In a market where stocks are overvalued and yields are hard to come by, it's refreshing to find investment opportunities that offer great dividends at a reasonable price. This is exactly what you'll get with three medical real estate investment trusts (REITs) - Omega Healthcare Investors, Medical Properties Trust, and Physicians Realty Trust.

Omega Healthcare: A Hidden Gem

Omega Healthcare focuses on skilled nursing and assisted living facilities. Despite the challenges faced by these facilities during the pandemic, Omega's financials have already rebounded. Although the stock is down this year, this drop has actually made it undervalued, with a price-to-FFO ratio of 13.5 times - the lowest among the three REITs.

In the third quarter, Omega reported a significant increase in earnings per share (EPS) and listed FFO. The company has also raised its dividend for 17 consecutive years, offering a current yield of about 9%. With a safe AFFO payout ratio below 80%, Omega Healthcare is a solid choice for dividend investors.

Medical Properties Trust: A Reliable Performer

As the nation's leading nongovernment landlord of hospitals, Medical Properties Trust has a strong presence in the medical real estate market. With a diverse portfolio of properties across states and countries, the company enjoys stable rental income from its quality tenants.

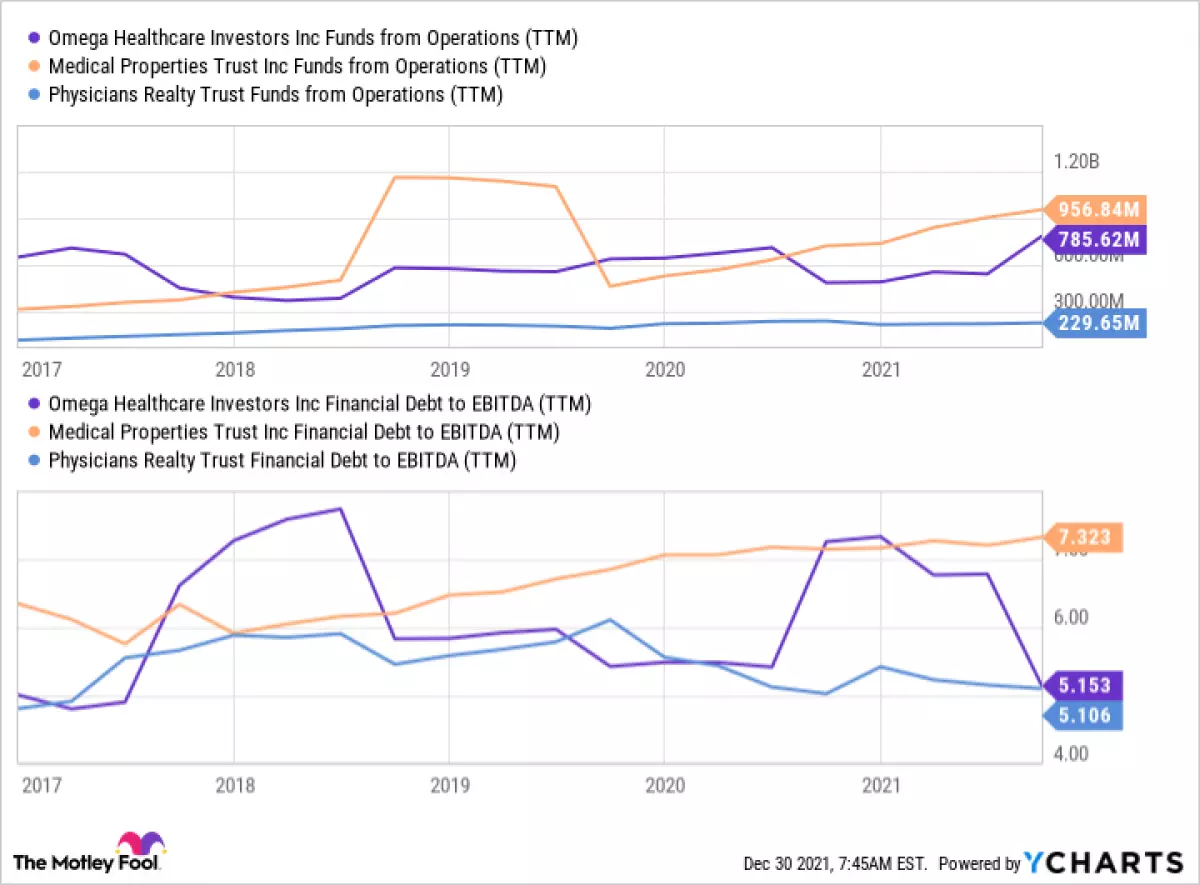

Medical Properties Trust has consistently increased its dividend for eight years, offering a yield of 4.80%. Its FFO has grown by 202% over the past five years, making it a reliable performer. While the stock may be slightly more expensive than Omega Healthcare, it remains a solid choice for investors seeking both income and stability.

Physicians Realty Trust: Unleashing Growth Potential

Specializing in medical office buildings, Physicians Realty Trust offers a unique opportunity for investors looking to tap into the growing healthcare industry. With its focus on physicians, hospitals, and healthcare delivery systems, the company is well-positioned for future growth.

Despite being the smallest among the three REITs, Physicians Realty Trust boasts the lowest debt-to-EBITDA level and has seen consistent growth in its FFO. While its dividend hasn't increased since 2017, the company's growth potential and high occupancy rate make it an attractive option for long-term investors.

OHI Funds from Operations (TTM) Chart

OHI Funds from Operations (TTM) Chart

The Clear Choice for Dividend Investors

While each of these three REITs has its merits, Omega Healthcare Investors stands out as the top pick. With the longest track record of dividend raises, the highest dividend yield, and the lowest AFFO payout ratio, it offers a winning combination for income-seeking investors. Moreover, its price-to-FFO ratio indicates that it is the most undervalued among the three stocks.

Medical Properties Trust also presents a compelling investment opportunity, backed by its consistent dividend growth and a strong tenant base. However, the company's high debt-to-EBITDA level may hinder its growth potential.

Lastly, Physicians Realty Trust holds promise with its low debt-to-equity level and growth prospects. However, its high AFFO payout ratio poses some risk to its dividend if the company faces a downturn.

In conclusion, these three bargain medical REITs offer impressive dividends and the potential for capital appreciation. Consider adding them to your investment portfolio for a balanced and profitable investment strategy.