could weather the storms.

However, it's clear to see that to increase the dividend for 26 consecutive years in a row is no fluke, and there is much more under the hood.

When you open O's hood, you can see prudent capital allocation in which the company has built a high-quality real estate portfolio through sensible, top-down, data-driven investment processes. The business model is simple; the company must seek to own properties that generate positive investment spreads using its low cost of capital advantage.

By seeking to own "high quality" net lease properties, the company obtains sites at or below market rents, above-average rent coverage, long-term leases, and higher longer-term IRR.

This is no different than being a low-cost leader in any other category, and over the years, Realty Income has worked to generate this wide moat advantage.

Keep in mind, the engine is powerful; Realty Income is the only A-rated net lease REIT (A- / A3) with "fortress-like" metrics: Target leverage maintained at 5.5x Net Debt & Pref./EBITDAre. Accordingly, this superior balance sheet strength has resulted in very strong and diversified cash flows guaranteed by some of the best-in-class, blue-chip tenants:

Scale has its advantages too; Realty Income has industry-leading occupancy levels that have been consistent through various economic cycles (98% in Q1-21).

The size of the addressable net lease market is enormous - over $12 trillion - and Realty Income is in a perfect position to continue to capitalize on the fragmentation. The company sourced over $64 billion in 2020 alone.

Another one of my favorite sayings goes like this:

"Make hay while the sun is shining."

Realty Income is in the dominant position to continue to forge a path to profits. The VEREIT deal is forecasted to be 10% accretive, and in my view, the company could see more M&A in the not-so-distant future.

Also, Europe is an attractive growth avenue with limited direct competition; public net lease REITs account for ~3% of the total addressable universe (in Europe). International opportunities added ~30% to O's combined sourcing volume in 2019-2020, so we consider the opportunity set massive.

Since 1995 O has grown AFFO/share by 5.1% vs. the REIT average of 3.2%. In addition, O has generated positive earnings growth in 24 of 25 years.

