If you're looking to invest in real estate investment trusts (REITs), now may be the perfect time. Despite recent gains, many REITs are still trading below their 52-week highs. In particular, net lease REITs like NNN and Alpine Income Property Trust have significant potential for growth. Let's delve deeper into the reasons behind this and explore these two promising options.

REITs and the Impact of Interest Rates

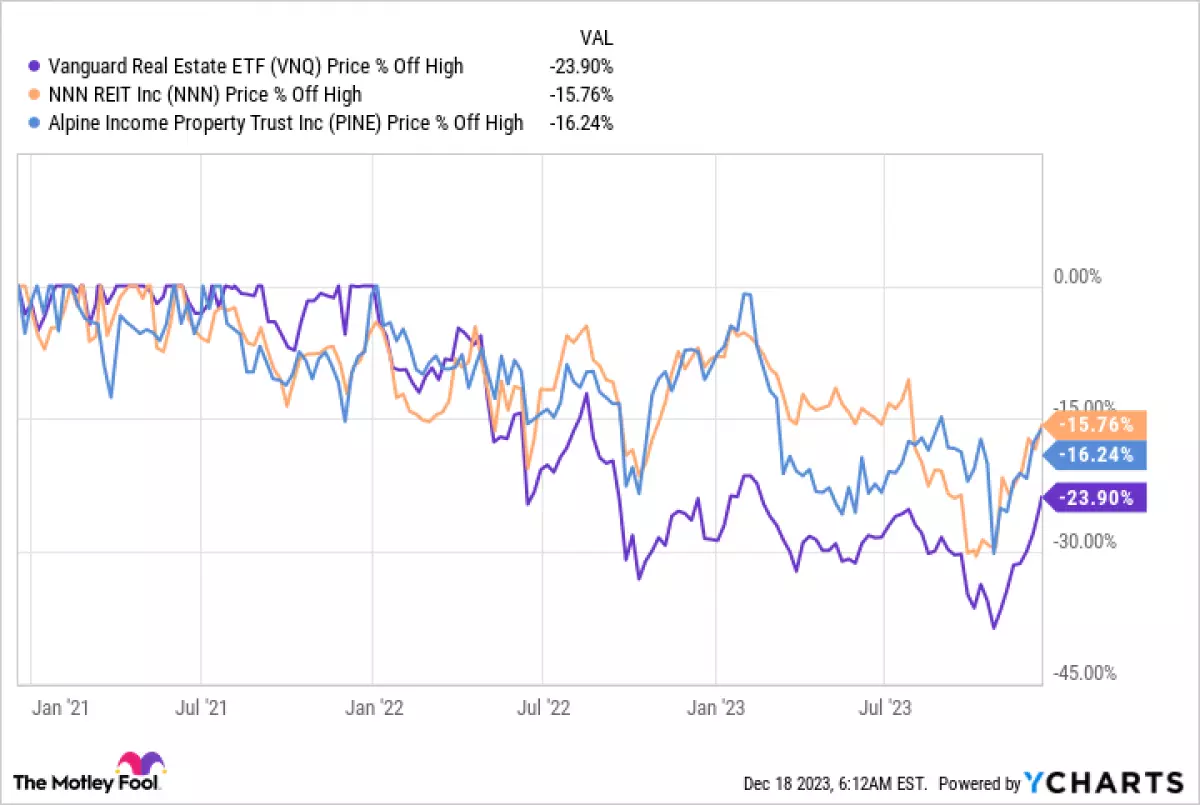

Over the past year, REITs have faced challenges due to rising interest rates. However, this trend didn't emerge overnight. If we take a broader look at the past three years, we can see that the average REIT is still down more than 20% from its peak. Despite this setback, there is ample opportunity for investors who take a step back and consider the bigger picture.

VNQ data by YCharts

VNQ data by YCharts

NNN and Alpine: Undervalued REITs with Potential

Two REITs that are worth considering are NNN and Alpine. Although both stocks are down around 15% from their three-year highs, they offer investors attractive yields and strong growth potential.

NNN, one of the oldest companies in the net lease space, boasts an impressive track record of 34 years of annual dividend increases. With a diverse portfolio of approximately 3,500 assets, mainly focusing on necessity tenants, NNN offers stability. The average remaining lease term of over 10 years provides a cushion against economic downturns such as recessions. Additionally, NNN's yield of approximately 5.3% is higher than the average REIT's 4.4% and the S&P 500 Index's 1.4%.

On the other hand, Alpine Income Property Trust is a smaller player in the industry, with a market cap of around $260 million compared to NNN's $7.6 billion. However, this makes it an intriguing option for more aggressive investors. Despite its small portfolio of just 138 properties, nearly two-thirds of its tenants have investment-grade ratings. Alpine has consistently increased its dividend since its 2019 IPO. Furthermore, its funds from operations (FFO) payout ratio of around 75% is reasonable and comparable to larger players in the industry.

Making an Informed Choice

For conservative investors seeking stability, NNN presents a solid choice. As a leader in the net lease REIT sector with a proven track record and an attractive yield, NNN still has room to grow before reaching its previous highs. On the other hand, if you're willing to take on more risk for potentially higher returns, Alpine may be a good fit. Its smaller size offers more growth opportunities, and it currently trades at a discount relative to its peers.

By considering these two REIT stocks, investors can take advantage of the current market conditions and position themselves for potential future gains. Whether you prefer stability or are willing to take calculated risks, the choice is yours.