Selling a home involves various financial aspects that can often be overwhelming, especially for beginners. One important tool that can help you navigate through these complexities is a Seller Net Sheet. In this article, we will delve into the fundamentals of Seller Net Sheets, providing you with a beginner's guide to understanding and utilizing them effectively.

What is a Seller Net Sheet?

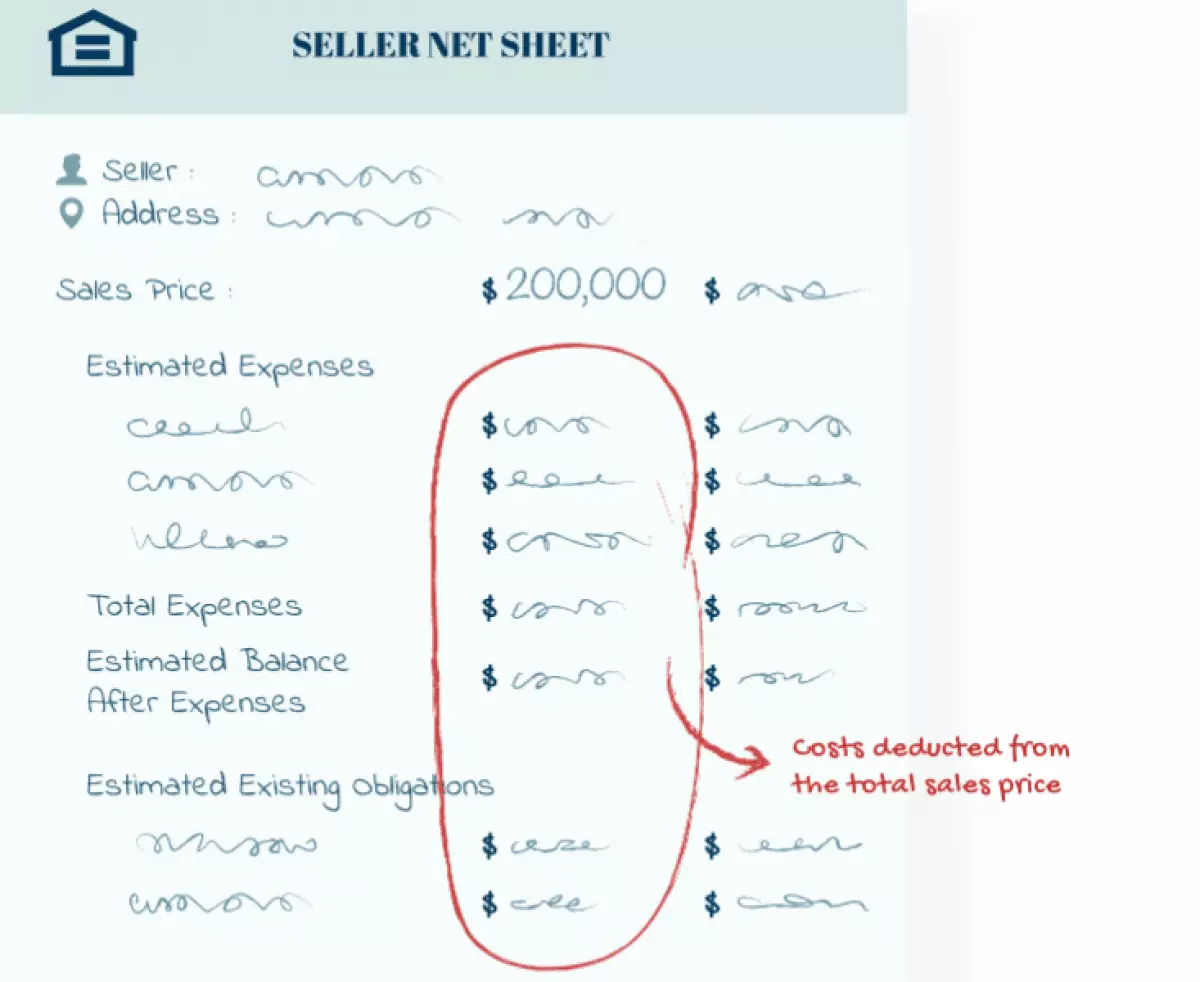

A Seller Net Sheet is a document that provides an overview of all the expenses and financial implications associated with selling a property. It offers a comprehensive breakdown of costs, including commissions paid to agents, mortgage payoffs, closing fees, and more. Essentially, it gives you a clear picture of the net proceeds you can expect to receive from the sale of your home.

Breaking Down the Seller Net Sheet

Estimated Sales Price and Listing Price

The Seller Net Sheet begins with the estimated sales price, which represents the amount the seller expects to receive for the house. This figure is influenced by factors such as the property's condition and location. It is crucial to consult with a knowledgeable real estate agent to determine an accurate estimated price.

The listing price, on the other hand, reflects the amount initially paid for the property when it was purchased. If the listing price is $0, it means there were no costs associated with buying the home. In this section, closing costs are also included to give you a comprehensive understanding of your overall profit or loss from the sale.

Estimated Cost of Sale and Adjustments/Deductions

The estimated cost of sale includes all the expenses related to selling the property. This encompasses closing fees, commissions paid to agents or brokers, real estate taxes, and capital gains tax due at settlement. These costs play a significant role in determining your net proceeds.

The adjustments/deductions column accounts for any adjustments from previous transactions. For example, if you made improvements to your home that were not reflected in its initial value, those expenses would be listed here. Additionally, any capital gains tax owed by the seller prior to settlement may also appear in this section.

Mortgage Loan Payoff and Net Proceeds

The mortgage loan payoff represents the outstanding amount the seller owes on their mortgage before receiving any proceeds from the sale. It is important to note that the buyer is responsible for paying this amount at settlement.

The net proceeds highlight your total profit or loss based on the price you paid for the property and its selling price. The final column labeled "NET" provides this information in dollars. Some individuals prefer to see it expressed as a percentage, with a good rule of thumb being between 40-60%. Anything below 30% may warrant reconsideration, as it indicates a lower return on investment.

Other Costs and Fees

In addition to the aforementioned elements, the Seller Net Sheet includes various other costs and fees that may apply during the selling process. These include attorney fees, grantor's tax, transfer tax, title company fees, appraisal repairs, title insurance, recording fees, realtor commission, escrow fees, closing costs, and HOA packets. Each of these factors can influence your net proceeds and should be taken into account when creating a Seller Net Sheet.

Conclusion

Understanding the intricacies of selling a home is crucial for maximizing your financial outcome. A Seller Net Sheet provides an essential tool to evaluate the potential net proceeds from a property sale. By utilizing this guide, you can navigate the complexities of Seller Net Sheets with confidence, ensuring a successful and profitable selling experience.

Picture: Seller Net Sheet