Image credit: franckreporter

Image credit: franckreporter

I’m sure you’ve heard about the term "full faith and credit" when it comes to describing the unconditional guarantee or commitment by one entity to back the interest and principal of another entity's debt. Typically, this is used by a government to lower the borrowing costs of a smaller, less stable government or a government-sponsored agency.

The value of the words "full faith and credit" cannot be understated when describing America's credit quality. It's widely accepted that the U.S. government will never default on its loan obligations, and that's why investments backed by the U.S. government are considered extremely reliable.

In this article, we will explore two REITs that are backed by the full faith of the U.S. government - Postal Realty Trust (PSTL) and Easterly Government Properties (DEA). Let's take a closer look at both of these REITs.

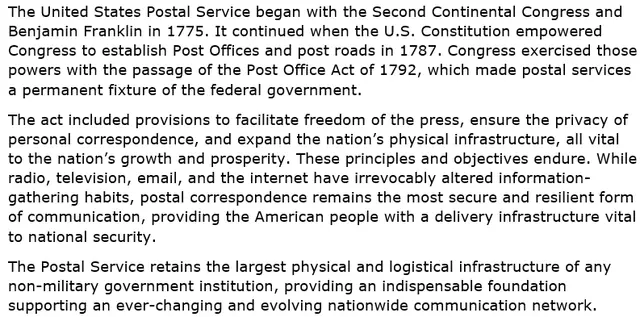

Postal Realty Trust

When researching a company, it's important to approach it with an open mind and without any preconceived biases. Postal Realty Trust is a REIT that primarily focuses on post offices, and initially, you might question the viability of such a venture. After all, the Postal Service has been experiencing losses for years, and the decline of traditional mail usage is evident.

But let's dig deeper and look at the facts. The Postal Service has been a critical piece of the country's infrastructure since the inception of America. Despite the losses it has been experiencing, many of these are due to government regulations and mandates placed on it. The Postal Service is required to provide a minimum level of mail service at a reasonable price, and it has been burdened by pre-funding retiree health care benefits.

However, it's important to note that the government will not allow the Postal Service to fail. It is far too vital to the functioning of the country. Additionally, while traditional mail volumes may be declining, package deliveries are on the rise, thanks to the booming e-commerce industry. The Postal Service plays a crucial role in package delivery and works closely with shipping companies like FedEx and UPS.

Postal Realty Trust owns 1,239 properties across 49 states, with a weighted average lease term of approximately four years and occupancy rates of 99.7%. The company has a major size and scale advantage in the highly fragmented market of post office real estate, which positions it well for future consolidation and increased market share.

The REIT has a strong track record of tenant retention rates, with a historical weighted average lease retention rate of 98.8% over the past 10-plus years. This reflects the strategic importance of these properties to both the Postal Service and the communities they serve. Postal Realty Trust also boasts a high rent collection rate, with 100% of rent payments made on time.

In terms of valuation, Postal Realty Trust is trading at an FFO multiple of 15.89, while its normal FFO multiple is 20.35. FFO is expected to increase by 3% in 2023 and 5% in 2024. The company has a dividend yield of 6.23%, and its dividend payout ratios have been reasonable in recent years.

Overall, Postal Realty Trust presents a compelling investment opportunity. With its strong tenant retention rates, high rent collection, and potential for consolidation in the post office real estate market, it offers attractive risk-adjusted returns.

Easterly Government Properties

Easterly Government Properties is another REIT that focuses on properties leased to the U.S. government. The REIT owns 86 properties, of which 99.3% are leased. It has a weighted average lease term of 10.5 years and a well-diversified geographic footprint across the United States.

While Easterly Government Properties benefits from having the U.S. government as its tenant, there are some concerns to consider. The company has a higher adjusted net debt to EBITDA ratio, which raises questions about its overall leverage. However, it has a comfortable interest coverage ratio, indicating its ability to service its interest payments.

Easterly Government Properties has had a relatively low FFO growth rate in recent years, and its forecasted FFO growth rate for 2023 is negative. The REIT is currently trading at a discounted FFO multiple, but this may reflect investor concerns about a potential dividend cut.

The company's dividend yield is 6.94%, but its AFFO payout ratio has been high in the past. While the payout ratio has improved in recent years, it is still a concern, especially considering the projected decline in cash flow and negative growth forecasts for 2023 and 2024.

Given these factors, we have downgraded Easterly Government Properties from a Spec Buy to a Hold. While the REIT has some positive qualities, such as its strong tenant and diversified property portfolio, the elevated payout ratio and bearish growth forecasts raise caution.

In Closing...

In the micro-sector of U.S. government-backed leases, Postal Realty Trust stands out as a more attractive investment compared to Easterly Government Properties. With its strong market position, high tenant retention rates, and solid growth prospects, Postal Realty Trust offers a better risk-adjusted return.

As always, when considering REIT investments, it's important to focus on the fundamentals. We prioritize companies that demonstrate strong credit backing, sound financials, and sustainable dividend payments. By staying true to these principles, we can separate the best opportunities from the rest.

Happy REIT investing!

Note: This article is for informational purposes only and does not constitute financial advice. Investors are encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions.