Welcome to our comprehensive guide on the 2022 housing market forecast and predictions. Get ready for a whirlwind year of opportunities and challenges in the real estate market. Whether you're a first-time buyer or looking to sell your home, this article will provide you with valuable insights to navigate the housing market with confidence.

A Promising Outlook for Homebuyers

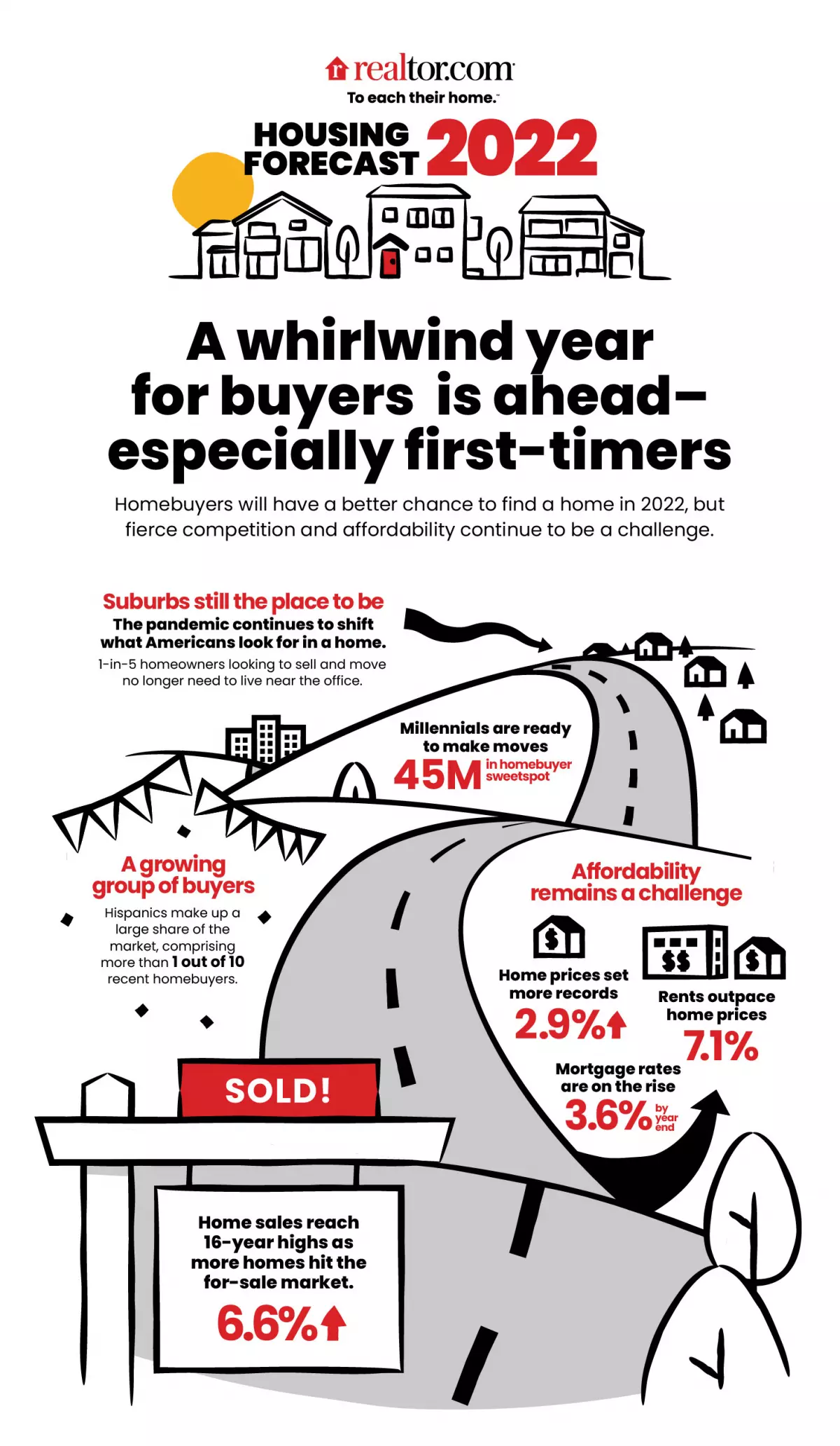

In 2022, Americans will have a better chance of finding their dream home. However, they will also face a competitive seller's market as demand from first-time buyers outmatches the inventory recovery. Despite this, there are many positive factors to consider.

Image Source: Realtor.com

Image Source: Realtor.com

Key Housing Indicators for 2022

Let's take a look at the Realtor.com® 2022 forecast for key housing indicators:

Existing Home Median Sales Price Appreciation: Up 2.9%

Existing Home Sales: Up 6.6%

Existing Home For-Sale Inventory: Up 0.3%

Mortgage Rates: Average 3.3% throughout the year, 3.6% by the end of the year

Single-Family Home Housing Starts: Up 5%

Homeownership Rate: 65.8%

Home Sales: Hit 16-year Highs

At a national level, we expect to see continued home sales growth in 2022, with a projected increase of 6.6%. This means we will witness 16-year highs for sales nationwide and in many metro areas. The demand for housing remains strong, fueled by a growing economy, declining unemployment rates, and income growth.