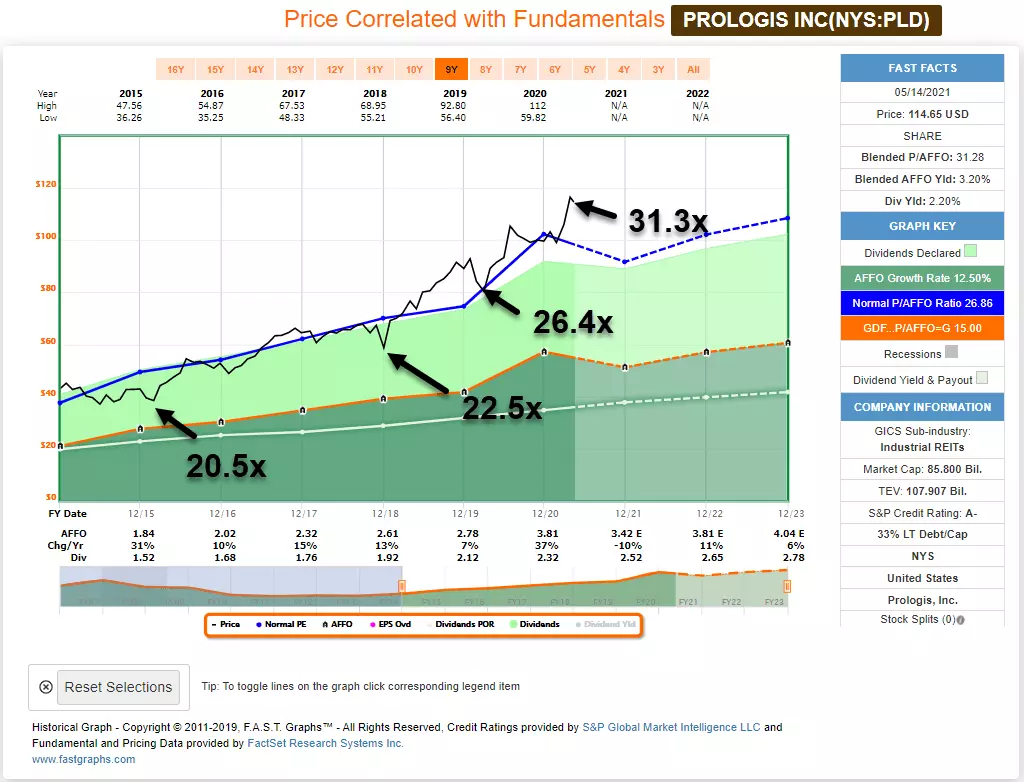

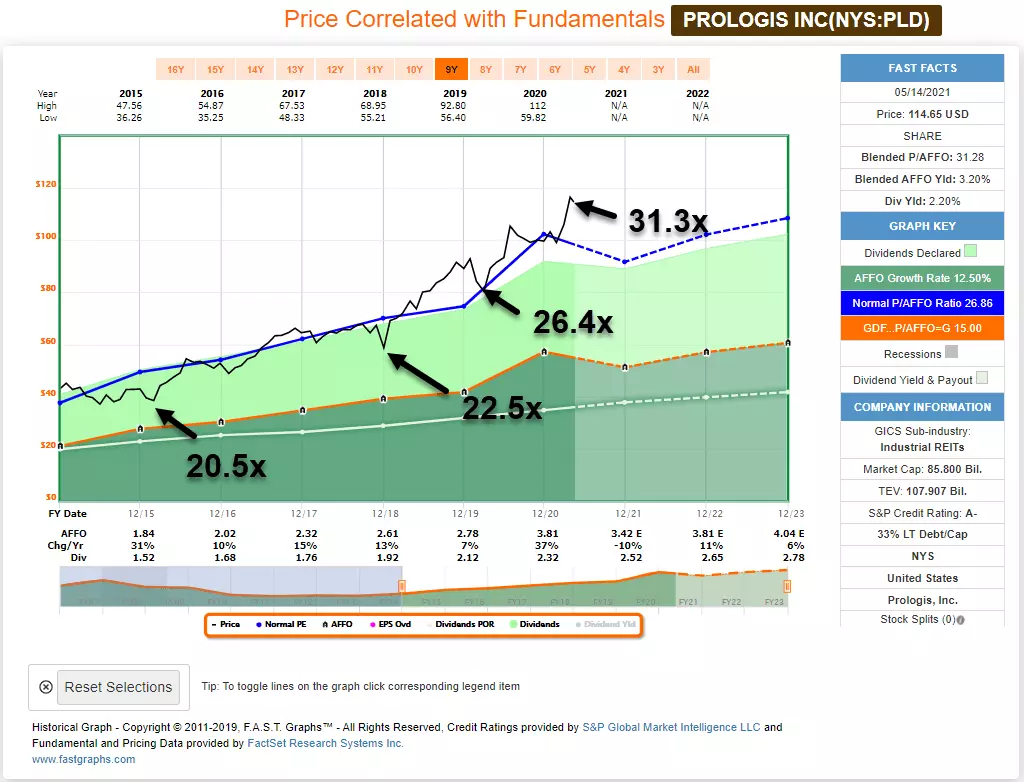

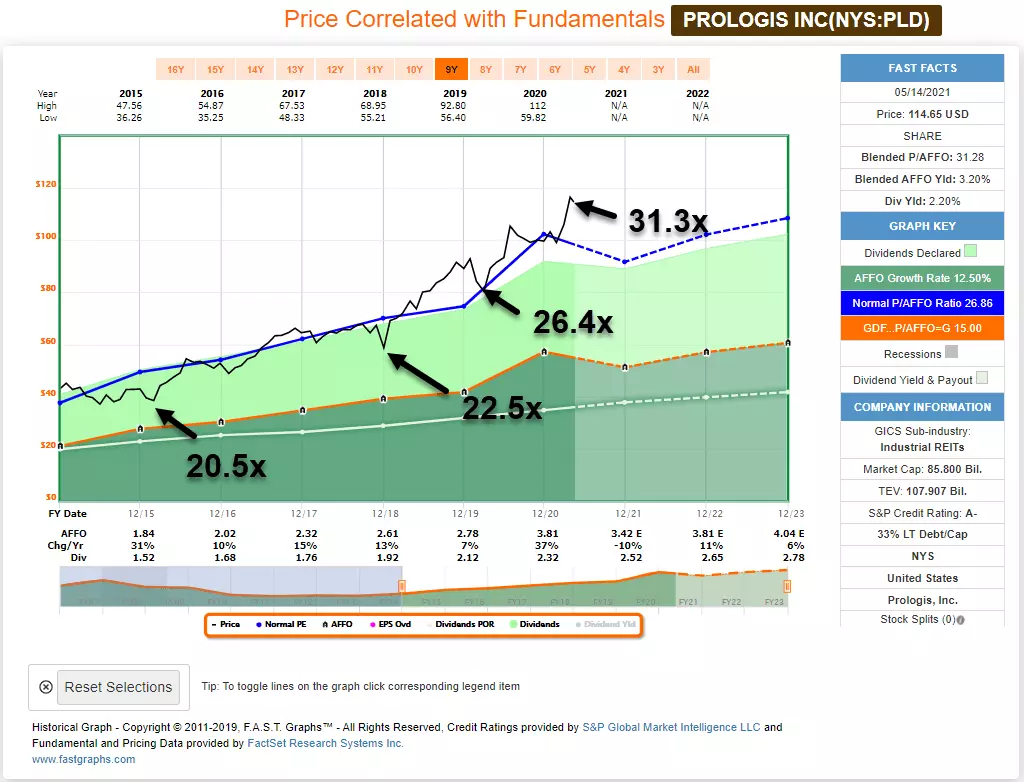

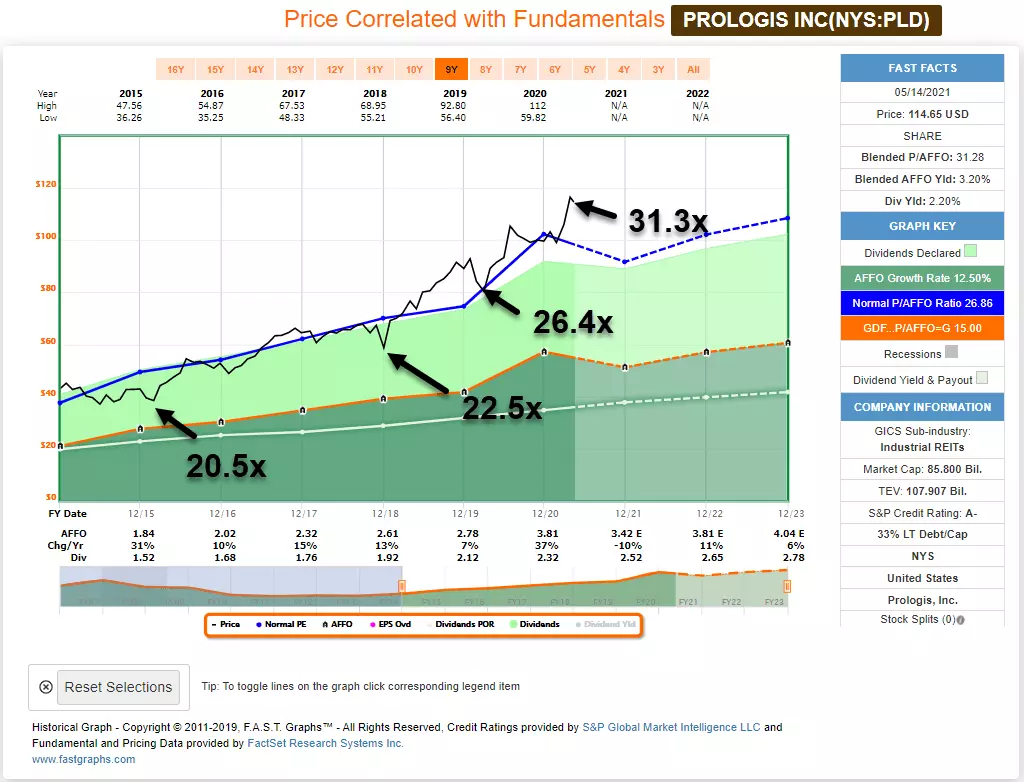

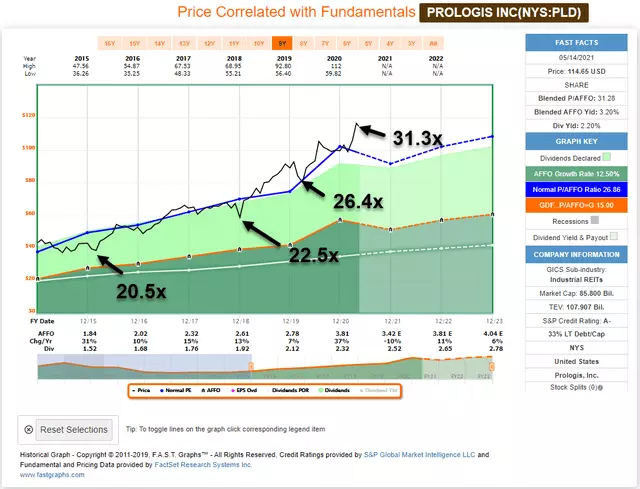

Given the growth taking place within the net lease sector today, we believe O has the ability to break away from the "net lease" peers and begin to trade in-line with a closer "fortress" REIT known as Prologis (PLD).

Keep in mind. PLD is also A-rated.

Let me be clear, I'm not saying that O deserves to trade at 31x P/AFFO like PLD.

However, what I'm saying is that the O/VER deal is transformational, and this merger puts O into a "league of its own." Later in the week, I will be working on a detailed article related to O's primary "moat" - its low cost of capital advantage - and highlighting the importance of the fortress and wide moat.

We are maintaining a BUY today as shares are trading at $65.34 with a dividend yield of 4.3%.

Source: FAST Graphs