Image source: ogichobanov/iStock via Getty Images

Introduction

Have you ever wondered who owns the shopping centers you visit? I recently stumbled upon American Assets Trust (NYSE:AAT), a lesser-known company that owns high-quality real estate properties in the San Diego area. Intrigued by their growth, I decided to take a closer look and share my analysis with you. In this article, we'll explore why this REIT might be a great investment opportunity for long-term dividend investors, especially in light of the back-to-office recovery and lower interest rates.

Who is AAT?

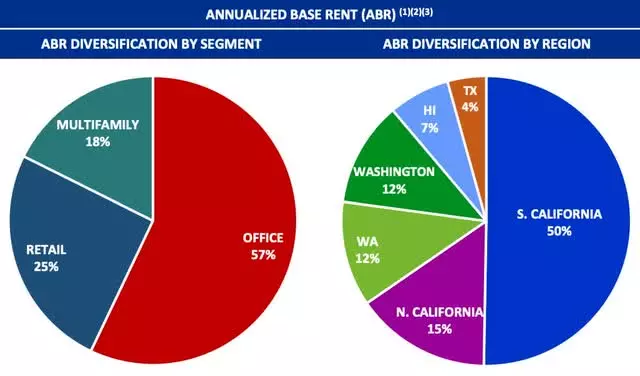

Despite being new to me, American Assets Trust has actually been around for over half a century and is headquartered in San Diego. They own a diverse portfolio of high-quality real estate properties in Southern & Northern California, Washington, Oregon, Texas, and Hawaii. With a significant presence in the expensive San Diego market and iconic locations like the Waikiki Beach Walk in Honolulu, AAT's real estate portfolio is truly impressive.

Headwinds

It's important to acknowledge that the REIT sector has faced volatility due to rising interest rates, and AAT has not been immune to the challenges. The COVID-19 pandemic has also had a significant impact on their operations, and despite their resilience, the REIT is yet to fully recover. However, this doesn't make it a bad investment. In fact, AAT has proven to be resilient and has demonstrated strong management capabilities.

Data by YCharts

One of the main reasons for their recent struggles is the hybrid work-from-home schedule adopted by many businesses. Since AAT derives a significant portion of its rent from office properties, the decline in office utilization has affected their share price. However, there is hope on the horizon. As more companies plan to implement return-to-office policies, office properties like those owned by AAT are expected to benefit. While a complete recovery may take time, AAT's management is well-aware of the office trends and anticipates positive changes in the near future.

Resilient Financials

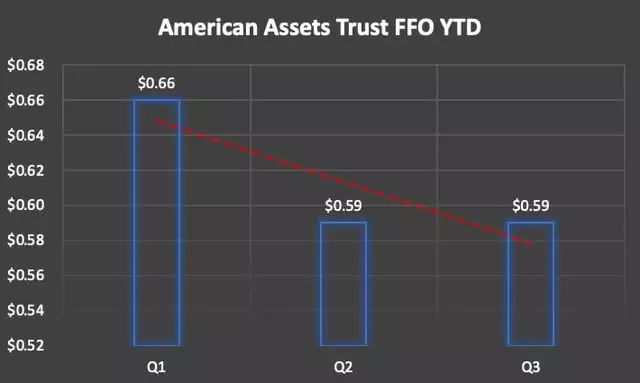

What sets American Assets Trust apart is their resilience in the face of challenges. Despite headwinds, they have raised their full-year FFO guidance twice this year. While FFO has declined due to the economic environment and the reliance on office properties, it remains impressive given the circumstances. Additionally, revenue has continued to grow quarter over quarter, showcasing AAT's ability to adapt and thrive.

Author creation

With a conservative payout ratio of approximately 56%, AAT's dividend is well-covered. Even during the pandemic, when the dividend was temporarily cut, the company quickly resumed its growth and currently offers a safe and attractive dividend. Furthermore, AAT boasts a strong balance sheet with investment-grade ratings from major agencies. While their net-debt-to-EBITDA ratio could be lower, management is actively working to deleverage and achieve a more comfortable range.

Is It a Buy, Hold, or Sell?

Given the headwinds in the sector and the uncertainties surrounding the office property market, AAT's stock is currently undervalued compared to its historical averages. With a positive long-term outlook for the sector and potential for significant growth, AAT presents a compelling investment opportunity. However, it's worth noting that Wall Street currently rates the stock as a hold with a price target of $21.67.

Image source: Seeking Alpha

Risk Factors

As with any investment, there are potential risks to consider. Higher interest rates, which are not favorable for REITs due to their reliance on debt, can impact AAT's business model. Additionally, a recession could lead to higher vacancies and tighter consumer spending, particularly in the multi-family segment. While AAT has proven its resilience, these factors could have an adverse effect on the REIT's performance.

Bottom Line

American Assets Trust is a smaller-cap REIT that focuses on high-quality real estate in the Western part of the United States. Despite facing headwinds in the sector and a significant reliance on office properties, AAT has shown remarkable resilience and stability. With their strong financials, experienced management team, and potential for growth, AAT is an intriguing investment opportunity. However, it's important to consider the uncertainties surrounding the office environment and the potential impact of a recession. As always, thorough research and careful consideration are crucial when making investment decisions.