Home Prices: Advancing at a More Moderate Pace

Home prices have been on a steady rise since 2012, and this trend is expected to continue in 2022. However, the pace of increase will be more moderate, with a projected rise of 2.9%. While affordability challenges will persist due to rising prices and mortgage rates, builders ramping up production and remote work enabling broader search areas for buyers may provide some relief.

For-Sale Inventory: Beginnings of a Turnaround

Although inventory will remain limited, we anticipate a rebound from the lows of 2021. The for-sale inventory is projected to grow by 0.3% on average throughout 2022. As more homeowners express their intention to sell, this positive trend will gain momentum, providing more options for homebuyers. Additionally, rising new construction will eventually contribute to the increase in housing supply.

Rents: Expected to Outpace Home Price Growth

Rents, like home prices, experienced slower growth in the early stages of the pandemic. However, as the U.S. made significant progress against the pandemic, rent growth surged due to limited supply and increased demand. In 2022, we expect this trend to continue with a forecasted rent growth of 7.1% nationwide. Renters should anticipate rising costs as demand outpaces supply.

Key 2022 Housing Trends & Demographics

Still Preferring the Suburbs

The pandemic has shifted shopper preferences toward space and versatility, leading to a boom in homebuyers and renters shifting to suburban areas and less-dense metros. While urban areas remain pricier, the allure of suburbs for better affordability and a less competitive market persists.

Remote, In-Office, or Hybrid? The Future of Work Brings Flexibility for Workers

Increased workplace flexibility is likely to maintain the popularity of suburban areas. Many companies have embraced remote work, granting workers ongoing flexibility. This flexibility allows homebuyers to broaden their search parameters and explore more affordable housing markets while reducing their reliance on proximity to work.

Searchers Dream Big, but Budget Realities and For-Sale Availability Might Mean Smaller Homes Prevail

Homebuyers seek larger homes that provide space for occasional remote work and versatility. However, rising affordability challenges may lead some buyers to prioritize budget and opt for smaller homes. Newly constructed single-family homes have bucked the trend of declining sizes, but the typical active single-family home for sale has trended smaller in recent months.

Hispanic Homebuyers Are A Growing Demographic

Hispanic homebuyers comprise more than 1 in 10 recent homebuyers but remain under-represented relative to their share of the population. This demographic group is expected to play a growing role in the homebuying market, particularly among younger and first-time buyers.

First-time Homebuyers Face an Uphill Journey

First-time buyers will face challenges in the 2022 housing market due to limited inventory, high and rising prices, and increasing mortgage rates. However, a competitive labor market and extended workplace flexibility may offset some of these challenges, enabling first-time buyers to explore more affordable housing markets and broaden their search options.

Housing Market Perspectives

What will 2022 be like for homebuyers, especially first-time homebuyers?

Homebuyers have much to look forward to in 2022. Although inventory will increase, the market will remain competitive, particularly for entry-level homes. Rising prices and mortgage rates may result in higher monthly payments. Buyers will need to make quick decisions to secure offers in a fast-paced market.

How can homebuyers prepare?

To navigate these challenges, buyers must carefully consider their budget and use tools like the affordability calculator to determine what they can afford. Creating a list of must-haves can help focus the search, and personalization tools can ensure the online search aligns with their preferences.

What will 2022 be like for home sellers?

Sellers in 2022 are in a favorable position. Home prices are expected to continue their streak of annual gains, offering opportunities for sellers to walk away with healthy profits. Well-priced homes in good condition will sell quickly, although competition may increase with the growing inventory.

How can sellers prepare?

Sellers should explore their options, including listing their homes with real estate agents to maximize exposure to potential buyers. Using tools like the Realtor.com seller's marketplace can help sellers assess the best selling strategy.

What will 2022 be like for renters?

Rents are expected to increase in 2022 as home prices continue to rise. Demand for rental homes remains high, and limited supply and eviction protection expiration may further drive rent growth. Renters may consider moving out to form new households, increasing rental demand.

What will 2022 be like for investors?

Investors can expect solid returns from the housing market in 2022. With rising home prices and rents, opportunities for high yields are abundant. However, rising mortgage rates and potential eviction considerations may impact investment decisions.

Housing Market Predictions 2022 - Metro Area Breakdown

To gain further insight into the housing market, here are the projected sales growth and price growth percentages for various metro areas in 2022:

Please refer to the original article for the full list of metro areas.

Stay Informed with Monthly Updates

Subscribe to our mailing list to receive monthly updates and notifications on the latest data and research. Don't miss out on valuable information that can help you navigate the ever-changing housing market.

Conclusion

The 2022 housing market presents both challenges and opportunities for homebuyers, sellers, renters, and investors. Understanding the forecasted trends and demographics will empower you to make informed decisions. Whether you're looking to buy, sell, or rent, remember to plan and prepare accordingly. Good luck in your real estate endeavors in 2022!