The Federal Reserve's decision to increase interest rates has had a significant impact on real estate investment trusts (REITs). However, as interest rate concerns ease, some REIT stocks are starting to rally, presenting interesting opportunities for investors. Two such REIT stocks to consider are Prologis and Realty Income.

Why are interest rates an issue for REITs?

REITs face challenges with rising interest rates because they rely on capital markets for growth capital. As REITs pay out most of their cash flow as dividends, any growth investment requires selling debt or issuing stock. Thus, higher interest rates make it more expensive to be a REIT.

Additionally, rising interest rates can potentially lead to an economic slowdown or even a recession. For companies like Prologis and Realty Income, a recession could result in weaker occupancy and more difficult lease renewals. However, as interest rates stabilize or begin to fall, these concerns start to fade.

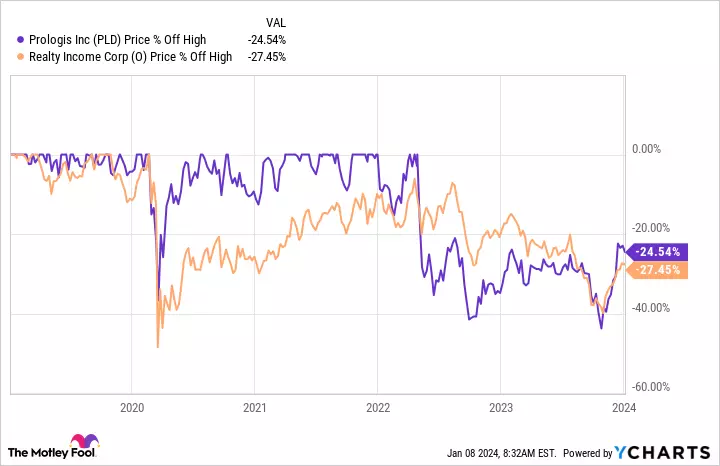

PLD Chart

PLD Chart

There's still more room to go

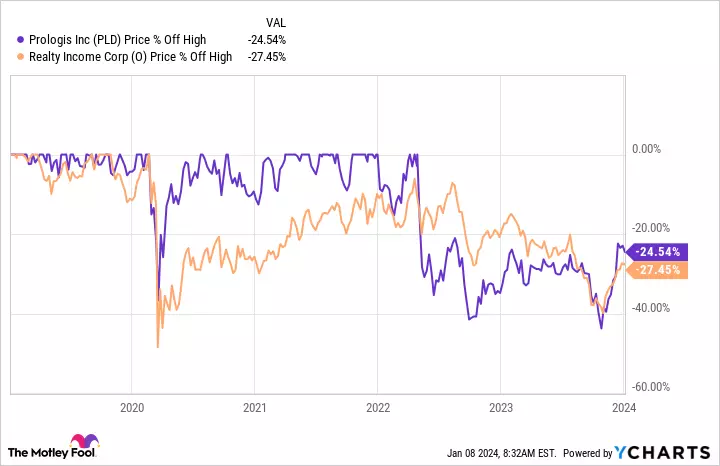

Although Prologis and Realty Income have experienced significant gains in recent months, they have not fully recovered from their previous highs. Prologis is still around 25% off its 2022 high, while Realty Income is down approximately 27% from its 2020 peak. This suggests that there is still potential for further upside.

PLD Chart

PLD Chart

What makes these two REIT stocks particularly attractive is their market positions and global presence. Prologis, with a market cap of $120 billion, is one of the largest REITs in existence. Realty Income, with a market cap over $40 billion, is more than twice as large as its closest competitor.

Both companies have easier access to capital markets and the ability to execute deals that smaller players cannot. Prologis offers warehouse space across North America, South America, Europe, and Asia, with development land in all these regions. Realty Income has a significant foothold in Europe, where the net lease approach is still growing. This presents a growth opportunity for a trusted partner like Realty Income.

Despite Wall Street's current outlook, both Prologis and Realty Income have strong fundamentals. Prologis reported a roughly 50% increase in rents on renewing leases in the third quarter of 2023, while Realty Income recaptured 106.9% of expiring lease rents through new deals.

Give these REIT giants a second look

If you thought you missed the boat on the REIT recovery, fear not. There are still industry-leading stocks with potential for further recovery. However, it's wise to focus on the largest and best-positioned competitors, such as Prologis and Realty Income, who continue to perform well on the business front.

These two REIT stocks offer a compelling investment opportunity, backed by their market positions, global diversification, and strong fundamentals. As interest rate concerns subside, Prologis and Realty Income have the potential to surge even higher in 2024. Consider investing in these REIT giants before their value skyrockets.