Investing in commercial real estate can be a lucrative endeavor, but with so many options available, it's crucial to understand each vehicle's nuances to find the right fit. One popular choice among individual investors is the net lease REIT (Real Estate Investment Trust). In this article, we'll dive into what net lease REITs are, outline their pros and cons, and compare them to private equity investments. By the end, you'll have a clear understanding of which option aligns better with your investment goals.

What is a Net Lease REIT?

A net lease REIT focuses on acquiring and managing net leased properties. A net lease is a type of commercial property lease where tenants pay a base monthly rent along with a portion of operating expenses. Net leases are classified into four types: single net lease, double net lease, triple net lease, and absolute net lease. Among these, single tenant, triple net leased properties are particularly popular with individual investors. These properties often house high-quality, national companies like Walgreens or Starbucks, making them an attractive investment option. However, due to their high cost, fractional ownership vehicles like REITs and private equity provide individuals easier access to these assets.

Understanding REITs

A real estate investment trust (REIT) is a real estate company that owns, operates, and/or finances commercial real estate assets. For the purposes of this article, we'll focus on publicly traded REITs, which are listed on major stock exchanges. Publicly traded REITs offer investors benefits like liquidity, diversification, and tax advantages. However, their stock prices can be influenced by market movements rather than the underlying real estate. It's worth noting that REITs specialize in specific property types, such as cell phone towers or warehouse/logistics facilities. In this article, we'll specifically focus on REITs specializing in "net leased" properties.

Net Lease REIT Options

If you're interested in net lease REITs, several well-established options are worth considering:

- Realty Income (Ticker: O): Owns approximately 6,750 net leased properties in the United States, Puerto Rico, and the UK.

- W.P. Carey (Ticker: WPC): Owns around 1,250 net leased properties spanning 25 countries.

- National Retail Properties (Ticker: NNN): Owns roughly 3,150 properties across 48 states.

Each of these REITs has its own unique portfolio composition, typically consisting of single-tenant properties occupied by popular national companies like 7-Eleven, Mister Car Wash, and Taco Bell. As a result, performance can vary among these REITs based on the specific composition of their portfolios.

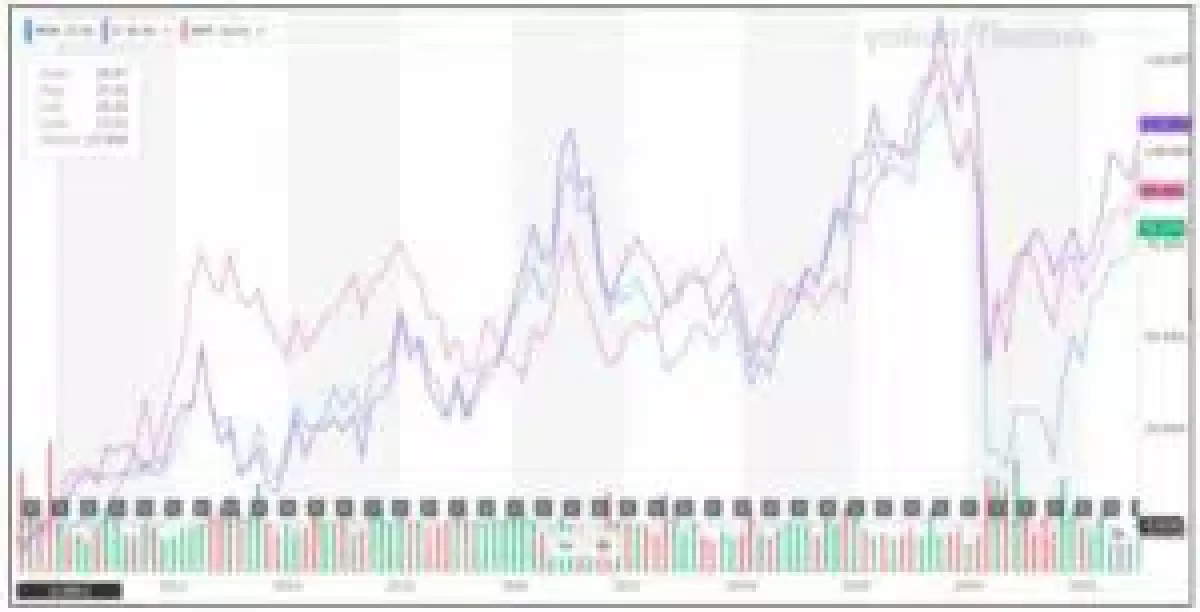

Net Lease REIT Performance

Returns from net lease REITs primarily consist of stock price appreciation and dividend income. Factors like market sentiment, tenant occupancy, capitalization levels, leasing activity, portfolio performance, and tenant strength influence stock price appreciation. While stock price performance can vary among different REITs, it's essential to consider dividends as a crucial component of total returns. REITs are required to distribute a significant portion of their taxable income as dividends. As a result, their dividend yields are generally higher compared to other companies. As of this writing, the dividend yields for the above-mentioned REITs are as follows:

- Realty Income: 3.93%

- W.P. Carey: 5.42%

- National Retail Properties: 4.52%

While National Retail Properties has provided the highest stock price return, W.P. Carey boasts the highest dividend yield. Considering both stock price appreciation and dividends is vital to evaluate the overall performance of net lease REITs.

Advantages of Net Lease REITs

Net lease REITs offer several advantages for investors venturing into commercial real estate:

- Low Minimums: Investing in net lease REITs requires minimal capital, often as little as $50 or $100, making it accessible to a broader range of investors.

- Liquidity: Publicly traded REITs allow investors to buy and sell shares easily, providing a level of liquidity not commonly found in other commercial real estate investments.

- Income Generation: Thanks to their dividend distribution requirements, REITs offer investors a steady stream of passive income.

- Diversification: With thousands of properties typically included in their portfolios, net lease REITs provide investors with a high level of diversification even with a single share purchase.

These advantages make net lease REITs particularly appealing to individual investors looking for income generation and having a shorter to medium-term investment horizon (1-10 years).

Net Lease REITs vs. Private Equity Investments

While net lease REITs are one option for investing in commercial real estate, private equity firms like First National Realty Partners (FNRP) offer another enticing avenue. Private equity investments share the same objective of using investor capital to purchase a diversified basket of commercial real estate assets, but there are crucial differences between the two:

- Legal Differences: Private equity firms are not required to distribute a high percentage of their income as dividends, potentially leading to smaller cash flow streams. Instead, a significant portion of returns from private equity investments comes from property price appreciation.

- Liquidity: Unlike publicly traded REITs, private equity investments are not publicly traded and, thus, lack the same level of liquidity. Investors often face holding periods of 5-10 years, during which they cannot sell their stake.

- Deal Structure: Private equity firms offer various investment options, with some providing access to a "fund" similar to a REIT or ETF. Others, like FNRP, allow investors to participate in individual net lease deals, giving them the opportunity to conduct their own due diligence on the property and tenants.

When comparing net lease REITs and private equity investments, it's crucial to thoroughly research the specifics of each opportunity and choose the one that aligns best with your investment objectives.

Summary & Conclusion

In summary, net lease REITs are real estate investment trusts specializing in net lease properties. These properties typically feature high-quality retail tenants on long-term leases. The performance of publicly traded net lease REITs relies on both stock price appreciation and dividends, making it essential to consider both components when evaluating potential total returns.

Net lease REITs offer advantages such as liquidity, low minimum investments, passive income, and diversification. However, private equity investments provide different benefits, including potentially higher returns driven by property price appreciation and unique deal structures.

Considering your individual objectives, thoroughly researching each investment opportunity is crucial for making an informed decision. Whether you choose to invest in a net lease REIT or opt for a private equity firm like FNRP, the world of commercial real estate holds opportunities that can help you achieve your investment goals.

Picture:

Caption: Line chart showing returns from three REITs

Caption: Line chart showing returns from three REITs